Va Income Tax Rate

Virginia, often referred to as the Commonwealth of Virginia, boasts a rich history and a diverse economy. When it comes to taxation, understanding the income tax rate is crucial for both residents and businesses operating within the state. This article aims to provide a comprehensive guide to Virginia's income tax structure, offering insights into rates, brackets, and the factors that influence the tax landscape.

Understanding Virginia’s Income Tax Structure

Virginia employs a progressive income tax system, which means that as your income increases, so does the tax rate applied to your earnings. This system ensures that individuals with higher incomes contribute a larger proportion of their earnings towards state revenue. The income tax rates in Virginia are determined by tax brackets, and these brackets are periodically adjusted to account for inflation and changing economic conditions.

Tax Brackets and Rates

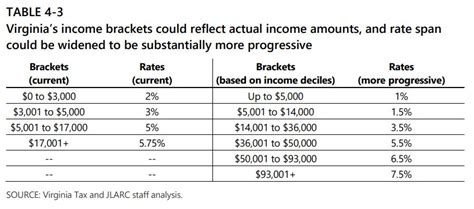

As of the 2023 tax year, Virginia’s income tax brackets and corresponding rates are as follows:

| Tax Bracket (Income Range) | Tax Rate |

|---|---|

| $0 - $3,000 | 2% |

| $3,001 - $5,000 | 3% |

| $5,001 - $17,000 | 5% |

| $17,001 - $25,000 | 5.75% |

| $25,001 and above | 5.75% |

It's important to note that these tax rates are subject to change, and it's always advisable to refer to the Virginia Department of Taxation for the most up-to-date information. The state's tax code also includes provisions for various deductions, credits, and exemptions, which can further impact an individual's or business's tax liability.

Income Tax Implications for Residents

For Virginia residents, understanding the income tax landscape is crucial for effective financial planning. The progressive nature of the tax system means that as your income increases, you’ll move into higher tax brackets, resulting in a higher overall tax liability. However, the state also offers various deductions and credits that can help reduce this burden.

Deductions and Credits

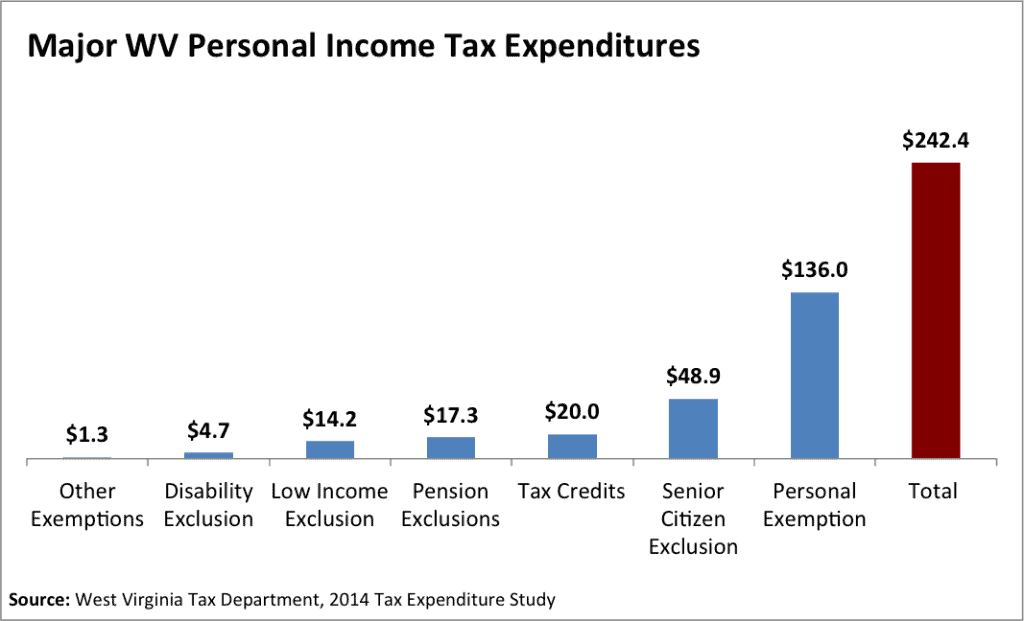

Virginia allows several deductions and credits that can offset an individual’s taxable income. These include deductions for medical expenses, charitable contributions, and certain business-related expenses. Additionally, the state offers credits for things like dependent care, energy efficiency improvements, and even film production expenses.

One notable deduction is the Virginia Resident Income Tax Credit, which provides a dollar-for-dollar reduction in tax liability for eligible residents. This credit is designed to provide relief for low- and moderate-income households and is calculated based on federal adjusted gross income.

Furthermore, Virginia offers a tax credit for retirees who meet specific criteria. This credit can provide significant savings for eligible retirees, further reducing their tax burden.

Business Income Tax Considerations

Virginia’s tax structure also has implications for businesses operating within the state. Corporations and pass-through entities are subject to different tax rates and requirements.

Corporate Income Tax

Corporations in Virginia are subject to a flat tax rate of 6% on their taxable income. This rate applies to both C-corporations and S-corporations, although S-corps may also be subject to additional taxes at the shareholder level.

Virginia's corporate tax structure is relatively straightforward, but businesses should be aware of various tax incentives and credits that can reduce their overall tax burden. These incentives often target specific industries or encourage certain behaviors, such as investing in renewable energy or creating jobs in designated opportunity zones.

Pass-Through Entities

Pass-through entities, such as partnerships, LLCs, and sole proprietorships, are taxed differently in Virginia. These entities are not subject to corporate income tax but instead pass their income through to the owners, who then report it on their personal income tax returns. The income is then taxed at the applicable individual tax rates.

For pass-through entities, understanding the tax implications at both the entity and individual levels is crucial. This includes staying informed about changes in tax laws and regulations, as well as taking advantage of deductions and credits that can reduce overall tax liability.

Future Outlook and Tax Policy Changes

Virginia’s tax landscape is subject to ongoing discussions and potential changes. As the state’s economy evolves and new challenges arise, policymakers may consider adjustments to the tax system to promote fairness, stimulate economic growth, or address budget concerns.

Potential Changes and Their Impact

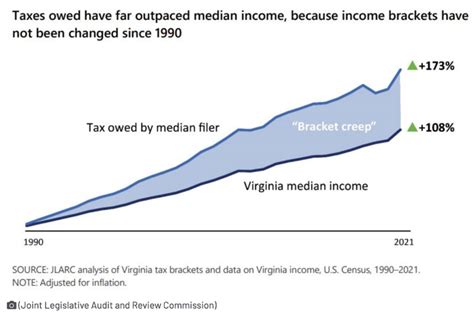

One potential area of change is the income tax brackets and rates. While the current structure is progressive, there have been proposals to make it more so, with higher tax rates for the highest income earners. Such a change could generate additional revenue for the state but may also face opposition from those affected.

Another area of focus could be expanding tax credits and deductions to provide relief for specific groups or industries. For example, Virginia might consider enhancing tax incentives for renewable energy or technology startups to encourage economic diversification and innovation.

Additionally, there is ongoing debate about the balance between state and local tax policies. Some advocate for more local control over taxation, while others prefer a more centralized approach. The outcome of these discussions could significantly impact Virginia's overall tax landscape and the financial obligations of its residents and businesses.

Conclusion

Virginia’s income tax rate is a critical component of the state’s fiscal policy, impacting both individuals and businesses. Understanding the progressive tax structure, tax brackets, and the various deductions and credits available is essential for effective financial planning. As the state’s economy evolves, so too will its tax policies, requiring residents and businesses to stay informed and adaptable.

Whether you're a Virginia resident navigating your personal tax obligations or a business owner seeking to understand the tax implications of operating in the state, staying abreast of the latest tax developments is key to ensuring compliance and optimizing your financial strategy.

When are Virginia income tax returns due?

+

Virginia income tax returns are due on the same date as federal returns, typically April 15th. However, this deadline may be extended in certain circumstances.

Are there any special tax considerations for remote workers in Virginia?

+

Yes, Virginia has specific rules for remote workers, particularly those working for out-of-state companies. It’s essential to understand these rules to avoid double taxation or other complications.

How does Virginia’s income tax rate compare to other states?

+

Virginia’s income tax rate is relatively competitive compared to other states, especially when considering the range of deductions and credits available. However, it’s important to compare the overall tax burden, including property and sales taxes, for a comprehensive understanding.