Denver Colorado Sales Tax

Welcome to the Mile High City, where the air is crisp, the mountains are majestic, and the sales tax is a unique part of the local economy. Denver, Colorado, offers a vibrant urban experience with a thriving business climate, and understanding its sales tax system is crucial for both residents and visitors alike. In this comprehensive guide, we will delve into the intricacies of Denver's sales tax, exploring its rates, applications, and the impact it has on the city's vibrant culture and economy.

The Denver Sales Tax Ecosystem

Denver’s sales tax structure is a complex yet fascinating blend of local, state, and regional tax policies. As of 2023, the sales tax in Denver consists of multiple layers, each serving a specific purpose and contributing to the city’s fiscal health.

The foundation of Denver's sales tax is the state sales tax, which currently stands at 2.9%. This rate is uniform across Colorado and applies to a wide range of goods and services. On top of this, Denver County levies an additional 2.5% tax, bringing the total county-wide sales tax to 5.4%. But the story doesn't end there.

To support specific initiatives and programs, Denver also imposes a special district tax, which varies depending on the location within the city. This tax is allocated to fund important community projects, with rates ranging from 0.1% to 1.0% across different districts. These district-specific taxes ensure that the city's diverse neighborhoods can thrive and receive tailored support.

Additionally, certain goods and services are subject to additional taxes. For instance, prepared food and beverages carry an extra 2.25% tax, while vehicle rentals are taxed at 8.25% and short-term accommodations at 9.25%. These rates are designed to support tourism, transportation, and infrastructure development in Denver.

A Snapshot of Denver’s Sales Tax Rates

| Tax Type | Rate | Description |

|---|---|---|

| State Sales Tax | 2.9% | Applied uniformly across Colorado. |

| Denver County Sales Tax | 2.5% | Supplements the state tax, specific to Denver County. |

| Special District Tax | 0.1% - 1.0% | Varies by location, funds community projects. |

| Prepared Food/Beverage Tax | 2.25% | Applies to restaurant meals and takeaway food. |

| Vehicle Rental Tax | 8.25% | Levied on car and vehicle rentals. |

| Accommodations Tax | 9.25% | Applies to hotels, motels, and short-term stays. |

Understanding these tax rates is crucial for both businesses and consumers in Denver. For businesses, accurately calculating and remitting sales tax is essential to avoid penalties and maintain compliance. Consumers, on the other hand, benefit from transparency in pricing, ensuring they are aware of the taxes they pay and how these funds contribute to the city's development.

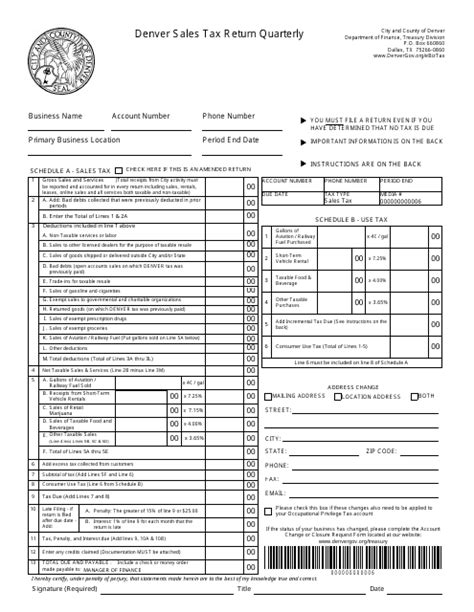

Navigating Sales Tax in Denver: A Practical Guide

The intricacies of Denver’s sales tax system can be a challenge to navigate, especially for those new to the city or the world of taxation. Let’s explore some practical tips and insights to make the process more straightforward.

Registering Your Business for Sales Tax

If you’re a business owner in Denver, registering for sales tax is a critical step. The process involves obtaining a Seller’s Permit from the Colorado Department of Revenue. This permit authorizes your business to collect and remit sales tax to the state and local authorities.

The registration process typically requires providing detailed information about your business, including its legal structure, location, and the types of goods or services offered. Once registered, you'll receive a unique tax identification number and be responsible for filing regular sales tax returns.

Calculating Sales Tax: A Step-by-Step Guide

Calculating sales tax accurately is essential to ensure compliance and avoid errors. Here’s a simplified guide to help you through the process:

- Determine the Applicable Tax Rate: Start by identifying the total tax rate applicable to your location. This includes the state, county, and special district taxes. Refer to the rates mentioned earlier or use online tools provided by the Department of Revenue for precise calculations.

- Calculate the Taxable Amount: Next, identify the portion of your sale that is subject to sales tax. Certain items, like groceries, may be exempt, while others, like luxury goods, may be taxed at a higher rate. Ensure you understand the taxability of each item.

- Apply the Tax Rate: Multiply the taxable amount by the applicable tax rate. For example, if an item costs $100 and the tax rate is 5.4%, the sales tax would be $5.40 ($100 x 0.054).

- Include Tax in Pricing: To provide transparency to your customers, consider including the sales tax in your pricing. This simplifies the checkout process and ensures your customers are aware of the total cost.

Remitting Sales Tax: A Timely Task

Timely remittance of sales tax is crucial to maintain compliance and avoid penalties. The frequency of remittance depends on your business’s sales volume. Larger businesses may be required to remit sales tax monthly or even quarterly, while smaller businesses might be allowed to remit annually.

The Department of Revenue provides online portals and tools to simplify the remittance process. Ensure you familiarize yourself with the deadlines and procedures to avoid any late fees or other complications.

The Impact of Sales Tax on Denver’s Economy

Sales tax is not merely a revenue stream for Denver; it is a vital component of the city’s economic ecosystem. The funds generated through sales tax support a multitude of public services and initiatives, shaping the city’s future and enhancing the quality of life for its residents.

Funding Public Services and Infrastructure

A significant portion of Denver’s sales tax revenue is allocated to funding essential public services. This includes maintaining and improving the city’s renowned parks and recreational facilities, ensuring clean water and efficient waste management, and supporting public safety initiatives.

Sales tax also contributes to the development and maintenance of Denver's infrastructure. From roads and bridges to public transportation systems, these funds ensure the city remains accessible and well-connected, fostering economic growth and attracting businesses and visitors alike.

Investing in Community Development

One of the most remarkable aspects of Denver’s sales tax system is its commitment to community development. The special district taxes, in particular, are designed to fund projects that enhance the quality of life in specific neighborhoods.

These funds are often used to support local businesses, improve public spaces, and address unique community needs. For instance, a district might use its sales tax revenue to fund a community garden, a local arts program, or even a small business incubator, fostering a sense of pride and ownership among residents.

Attracting Tourism and Business

Denver’s vibrant culture, stunning natural surroundings, and thriving business climate make it an attractive destination for tourists and businesses alike. The sales tax on accommodations, vehicle rentals, and prepared food contributes significantly to the city’s tourism revenue, funding initiatives that promote Denver as a premier travel destination.

For businesses, Denver's competitive tax rates and incentives make it an appealing location for expansion or relocation. The city's commitment to investing sales tax revenue back into the community creates a positive feedback loop, attracting more businesses, creating jobs, and boosting the local economy.

The Future of Sales Tax in Denver

As Denver continues to grow and evolve, its sales tax system will likely undergo changes and adaptations to meet the needs of its residents and businesses. Here are some potential future developments and their implications.

Potential Rate Adjustments

Sales tax rates in Denver, like in any city, are subject to change. As economic conditions evolve, the city might consider adjusting rates to meet revenue goals or to address specific community needs. While these changes are typically incremental, they can have a noticeable impact on businesses and consumers.

For businesses, staying informed about potential rate changes is crucial. Being proactive in understanding and adapting to these changes can help minimize disruptions and ensure smooth operations.

Digital Sales Tax and E-Commerce

The rise of e-commerce has presented new challenges for sales tax collection. Denver, like many cities, is exploring ways to effectively tax online sales, ensuring that digital businesses contribute their fair share to the local economy.

As digital sales tax policies evolve, businesses selling online will need to stay abreast of the latest regulations. This may involve registering for additional permits, calculating and remitting taxes for online sales, and providing clear pricing information to online customers.

Community Engagement and Transparency

Denver’s commitment to community development through sales tax revenue is a unique and commendable aspect of its tax system. As the city grows, there is an increasing emphasis on engaging residents and stakeholders in decision-making processes related to tax revenue allocation.

By involving the community, Denver ensures that sales tax funds are directed towards initiatives that truly resonate with and benefit its diverse neighborhoods. This level of transparency and engagement fosters trust and a sense of ownership among residents, strengthening the city's social fabric.

How often do I need to remit sales tax in Denver?

+

The frequency of sales tax remittance depends on your business’s sales volume. Larger businesses may be required to remit monthly or quarterly, while smaller businesses might remit annually. It’s important to consult with the Department of Revenue to determine your specific remittance schedule.

Are there any sales tax exemptions in Denver?

+

Yes, certain items are exempt from sales tax in Denver. This includes most groceries, prescription medications, and some agricultural products. It’s important to stay updated on the specific exemptions to ensure accurate tax calculations.

How does Denver’s sales tax compare to other major cities in the US?

+

Denver’s sales tax rates are relatively competitive compared to other major cities. While the total rate of 5.4% (state and county tax) is on the lower end, the additional special district tax can push the rate higher in certain areas. It’s important to research and compare sales tax rates when considering a business location.

Can I deduct sales tax from my business expenses for tax purposes?

+

No, sales tax paid to the government is not deductible as a business expense for federal income tax purposes. However, if your business collects sales tax from customers, you can deduct the cost of collecting and remitting that tax as a business expense.

How does Denver’s sales tax impact tourism and visitor spending?

+

Denver’s sales tax, particularly on accommodations and prepared food, can influence tourism and visitor spending. While tourists are accustomed to sales taxes, high rates can impact their spending decisions. Denver’s competitive tax rates and investment in tourism initiatives aim to strike a balance between revenue generation and visitor experience.