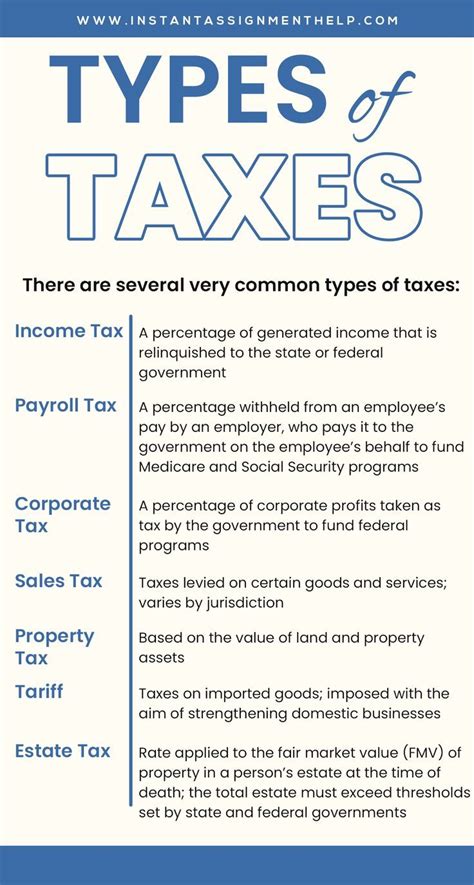

Gilbert Sales Tax

The implementation and administration of sales tax vary across jurisdictions, and one such example is the Gilbert Sales Tax, which serves as a critical revenue source for the town of Gilbert, Arizona. This tax not only funds essential public services but also reflects the unique economic landscape of the region. Understanding the intricacies of Gilbert's sales tax provides valuable insights into the interplay between local economies and taxation policies.

Gilbert’s Sales Tax Structure

Gilbert, like many other municipalities, levies a sales tax on various goods and services sold within its borders. This tax is an essential component of the town’s revenue stream, enabling the local government to provide essential services such as public safety, education, infrastructure development, and maintenance.

Rate and Components

The sales tax rate in Gilbert is comprised of several components, including the state sales tax, county tax, and municipal tax. As of [current year], the combined sales tax rate in Gilbert stands at [current rate]%, which is slightly higher than the state average. The additional municipal tax rate, set at [Gilbert’s municipal tax rate]%, is a critical tool for the town to generate revenue for local projects and services.

| Tax Type | Rate |

|---|---|

| State Sales Tax | [State Sales Tax Rate]% |

| County Tax | [County Tax Rate]% |

| Municipal Tax | [Gilbert's Municipal Tax Rate]% |

| Total Sales Tax Rate | [Combined Rate]% |

This structure allows the town to have a degree of control over its fiscal policy, ensuring that it can respond to the specific needs and priorities of its residents and businesses.

Exemptions and Special Cases

While the sales tax applies to most goods and services, certain items are exempt or have special tax rates. These exemptions are typically based on state and local laws and can include essential items like groceries, medications, and certain types of services. For instance, in Gilbert, certain food items for home consumption are exempt from sales tax, providing a relief to residents’ daily expenses.

Additionally, there are provisions for tax holidays or special events where specific items are exempt from sales tax for a limited period. These initiatives are often aimed at stimulating the local economy and encouraging consumer spending.

Impact on Local Economy

The Gilbert Sales Tax plays a pivotal role in shaping the town’s economic landscape. It influences consumer behavior, business strategies, and overall economic growth.

Consumer Perspective

For consumers, the sales tax is a visible reminder of the cost of living in Gilbert. While it adds to the price of goods and services, it also contributes to the maintenance and development of the community. Residents often consider the sales tax rate when making purchasing decisions, especially for big-ticket items. Understanding the tax structure can help consumers make more informed choices and potentially save money through strategic timing of purchases, such as during tax-free weekends or sales events.

Business Implications

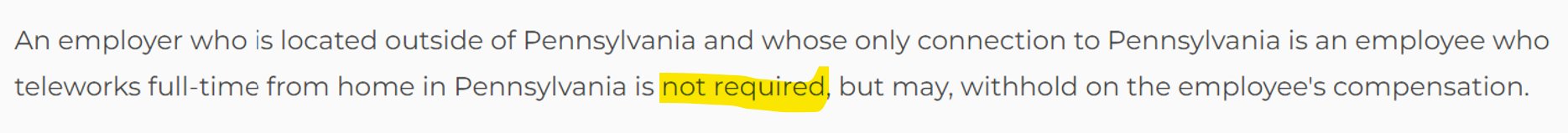

Businesses operating in Gilbert are directly impacted by the sales tax. They are responsible for collecting and remitting the tax to the appropriate authorities, which adds an administrative burden. However, the sales tax can also be a strategic consideration for businesses. For instance, companies may choose to locate their operations in Gilbert due to its tax structure, particularly if they can pass on the tax to consumers without affecting their competitive pricing. On the other hand, businesses might consider alternative pricing strategies or pass the tax burden to consumers to maintain their margins.

Economic Development

From an economic development perspective, the sales tax is a vital tool for the town to invest in infrastructure, attract businesses, and create jobs. The revenue generated from the sales tax can be directed towards initiatives such as improving roads, public transportation, and utilities, which in turn make the town more attractive for residents and businesses alike. Additionally, the tax can fund incentives for businesses to locate in Gilbert, further boosting the local economy.

Compliance and Administration

Ensuring compliance with sales tax regulations is a complex task for businesses and individuals alike. The process involves accurate tax calculation, timely filing, and proper record-keeping.

Tax Calculation and Filing

Businesses in Gilbert are required to calculate the sales tax based on the total taxable sales for the period. This involves a meticulous process of categorizing sales, applying the appropriate tax rates, and ensuring accuracy. The calculated tax amount is then remitted to the state and local authorities by the due date. Non-compliance can result in penalties and interest, making timely and accurate filing crucial.

Record-Keeping and Audits

Maintaining detailed records of sales transactions is essential for sales tax compliance. These records serve as evidence during audits, which are conducted by the state and local tax authorities to ensure businesses are accurately calculating and remitting the sales tax. Audits can be complex and time-consuming, requiring businesses to have robust record-keeping systems in place.

Resources and Support

To assist businesses and individuals with sales tax compliance, Gilbert and Arizona provide various resources. These include detailed guides, workshops, and online tools to help understand and navigate the sales tax regulations. Additionally, tax professionals and consultants offer specialized services to ensure businesses are compliant and take advantage of any available incentives or exemptions.

Future Prospects and Trends

The future of Gilbert’s sales tax is influenced by various factors, including economic growth, demographic shifts, and policy changes.

Economic Growth and Development

As Gilbert continues to experience economic growth, the sales tax revenue is expected to increase. This growth can be attributed to factors such as population increase, rising consumer spending, and the influx of new businesses. However, the town must carefully manage this growth to ensure the sales tax remains competitive and does not deter businesses or consumers.

Policy Changes and Reforms

Policy changes at the state and local level can significantly impact Gilbert’s sales tax structure. For instance, reforms aimed at simplifying the tax code or harmonizing tax rates across the state can have far-reaching implications. Similarly, changes in tax exemptions or incentives can influence business decisions and consumer behavior. Staying informed about potential policy changes is crucial for businesses and residents to adapt their strategies accordingly.

Technological Innovations

The digital age has brought about significant advancements in tax administration and compliance. Technological innovations, such as cloud-based accounting software and online tax filing systems, have streamlined the sales tax process, making it more efficient and accessible. These tools can help businesses in Gilbert stay compliant and reduce the administrative burden associated with sales tax.

How often are sales tax rates updated in Gilbert?

+Sales tax rates in Gilbert are subject to periodic reviews and adjustments. These changes typically occur annually or biennially, aligned with the state’s tax calendar. However, special circumstances, such as significant economic shifts or legislative amendments, can prompt more frequent rate updates.

Are there any sales tax holidays in Gilbert?

+Yes, Gilbert, along with many other Arizona municipalities, observes sales tax holidays. These are designated periods, often during major shopping seasons, where specific items are exempt from sales tax. This initiative aims to stimulate consumer spending and provide a temporary relief from the sales tax burden.

How can businesses in Gilbert ensure compliance with sales tax regulations?

+Businesses in Gilbert can ensure compliance by staying informed about the latest sales tax regulations, using reliable tax calculation tools, and maintaining accurate records. Regularly consulting with tax professionals or utilizing specialized software can also help businesses navigate the complexities of sales tax compliance.