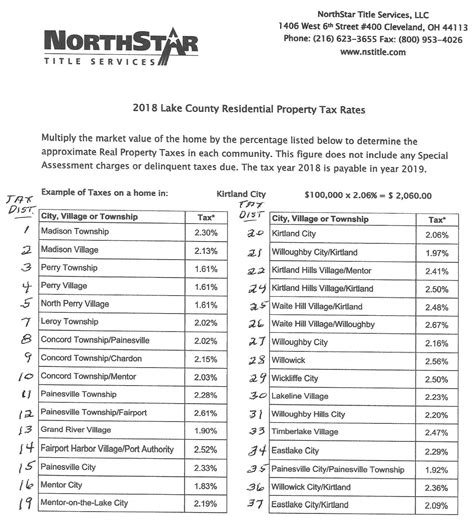

Lake County Real Estate Taxes

Welcome to an in-depth exploration of the world of Lake County real estate taxes. This comprehensive guide aims to provide you with an expert understanding of the ins and outs of this essential aspect of property ownership. From the basics of tax assessment to strategies for effective tax management, we will cover it all. Whether you're a seasoned investor or a first-time homeowner, this article will equip you with the knowledge to navigate the complexities of Lake County's real estate tax landscape.

Understanding the Basics: Real Estate Tax Assessment in Lake County

Real estate taxes are a vital component of property ownership, and Lake County, with its diverse landscapes and thriving communities, has its unique tax assessment process. Understanding how these taxes are calculated and assessed is the first step towards effective tax management.

In Lake County, the process begins with the County Assessor's Office, which is responsible for evaluating the value of each property within the county. This valuation is a crucial determinant of the tax liability for property owners. The assessor's office employs a range of methods, including sales comparison, cost approach, and income approach, to estimate the fair market value of each property.

The assessed value is then subject to a tax rate, which is determined by the local government and can vary based on the type of property and its location within the county. This rate is typically expressed as a percentage of the assessed value and is used to calculate the actual tax amount owed by the property owner.

For instance, consider a residential property in Lake County with an assessed value of $300,000. If the tax rate for residential properties is set at 1.5%, the annual tax liability for this property would be $4,500 ($300,000 x 0.015). This calculation provides a straightforward illustration of how the tax rate directly influences the tax burden on property owners.

The Impact of Property Value on Tax Liability

It’s essential to understand that property value is a dynamic entity, subject to fluctuations based on market conditions, improvements made to the property, or even changes in the local economy. As such, the assessed value of a property can change annually, leading to variations in the tax liability from year to year.

To illustrate this point, let's consider a commercial property in Lake County. If this property was initially assessed at $500,000 and the tax rate was 2%, the annual tax liability would be $10,000 ($500,000 x 0.02). However, if the property value increases to $600,000 in the following year due to improvements or market appreciation, the new tax liability would be $12,000 ($600,000 x 0.02), highlighting the direct correlation between property value and tax burden.

Tax Exemptions and Relief: Strategies for Lake County Property Owners

While real estate taxes are an inevitable aspect of property ownership, Lake County offers a range of tax exemptions and relief programs designed to ease the tax burden on property owners. Understanding these opportunities can be a game-changer for effective tax management.

Homestead Exemptions: Protecting Your Primary Residence

One of the most significant tax relief programs available to Lake County residents is the Homestead Exemption. This exemption applies to the primary residence of a homeowner and provides a reduction in the assessed value of the property, which, in turn, lowers the tax liability. The Homestead Exemption is particularly beneficial for long-term residents, as it offers a stable tax base, protecting them from significant increases in tax liability due to rising property values.

For example, if a homeowner in Lake County qualifies for the Homestead Exemption and their primary residence is assessed at $400,000, the exemption could reduce the assessed value by up to $50,000, resulting in a tax savings of $750 annually ($50,000 x 1.5% tax rate). This exemption ensures that homeowners can enjoy the benefits of property ownership without being burdened by excessive tax increases.

Senior Citizen Exemptions: Supporting Our Aging Population

Lake County also recognizes the unique needs of its senior citizens by offering Senior Citizen Exemptions. These exemptions are designed to provide tax relief to homeowners aged 65 and above, ensuring that they can continue to afford their homes as they age. The Senior Citizen Exemption can significantly reduce the tax liability for eligible homeowners, making it a crucial aspect of financial planning for this demographic.

Consider a senior homeowner in Lake County with a property assessed at $350,000. If they qualify for the Senior Citizen Exemption, their assessed value could be reduced by $35,000, resulting in an annual tax savings of $525 ($35,000 x 1.5% tax rate). This exemption not only provides financial relief but also ensures that seniors can maintain their standard of living without the burden of escalating tax liabilities.

Other Tax Relief Programs: Supporting Local Businesses and Communities

Beyond the Homestead and Senior Citizen Exemptions, Lake County offers a range of other tax relief programs aimed at supporting local businesses and communities. These programs can include:

- Agricultural Exemptions: These exemptions are designed to support farming and agricultural operations, providing reduced tax assessments for qualifying properties.

- Disabled Veteran Exemptions: Lake County recognizes the sacrifices made by its veterans by offering tax exemptions to those with service-related disabilities.

- Historic Property Tax Credits: To encourage the preservation of historic properties, Lake County provides tax credits for eligible renovations and improvements.

- Brownfield Remediation Tax Incentives: Aimed at promoting environmental remediation and redevelopment, these incentives offer tax breaks for the cleanup and reuse of contaminated properties.

By taking advantage of these programs, property owners in Lake County can not only reduce their tax liabilities but also contribute to the growth and sustainability of their local communities.

Staying Informed: Tax Appeals and Assessment Reviews

While tax exemptions and relief programs offer significant benefits, it’s crucial for property owners to stay informed about their assessment and potential avenues for appeal. Understanding the assessment process and being aware of your rights can lead to more favorable tax outcomes.

Understanding the Assessment Process: From Valuation to Tax Bill

The assessment process in Lake County is a meticulous journey, involving several key steps. It begins with the initial valuation of the property, which is conducted by the County Assessor’s Office. This valuation is based on a range of factors, including recent sales of comparable properties, the cost of constructing similar buildings, and the potential income-generating capacity of the property.

Once the valuation is complete, the Assessor's Office applies the appropriate tax rate, as determined by the local government, to calculate the tax liability. This process results in the issuance of a tax bill, which outlines the property's assessed value, the applicable tax rate, and the total tax amount owed by the property owner.

For instance, if a commercial property in Lake County is assessed at $700,000 and the tax rate is 2.2%, the tax bill will reflect a total tax liability of $15,400 ($700,000 x 0.022). This bill provides a clear breakdown of the tax calculation, allowing property owners to understand their financial obligations.

Navigating the Appeal Process: When to Consider an Assessment Review

In some cases, property owners may feel that their assessed value is inaccurate or unfair. In such situations, it’s essential to know that Lake County offers an Assessment Review Process, which allows property owners to challenge their assessment and potentially reduce their tax liability.

The Assessment Review Process typically involves the following steps:

- Notice of Assessment: Property owners receive a notice of their assessed value, along with information on the assessment process and their rights to appeal.

- Informal Review: Property owners can request an informal review with the Assessor's Office to discuss their assessment and provide additional information or documentation to support their case.

- Formal Appeal: If the informal review does not result in a satisfactory outcome, property owners can file a formal appeal with the Board of Review, an independent body that hears and decides on assessment appeals.

- Board of Review Hearing: During the hearing, property owners present their case to the Board of Review, providing evidence and arguments to support their claim for a reduced assessment.

- Decision: The Board of Review makes a decision on the appeal, either upholding the original assessment or reducing it based on the evidence presented. This decision is final and binding.

For example, if a property owner believes their residential property in Lake County has been overvalued, they can initiate the Assessment Review Process. By providing evidence such as recent sales of similar properties at lower prices or documentation of property damage that affects value, they can make a strong case for a reduced assessment. If successful, this could lead to a lower tax liability, providing significant financial relief.

Conclusion: Empowering Lake County Property Owners

Navigating the world of real estate taxes can be a complex journey, but with the right knowledge and strategies, property owners in Lake County can effectively manage their tax liabilities. From understanding the assessment process to taking advantage of tax exemptions and relief programs, there are numerous ways to optimize your tax management.

By staying informed, engaging with the local tax authorities, and utilizing the resources available, property owners can ensure they are treated fairly and receive the tax benefits they deserve. Whether it's protecting your primary residence with a Homestead Exemption, seeking relief as a senior citizen, or appealing an unfair assessment, the key is to be proactive and knowledgeable about your rights and responsibilities.

In conclusion, effective tax management is not just about meeting financial obligations; it's about empowering property owners to make the most of their investment. With the insights and strategies outlined in this guide, Lake County property owners can take control of their tax situation, ensuring their financial well-being and contributing to the growth and prosperity of their local communities.

What is the average real estate tax rate in Lake County?

+The average real estate tax rate in Lake County varies based on the type of property and its location. As of the latest data, the average tax rate for residential properties is approximately 1.5%, while commercial properties may have a slightly higher rate, averaging around 2.2%.

How often are properties reassessed for tax purposes in Lake County?

+Properties in Lake County are typically reassessed every three years. However, certain changes, such as significant improvements or damage to the property, can trigger an early reassessment. It’s important for property owners to stay informed about their assessment and any changes that may impact their tax liability.

Are there any online resources to help calculate my potential tax liability in Lake County?

+Yes, the Lake County Assessor’s Office provides an online property tax calculator on their website. This tool allows property owners to estimate their potential tax liability based on their property’s assessed value and the applicable tax rate. It’s a convenient way to get a rough estimate of your tax obligations.

Can I receive tax notifications and updates via email or text in Lake County?

+Absolutely! Lake County offers a convenient service called “Property Tax E-Notice,” which allows property owners to receive tax notifications and updates via email or text message. This service ensures that you stay informed about important tax-related deadlines and changes.

What is the process for applying for a tax exemption or relief program in Lake County?

+The process for applying for tax exemptions or relief programs varies depending on the specific program. It’s recommended to visit the Lake County Assessor’s Office website or contact their office directly for detailed information on the application process and required documentation for each program.