New York Property Tax Search

Welcome to our comprehensive guide on the New York Property Tax Search, an essential tool for anyone looking to navigate the property tax landscape in the Empire State. Whether you're a real estate investor, a homeowner, or simply curious about the property tax process, this article will provide you with a deep dive into the specifics of New York's property tax system. We'll explore the ins and outs of the search process, delve into the factors that influence property tax assessments, and offer valuable insights to help you understand and manage your property tax obligations effectively.

Unraveling the New York Property Tax Search

The New York Property Tax Search is a powerful online resource that allows property owners and interested parties to access vital information about a property’s tax status. This search tool, accessible through the official government websites of New York counties, provides a transparent window into the world of property taxes, offering a wealth of data that is crucial for making informed decisions.

What Can You Discover Through the Search?

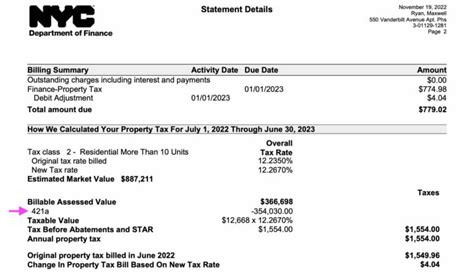

The New York Property Tax Search provides a comprehensive overview of a property’s tax history and current status. Here’s a glimpse of what you can uncover:

- Tax Assessment Details: Access the assessed value of a property, which is a key factor in determining the property taxes owed.

- Tax Rates and Charges: View the tax rates applicable to the property and calculate the estimated tax amount for a given period.

- Tax Payment History: Review past tax payments, including dates, amounts, and any penalties or interest applied.

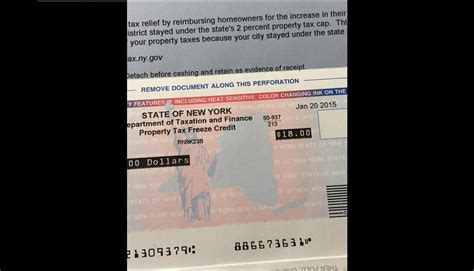

- Exemptions and Abatements: Identify any tax exemptions or abatements that may apply to the property, reducing the overall tax burden.

- Property Characteristics: Obtain information about the property's physical attributes, such as its size, improvements, and any special features.

| Property Type | Assessment Value | Tax Rate |

|---|---|---|

| Residential | $500,000 | 1.5% |

| Commercial | $800,000 | 2.2% |

| Industrial | $350,000 | 1.8% |

Step-by-Step Guide to Conducting the Search

Performing a New York Property Tax Search is straightforward and user-friendly. Follow these steps to retrieve the information you need:

- Visit the Official County Website: Start by navigating to the official website of the county where the property is located. Each county in New York has its own online portal for property tax information.

- Locate the Property Tax Search Tool: Look for a link or section labeled "Property Tax Search," "Tax Assessment," or similar. This tool is typically easy to find on the homepage or in the navigation menu.

- Enter Property Details: You'll be prompted to enter specific details about the property, such as the address, parcel number, or owner's name. Ensure you have this information ready.

- Submit the Search: Click the "Search" or "Submit" button to initiate the query. The system will process your request and retrieve the relevant data.

- Review the Results: The search results page will display a comprehensive overview of the property's tax information. Take time to review and understand the details provided.

- Save or Print the Data: If needed, you can save or print the search results for future reference or for sharing with relevant parties.

Understanding Property Tax Assessments in New York

Property tax assessments are a critical component of the New York property tax system. These assessments determine the value of a property for tax purposes, influencing the amount of tax owed by the property owner. Here’s a closer look at how property tax assessments work in the Empire State.

The Assessment Process

Property tax assessments in New York are conducted by local assessors, who are responsible for evaluating the value of properties within their jurisdiction. The assessment process typically involves the following steps:

- Data Collection: Assessors gather information about properties, including physical characteristics, recent sales data, and market trends.

- Valuation Methods: Assessors use various valuation methods, such as the cost approach, income approach, and market approach, to estimate a property's value. These methods consider factors like construction costs, rental income, and comparable sales.

- Site Visits: In some cases, assessors may conduct site visits to inspect properties and verify the accuracy of the data collected.

- Assessment Roll Preparation: After completing the valuation process, assessors create an assessment roll, which is a list of all properties in the jurisdiction along with their assessed values.

- Notice of Assessment: Property owners are typically notified of their assessed values through a Notice of Assessment, which outlines the property's value and provides information on how to appeal if necessary.

Factors Affecting Property Tax Assessments

Several factors influence the assessed value of a property in New York. Understanding these factors can help property owners anticipate potential changes in their tax obligations:

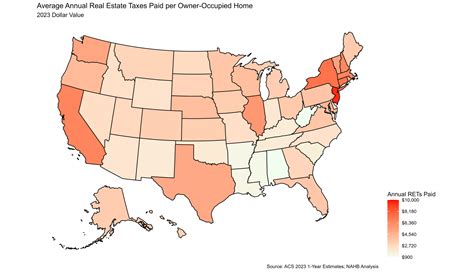

- Market Value: The market value of a property is a key determinant of its assessed value. Properties that are in high demand or located in desirable areas may have higher assessments.

- Improvements: Any improvements made to a property, such as renovations, additions, or upgrades, can impact its assessed value. These improvements may increase the property's market value and, consequently, its tax assessment.

- Economic Conditions: Local and regional economic conditions can influence property values. For example, a strong local economy may lead to increased property values and higher assessments.

- Assessment Ratio: New York uses an assessment ratio, typically 100%, to calculate the assessed value. The assessment ratio is applied to the property's market value to determine its assessed value.

- Tax Caps and Limits: New York has certain tax caps and limits in place to control property tax increases. These limits may restrict the amount by which a property's assessed value can increase from year to year.

Managing Your Property Tax Obligations

Understanding your property tax obligations is crucial for effective financial planning and compliance with local regulations. Here’s a guide to help you manage your property taxes in New York.

Review Your Assessment Notice

When you receive your Notice of Assessment, take the time to carefully review it. Verify that the information is accurate, including the property’s physical description, assessed value, and any exemptions or abatements applied. If you have questions or concerns about the assessment, contact your local assessor’s office for clarification.

Appealing Your Assessment

If you believe your property’s assessed value is incorrect or unfair, you have the right to appeal. The appeal process varies by county, but generally involves the following steps:

- Review the Appeal Process: Familiarize yourself with the appeal process and deadlines specific to your county. This information is typically available on the county's official website or by contacting the assessor's office.

- Prepare Your Case: Gather evidence to support your appeal, such as recent sales data of comparable properties, professional appraisals, or photographs illustrating the property's condition.

- File an Appeal: Submit your appeal within the specified timeframe. You may need to complete an appeal form and provide supporting documentation.

- Hearing or Review: Depending on the appeal process, you may have the opportunity to attend a hearing or have your case reviewed by an assessment review board.

- Decision and Notification: After the appeal process, you will receive a decision regarding your assessment. If your appeal is successful, your assessed value may be adjusted, potentially reducing your tax obligation.

Understanding Tax Bills and Payment Options

Property tax bills in New York are typically issued annually and cover a specific period, such as a fiscal year. The tax bill outlines the amount owed, the due date, and payment options. Here are some key points to consider:

- Due Dates: Property tax bills often have multiple due dates throughout the year. Make sure to pay your taxes on time to avoid penalties and interest charges.

- Payment Methods: Property tax payments can be made online, by mail, or in person at designated locations. Some counties offer convenient payment options, such as electronic funds transfer or credit card payments.

- Escrow Accounts: If you have a mortgage, your lender may require you to set up an escrow account to cover property taxes. In this case, your tax payments are included in your monthly mortgage payments.

- Payment Plans: If you are facing financial difficulties, some counties offer payment plans to help property owners manage their tax obligations over time.

The Future of Property Taxes in New York

As New York continues to evolve, so does its property tax landscape. Here’s a glimpse into some potential future developments and trends that may impact property taxes in the state.

Property Tax Reform Initiatives

There have been ongoing discussions and initiatives aimed at reforming the property tax system in New York. These efforts seek to address concerns such as tax fairness, affordability, and the impact of property taxes on different segments of the population. Some proposed reforms include:

- Implementing a property tax cap to limit annual increases.

- Expanding tax relief programs for low- and middle-income homeowners.

- Revising assessment practices to ensure accuracy and consistency.

- Exploring alternative revenue sources to reduce reliance on property taxes.

Technological Advancements

Technology continues to play a significant role in enhancing the efficiency and transparency of property tax processes. Here are some technological advancements that may shape the future of property taxes in New York:

- Digital Assessment Tools: Advanced software and data analytics can improve the accuracy and efficiency of property assessments, reducing the need for manual inspections.

- Online Services: Further development of online platforms and mobile apps may make it even easier for property owners to access tax information, pay taxes, and manage their accounts.

- Blockchain and Smart Contracts: These emerging technologies have the potential to enhance security, transparency, and efficiency in property tax transactions.

Economic and Demographic Changes

Economic and demographic shifts can influence property values and, consequently, property taxes. As New York’s economy evolves and its population dynamics change, we may see the following impacts:

- Shifts in property values due to changes in market demand.

- Potential impacts on property taxes from changes in population growth and migration patterns.

- Adjustments in tax policies to accommodate evolving economic conditions.

Conclusion

The New York Property Tax Search is a valuable tool for anyone looking to navigate the complexities of property taxes in the state. By understanding the search process, assessment methods, and management strategies, property owners can make informed decisions and effectively manage their tax obligations. As the property tax landscape continues to evolve, staying informed and proactive is key to ensuring a fair and transparent tax system for all New Yorkers.

How often are property tax assessments conducted in New York?

+Property tax assessments in New York are typically conducted annually. However, some counties may reassess properties more frequently, especially if there have been significant changes or improvements to the property.

Can I pay my property taxes online in New York?

+Yes, many counties in New York offer online payment options for property taxes. You can typically make payments through the county’s official website or designated online portals. Check with your specific county’s tax office for more information.

What happens if I don’t pay my property taxes on time in New York?

+Failure to pay property taxes on time in New York can result in penalties and interest charges. In severe cases, it may lead to tax liens being placed on the property or even foreclosure proceedings. It’s crucial to stay current with your tax payments to avoid these consequences.

Are there any property tax exemptions available in New York?

+Yes, New York offers various property tax exemptions to eligible homeowners. These exemptions can reduce the assessed value of a property and, consequently, the tax obligation. Common exemptions include the Basic Star exemption for primary residences, senior citizen exemptions, and exemptions for veterans and disabled individuals. Check with your local assessor’s office to determine your eligibility.