Ohio Tax Return Form

The Ohio Tax Return Form is a crucial document for residents and businesses operating within the state of Ohio. This form is used to calculate and report taxes owed to the state government, ensuring compliance with tax laws and regulations. The Ohio Department of Taxation provides a range of forms and resources to assist taxpayers in accurately filing their returns. In this comprehensive guide, we will delve into the intricacies of the Ohio Tax Return Form, covering its purpose, key components, filing requirements, and strategies to optimize your tax obligations.

Understanding the Ohio Tax Return Form

The Ohio Tax Return Form serves as the primary vehicle for taxpayers to declare their income, deductions, credits, and other relevant financial information. It enables the state government to assess the tax liability of individuals and businesses, ensuring a fair and equitable tax system. The form varies depending on the taxpayer’s status, whether they are individuals, sole proprietors, partnerships, corporations, or other entities.

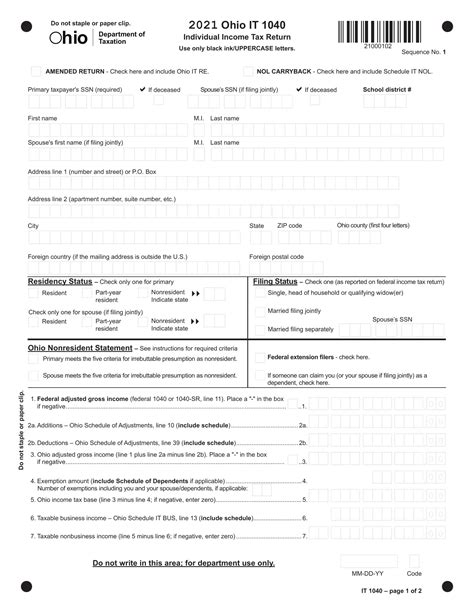

For individual taxpayers, the most common form used is the IT 1040, which is the Ohio Individual Income Tax Return. This form allows residents to report their wages, salaries, interest income, dividends, capital gains, and other taxable sources of income. Additionally, it provides spaces for claiming deductions, such as standard deductions, itemized deductions, and personal exemptions. The IT 1040 also includes schedules for reporting income from specific sources, such as business income, rental income, and farm income.

Businesses operating in Ohio, including sole proprietorships, partnerships, and corporations, have their respective forms to file their taxes. The specific form used depends on the business structure and type of income generated. For instance, sole proprietors often use the IT 1040-SCHED B to report business income and expenses. Partnerships file the IT 1065, while corporations utilize the IT 101 or IT 102, depending on their tax classification.

Key Components of the Ohio Tax Return Form

The Ohio Tax Return Form consists of several critical sections and schedules, each designed to capture specific financial information. Here’s a breakdown of some key components:

- Personal Information: This section requires taxpayers to provide their name, address, social security number, and other identifying details. It is essential to ensure accuracy to avoid processing delays.

- Income Reporting: Depending on the form, taxpayers must report various types of income, including wages, salaries, interest, dividends, business income, and rental income. Each source of income has its own schedule or line item.

- Deductions and Credits: Taxpayers can claim deductions to reduce their taxable income. These may include standard deductions, itemized deductions (such as medical expenses, charitable contributions, and state taxes paid), and various tax credits. The form provides sections to calculate and claim these deductions and credits.

- Calculating Tax Liability: The form guides taxpayers through the process of calculating their tax liability. This involves applying the appropriate tax rates and brackets to the taxable income, taking into account any deductions and credits claimed. The result is the amount of tax owed to the state of Ohio.

- Payment and Refunds: Taxpayers can choose to pay their taxes in full or make estimated payments throughout the year. The form provides instructions for making payments and claiming any refunds due. It is important to ensure timely payments to avoid penalties and interest.

| Form | Description |

|---|---|

| IT 1040 | Ohio Individual Income Tax Return for individuals |

| IT 1040-SCHED B | Business income reporting schedule for sole proprietors |

| IT 1065 | Ohio Partnership Return of Income |

| IT 101 | Ohio Corporation Return of Income (C Corporation) |

| IT 102 | Ohio Corporation Return of Income (S Corporation) |

Filing Requirements and Deadlines

Understanding the filing requirements and deadlines is essential to ensure timely and accurate submission of the Ohio Tax Return Form. Here are some key points to consider:

- Filing Status: Taxpayers must determine their filing status, which can be single, married filing jointly, married filing separately, head of household, or qualifying widow(er) with dependent child. The filing status affects the tax rates and deductions available.

- Tax Year: The Ohio tax year typically follows the federal tax year, running from January 1st to December 31st. Taxpayers must file their returns by the deadline, which is generally April 15th of the following year. However, it is essential to stay updated on any changes or extensions announced by the state.

- Filing Methods: Taxpayers have the option to file their Ohio Tax Return Form electronically or by mail. Electronic filing is often the preferred method as it is faster, more secure, and reduces the risk of errors. The Ohio Department of Taxation provides online filing options through its website.

- Required Documentation: When preparing the tax return, taxpayers should gather all relevant documentation, including W-2 forms, 1099 forms, receipts for deductions, and any other supporting documents. These records are essential for accurate reporting and verification.

Optimizing Your Ohio Tax Return

Filing your Ohio Tax Return accurately and strategically can help you minimize your tax liability and maximize any potential refunds. Here are some tips and strategies to consider:

- Take Advantage of Deductions and Credits: Research and understand the various deductions and credits available to Ohio taxpayers. These can significantly reduce your taxable income and overall tax liability. Some common deductions include mortgage interest, student loan interest, and contributions to retirement accounts. Additionally, explore tax credits such as the Earned Income Tax Credit (EITC) or the Child and Dependent Care Credit.

- Itemize or Take the Standard Deduction: Taxpayers have the option to itemize their deductions or take the standard deduction. Itemizing may be beneficial if your deductible expenses, such as medical costs or state taxes paid, exceed the standard deduction amount. However, it is important to carefully calculate and compare both options to determine which is more advantageous for your specific situation.

- Consider Tax-Efficient Investments: Strategically planning your investments can impact your tax liability. For example, investing in tax-advantaged accounts, such as 401(k)s or IRAs, can provide tax benefits. Additionally, exploring investment options that generate tax-efficient income, such as municipal bonds, can help reduce your taxable income.

- Utilize Tax Software or Professional Assistance: Filing taxes can be complex, especially for businesses or individuals with multiple sources of income. Consider using tax preparation software or seeking the assistance of a tax professional. These tools can help ensure accuracy, identify potential deductions and credits, and provide peace of mind during the filing process.

Conclusion

The Ohio Tax Return Form is a critical component of fulfilling your tax obligations as a resident or business owner in the state. By understanding the purpose, key components, and filing requirements, you can navigate the process with confidence. Optimizing your tax return through careful planning and utilizing available deductions and credits can help minimize your tax liability and maximize your financial well-being. Remember to stay informed about any updates or changes to Ohio’s tax laws and regulations to ensure compliance and take advantage of any new tax benefits.

FAQ

What is the deadline for filing my Ohio Tax Return?

+The deadline for filing your Ohio Tax Return is typically April 15th of the following year. However, it is important to stay updated on any changes or extensions announced by the state.

Can I file my Ohio Tax Return electronically?

+Yes, you can file your Ohio Tax Return electronically through the Ohio Department of Taxation’s website. Electronic filing is often faster, more secure, and reduces the risk of errors.

What documentation do I need to prepare my Ohio Tax Return?

+When preparing your Ohio Tax Return, you will need to gather relevant documentation such as W-2 forms, 1099 forms, receipts for deductions, and any other supporting documents related to your income, deductions, and credits.

Are there any tax credits or deductions available specifically for Ohio taxpayers?

+Yes, Ohio offers various tax credits and deductions to its residents. These include the Earned Income Tax Credit (EITC), Child and Dependent Care Credit, and deductions for mortgage interest, student loan interest, and contributions to retirement accounts. It is important to research and understand the specific requirements and qualifications for each credit or deduction.