Santa Monica Sales Tax

In the bustling city of Santa Monica, nestled along the California coastline, sales tax plays a crucial role in the local economy and the overall tax system. With its vibrant tourism industry, thriving businesses, and a commitment to providing essential public services, the city's sales tax regulations are designed to ensure fair revenue collection and support the community's growth.

Understanding Santa Monica’s Sales Tax Structure

Santa Monica, like many cities in California, imposes a sales and use tax on various transactions, including retail sales, leases, and rentals. The sales tax rate in Santa Monica consists of a combination of state, county, and city taxes, each serving a specific purpose in funding public initiatives.

State Sales Tax

The state of California levies a general sales and use tax rate of 7.25%, one of the highest in the nation. This tax is applied to most retail transactions and is a significant source of revenue for the state, contributing to funding education, healthcare, and infrastructure projects.

County Sales Tax

Los Angeles County, where Santa Monica is located, adds an additional 0.25% sales tax, known as the “county transportation occupancy tax.” This tax is dedicated to supporting transportation infrastructure and mobility projects within the county, ensuring efficient and sustainable mobility options for residents and visitors alike.

City Sales Tax

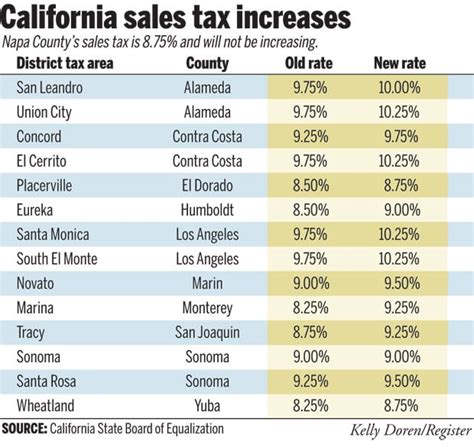

Santa Monica imposes its own sales tax, currently set at 1.5%, bringing the total sales tax rate in the city to 9%. This city-specific tax is a vital revenue stream for the local government, allowing for the provision of essential services such as public safety, parks and recreation, and community development programs.

| Sales Tax Component | Tax Rate |

|---|---|

| State Sales Tax | 7.25% |

| County Sales Tax | 0.25% |

| City Sales Tax | 1.5% |

| Total Sales Tax in Santa Monica | 9% |

It's important to note that certain items, such as groceries and prescription drugs, are exempt from the state sales tax in California, providing much-needed relief to residents and ensuring essential goods remain more affordable.

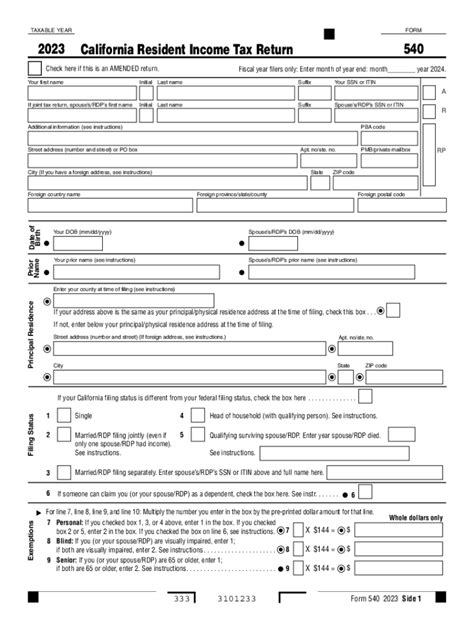

Sales Tax Compliance and Registration

For businesses operating in Santa Monica, understanding and complying with sales tax regulations is crucial to avoid penalties and legal issues. Here’s a brief overview of the key aspects of sales tax compliance and registration in the city.

Registration and Permits

All businesses operating in Santa Monica, whether selling tangible goods, providing services, or leasing property, must obtain a Business Tax Certificate from the city. This certificate serves as a permit to conduct business activities and ensures compliance with local tax laws.

In addition to the city-specific registration, businesses must also register with the California Department of Tax and Fee Administration to obtain a Seller's Permit. This permit authorizes the business to collect and remit sales tax to the state and is a prerequisite for any business involved in taxable transactions.

Sales Tax Collection and Remittance

Businesses are responsible for collecting the applicable sales tax from customers at the point of sale and remitting the collected tax to the appropriate tax authorities. The frequency of remittance depends on the business’s sales volume and can range from monthly to quarterly filings.

It's important for businesses to maintain accurate records of sales transactions, including the breakdown of taxable and exempt items, to ensure proper tax calculation and compliance. Failure to collect and remit sales tax accurately can result in penalties and interest charges.

Online Sales and Marketplace Facilitator Laws

With the rise of e-commerce, California has implemented laws to ensure that online sellers, including those operating on third-party platforms, collect and remit sales tax. The Marketplace Facilitator Law requires marketplace facilitators to collect and remit sales tax on behalf of their third-party sellers, simplifying the tax collection process for both the state and online businesses.

Sales Tax Exemptions and Discounts

While sales tax is applicable to most transactions, there are certain exemptions and discounts available to specific groups and situations in Santa Monica and California as a whole. These exemptions aim to provide financial relief and promote equity in the tax system.

Exemptions for Specific Items

As mentioned earlier, groceries and prescription drugs are exempt from state sales tax in California. This exemption ensures that essential items remain more affordable for residents, especially those on fixed incomes or with limited financial means.

Additionally, certain categories of items, such as clothing, footwear, and school supplies, are exempt from sales tax during specific periods, usually coinciding with back-to-school shopping seasons. These temporary exemptions provide a boost to local economies and encourage consumer spending.

Discounts for Seniors and Veterans

Santa Monica, along with many cities in California, offers sales tax discounts to senior citizens and veterans. These discounts, typically ranging from 5% to 10%, are applied to certain transactions and aim to provide financial relief to these deserving groups, who have made significant contributions to society.

To avail of these discounts, seniors and veterans must present valid identification, such as a driver's license or military ID, at the time of purchase. The specific eligibility criteria and discount rates may vary based on the city and the type of transaction.

The Impact of Sales Tax on Santa Monica’s Economy

Sales tax plays a significant role in shaping Santa Monica’s economy, influencing consumer behavior, business operations, and the overall tax landscape. Here’s a deeper dive into the economic implications of sales tax in the city.

Consumer Spending and Tax Burden

The sales tax rate in Santa Monica, while seemingly high, is distributed across a wide range of transactions, including both resident and tourist spending. This distribution helps alleviate the tax burden on any single group, ensuring a more equitable tax system.

However, the tax can have an impact on consumer spending habits. Higher tax rates may discourage impulse purchases or lead to consumers seeking tax-free alternatives, such as online shopping or visiting nearby cities with lower tax rates. As such, businesses in Santa Monica must find ways to offer value and create a compelling shopping experience to mitigate the potential negative impact of sales tax.

Business Operations and Profitability

For businesses, sales tax can significantly impact profitability, especially for those with thin margins. The tax adds to the cost of doing business and must be factored into pricing strategies. Businesses must carefully consider their pricing to remain competitive while ensuring they can cover their costs, including sales tax liabilities.

Additionally, businesses must stay informed about sales tax regulations and compliance requirements to avoid legal issues and potential penalties. This includes understanding the taxability of various products and services, as well as staying updated on any changes in tax laws and rates.

Local Economic Development and Public Services

The revenue generated from sales tax in Santa Monica is a crucial funding source for local economic development initiatives and public services. It supports infrastructure projects, community development programs, and public safety efforts, all of which contribute to the city’s overall growth and well-being.

By investing in these areas, Santa Monica can create a vibrant and sustainable community, attracting businesses and residents alike. The city's commitment to fair and efficient tax collection ensures that the revenue is directed towards initiatives that benefit the community as a whole.

Future Outlook and Potential Changes

As with any tax system, Santa Monica’s sales tax structure is subject to change and evolution. Here are some potential future developments and their implications.

Potential Tax Rate Adjustments

The sales tax rate in Santa Monica, like any tax rate, is subject to periodic review and adjustment. The city may consider increasing or decreasing the tax rate based on various factors, including economic conditions, revenue needs, and the impact on local businesses and residents.

While a rate increase could provide additional revenue for the city, it may also impact consumer spending and business profitability. Conversely, a rate decrease could stimulate economic activity but may result in reduced revenue for essential public services.

Impact of E-Commerce and Remote Sellers

The rise of e-commerce and remote sellers has presented unique challenges to tax collection. California’s Marketplace Facilitator Law has addressed some of these challenges, but the rapid growth of online sales continues to shape the tax landscape.

As more transactions move online, Santa Monica and other cities may need to adapt their tax collection methods to ensure compliance and fair revenue distribution. This could involve further streamlining the registration and reporting processes for online businesses or exploring innovative technologies to enhance tax collection efficiency.

Exploring Alternative Tax Structures

While sales tax remains a significant revenue source for Santa Monica, the city may consider exploring alternative tax structures to supplement its funding. This could include implementing a local income tax, property tax reforms, or introducing new fees and charges tailored to specific industries or activities.

These alternative tax structures could provide a more stable and diversified revenue stream, reducing the reliance on sales tax and mitigating the impact of economic fluctuations. However, such changes would require careful consideration and community engagement to ensure fairness and acceptance.

What is the current sales tax rate in Santa Monica, California?

+

The total sales tax rate in Santa Monica is 9%, which includes the state sales tax of 7.25%, the county sales tax of 0.25%, and the city sales tax of 1.5%.

Are there any sales tax exemptions in Santa Monica for specific items or groups?

+

Yes, certain items like groceries and prescription drugs are exempt from state sales tax in California. Additionally, there are temporary exemptions for clothing, footwear, and school supplies during specific periods. Santa Monica also offers sales tax discounts to senior citizens and veterans for certain transactions.

How often do businesses need to remit sales tax in Santa Monica?

+

The frequency of sales tax remittance depends on the business’s sales volume. Businesses with higher sales volumes may need to remit taxes monthly, while those with lower sales may remit quarterly. It’s essential for businesses to maintain accurate records and comply with the remittance schedule to avoid penalties.

What are the consequences of non-compliance with sales tax regulations in Santa Monica?

+

Non-compliance with sales tax regulations can result in penalties, interest charges, and legal consequences. Businesses found to be non-compliant may face fines, audits, and even revocation of their business permits. It’s crucial for businesses to understand and adhere to sales tax laws to avoid these issues.

How does Santa Monica’s sales tax revenue contribute to the local economy and community development?

+

Sales tax revenue in Santa Monica is a vital funding source for local economic development initiatives and public services. It supports infrastructure projects, community programs, and public safety efforts, all of which contribute to the city’s growth and well-being. By investing in these areas, Santa Monica creates a vibrant and sustainable community.