South Carolina Automobile Tax

When it comes to owning a vehicle in South Carolina, one aspect that vehicle owners need to be aware of is the automobile tax, often referred to as the vehicle property tax or ad valorem tax. This tax is an important revenue source for the state and local governments, and it is essential for residents to understand the ins and outs of this tax to ensure compliance and avoid any penalties.

In this comprehensive guide, we will delve into the intricacies of the South Carolina automobile tax, covering everything from the calculation methods to the payment process and potential exemptions. By the end of this article, you will have a thorough understanding of this tax and be equipped with the knowledge to navigate the process smoothly.

Understanding the South Carolina Automobile Tax

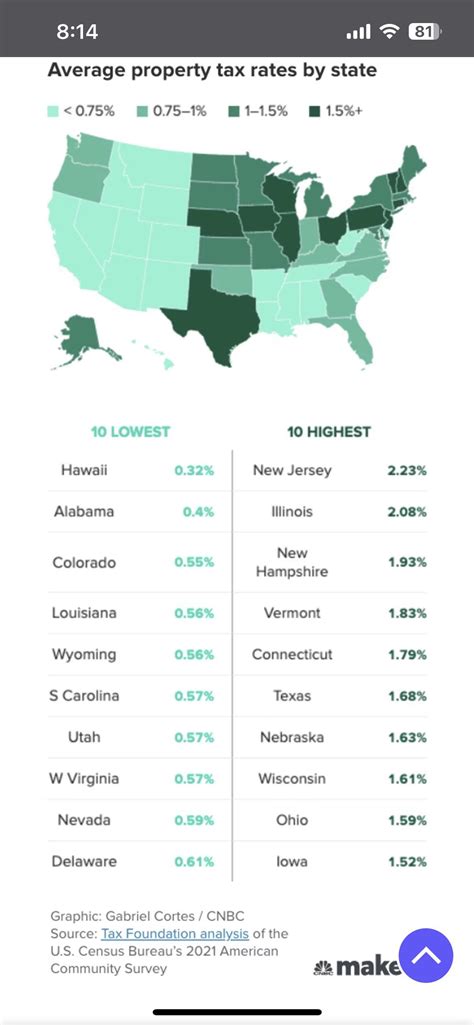

The automobile tax in South Carolina is an annual assessment based on the value of your vehicle. It is a property tax, which means it is levied on the ownership of the vehicle, similar to how property taxes are imposed on real estate. The tax is calculated using a formula that takes into account various factors, including the make, model, and age of the vehicle.

The primary purpose of this tax is to generate revenue for the state and local governments, which is then utilized for various public services and infrastructure projects. It is an essential part of South Carolina's tax system, contributing to the overall fiscal health of the state.

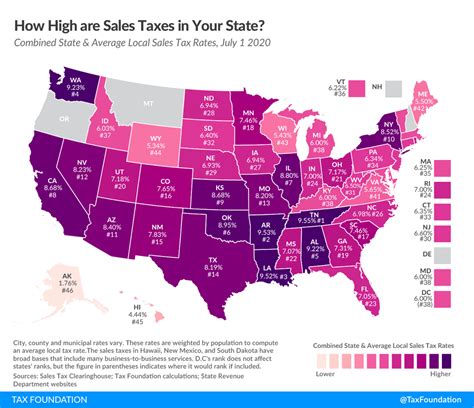

Tax Rate and Assessment

The automobile tax rate in South Carolina is set at a statewide level, with a uniform rate applicable to all vehicles. As of [current year], the tax rate is [XX]% of the vehicle’s assessed value. This rate may be subject to change annually, so it is advisable to check the official sources for the most up-to-date information.

The assessed value of your vehicle is determined by the South Carolina Department of Revenue (SCDOR). They use a complex formula that considers the original manufacturer's suggested retail price (MSRP) and adjusts it based on the vehicle's age and depreciation. This assessment ensures that the tax is fair and reflects the current value of the vehicle.

It's important to note that the assessed value of your vehicle may not always align with its market value. The SCDOR's assessment takes into account various factors, and the tax is calculated based on this official valuation.

| Vehicle Type | Tax Rate |

|---|---|

| Passenger Vehicles | [XX]% of Assessed Value |

| Commercial Vehicles | [XX]% of Assessed Value |

| Motorcycles | [XX]% of Assessed Value |

Taxable Vehicles

The South Carolina automobile tax applies to various types of vehicles, including passenger cars, trucks, motorcycles, and recreational vehicles (RVs). However, it’s crucial to understand that certain vehicles may be exempt from this tax, as we will discuss in the following sections.

Calculation and Assessment Process

The calculation of the automobile tax in South Carolina involves a series of steps to determine the final tax amount. Let’s break down this process to provide a clear understanding of how it works.

Step 1: Vehicle Valuation

The first step in the process is the valuation of your vehicle. As mentioned earlier, the SCDOR uses a formula to determine the assessed value of your vehicle. This valuation takes into account the following factors:

- Manufacturer's Suggested Retail Price (MSRP): The original price of the vehicle as suggested by the manufacturer.

- Vehicle Age: The age of your vehicle, which is typically calculated from the model year to the current year.

- Depreciation: The decrease in value over time due to wear and tear and market factors.

The SCDOR utilizes a complex algorithm to calculate the assessed value, ensuring fairness and consistency across all vehicles.

Step 2: Taxable Value Determination

Once the assessed value is determined, the taxable value is calculated. This is done by applying any applicable deductions or exemptions to the assessed value. For instance, if you qualify for a disability exemption, a portion of the assessed value may be exempt from taxation.

The taxable value is then used to calculate the actual tax amount. This value is multiplied by the current tax rate, resulting in the total tax liability for your vehicle.

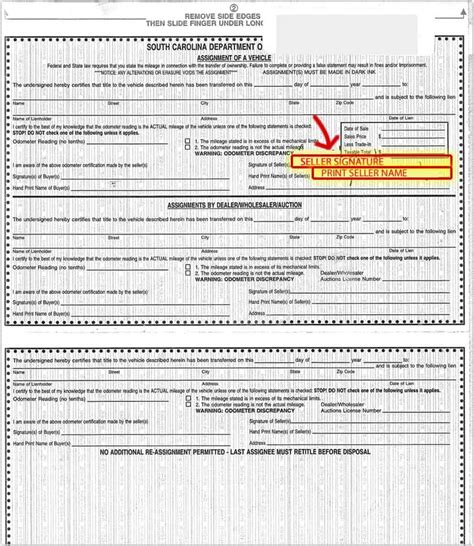

Step 3: Tax Notification and Payment

After the assessment process is complete, the SCDOR will send you a tax notification. This notification will include the assessed value of your vehicle, the taxable value, and the total tax amount due. It will also provide important information regarding the payment due date and any applicable penalties for late payments.

It is crucial to carefully review this notification and ensure that the information is accurate. If you have any discrepancies or believe there has been an error in the assessment, you have the right to appeal the decision. The SCDOR provides guidelines and procedures for appealing tax assessments.

Payment Options and Due Dates

The South Carolina automobile tax is typically due on an annual basis. The exact due date may vary depending on the county in which you reside. It is important to stay informed about the specific due date for your vehicle to avoid any late fees or penalties.

Payment Methods

The SCDOR offers several convenient payment methods for your automobile tax. These include:

- Online Payment: You can make your tax payment securely through the SCDOR's online portal. This method is quick and efficient, allowing you to pay your taxes from the comfort of your home.

- Mail-in Payment: If you prefer a traditional method, you can mail your payment to the SCDOR along with the provided tax notice. Ensure that you use the correct mailing address and allow sufficient time for processing.

- In-Person Payment: For those who prefer a more personal approach, you can visit a local SCDOR office and make your payment in person. This option may be convenient for those who have questions or need assistance with the payment process.

Late Payment Penalties

It is crucial to pay your automobile tax by the due date to avoid any late payment penalties. These penalties can accrue over time and significantly increase your overall tax liability. The SCDOR imposes penalties based on the amount of time your payment is overdue.

To avoid late payment penalties, it is advisable to set reminders and plan your payments well in advance. If you encounter any financial difficulties, it is recommended to contact the SCDOR to discuss potential payment plans or extensions.

Exemptions and Special Considerations

While the South Carolina automobile tax applies to most vehicles, there are certain exemptions and special considerations that may reduce or eliminate your tax liability. It is important to understand these provisions to determine if you qualify for any tax relief.

Disability Exemptions

Individuals with disabilities may be eligible for a disability exemption on their automobile tax. This exemption applies to vehicles that are specifically modified or equipped to accommodate the disability. The SCDOR provides guidelines and criteria for qualifying for this exemption.

To claim this exemption, you must submit an application to the SCDOR along with the required documentation. The application process may involve providing medical certifications and details about the vehicle modifications. Once approved, the exemption will be applied to your automobile tax assessment.

Senior Citizen Exemptions

Senior citizens in South Carolina may also qualify for exemptions on their automobile tax. These exemptions are typically based on age and income criteria. The SCDOR offers various programs and exemptions to assist senior citizens with their tax obligations.

To determine if you are eligible for a senior citizen exemption, it is advisable to consult the SCDOR's guidelines and application procedures. The application process may involve providing proof of age and income verification.

Military Exemptions

Active-duty military personnel and veterans may be eligible for exemptions or reduced tax rates on their automobile tax. These exemptions are a way to recognize and support the service and sacrifice of our military members.

The SCDOR provides specific guidelines and criteria for military exemptions. It is important to carefully review these guidelines and submit the necessary documentation to claim the exemption. This may include providing proof of military service and residency requirements.

Future Implications and Changes

As with any tax system, the South Carolina automobile tax is subject to potential changes and reforms. It is essential to stay informed about any upcoming modifications to ensure compliance with the latest regulations.

Proposed Changes and Reforms

Over the years, there have been discussions and proposals for reforming the automobile tax system in South Carolina. These proposals aim to address concerns such as fairness, transparency, and the impact on different vehicle types.

Some of the proposed changes include adjusting the tax rate, implementing a flat tax system, or introducing new valuation methods. These reforms are aimed at making the tax system more equitable and responsive to the changing landscape of the automotive industry.

Impact on Vehicle Owners

Any changes to the automobile tax system can have a direct impact on vehicle owners. It is crucial to stay updated on these changes to understand how they may affect your tax liability. The SCDOR and other relevant authorities provide resources and information to help vehicle owners navigate these transitions.

By staying informed and proactive, vehicle owners can ensure that they are prepared for any changes and can take advantage of any new exemptions or provisions that may benefit them.

Conclusion

Understanding the South Carolina automobile tax is essential for vehicle owners in the state. This comprehensive guide has provided an in-depth look at the tax calculation, assessment, payment process, and exemptions. By familiarizing yourself with the intricacies of this tax, you can ensure compliance and avoid any unnecessary penalties.

Remember to stay updated on any changes or reforms to the tax system, as these can have a direct impact on your tax liability. The SCDOR and other resources are available to provide guidance and assistance throughout the process.

With this knowledge, you can confidently navigate the automobile tax landscape in South Carolina and ensure that you are fulfilling your tax obligations accurately and efficiently.

How often do I need to pay the automobile tax in South Carolina?

+The automobile tax in South Carolina is typically an annual assessment. However, the due date may vary depending on your county of residence. It is important to check the official sources or contact the SCDOR to confirm the specific due date for your vehicle.

Can I appeal my automobile tax assessment if I believe it is incorrect?

+Yes, if you believe your automobile tax assessment is incorrect, you have the right to appeal the decision. The SCDOR provides guidelines and procedures for appealing tax assessments. It is important to follow these procedures and provide any necessary documentation to support your appeal.

Are there any exemptions available for electric vehicles in South Carolina?

+As of my last update, there are specific exemptions for electric vehicles in South Carolina. However, it is advisable to check with the SCDOR or relevant authorities for the most current information. Electric vehicle incentives and exemptions may be subject to change, so staying informed is crucial.

Can I pay my automobile tax online?

+Yes, the SCDOR offers an online payment portal for your convenience. You can securely make your automobile tax payment through their official website. This method is quick, efficient, and allows you to pay your taxes from anywhere with an internet connection.

What happens if I miss the automobile tax payment deadline?

+If you miss the automobile tax payment deadline, you may be subject to late payment penalties. These penalties can accrue over time, increasing your overall tax liability. It is important to pay your taxes by the due date to avoid any additional fees and potential enforcement actions.