Types Of Taxes Microeconomics U6

In the realm of microeconomics, understanding the various types of taxes is crucial, as they play a significant role in shaping market outcomes and influencing economic decisions. Taxes are a fundamental tool used by governments to generate revenue, redistribute wealth, and achieve policy objectives. This article aims to provide an in-depth exploration of the different types of taxes, their characteristics, and their implications within the context of microeconomics, particularly focusing on the unit U6.

Direct and Indirect Taxes: A Fundamental Distinction

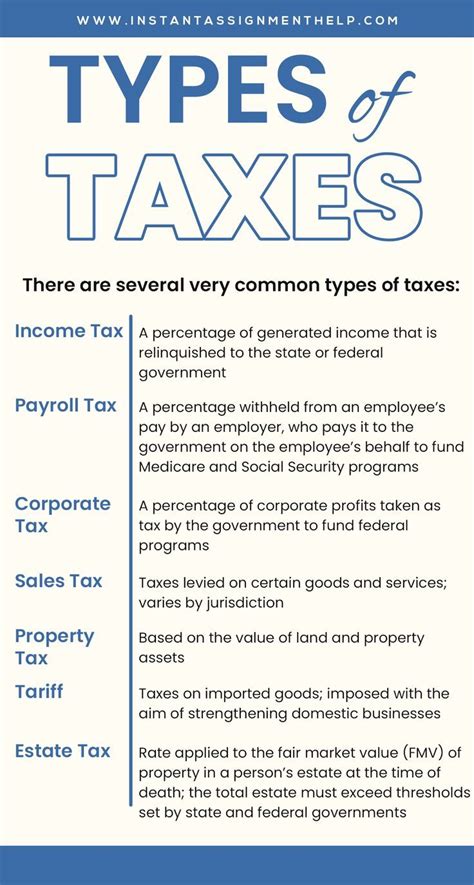

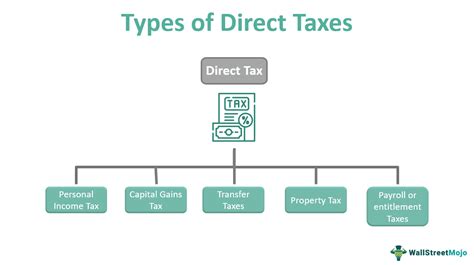

One of the primary classifications of taxes is between direct taxes and indirect taxes. Direct taxes are levied directly on individuals or entities, such as income tax, property tax, or wealth tax. These taxes are often considered more transparent, as the burden and benefit of the tax are directly visible to the taxpayer.

On the other hand, indirect taxes are imposed on goods and services, and they are typically collected by intermediaries, such as producers or retailers, who then pass on the tax burden to consumers. Value-added tax (VAT), sales tax, and excise duties are common examples of indirect taxes. Unlike direct taxes, the incidence of indirect taxes can be more complex and less transparent, as the final consumer might not always be aware of the tax component in the price they pay.

| Tax Type | Key Characteristics |

|---|---|

| Direct Taxes | Transparent, levied on individuals/entities, includes income tax, property tax |

| Indirect Taxes | Collected through intermediaries, imposed on goods/services, includes VAT, sales tax |

Progressive, Regressive, and Proportional Tax Systems

The design of a tax system can have significant distributional implications. Progressive tax systems are structured such that the tax rate increases as the taxable base (e.g., income) increases. This approach aims to redistribute wealth from higher-income individuals to lower-income ones, promoting social equity. An example of a progressive tax is the U.S. federal income tax, where higher income brackets face higher marginal tax rates.

In contrast, regressive tax systems impose a higher burden on lower-income individuals relative to their income. This is often the case with taxes on consumption, such as sales taxes, as these taxes are typically a larger proportion of a low-income individual's budget compared to a high-income individual's. Regressive taxes can exacerbate income inequality.

A proportional tax system, also known as a flat tax, applies the same tax rate to all income levels. While this system is considered simple and easy to administer, it lacks the redistributive effects of progressive taxes.

| Tax System | Key Features |

|---|---|

| Progressive | Higher tax rates for higher incomes, promotes social equity |

| Regressive | Higher burden on lower incomes, can worsen income inequality |

| Proportional (Flat Tax) | Same tax rate for all incomes, simple administration |

Specific Taxes and Their Economic Impact

Income Tax: Impact on Labor Supply and Incentives

Income tax, a direct tax, has a significant influence on labor supply and individual incentives. Higher income tax rates can discourage work effort, as individuals face a higher marginal tax rate, reducing the incentive to work longer hours or take on additional jobs. This effect is particularly relevant when considering the substitution and income effects of taxation.

The substitution effect suggests that as tax rates rise, the opportunity cost of leisure increases, potentially leading individuals to work less. Conversely, the income effect implies that higher taxes reduce disposable income, which might encourage individuals to work more to maintain their desired standard of living.

Sales Tax and Consumer Behavior

Sales tax, an indirect tax, affects consumer behavior by increasing the price of goods and services. This can lead to a reduction in demand, especially for price-sensitive consumers. However, sales tax also provides a steady stream of revenue for governments, making it a popular choice for local and state governments.

Additionally, sales tax can influence consumption patterns. For example, if certain goods are exempted from sales tax (e.g., groceries or medications), consumers might shift their spending towards these items, impacting the overall market structure.

Excise Duties and Market Efficiency

Excise duties are a form of indirect tax levied on specific goods, often those considered harmful or socially undesirable, such as tobacco, alcohol, or fuel. These taxes can serve multiple purposes: generating revenue, discouraging consumption of harmful products, and addressing externalities.

From a microeconomic perspective, excise duties can improve market efficiency by internalizing negative externalities associated with the production or consumption of these goods. For instance, a tax on fuel can help mitigate the environmental costs of pollution and encourage the adoption of more sustainable practices.

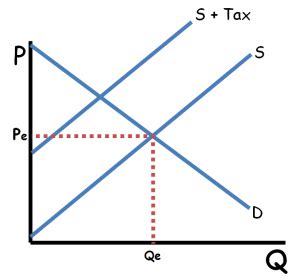

Tax Incidence and Burden Shifting

Understanding tax incidence is crucial for analyzing the ultimate impact of taxes. Tax incidence refers to the entity that bears the burden of a tax. While a tax might be imposed on a particular entity, the burden can shift to other parties through price adjustments or cost transfers.

For instance, consider a tax imposed on producers. While the tax might initially be borne by the producers, they could pass on this burden to consumers by increasing the price of the product. This shift in tax burden is a common occurrence in markets with imperfect competition.

Taxes and Market Structure: The Impact on Competition

The introduction of taxes can significantly alter market structures and competitive dynamics. In perfectly competitive markets, taxes can lead to a reduction in both consumer surplus and producer surplus, as the tax burden is shared between producers and consumers. However, in markets with market power, such as monopolies or oligopolies, the impact can be more complex.

In a monopoly, for example, a tax might initially reduce the firm's profits, but the firm could respond by increasing prices, potentially shifting a significant portion of the tax burden to consumers. This can lead to a reduction in social welfare, as the tax reduces consumer surplus without providing an equivalent benefit to producers.

Conclusion: The Role of Taxes in Microeconomics

Taxes are a vital component of economic policy, and their design and implementation have far-reaching implications. In the context of microeconomics, understanding the different types of taxes, their incidence, and their impact on market outcomes is essential for analyzing economic decisions and market behavior. The choice of tax system and specific tax policies can shape income distribution, market efficiency, and competitive dynamics, making taxes a powerful tool for economic management and social welfare.

What is the primary difference between direct and indirect taxes?

+

Direct taxes are levied directly on individuals or entities, while indirect taxes are imposed on goods and services and are typically collected by intermediaries.

How do progressive tax systems impact income distribution?

+

Progressive tax systems aim to redistribute wealth by imposing higher tax rates on higher incomes, which can reduce income inequality.

What are the potential effects of sales tax on consumer behavior?

+

Sales tax can reduce demand for goods and services, especially for price-sensitive consumers. It can also influence consumption patterns by encouraging spending on tax-exempt items.

How do excise duties impact market efficiency?

+

Excise duties can improve market efficiency by internalizing negative externalities associated with the production or consumption of certain goods, such as environmental costs.