Michigan Income Tax Refund Status

For Michigan residents, understanding the status of their income tax refunds is an important financial matter. This article aims to provide a comprehensive guide to help you navigate the process of checking the status of your Michigan income tax refund, offering practical steps and insights.

Navigating the Michigan Income Tax Refund Process

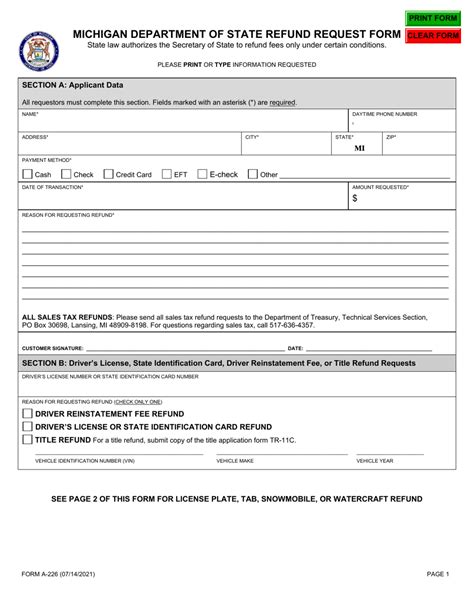

The Michigan Department of Treasury manages the state’s income tax refund process, and it is essential to familiarize yourself with their procedures to ensure a smooth and efficient experience.

Online Tools for Tracking Refunds

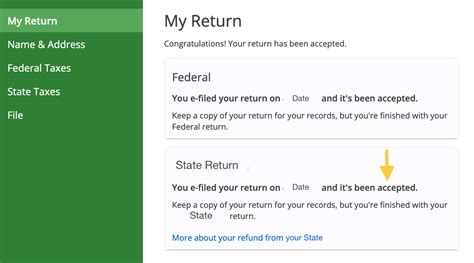

The Michigan Department of Treasury offers a user-friendly online platform, MiTax, which allows taxpayers to check the status of their refunds conveniently. This platform provides real-time updates, ensuring that you stay informed about the progress of your refund.

To access MiTax, you will need to create an account using your personal details, including your Social Security Number, date of birth, and other identifying information. Once logged in, you can view the status of your refund, along with other important tax-related information.

Understanding the Refund Timeline

The timeline for Michigan income tax refunds can vary depending on several factors, including the complexity of your tax return and the volume of returns being processed. Generally, the Michigan Department of Treasury aims to process refunds within 45 days of receiving the return.

It's important to note that this timeline may be affected by factors such as errors or discrepancies in your return, which could require additional review and potentially delay the refund process. Staying organized and ensuring the accuracy of your tax return can help expedite the process.

Tracking Your Refund Status

To track the status of your Michigan income tax refund, you can utilize the following methods:

- MiTax Online Portal: As mentioned earlier, the MiTax portal provides a convenient way to check your refund status. Simply log in to your account, and you will be able to view the current status of your refund, along with any updates or messages from the Department of Treasury.

- Phone Inquiries: If you prefer a more personal approach, you can call the Michigan Department of Treasury's toll-free number at 1-800-307-3282 during their business hours. A customer service representative will assist you in checking the status of your refund and answering any questions you may have.

- Email Support: For those who prefer digital communication, the Department of Treasury offers an email support system. You can send your inquiries to midept@michigan.gov, and a representative will respond to your query within a few business days.

What to Do if Your Refund is Delayed

In some cases, refunds may be delayed due to various reasons, such as errors, missing information, or even system glitches. If you find that your refund is taking longer than expected, here are some steps you can take:

- Check for Errors: Review your tax return for any potential errors or discrepancies. Double-check the accuracy of your personal information, calculations, and any deductions or credits claimed. If you find an error, amend your return and resubmit it.

- Contact the Department of Treasury: Reach out to the Michigan Department of Treasury using the contact methods mentioned above. Their customer service team can provide you with specific information regarding the delay and guide you through the necessary steps to resolve the issue.

- Consider Other Refund Methods: If you typically receive your refund via check, you may want to consider opting for direct deposit in the future. Direct deposit can often expedite the refund process, as it eliminates the time needed for printing and mailing a physical check.

Maximizing Your Refund

To ensure you receive the maximum refund you’re entitled to, it’s crucial to take advantage of all the deductions and credits available to you. Here are some tips to help you maximize your Michigan income tax refund:

- Utilize Deductions: Familiarize yourself with the various deductions offered by the state, such as the Michigan Homestead Property Tax Credit and the Michigan Education Credit. These deductions can significantly reduce your taxable income and increase your refund.

- Claim All Eligible Credits: Michigan offers several tax credits, including the Michigan Earned Income Tax Credit and the Child and Dependent Care Credit. Make sure you claim all the credits you are eligible for to boost your refund amount.

- Seek Professional Help: If you find the tax process complex or are unsure about maximizing your deductions and credits, consider seeking the assistance of a tax professional. They can guide you through the process and ensure you take advantage of all the available benefits.

Future Implications and Tax Planning

Understanding the status of your Michigan income tax refund is not only about the current tax year but also about planning for the future. By tracking your refund status and maximizing your deductions and credits, you can develop a better understanding of your financial situation and make informed decisions for the upcoming tax season.

Additionally, staying informed about any changes in Michigan's tax laws and regulations can help you adapt your tax strategy accordingly. The Michigan Department of Treasury often provides updates and resources to assist taxpayers in navigating these changes.

By staying organized, utilizing available tools, and seeking professional guidance when needed, you can ensure a smooth and efficient process when it comes to your Michigan income tax refunds.

Frequently Asked Questions

How long does it typically take to receive a Michigan income tax refund?

+

The Michigan Department of Treasury aims to process refunds within 45 days of receiving the return. However, factors like errors or high volumes of returns can cause delays.

What if I haven’t received my refund after 45 days?

+

If you haven’t received your refund after 45 days, it’s advisable to check the status of your refund using the MiTax portal or contact the Department of Treasury for assistance. They can provide specific information regarding any delays.

Can I track my refund status without creating an account on MiTax?

+

While creating an account on MiTax provides a more comprehensive view of your refund status, you can also check the status of your refund by calling the Department of Treasury’s toll-free number or sending an email inquiry.

What should I do if I think there’s an error with my refund amount?

+

If you suspect an error with your refund amount, carefully review your tax return for any discrepancies. If you find an error, amend your return and resubmit it. You can also contact the Department of Treasury for assistance.

Are there any deductions or credits I should be aware of to maximize my refund?

+

Yes, Michigan offers various deductions and credits, such as the Michigan Homestead Property Tax Credit, Michigan Education Credit, Michigan Earned Income Tax Credit, and Child and Dependent Care Credit. Ensure you claim all eligible deductions and credits to maximize your refund.