Dc Real Estate Taxes

The District of Columbia, often referred to as Washington, D.C., offers a unique landscape for real estate investors and homeowners alike. With a thriving urban environment, diverse neighborhoods, and a robust economy, the real estate market in D.C. presents exciting opportunities. However, it also comes with a complex system of property taxes that can significantly impact your financial planning. In this comprehensive guide, we will delve into the intricacies of DC real estate taxes, providing you with valuable insights to navigate this crucial aspect of property ownership in the nation's capital.

Understanding DC Real Estate Taxes: An Overview

Real estate taxes in Washington, D.C., play a vital role in funding essential public services, infrastructure development, and the overall functioning of the city. These taxes are assessed on both residential and commercial properties, and the revenue generated contributes to the city’s budget. As a property owner in D.C., it is essential to comprehend the mechanics of real estate taxes to make informed decisions regarding your financial obligations and potential investments.

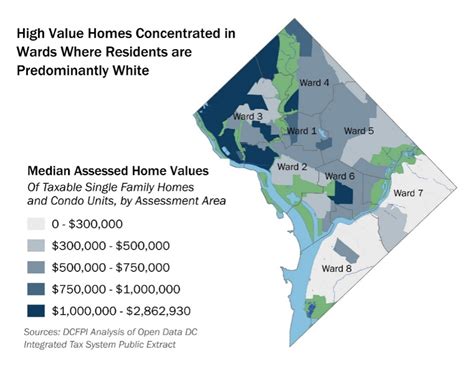

The Assessment Process: How Property Values are Determined

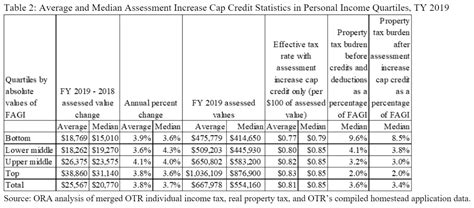

The Office of Tax and Revenue (OTR) is responsible for assessing the value of real estate properties in Washington, D.C. This process involves evaluating various factors such as the property’s location, size, improvements, and recent sales data of comparable properties. The OTR conducts a comprehensive assessment every four years, with interim adjustments made annually to ensure property values remain up-to-date.

The assessed value of a property is crucial as it forms the basis for calculating the real estate tax liability. The OTR utilizes a formula that takes into account the assessed value, applicable tax rates, and any exemptions or deductions to determine the final tax amount.

| Assessment Year | Average Assessment Ratio | Residential Tax Rate (per $100 of Assessed Value) | Commercial Tax Rate (per $100 of Assessed Value) |

|---|---|---|---|

| 2022 | 13.5% | 0.85 | 1.75 |

| 2021 | 13.3% | 0.85 | 1.75 |

| 2020 | 13.1% | 0.85 | 1.75 |

For example, if your residential property has an assessed value of $500,000, the tax calculation would be as follows: $500,000 (assessed value) x 0.85 (tax rate) = $425,000. This means your annual real estate tax liability for the year would be $425,000.

Tax Rates and Exemptions: Navigating the Complex Landscape

The District of Columbia employs a progressive tax system for real estate, with tax rates varying based on the property’s classification. Residential properties generally have lower tax rates compared to commercial properties, encouraging homeownership and stability in the city.

Additionally, Washington, D.C., offers various exemptions and deductions to eligible property owners. These include the Homestead Deduction, which provides a reduction in the assessed value of owner-occupied residential properties, and the Senior Citizen and Disabled Tax Relief programs, offering tax benefits to qualifying individuals. Understanding these exemptions and their eligibility criteria is essential to optimize your tax obligations.

The Impact of Real Estate Taxes on Property Ownership

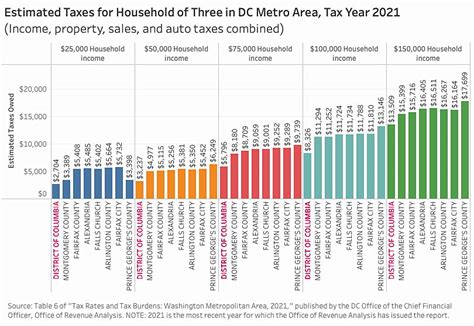

Real estate taxes in Washington, D.C., can significantly influence the financial aspect of property ownership. Whether you’re a first-time homebuyer or an experienced investor, it’s crucial to consider the tax implications when making real estate decisions.

Financial Planning and Budgeting

Real estate taxes are a recurring expense that property owners must budget for. By understanding the tax rates, assessment values, and potential exemptions, you can create a comprehensive financial plan. This ensures you allocate sufficient funds to cover your tax obligations and avoid any surprises when tax bills arrive.

Consider seeking professional advice from tax consultants or financial planners who specialize in real estate to develop a tailored strategy that aligns with your financial goals and the specific characteristics of your property.

Investment Strategies and Property Value Analysis

For investors, real estate taxes are a critical factor in evaluating potential investment opportunities. The tax implications can influence the overall return on investment and the cash flow generated from rental properties. By analyzing the tax landscape, investors can make informed decisions regarding property acquisitions, renovations, and rental strategies.

Furthermore, the assessment process and tax rates can impact property values. Properties with favorable tax assessments and lower tax obligations may be more attractive to potential buyers, influencing the overall demand and pricing in the real estate market.

Real-Life Examples and Case Studies

To provide a clearer understanding of DC real estate taxes, let’s explore some real-life scenarios and their tax implications.

Case Study 1: Homeownership in D.C.

John, a young professional, recently purchased a condominium in the bustling neighborhood of Adams Morgan. The property has an assessed value of 450,000, and John qualifies for the Homestead Deduction, reducing his assessed value by 75,000. With the residential tax rate of 0.85, John’s annual real estate tax liability is calculated as follows:

$450,000 (assessed value) - $75,000 (Homestead Deduction) x 0.85 (tax rate) = $307,500

As a result, John's annual real estate tax bill amounts to $307,500, which he must budget for alongside his mortgage payments and other expenses associated with homeownership.

Case Study 2: Commercial Real Estate Investment

Sarah, an experienced real estate investor, is considering acquiring a mixed-use commercial property in the heart of downtown D.C. The property has an assessed value of $2 million, and Sarah is aware of the higher tax rate for commercial properties at 1.75. By applying the tax rate to the assessed value, Sarah can estimate her annual real estate tax liability:

$2,000,000 (assessed value) x 1.75 (tax rate) = $3,500,000

Sarah must factor in this significant tax obligation when evaluating the investment's financial viability and potential returns. The real estate taxes will impact her cash flow and overall profitability, influencing her decision-making process.

Future Implications and Trends in DC Real Estate Taxes

As Washington, D.C., continues to evolve and adapt to changing economic and social dynamics, the real estate tax landscape may also undergo transformations. Here are some key factors to consider when analyzing the future of DC real estate taxes:

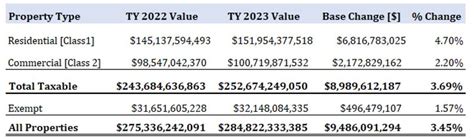

Economic Growth and Property Values

The District of Columbia’s robust economy and growing population have led to increased demand for real estate. As property values rise, so do the assessed values, resulting in higher real estate tax obligations. This trend is likely to continue as the city attracts new businesses, residents, and investors.

Potential Tax Reforms and Initiatives

The District government periodically reviews and proposes changes to the tax system to ensure fairness and sustainability. Keep an eye out for any proposed reforms or initiatives that may impact real estate taxes. These changes could include adjustments to tax rates, the introduction of new exemptions, or modifications to the assessment process.

Community Development and Infrastructure Investments

Real estate taxes play a crucial role in funding community development projects and infrastructure improvements. As the city invests in enhancing neighborhoods, transportation systems, and public amenities, the demand for real estate may increase, leading to higher property values and, consequently, higher tax obligations.

Conclusion: Navigating the Complex World of DC Real Estate Taxes

Understanding the intricacies of DC real estate taxes is essential for both homeowners and investors. By staying informed about the assessment process, tax rates, and available exemptions, you can make well-informed financial decisions and optimize your tax obligations. Remember, real estate taxes are a critical component of property ownership, and their impact extends beyond the tax bill itself.

Whether you're a first-time homebuyer or an experienced investor, seeking professional advice and staying up-to-date with the latest tax developments will help you navigate the complex world of DC real estate taxes. By doing so, you can make the most of your real estate investments and contribute to the vibrant and thriving community of Washington, D.C.

How often are real estate taxes assessed in Washington, D.C.?

+The Office of Tax and Revenue (OTR) conducts a comprehensive assessment of real estate properties every four years. However, interim adjustments are made annually to ensure property values remain up-to-date.

Are there any exemptions or deductions available for DC real estate taxes?

+Yes, Washington, D.C., offers several exemptions and deductions. These include the Homestead Deduction for owner-occupied residential properties, Senior Citizen Tax Relief, and Disabled Tax Relief programs. It’s important to research and understand the eligibility criteria for these programs.

How can I dispute my property’s assessed value if I believe it is incorrect?

+If you disagree with your property’s assessed value, you have the right to appeal. The OTR provides guidelines and a process for filing an appeal. It’s advisable to gather supporting evidence, such as recent sales data of comparable properties, to strengthen your case.

What happens if I fail to pay my real estate taxes on time in Washington, D.C.?

+Late payment of real estate taxes can result in penalties and interest charges. The OTR provides information on payment due dates and late payment consequences. It’s crucial to stay organized and plan your payments accordingly to avoid additional financial burdens.