Payroll Tax Vs Income Tax

Welcome to an insightful exploration of the intricate world of taxation, where we delve into the differences between two fundamental concepts: payroll tax and income tax. These two tax systems play a significant role in our financial lives, yet they are often misunderstood and misconstrued. In this comprehensive guide, we aim to shed light on their distinct characteristics, functions, and implications, offering a clear understanding of their roles in the economic landscape.

Understanding Payroll Tax: The Essential Employee Deduction

Payroll tax is a crucial component of the employment landscape, impacting both employees and employers. This tax is levied on the wages or salaries of workers and serves as a primary source of revenue for governments to fund essential services and social programs.

Definition and Purpose

Payroll tax, also known as pay-as-you-earn tax or PAYE, is a statutory deduction made from an employee’s wages or salaries by their employer. This tax is then remitted to the relevant tax authority, typically on a periodic basis. The primary purpose of payroll tax is to ensure that employees contribute their fair share towards social security, healthcare, and other public services.

How Payroll Tax Works

The calculation of payroll tax involves several key components. First, the employee’s gross income is considered, which includes their wages, salaries, bonuses, and any other taxable earnings. From this gross income, various deductions are made, including income tax, social security contributions, Medicare contributions, and any other applicable taxes or deductions.

| Payroll Tax Components | Description |

|---|---|

| Income Tax | Tax based on an individual's taxable income, calculated using tax brackets and rates. |

| Social Security | A tax that funds social insurance programs, including retirement, disability, and survivor benefits. |

| Medicare | A tax that finances the Medicare program, providing healthcare coverage to eligible individuals. |

| State/Local Taxes | Additional taxes imposed by state or local governments, varying across jurisdictions. |

The remaining amount after all deductions is known as the employee's net pay or take-home pay, which they receive as their compensation for the pay period.

Payroll Tax Rates and Brackets

Payroll tax rates and brackets vary depending on the jurisdiction and the specific tax being considered. For instance, income tax rates often follow a progressive system, where higher income levels are taxed at higher rates. Social security and Medicare contributions typically have fixed rates, with maximum contribution limits to ensure that higher earners do not pay disproportionately more.

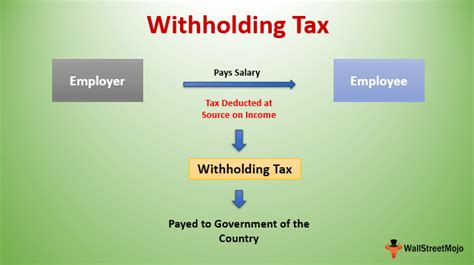

Employer Responsibilities

Employers bear significant responsibilities when it comes to payroll tax. They are required to withhold the appropriate payroll taxes from their employees’ wages, remit these taxes to the relevant tax authorities, and file payroll tax returns. Additionally, employers often contribute to social security and Medicare on behalf of their employees, further emphasizing the importance of payroll tax in the employment context.

Income Tax: Taxing Personal Earnings

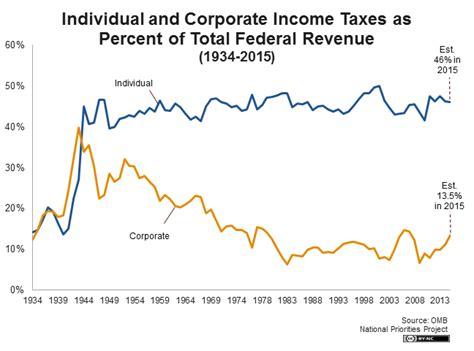

Income tax, on the other hand, is a tax levied on an individual’s income, whether it comes from employment, investments, or other sources. It is a critical component of a country’s tax system, as it provides a significant portion of the government’s revenue.

The Basics of Income Tax

Income tax is a progressive tax, meaning that higher income levels are taxed at higher rates. This ensures that individuals with greater financial means contribute a larger proportion of their income to the government. The income tax system is designed to be fair and equitable, taking into account an individual’s overall financial situation.

Taxable Income and Deductions

When calculating income tax, the starting point is an individual’s taxable income. This is the income remaining after various deductions and exemptions are applied. Deductions can include contributions to retirement accounts, medical expenses, charitable donations, and certain business expenses. These deductions reduce the taxable income, thereby lowering the overall tax liability.

| Common Income Tax Deductions | Description |

|---|---|

| Standard Deduction | A fixed amount that reduces taxable income, available to most taxpayers. |

| Itemized Deductions | Specific expenses that can be deducted, such as mortgage interest, state taxes, and medical costs. |

| Retirement Contributions | Deductions for contributions to retirement accounts like 401(k)s or IRAs. |

| Education Expenses | Deductions for qualified education expenses, such as tuition and fees. |

Tax Brackets and Rates

Income tax rates are typically divided into tax brackets, with each bracket corresponding to a specific income range. As income increases, the tax rate also increases. For example, an individual’s income might be taxed at 10% for the first 10,000, 15% for the next 20,000, and so on. This progressive structure ensures that higher incomes are taxed at a higher rate, promoting economic fairness.

Filing and Payment

Individuals are generally required to file an income tax return annually, declaring their income and calculating their tax liability. Depending on the jurisdiction, taxpayers may have to make periodic payments throughout the year to cover their estimated tax liability. These payments are then reconciled when the final tax return is filed.

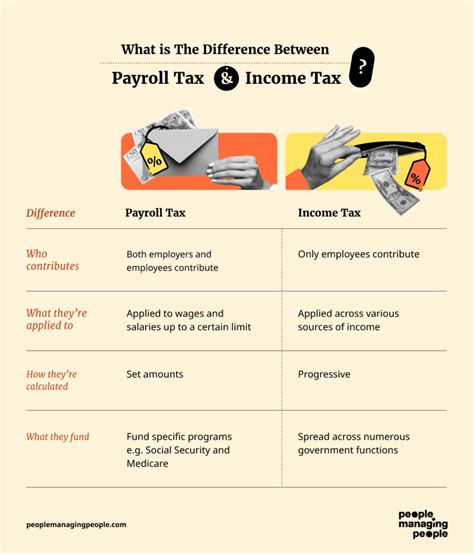

Key Differences Between Payroll and Income Tax

While both payroll tax and income tax are crucial components of a country’s tax system, they serve different purposes and have distinct characteristics:

Scope and Application

- Payroll tax is specifically applied to income earned through employment. It is a statutory deduction made by employers from their employees’ wages or salaries.

- Income tax, on the other hand, is levied on all forms of income, including employment income, investment income, rental income, and other sources.

Calculation and Rates

- Payroll tax rates are typically fixed or have maximum contribution limits, ensuring that higher earners do not pay disproportionately more.

- Income tax rates are progressive, with higher income levels subject to higher tax rates. This ensures that those with greater financial means contribute a larger share of their income to the government.

Withholding and Remittance

- Payroll tax is withheld by employers and remitted to the relevant tax authority on behalf of the employee.

- Income tax may be withheld by employers, but individuals are also responsible for making estimated tax payments throughout the year and filing an annual tax return.

Purpose and Impact

- Payroll tax primarily funds social security, healthcare, and other public services, ensuring that employees contribute to these essential programs.

- Income tax provides a significant portion of a country’s revenue, funding various government operations and initiatives.

The Impact of Payroll and Income Tax on Individuals and Businesses

Both payroll and income tax have significant implications for individuals and businesses:

For Employees

- Payroll tax deductions reduce an employee’s take-home pay, impacting their disposable income and financial planning.

- Understanding income tax rates and brackets can help employees plan their finances and optimize their tax liability through deductions and credits.

For Employers

- Payroll tax obligations require employers to manage payroll tax withholding, remittance, and reporting, adding to their administrative burden.

- Income tax considerations, such as offering tax-efficient benefits or providing tax guidance to employees, can impact employer-employee relationships and overall business operations.

For Businesses

- Businesses must also navigate income tax obligations, including corporate income tax, which can significantly impact their profitability and growth plans.

- Strategic tax planning can help businesses optimize their tax liability and allocate resources more effectively.

Future Trends and Implications

The landscape of payroll and income tax is continually evolving, influenced by economic, social, and political factors. Some key trends and implications to consider include:

Tax Reform and Policy Changes

Governments may introduce tax reforms to address economic challenges, promote social equity, or simplify the tax system. These reforms can impact both payroll and income tax rates, brackets, and deductions, requiring individuals and businesses to adapt their financial strategies.

Technology and Digitalization

The rise of digital technologies and automation is transforming the tax landscape. Online tax filing and payment systems, as well as the use of AI and data analytics, are enhancing tax administration and compliance. These advancements can streamline tax processes and reduce the administrative burden on taxpayers.

Global Tax Trends

In an increasingly globalized economy, tax policies and practices are becoming more interconnected. Countries are collaborating to combat tax evasion and harmonize tax regulations. These global trends can impact international businesses and individuals with cross-border operations or investments.

Social and Economic Factors

Economic growth, inflation, and social programs can influence tax policies. For instance, during economic downturns, governments may introduce tax relief measures to stimulate the economy, while in times of prosperity, tax rates may be adjusted to fund social initiatives. These factors can significantly impact payroll and income tax obligations.

Conclusion: Navigating the Complex World of Taxation

Payroll tax and income tax are fundamental components of a country’s tax system, each playing a distinct role in funding essential services and promoting economic fairness. Understanding these tax systems is crucial for individuals and businesses to navigate their financial obligations and optimize their strategies.

As the tax landscape continues to evolve, staying informed and adapting to changes is essential. By seeking professional advice and staying abreast of tax reforms and trends, individuals and businesses can ensure compliance, minimize their tax liability, and make informed financial decisions.

FAQ

How often are payroll taxes remitted to the tax authority?

+

The frequency of payroll tax remittance varies depending on the jurisdiction and the amount of tax withheld. In some cases, employers may be required to remit payroll taxes on a weekly, biweekly, or monthly basis. For larger employers or those with higher tax liabilities, more frequent remittances may be necessary.

Are there any income tax exemptions or credits available to reduce tax liability?

+

Yes, many jurisdictions offer income tax exemptions and credits to reduce the tax burden on certain individuals or groups. These can include exemptions for specific types of income, such as tax-free allowances, or credits for factors like having dependents, owning a home, or making charitable contributions.

How do employers calculate payroll tax for their employees?

+

Employers calculate payroll tax by considering the employee’s gross income, including wages, salaries, bonuses, and other taxable earnings. They then apply the appropriate tax rates and deductions for income tax, social security, Medicare, and any other applicable taxes. The remaining amount is the employee’s net pay.

Can individuals claim deductions for business expenses on their income tax return?

+

Yes, individuals who operate a business or have business-related expenses can often claim deductions on their income tax return. These deductions can include expenses for office space, equipment, travel, and other business-related costs. However, the specific rules and limitations for claiming business expenses vary by jurisdiction.

What happens if an individual or business fails to remit payroll or income taxes on time?

+

Failing to remit payroll or income taxes on time can result in significant penalties and interest charges. Tax authorities may impose fines, seize assets, or even initiate legal proceedings against individuals or businesses that fail to meet their tax obligations. It is crucial to stay compliant and seek professional advice if needed.