The Ultimate Guide to Understanding the US Foreign Tax Bill

In recent years, discussions surrounding the U.S. foreign tax bill have garnered increased attention from policymakers, business leaders, and international observers. The complexities of international taxation, coupled with the broader implications for global economic relations, make understanding this legislation crucial for stakeholders across sectors. At its core, the U.S. foreign tax bill embodies a legislative attempt to modulate how American entities and individuals are taxed on foreign-earned income, reflecting shifting priorities in economic policy, national sovereignty, and international cooperation.

Dissecting the Framework: What Is the U.S. Foreign Tax Bill?

The U.S. foreign tax bill, often introduced as part of broader tax reform packages, seeks to address how the United States taxes income earned abroad by its residents and corporations. Historically, the U.S. has maintained a ©worldwide taxation system, meaning it taxes its citizens and residents on income regardless of where it is earned. This approach contrasts with territorial systems used by many other OECD countries, which tax only income earned within their borders.

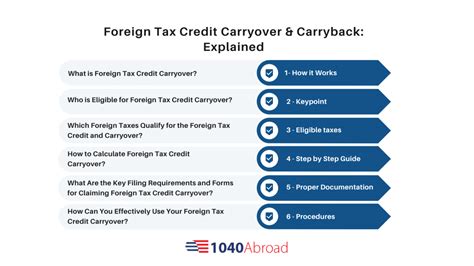

The bill in question introduces numerous provisions, including adjustments to the Foreign Tax Credit (FTC), modifications to the GILTI (Global Intangible Low-Taxed Income) regime, and new reporting obligations. It aims to strike a balance between preventing double taxation and discouraging profit shifting—practices that allow companies to exploit loopholes and minimize tax liabilities through offshore arrangements.

Furthermore, the legislation reflects an evolving diplomatic landscape, where the U.S. seeks to align its taxation policies with international standards promoted by organizations such as the OECD’s Base Erosion and Profit Shifting (BEPS) initiative.

Key Points

- Understanding the balance between tax sovereignty and international cooperation is vital in evaluating the bill's efficacy.

- The bill’s complex provisions significantly impact multinational corporations’ tax strategies.

- Policy debates revolve around whether the bill incentivizes repatriation or impairs global competitiveness.

- Changes to tax credits and GILTI can substantially influence the behavior of U.S.-based multinationals.

- The legislation's potential to reshape international tax compliance emphasizes the importance of strategic planning.

Opposing Perspectives on the U.S. Foreign Tax Bill

Perspective 1: Advocates for the Bill Emphasize Global Fairness and Competitiveness

Proponents of the U.S. foreign tax bill argue that it represents a vital step towards modernizing a system perceived as outdated and overly punitive to American multinational corporations (MNCs). By revising the FTC and GILTI provisions, supporters contend the bill simplifies compliance, reduces loopholes, and encourages repatriation of overseas profits.

From a policy standpoint, these advocates emphasize that the current U.S. taxation model discourages investment, leading to a drain of capital and jobs—especially as companies shift profits to jurisdictions with more favorable tax treatments. They cite empirical data indicating that repatriation rates have historically lagged, with less than 10% of accumulated overseas earnings brought back to the U.S. post-2017 tax reforms.

Furthermore, proponents highlight that aligning U.S. international tax policies with OECD standards enhances credibility in global forums and fosters fair competition among nations. They argue that the bill curtails profit shifting by closing tax loopholes, thereby protecting the U.S. tax base and ensuring that multinational corporations contribute their fair share to national development.

Perspective 2: Critics Argue the Bill Undermines International Competitiveness and Unduly Burdens Business

On the other side, critics contend that the U.S. foreign tax bill risks hampering the competitiveness of American enterprises on the global stage. They argue that increased tax burdens and complex compliance requirements introduce uncertainties, potentially deterring foreign investment and encouraging profit shifting through illicit channels.

Analysis from some think tanks and industry groups suggests that the amendments could induce double taxation or elevate effective tax rates beyond global norms. For instance, increased GILTI taxes and restrictions on foreign tax credits may lead to higher marginal costs for American companies, reducing their global profitability.

Moreover, critics warn that the legislation could create an uneven playing field, advantaging foreign competitors benefiting from territorial systems and more favorable tax regimes. This disparity could translate into a potential loss of market share for U.S. firms, larger tax planning expenses, and reduced innovation incentives.

Empirical research indicates that multinational firms disproportionately allocate their profits to low-tax jurisdictions, and overly aggressive taxation may push them further offshore, undermining the intended revenue gains of the bill.

Evaluating the Impact: The Practical and Economic Consequences

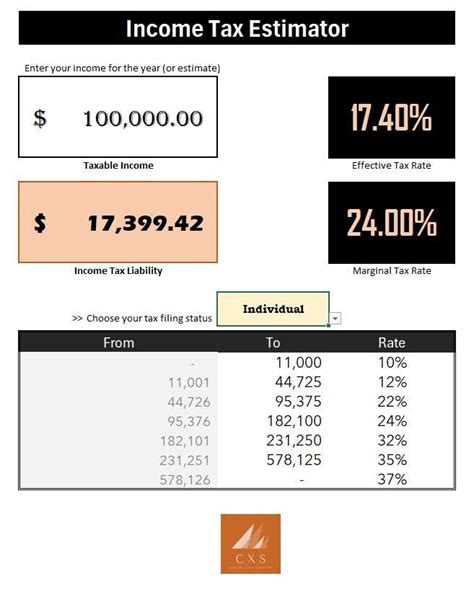

Deciphering the real-world impact of the U.S. foreign tax bill involves analyzing both macroeconomic and microeconomic factors. On one hand, a tax reform aiming at reducing the effective tax rate and improving compliance could stimulate inward investment and support job creation. A 2022 report from the Congressional Budget Office suggests that targeted reforms could increase after-tax income for U.S. corporations by approximately 5–7%, fostering capital retention and reinvestment.

On the other hand, increased complexity and higher effective tax rates—if not carefully calibrated—may induce capital flight and discourage foreign direct investment (FDI). The OECD data shows that countries with territorial systems typically attract more FDI than those with worldwide systems, reinforcing the argument that strategic tax reform must consider global competitiveness.

Furthermore, the ongoing debate over foreign tax credits reflects a fundamental tension: Should the U.S. prioritize preventing double taxation at the expense of fostering a more globally competitive tax environment, or vice versa? The answer hinges on balancing revenue objectives with maintaining a dynamic, innovative domestic business climate.

| Relevant Category | Substantive Data |

|---|---|

| Repatriation Rate | Less than 10% of overseas earnings repatriated post-2017 reforms |

| Effective Corporate Tax Rate | Current US statutory rate at 21%, potentially elevated to 25-28% with modifications |

| Foreign Direct Investment | OECD countries with territorial systems attract 40–60% more FDI |

| Tax Revenue Impact | Projected increase in federal revenue by $80–$120 billion over a decade, contingent on compliance and behavioral responses |

Synthesis and Final Perspective

The debate over the U.S. foreign tax bill underscores the enduring tension between safeguarding tax revenues and nurturing a conducive environment for global business operations. Supporters’ emphasis on fairness, transparency, and alignment with global standards seeks to address longstanding issues of profit shifting and tax base erosion. Conversely, opponents caution that overly aggressive reforms risk unintended economic consequences, including reduced competitiveness and increased illicit tax avoidance.

A nuanced evaluation suggests that the optimal policy approach involves phased, evidence-based adjustments. Incorporating features such as clearer guidelines for transfer pricing, incentivizing repatriation without creating excessive compliance burdens, and maintaining flexibility to respond to global economic shifts may represent a balanced pathway.

Ultimately, the efficacy of the U.S. foreign tax bill hinges on its capacity to reconcile national fiscal objectives with the realities of an interconnected, competitive global economy—an endeavor that demands ongoing dialogue among policymakers, industry stakeholders, and international organizations.

How does the U.S. foreign tax bill compare with other OECD countries’ tax systems?

+The U.S. employs a worldwide tax system, taxing residents on global income, whereas many OECD countries utilize territorial systems that focus on domestic income. This difference affects global investment flows and compliance strategies.

What are the main concerns of multinational corporations regarding the bill?

+Major concerns include increased effective tax rates, compliance costs, potential for double taxation, and diminished global competitiveness, which could reduce profits and influence investment decisions.

Can the bill influence international tax treaties?

+Yes, the bill’s provisions may lead to renegotiations of tax treaties, as countries align diplomatic and fiscal policies to accommodate new standards, impacting cross-border taxation agreements.

What are the long-term prospects for U.S. international tax policy reforms?

+Ongoing global initiatives, such as the OECD’s BEPS 2.0 project, suggest that international tax reforms will continue evolving. U.S. policies are likely to adapt gradually, emphasizing both revenue collection and competitiveness.

How might future economic shifts impact the effectiveness of the bill?

+Global economic dynamics, such as shifts towards digital economies or changes in offshore financial centers, could necessitate further revisions to balance tax fairness with economic vitality.