Delaware Corporate Tax

Delaware is renowned for its business-friendly environment, and one of the key aspects that attract companies to incorporate in the state is its corporate tax structure. Delaware's corporate tax laws are designed to provide a competitive and favorable environment for businesses, making it an attractive destination for companies seeking to establish their corporate presence. This article will delve into the intricacies of Delaware's corporate tax system, exploring its unique features, benefits, and how it contributes to the state's reputation as a leading corporate hub.

Understanding Delaware’s Corporate Tax Structure

Delaware’s corporate tax system is characterized by its simplicity, predictability, and competitive rates. The state has implemented a range of tax policies that cater to the needs of businesses, making it an ideal choice for corporations looking to optimize their tax obligations. Here’s an in-depth look at the key aspects of Delaware’s corporate tax landscape.

Tax Rates and Brackets

Delaware’s corporate income tax is progressive, with tax rates varying based on the corporation’s taxable income. The state employs a three-bracket system, offering a graduated tax structure that benefits businesses as they grow.

- Bracket 1: Corporations with taxable income up to 25,000 are subject to a tax rate of 8.7%.</li> <li>Bracket 2: Taxable income exceeding 25,000 but not surpassing 100,000 is taxed at a rate of 7.2%.</li> <li>Bracket 3: For taxable income exceeding 100,000, the rate is reduced to 6.6%.

This progressive tax system ensures that as corporations expand and generate higher profits, their tax burden remains manageable and competitive compared to other states.

Tax Incentives and Credits

Delaware recognizes the importance of incentivizing businesses to establish and thrive within the state. As such, it offers a range of tax incentives and credits that can significantly reduce a corporation’s tax liability.

- Research and Development Tax Credit: Corporations engaged in research and development activities can claim a tax credit of up to 5% of their qualified research expenses. This incentive promotes innovation and encourages businesses to invest in cutting-edge technologies.

- Job Creation Tax Credit: Delaware provides tax credits to corporations that create new jobs within the state. The credit is based on the number of full-time employees hired and can be a significant incentive for businesses looking to expand their workforce.

- Capital Investment Tax Credit: Corporations investing in new facilities, equipment, or infrastructure within Delaware can claim a tax credit. This credit aims to encourage businesses to make long-term investments in the state’s economy.

These tax incentives not only attract new businesses to Delaware but also provide an incentive for existing corporations to expand their operations and contribute to the state’s economic growth.

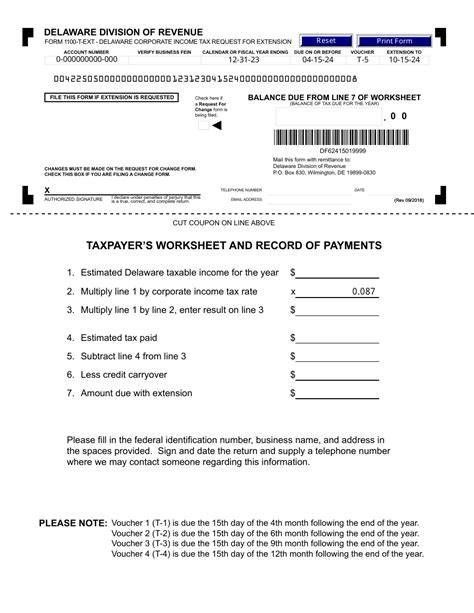

Tax Compliance and Filing

Delaware has streamlined its tax compliance processes to make it easier for corporations to fulfill their tax obligations. The state’s Division of Revenue provides clear guidelines and resources to assist businesses in understanding their tax responsibilities.

Corporations are required to file their tax returns annually, with the deadline typically falling on the 15th day of the third month following the end of their fiscal year. For example, a corporation with a fiscal year ending on December 31 would have until March 15 to file its tax return.

Delaware offers online filing options, making the process more convenient and efficient. Corporations can register for an online account with the Division of Revenue and access their tax forms, payment options, and other relevant information.

Tax Advantages for Holding Companies

Delaware’s corporate tax structure is particularly advantageous for holding companies. Holding companies are often established to manage and control other businesses, and Delaware’s laws provide a favorable environment for such entities.

One of the key advantages is the state’s lack of a franchise tax on holding companies. Unlike many other states, Delaware does not impose a tax on the mere existence of a holding company. This means that holding companies can operate in Delaware without incurring additional taxes solely based on their corporate structure.

Additionally, Delaware’s flexible corporate laws allow holding companies to engage in a wide range of activities, including owning and managing subsidiaries, without facing excessive taxation or regulatory burdens.

Delaware’s Corporate Tax Advantages: A Comparative Analysis

To understand the full extent of Delaware’s corporate tax benefits, it’s essential to compare them with other states. Let’s explore how Delaware stacks up against its peers in terms of corporate tax competitiveness.

Lower Tax Rates

Delaware’s corporate income tax rates are significantly lower than many other states. For instance, California’s corporate income tax rate is a flat 8.84%, while New York’s rate can vary between 6.5% and 7.25%, depending on the corporation’s income level. Delaware’s progressive tax structure ensures that corporations pay a lower overall tax rate as their profits increase.

No Franchise Tax

As mentioned earlier, Delaware does not impose a franchise tax on corporations. This is a significant advantage over states like Texas, which levies a franchise tax based on a corporation’s gross receipts or capital. By eliminating the franchise tax, Delaware provides corporations with a more straightforward and predictable tax environment.

Favorable Tax Treatment for Intellectual Property

Delaware offers a favorable tax environment for corporations that hold intellectual property. The state’s laws allow corporations to establish intellectual property holding companies, which can benefit from the state’s low corporate income tax rates. This encourages businesses to protect and monetize their intellectual property within Delaware.

Competitive Tax Incentives

Delaware’s tax incentives are designed to attract and retain businesses. The state’s research and development tax credit, job creation tax credit, and capital investment tax credit are highly competitive compared to other states. These incentives provide corporations with tangible benefits, making Delaware an attractive destination for businesses looking to optimize their tax obligations.

Real-World Examples: Delaware Corporate Tax in Action

Let’s examine some real-world scenarios to illustrate how Delaware’s corporate tax structure benefits businesses.

Case Study 1: Tech Startup Expansion

Imagine a tech startup based in California that is looking to expand its operations. The company has experienced significant growth and is considering relocating to a state with a more favorable corporate tax environment.

By incorporating in Delaware, the startup can take advantage of the state’s progressive tax rates. With taxable income falling into Bracket 3, the company would be subject to a tax rate of 6.6%, significantly lower than California’s flat rate of 8.84%. This reduction in tax liability could free up resources for the startup to invest in research, development, and hiring talented employees.

Case Study 2: Holding Company Structure

Consider a large multinational corporation with subsidiaries across various industries. The corporation is looking to streamline its operations and reduce its tax obligations.

By establishing a holding company in Delaware, the corporation can benefit from the state’s lack of a franchise tax. This means the holding company is not subject to an additional tax burden simply for existing as a corporate entity. Additionally, Delaware’s flexible corporate laws allow the holding company to engage in various activities without facing excessive taxation, providing the corporation with greater operational flexibility.

Case Study 3: Research and Development Focus

A pharmaceutical company based in Delaware is engaged in cutting-edge research and development activities. The company’s research expenses are significant, and it is looking for ways to optimize its tax obligations while continuing its innovative work.

Delaware’s research and development tax credit comes into play here. By claiming this credit, the pharmaceutical company can reduce its tax liability by up to 5% of its qualified research expenses. This incentive allows the company to reinvest a portion of its tax savings back into its research, fostering continued innovation and potentially leading to groundbreaking discoveries.

Future Implications and Considerations

Delaware’s corporate tax structure has played a pivotal role in establishing the state as a leading corporate hub. As businesses continue to seek competitive tax environments, Delaware’s advantages are likely to remain a key factor in corporate decision-making.

However, it’s important to consider the dynamic nature of tax policies. States may introduce new tax laws or incentives to attract businesses, and Delaware must remain vigilant in maintaining its competitive edge. Regular reviews and updates to Delaware’s tax policies will ensure the state continues to offer a favorable environment for corporations.

Additionally, as tax laws evolve, corporations must stay informed about potential changes that could impact their tax obligations. Staying up-to-date with tax legislation and seeking expert advice can help businesses navigate the complexities of Delaware’s corporate tax landscape effectively.

| Delaware Corporate Tax Key Takeaways |

|---|

| Progressive Tax Rates: Delaware offers a three-bracket system with rates ranging from 6.6% to 8.7%, providing a competitive advantage for businesses as they grow. |

| Tax Incentives: The state provides incentives such as research and development tax credits, job creation credits, and capital investment credits, reducing tax liability for eligible corporations. |

| Holding Company Benefits: Delaware's lack of a franchise tax and flexible corporate laws make it an attractive choice for holding companies seeking a streamlined tax environment. |

| Lower Rates Compared to Peers: Delaware's corporate tax rates are often lower than those of other states, making it a cost-effective choice for businesses. |

| Intellectual Property Advantages: Delaware's tax structure is favorable for corporations holding intellectual property, offering opportunities for tax optimization. |

How does Delaware’s corporate tax structure compare to other states in terms of overall tax burden for businesses?

+Delaware’s corporate tax structure is highly competitive compared to other states. Its progressive tax rates and lack of a franchise tax contribute to a lower overall tax burden for businesses. This makes Delaware an attractive choice for corporations looking to minimize their tax obligations while maintaining a presence in the United States.

Are there any specific industries or sectors that benefit the most from Delaware’s corporate tax advantages?

+Delaware’s corporate tax structure provides benefits across various industries. However, sectors such as technology, research and development, and intellectual property-intensive businesses often find Delaware particularly advantageous. The state’s tax incentives and flexible corporate laws cater to the needs of these industries, making it an ideal location for companies in these sectors.

What are the key considerations for a business when deciding to incorporate in Delaware based on its corporate tax structure?

+When considering Delaware for incorporation, businesses should evaluate their specific tax obligations and growth plans. Delaware’s progressive tax rates offer benefits as businesses expand, making it an attractive long-term choice. Additionally, the state’s tax incentives and lack of a franchise tax provide immediate advantages. Businesses should also consider the state’s reputation for corporate-friendly laws and the potential benefits of establishing a presence in a well-known corporate hub.