Puerto Rico Sales Tax

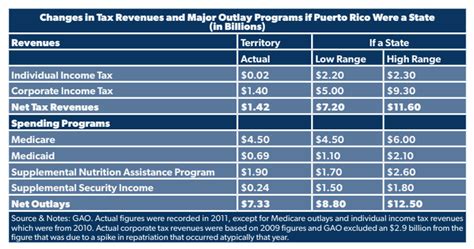

The implementation and management of sales taxes in Puerto Rico, a vibrant Caribbean territory with a unique economic landscape, is a topic of great interest, particularly for those navigating its business and investment opportunities. This article delves into the intricacies of Puerto Rico's sales tax system, exploring its history, current regulations, and the impact it has on local businesses and consumers.

Unveiling Puerto Rico’s Sales Tax Structure

Sales taxes in Puerto Rico are a crucial component of the territory’s fiscal policy, serving as a significant revenue stream for the government. The history of sales taxation in Puerto Rico dates back to the early 20th century, with the first sales tax legislation enacted in 1956. Since then, the sales tax system has evolved, adapting to the changing economic dynamics and the unique challenges faced by the island.

The primary sales tax in Puerto Rico is the Commonwealth Sales and Use Tax, commonly known as the Sales and Use Tax (SUT). This tax is levied on the sale, use, consumption, or storage of tangible personal property and certain services within the jurisdiction of Puerto Rico. The SUT is administered by the Puerto Rico Department of Treasury, specifically through its Bureau of Internal Revenue.

One of the distinctive features of Puerto Rico's sales tax system is its centralized administration. Unlike some states in the mainland U.S., where sales taxes are administered by local governments, in Puerto Rico, the sales tax is managed solely by the central government. This centralized approach ensures uniformity in tax rates and regulations across the island.

Tax Rates and Exemptions

The Sales and Use Tax in Puerto Rico operates on a progressive rate structure, with varying rates applied to different types of goods and services. As of [current year], the standard SUT rate for most tangible personal property is 11.5%, which includes a base rate of 7% and a municipal rate of 4.5%. This rate structure aims to balance revenue generation with the need to maintain a competitive business environment.

However, it's important to note that certain goods and services are exempt from the SUT. These exemptions are designed to promote specific economic sectors or provide relief to vulnerable populations. For instance, essential items like food, medicine, and certain educational materials are often exempted from sales tax.

| Category | Sales Tax Rate |

|---|---|

| Standard Rate for Most Goods | 11.5% |

| Base Rate | 7% |

| Municipal Rate | 4.5% |

| Exempt Items (e.g., Food, Medicine) | 0% |

Additionally, there are provisions for special tax rates applicable to specific industries or situations. For example, the hospitality industry, a vital part of Puerto Rico's economy, often benefits from reduced tax rates on certain goods and services provided to tourists.

Sales Tax Registration and Compliance

Businesses operating in Puerto Rico are required to register for sales tax if they meet certain criteria. This includes businesses that sell tangible personal property or provide taxable services within the jurisdiction. The registration process involves submitting the necessary forms and documentation to the Puerto Rico Department of Treasury.

Once registered, businesses must comply with the sales tax regulations, which include accurately calculating and collecting the applicable tax rates on taxable transactions. This responsibility extends to both online and brick-and-mortar businesses, ensuring a level playing field for all retailers.

To facilitate compliance, the Puerto Rico Department of Treasury provides resources and guidelines for businesses, including tax rate tables, exemption certificates, and instructions for filing sales tax returns. Non-compliance with sales tax regulations can result in penalties and interest charges, underscoring the importance of understanding and adhering to the rules.

The Impact on Businesses and Consumers

Puerto Rico’s sales tax system has a direct impact on both local businesses and consumers. For businesses, the sales tax is a critical consideration in their pricing strategies and financial planning. It influences their ability to compete in the market, especially when compared to businesses in jurisdictions with lower tax rates.

Businesses must factor in the sales tax when setting their retail prices, ensuring that the final cost to the consumer includes the applicable tax. This process can be complex, especially for businesses offering a wide range of products and services with varying tax rates. Accurate sales tax calculation and collection are essential to maintain compliance and avoid legal consequences.

From a consumer perspective, the sales tax adds to the final cost of goods and services, influencing purchasing decisions and overall spending power. The progressive tax rate structure means that consumers may encounter varying tax rates depending on the type of goods they purchase. Understanding these rates can help consumers budget effectively and make informed purchasing choices.

Challenges and Opportunities

Puerto Rico’s sales tax system, like any tax structure, presents both challenges and opportunities. One of the primary challenges is the complexity of the tax code, which can be daunting for small businesses and entrepreneurs, especially those new to the island.

However, the sales tax system also offers opportunities for businesses to leverage tax incentives and exemptions to their advantage. For instance, businesses operating in designated economic zones or those focused on specific industries may qualify for tax breaks or reduced tax rates, providing a competitive edge in the market.

Furthermore, the sales tax revenue generated contributes to the overall economic development of Puerto Rico, funding essential public services and infrastructure projects. This revenue stream is particularly crucial in the aftermath of natural disasters, such as hurricanes, which have plagued the island in recent years.

Conclusion: Navigating Puerto Rico’s Sales Tax Landscape

Puerto Rico’s sales tax system is a dynamic and integral part of the territory’s economic landscape. It serves as a vital revenue source for the government while influencing the operations of local businesses and the purchasing decisions of consumers.

Understanding Puerto Rico's sales tax structure, its rates, and exemptions is essential for businesses looking to establish themselves on the island. Compliance with sales tax regulations is not only a legal requirement but also a critical aspect of financial planning and competitive strategy.

For consumers, being aware of the sales tax rates and their impact on pricing can lead to more informed purchases and effective budgeting. The sales tax, while adding to the final cost of goods, also contributes to the overall development and stability of Puerto Rico's economy.

As Puerto Rico continues to evolve and adapt to changing economic conditions, its sales tax system will likely undergo further refinements and adjustments. Staying informed about these changes is crucial for businesses and consumers alike, ensuring they can navigate the sales tax landscape effectively and contribute to the island's economic prosperity.

What is the current sales tax rate in Puerto Rico?

+As of [current year], the standard sales tax rate in Puerto Rico is 11.5%, including a base rate of 7% and a municipal rate of 4.5%.

Are there any items exempt from sales tax in Puerto Rico?

+Yes, essential items like food, medicine, and certain educational materials are exempt from sales tax in Puerto Rico.

How do I register for sales tax in Puerto Rico as a business owner?

+To register for sales tax, you need to submit the necessary forms and documentation to the Puerto Rico Department of Treasury. You can find detailed instructions and resources on their official website.

What happens if I don’t comply with sales tax regulations in Puerto Rico?

+Non-compliance with sales tax regulations can result in penalties and interest charges. It’s important to understand and adhere to the rules to avoid legal consequences.