Obtain Tax Transcripts

Navigating the intricacies of the tax system can be a daunting task, especially when it comes to accessing and understanding your tax transcripts. These transcripts, provided by the Internal Revenue Service (IRS), are official records that offer a detailed breakdown of your tax return information. Whether you're preparing for an audit, applying for a mortgage, or simply seeking clarity on your tax history, obtaining tax transcripts is a crucial step. In this comprehensive guide, we'll delve into the process, highlighting the various methods and considerations to ensure a smooth and efficient experience.

Understanding Tax Transcripts

Tax transcripts serve as an essential tool for individuals and businesses alike, offering a transparent view of their tax filings and payments. These transcripts come in different forms, each catering to specific needs:

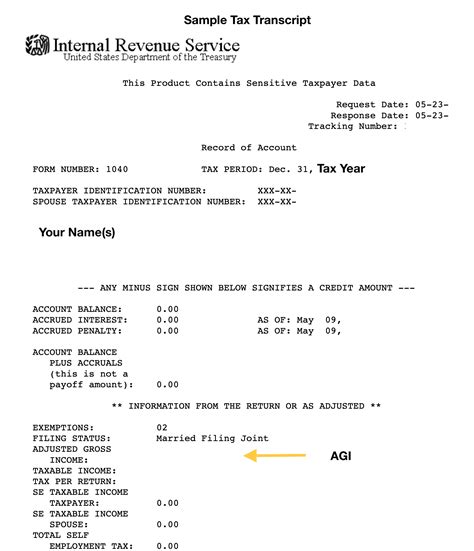

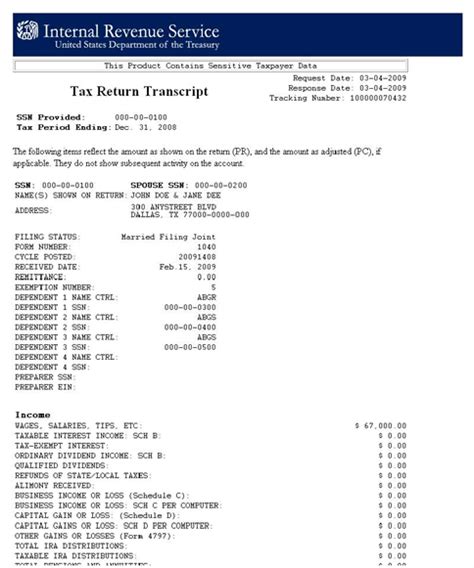

- Return Transcripts: These provide a comprehensive overview of your tax return, including adjustments, credits, and any other changes made during the filing process. Return transcripts are particularly useful for verifying the accuracy of your tax return and identifying any discrepancies.

- Account Transcripts: Offering a detailed account of your tax history, these transcripts include information on payments, refunds, and any tax liens or levies associated with your account. Account transcripts are invaluable for understanding your tax standing and managing any outstanding balances.

- Record of Account: This transcript combines the features of both return and account transcripts, providing a comprehensive snapshot of your tax return information and account activity. It serves as a single, all-encompassing document for those seeking a thorough understanding of their tax history.

- Wage and Income Transcripts: Focused on employment-related tax information, these transcripts detail your wage and income data as reported by employers and other entities. Wage and income transcripts are crucial for verifying your reported income and ensuring its accuracy.

By choosing the appropriate transcript type, you can access the specific information you need, making the process of reviewing and understanding your tax history more efficient and tailored to your requirements.

Methods to Obtain Tax Transcripts

The IRS offers multiple channels through which you can obtain your tax transcripts, each catering to different preferences and circumstances. Let’s explore these methods:

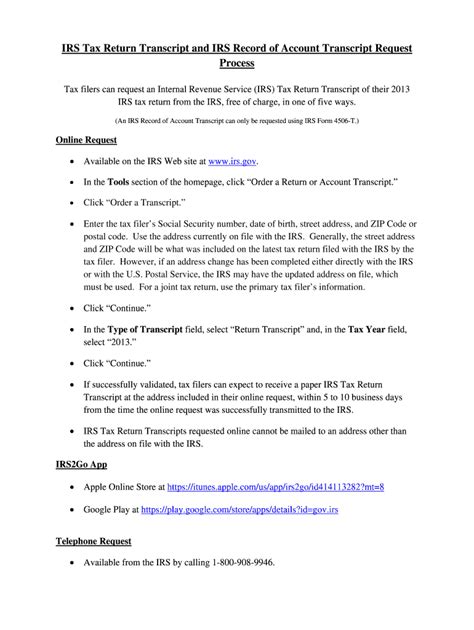

Online Retrieval

For those comfortable with digital platforms, the IRS provides a secure online tool called Get Transcript Online. This service allows you to access and download your tax transcripts in a matter of minutes. To utilize this method, you’ll need to create an account and verify your identity using security measures such as personal identification numbers (PINs) and challenge questions.

The online retrieval process is not only convenient but also highly secure, ensuring that your tax information remains protected. It's an ideal option for those seeking a quick and efficient way to obtain their transcripts without the need for physical paperwork.

Mail-in Request

If you prefer a more traditional approach or have concerns about online security, the IRS offers the option to request tax transcripts by mail. To do this, you’ll need to complete and submit Form 4506, “Request for Copy of Tax Return”, to the IRS. This form allows you to specify the type of transcript you require and provides a secure way to transmit your request.

When using the mail-in method, allow for additional time as the processing and delivery of your transcripts may take several weeks. While it may not be as immediate as the online option, it provides an alternative for those who value the familiarity and security of traditional postal services.

Fax Transmission

For urgent situations where you require your tax transcripts as soon as possible, the IRS offers a fax transmission service. By faxing a completed Form 4506 to a dedicated IRS fax number, you can expedite the process and receive your transcripts within 10 business days. This method is particularly useful for individuals facing time-sensitive matters, such as loan applications or impending audits.

Third-Party Services

In addition to the direct methods provided by the IRS, there are also third-party services that can assist in obtaining your tax transcripts. These services act as intermediaries, simplifying the process and offering additional support. While they may incur a fee, they can be beneficial for those who prefer a more personalized and guided experience.

When considering third-party services, ensure that you choose a reputable and trusted provider. Verify their credentials and read reviews to ensure a safe and efficient transaction. While these services can be convenient, they should be used judiciously, as direct interaction with the IRS is often the most secure and cost-effective approach.

Tips for a Smooth Process

Obtaining tax transcripts doesn’t have to be a complex or daunting task. By following these tips, you can ensure a seamless and stress-free experience:

- Gather Necessary Information: Before initiating the process, gather the required information, such as your Social Security Number, tax year, and filing status. Having this information readily available will expedite the process and reduce the chances of errors.

- Choose the Right Transcript: Understand the specific information you need and select the appropriate transcript type. This ensures that you receive the data relevant to your requirements, making the process more efficient and targeted.

- Plan Ahead: If you anticipate needing your tax transcripts for a specific purpose, such as a loan application, plan ahead. Allow sufficient time for the processing and delivery of your transcripts to avoid any last-minute rushes or delays.

- Keep Records: Maintain a record of your tax transcripts and related documents. This not only provides a reference for future needs but also ensures that you have a backup in case of any discrepancies or issues.

- Verify and Review: Once you receive your tax transcripts, take the time to review them thoroughly. Verify the accuracy of the information and address any discrepancies promptly. This step is crucial for maintaining the integrity of your tax records.

FAQs

How long does it take to receive tax transcripts via mail or fax?

+When requesting tax transcripts by mail or fax, the IRS typically processes and delivers them within 10 business days. However, it’s important to note that this timeframe can vary based on factors such as the volume of requests and any unforeseen delays.

Can I obtain tax transcripts for a specific tax year only?

+Absolutely! When requesting tax transcripts, you have the option to specify the tax year for which you require the information. This flexibility allows you to access transcripts for a specific year, making it convenient for targeted reviews and verifications.

Are there any fees associated with obtaining tax transcripts from the IRS?

+No, the IRS does not charge any fees for obtaining tax transcripts. Whether you choose to access them online, by mail, or via fax, the service is provided free of cost. However, if you engage a third-party service, there may be associated fees for their assistance.

Can I request tax transcripts for someone else, such as a family member or business partner?

+The IRS allows you to request tax transcripts for yourself or for another person with whom you have a valid power of attorney. To request transcripts for someone else, you must provide the necessary documentation, such as a completed Form 2848, “Power of Attorney and Declaration of Representative”, to establish your authorization.

What if I need tax transcripts for a year that is not available online or through the mail-in process?

+In such cases, you may need to contact the IRS directly to request access to older tax transcripts. The IRS maintains records for a certain number of years, and for older transcripts, they may require additional time for processing and delivery. Contact the IRS customer service to discuss your specific needs and explore the available options.

By staying informed and utilizing the resources provided by the IRS, obtaining tax transcripts can be a straightforward and efficient process. Whether you choose the convenience of online retrieval or the familiarity of a mail-in request, understanding your options and following the necessary steps will ensure a smooth and successful experience.