Washington Sales Tax Lookup

Welcome to our comprehensive guide on the Washington Sales Tax Lookup! In this article, we will delve into the intricacies of sales tax in the state of Washington, providing you with expert insights, practical examples, and valuable resources to navigate the tax landscape with ease. Whether you're a business owner, an accountant, or simply curious about how sales tax works in this vibrant state, you've come to the right place.

Understanding Sales Tax in Washington: A Comprehensive Overview

Washington, known for its breathtaking landscapes and thriving economy, has a unique sales tax system that varies across different counties and municipalities. This guide aims to shed light on the specifics of sales tax in Washington, ensuring you have the knowledge to make informed decisions regarding tax compliance and planning.

The Basics of Washington Sales Tax

Washington imposes a state sales tax rate of 6.5%, which applies to the sale of tangible personal property, certain services, and digital products. However, it’s important to note that local jurisdictions can levy additional taxes, resulting in varying tax rates across the state.

The state of Washington follows a destination-based sales tax system, which means the tax rate is determined by the location where the product or service is delivered or consumed. This can create complexities, especially for businesses operating in multiple counties or selling to customers in different parts of the state.

| Tax Jurisdiction | Sales Tax Rate |

|---|---|

| State of Washington | 6.5% |

| King County | 3.0% |

| Seattle City | 2.25% |

| Tacoma City | 1.0% |

| Spokane County | 1.5% |

| Bellevue City | 0.75% |

Sales Tax Exemptions and Special Considerations

Understanding the exemptions and special tax rules is crucial for accurate tax calculations. In Washington, certain goods and services are exempt from sales tax, including:

- Prescription drugs

- Medical devices

- Groceries and staple foods

- Residential utilities

- Most agricultural equipment and supplies

Additionally, Washington offers tax incentives and programs for specific industries, such as the Manufacturing Exemption, which allows manufacturers to claim a sales tax exemption on certain purchases.

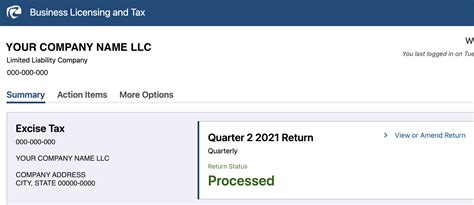

Registration and Compliance

Businesses operating in Washington or selling goods into the state must register with the Washington Department of Revenue and obtain a Business License. The registration process ensures that businesses can collect and remit sales tax accurately.

Compliance with sales tax regulations is crucial to avoid penalties and legal issues. Businesses should maintain proper records, calculate taxes correctly, and remit them on time. The Department of Revenue provides resources and guidance to assist businesses in meeting their tax obligations.

Navigating the Washington Sales Tax Landscape

Understanding the intricacies of Washington’s sales tax system is essential for businesses to thrive in this market. By familiarizing yourself with the rates, exemptions, and compliance requirements, you can ensure smooth operations and avoid costly mistakes.

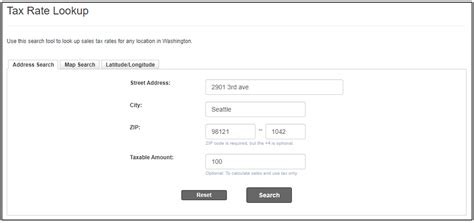

Calculating Sales Tax Accurately

To calculate sales tax accurately, businesses should consider the following steps:

- Determine the customer’s location to identify the applicable tax rate.

- Identify the type of product or service being sold to ensure it is taxable.

- Apply the appropriate tax rate to the taxable amount.

- Round the tax amount to the nearest penny as per Washington’s rounding rules.

Using tax calculation tools or software can simplify this process and reduce the risk of errors.

Sales Tax Filing and Remittance

Businesses registered for sales tax in Washington are required to file and remit taxes on a regular basis. The filing frequency depends on the business’s tax liability and can be monthly, quarterly, or annually.

The Department of Revenue provides online filing options, making the process efficient and convenient. Businesses can also opt for automatic payment methods to ensure timely remittance.

Audits and Compliance Checks

The Department of Revenue conducts audits to ensure businesses are complying with sales tax regulations. Audits can be random or triggered by specific factors, such as a significant increase in sales or changes in business operations.

To prepare for audits, businesses should maintain organized records, including sales receipts, purchase invoices, and tax returns. Having a clear understanding of the tax rules and staying updated with any changes is also crucial.

Resources and Support for Businesses

Navigating the sales tax landscape in Washington can be challenging, but businesses have access to valuable resources and support.

Department of Revenue’s Website

The Washington Department of Revenue’s website is a comprehensive resource for businesses. It provides detailed information on sales tax rates, regulations, exemptions, and filing requirements. The website also offers helpful guides, webinars, and FAQs to address common queries.

Additionally, the website provides access to tax forms, publications, and online tools to assist businesses in their tax compliance journey.

Tax Professionals and Consultants

Engaging the services of tax professionals or consultants can be beneficial, especially for businesses with complex tax structures or those expanding into new markets. These experts can provide tailored advice, ensure compliance, and offer strategic tax planning.

Tax professionals can assist with tax registration, filing, and reporting, as well as help businesses claim available tax incentives and credits.

Staying Updated with Tax Changes

Tax laws and regulations can evolve over time, so it’s essential for businesses to stay informed. The Department of Revenue’s website provides updates on tax changes, new legislation, and important announcements. Subscribing to their email notifications or following their social media accounts can ensure businesses receive timely information.

Conclusion: Empowering Businesses with Knowledge

Washington’s sales tax system may have its complexities, but with the right knowledge and resources, businesses can navigate it successfully. By understanding the tax rates, exemptions, and compliance requirements, businesses can ensure accurate tax calculations, timely filings, and smooth operations.

This guide has provided an in-depth look at Washington's sales tax landscape, offering practical insights and expert advice. Remember, staying informed and seeking professional guidance when needed can make a significant difference in your business's tax compliance and overall success.

How often should businesses file and remit sales tax in Washington?

+The filing frequency depends on the business’s tax liability. Generally, businesses with higher tax liabilities are required to file monthly, while those with lower liabilities can file quarterly or annually. It’s important to consult the Department of Revenue’s guidelines and assess your business’s specific situation.

Are there any online tools available to calculate sales tax in Washington?

+Yes, the Department of Revenue provides an online Sales Tax Calculator on their website. This tool allows businesses to input the applicable tax rate and taxable amount to calculate the sales tax due. It’s a convenient way to ensure accurate calculations.

What happens if a business fails to register for sales tax in Washington?

+Failing to register for sales tax can result in significant penalties and legal consequences. Businesses operating without a valid registration may be subject to back taxes, interest, and fines. It’s crucial to register promptly to avoid these issues and maintain compliance.