Vt Dept Of Taxes Refund

The Vermont Department of Taxes plays a crucial role in managing various tax-related affairs, including the processing of tax refunds. Understanding the intricacies of the Vt Dept Of Taxes Refund process is essential for individuals and businesses operating within the state. This comprehensive guide aims to provide an in-depth analysis of the refund system, offering insights into eligibility, timelines, and the steps involved in claiming a refund from the Vermont Department of Taxes.

Understanding the Vt Dept Of Taxes Refund Process

The Vermont Department of Taxes handles refunds for a range of tax types, including income tax, sales and use tax, room and meals tax, and more. Refunds are issued when taxpayers have overpaid their taxes or are eligible for certain tax credits and deductions.

The refund process is designed to be straightforward and efficient, with the department aiming to process refunds within a specific timeframe. However, the complexity of tax laws and the variety of tax scenarios can sometimes lead to variations in the refund journey.

Eligibility and Criteria

To be eligible for a refund, taxpayers must meet certain criteria. This includes filing the appropriate tax returns on time and claiming all applicable deductions and credits. The Department of Taxes has specific guidelines for each tax type, and taxpayers must adhere to these to qualify for a refund.

For instance, to claim a refund for income tax, individuals must have overpaid their taxes due to factors such as changes in their tax bracket, eligibility for credits, or deductions for certain expenses. Businesses, on the other hand, might be eligible for refunds based on overpayments of sales tax, use tax, or other applicable business taxes.

| Tax Type | Refund Eligibility Criteria |

|---|---|

| Income Tax | Overpayment due to tax bracket changes, credits, or deductions |

| Sales and Use Tax | Overpayment, especially for businesses |

| Room and Meals Tax | Applicable to businesses in the hospitality industry |

| Other Taxes | Varies based on tax type and specific circumstances |

Filing for a Refund

The process of filing for a refund begins with the taxpayer identifying the overpayment or the eligibility for a refund. This could be during the regular tax filing season or after a tax audit.

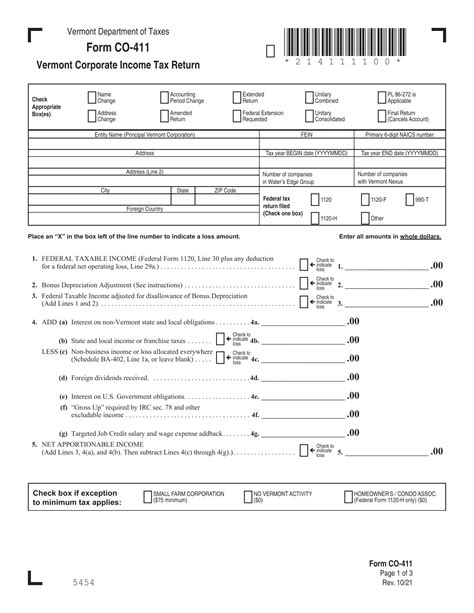

For income tax refunds, taxpayers must complete the relevant forms, such as the Individual Income Tax Return (Form VT-1040) for individuals or the Business Income Tax Return (Form VT-1120) for businesses. These forms guide taxpayers in calculating their taxable income, applying credits, and determining if a refund is due.

Similarly, for sales and use tax refunds, businesses must file the Sales and Use Tax Return (Form SU-100) and provide detailed records of sales transactions and purchases. This ensures that the Department of Taxes can accurately calculate the refund amount.

Timelines and Tracking Refunds

The Vermont Department of Taxes aims to process refunds within a specified timeframe to ensure timely returns to taxpayers. However, the actual processing time can vary based on several factors, including the complexity of the tax return, the accuracy of the information provided, and the department’s workload during peak seasons.

Estimated Timelines

According to the Department of Taxes, the estimated time for processing refunds is generally between 4 to 6 weeks from the date of receipt. However, it’s important to note that this is an estimate, and refunds can sometimes take longer, especially if there are issues with the tax return or additional documentation is required.

For instance, if a tax return is selected for further review due to potential errors or discrepancies, the processing time may extend beyond the estimated 6 weeks. In such cases, the Department of Taxes will communicate with the taxpayer to clarify the issues and provide guidance on the necessary steps.

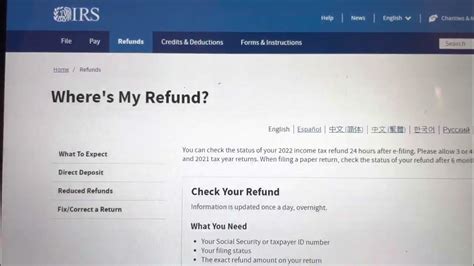

Tracking Refund Status

Taxpayers can track the status of their refund through the Vermont Department of Taxes’ online portal. This portal provides real-time updates on the progress of the refund, from the date of receipt to the date of issuance. It also offers a secure way for taxpayers to communicate with the department regarding their refund.

Additionally, the Department of Taxes provides a refund hotline for taxpayers to call and check the status of their refund. This hotline is particularly useful for taxpayers who prefer a more personal approach or have specific questions that require immediate attention.

Resolving Refund Issues

Despite the Department of Taxes’ efforts to streamline the refund process, issues can sometimes arise. These may include delays in processing, errors in calculating the refund amount, or discrepancies in the information provided by the taxpayer.

Common Issues and Solutions

- Delay in Processing: If a refund is not received within the estimated timeframe, taxpayers can contact the Department of Taxes to inquire about the status. The department will investigate the delay and provide an update on the expected issuance date.

- Incorrect Refund Amount: In case the refund amount received is different from what was expected, taxpayers should carefully review their tax return and the refund calculation. If an error is identified, they should contact the department to initiate a correction process.

- Missing or Incomplete Information: Sometimes, the Department of Taxes may request additional information to process a refund. Taxpayers should respond promptly to such requests to avoid further delays.

Appealing a Refund Decision

In rare cases, taxpayers may disagree with the Department of Taxes’ decision regarding their refund. In such situations, they have the right to appeal the decision. The appeal process involves submitting a written request, along with supporting documentation, to the department.

The Department of Taxes will review the appeal and provide a decision within a specified timeframe. If the taxpayer is still dissatisfied with the outcome, they can further pursue their case through the Vermont Tax Appeals Division, an independent body that reviews tax-related disputes.

Future Outlook and Enhancements

The Vermont Department of Taxes is continually working to improve its refund processes, leveraging technology to enhance efficiency and taxpayer experience. Some of the initiatives include:

- Implementing an online refund calculator to provide taxpayers with an estimate of their refund amount.

- Introducing a mobile app for taxpayers to track their refund status and receive real-time updates.

- Streamlining the refund process for businesses, especially those in the hospitality industry, to reduce administrative burdens.

Conclusion

Navigating the Vt Dept Of Taxes Refund process can be complex, but with the right information and understanding of the criteria and timelines, taxpayers can efficiently claim their refunds. The Vermont Department of Taxes’ commitment to improving taxpayer services and leveraging technology ensures a more streamlined and user-friendly experience.

Frequently Asked Questions

How long does it take to receive a refund from the Vermont Department of Taxes?

+The Vermont Department of Taxes aims to process refunds within 4 to 6 weeks from the date of receipt. However, this timeline can vary based on the complexity of the tax return and the department’s workload.

What should I do if I haven’t received my refund within the estimated timeframe?

+If your refund is delayed, you can contact the Department of Taxes to inquire about the status. They will investigate and provide an update on the expected issuance date.

How can I track the status of my refund?

+You can track your refund status through the Vermont Department of Taxes’ online portal or by calling their refund hotline. These platforms provide real-time updates on the progress of your refund.

What if I receive an incorrect refund amount?

+If you believe the refund amount is incorrect, carefully review your tax return and the refund calculation. If an error is identified, contact the Department of Taxes to initiate a correction process.

How can I appeal a refund decision made by the Department of Taxes?

+To appeal a refund decision, you need to submit a written request, along with supporting documentation, to the Department of Taxes. If you’re still dissatisfied with the outcome, you can further pursue your case through the Vermont Tax Appeals Division.