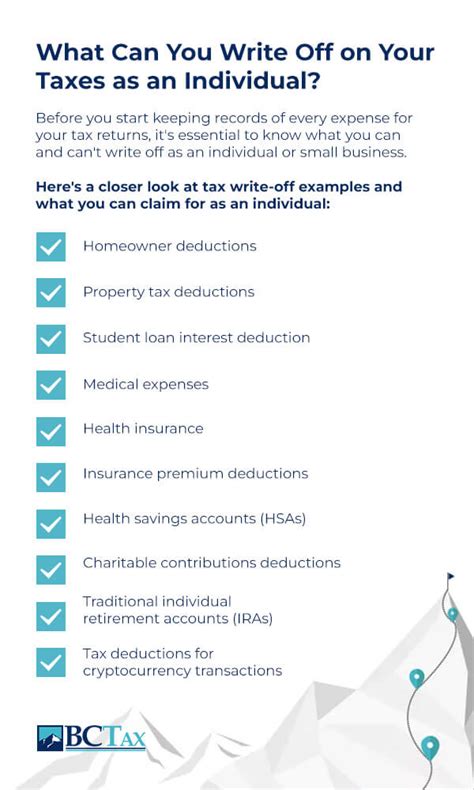

Can I Write Off Property Taxes

For many homeowners, property taxes are a significant financial obligation. The question of whether these taxes can be written off is a common concern, and the answer lies within the complex world of tax laws and regulations. This article aims to provide an in-depth analysis, exploring the conditions under which property taxes can be deducted and the potential benefits for taxpayers.

Understanding Property Taxes and Their Role

Property taxes are levied by local governments, often counties or municipalities, and are based on the assessed value of a property. These taxes contribute to funding essential services such as public schools, infrastructure development, and emergency services. While property taxes are a crucial source of revenue for local governments, they can be a substantial expense for homeowners.

The ability to write off property taxes has significant implications for taxpayers. It can reduce the overall tax liability, providing financial relief to homeowners. However, the process is not as straightforward as it might seem, and understanding the specific conditions and limitations is essential.

Deductions for Property Taxes: A Comprehensive Overview

In the United States, the Internal Revenue Service (IRS) allows taxpayers to claim deductions for various expenses, including property taxes. However, it’s important to note that the availability and extent of these deductions can vary based on factors such as the taxpayer’s filing status, income level, and the specific tax laws applicable in their jurisdiction.

Itemized Deductions: A Common Pathway

One of the primary ways to write off property taxes is through itemized deductions. Taxpayers who choose to itemize their deductions can include property taxes as a qualifying expense. This option is particularly beneficial for individuals with high property tax bills and other substantial deductions, such as mortgage interest, charitable contributions, and medical expenses.

When itemizing deductions, taxpayers can claim the full amount of property taxes paid during the tax year. This includes taxes paid on their primary residence as well as any additional properties they own. However, it's crucial to maintain accurate records and documentation to support these deductions.

| Deduction Type | Property Taxes |

|---|---|

| Itemized Deduction | Full amount paid |

Standard Deduction: A Simplified Approach

For taxpayers who prefer a simpler approach, the standard deduction might be a more suitable option. The standard deduction is a fixed amount set by the IRS, and taxpayers can choose to deduct this amount instead of itemizing their deductions. While the standard deduction provides a straightforward option, it may not be as advantageous for homeowners with high property taxes.

The standard deduction amount varies based on the taxpayer's filing status. For example, the standard deduction for single filers in 2022 was $12,950, while it was $25,900 for married couples filing jointly. Taxpayers must compare the total of their potential itemized deductions, including property taxes, with the standard deduction to determine which option offers the most tax benefits.

| Filing Status | Standard Deduction (2022) |

|---|---|

| Single | $12,950 |

| Married Filing Jointly | $25,900 |

Limitations and Considerations

While writing off property taxes can provide significant tax benefits, there are limitations and considerations to keep in mind.

- SALT Deduction Cap: The Tax Cuts and Jobs Act of 2017 introduced a cap on the deduction for state and local taxes (SALT), including property taxes. This cap limits the deduction to $10,000 ($5,000 for married filing separately) per tax year. Taxpayers with high property tax bills may find this cap restrictive, especially in high-tax states.

- Alternative Minimum Tax (AMT): The Alternative Minimum Tax is a parallel tax system designed to ensure that high-income individuals pay a minimum amount of tax. Deductions, including property taxes, may be limited or disallowed under the AMT. Taxpayers should consider the impact of AMT when planning their deductions.

- Homeownership Status: Property tax deductions are generally associated with homeownership. Renters cannot deduct their landlord's property taxes but may be able to claim a portion of their rent as a deduction if their landlord passes on the property tax burden.

Strategies for Maximizing Property Tax Deductions

To make the most of property tax deductions, taxpayers can employ several strategies:

- Consider Itemizing: If your property taxes, along with other potential deductions, exceed the standard deduction amount, itemizing may be a beneficial choice. Consult with a tax professional to determine the best approach for your specific situation.

- Prepay Property Taxes: In some cases, it may be advantageous to prepay property taxes, especially if you anticipate a higher tax bill in the following year. This strategy can be particularly useful for taxpayers affected by the SALT deduction cap.

- Review Your Tax Withholdings: Adjusting your tax withholdings throughout the year can help ensure you're not overpaying or underpaying your taxes. This strategy can be especially relevant for taxpayers with variable income or multiple sources of income.

Real-World Examples and Case Studies

To illustrate the impact of property tax deductions, let’s consider a few real-world examples:

Example 1: High-Income Taxpayer in a High-Tax State

John, a single filer residing in a high-tax state, has an annual income of 200,000. He owns a primary residence with an annual property tax bill of 15,000. John’s potential itemized deductions, including property taxes and charitable contributions, total 20,000. By itemizing, he can deduct the full 15,000 in property taxes, significantly reducing his tax liability.

Example 2: Middle-Income Taxpayer with Multiple Properties

Sarah, a married couple filing jointly, has an annual income of 100,000. They own a primary residence with an annual property tax bill of 8,000 and a rental property with an annual tax bill of 4,000. Sarah and her spouse can claim both property tax bills as itemized deductions, resulting in a total deduction of 12,000.

The Future of Property Tax Deductions

The future of property tax deductions is subject to ongoing tax policy debates and potential legislative changes. The SALT deduction cap, introduced in 2017, has been a point of contention, with many taxpayers and policymakers advocating for its removal or modification.

Additionally, the impact of the COVID-19 pandemic on local government finances and property values may influence future tax policies. As governments grapple with budget constraints, the role of property taxes and their deductibility could be subject to further scrutiny and potential adjustments.

Conclusion

Writing off property taxes can provide substantial tax benefits for homeowners, but it requires a thorough understanding of tax laws and individual circumstances. By exploring the options of itemized deductions and considering strategies like prepaying taxes, taxpayers can make informed decisions to maximize their tax savings. As the tax landscape evolves, staying informed and seeking professional advice will be essential to navigating the complexities of property tax deductions.

Frequently Asked Questions

Can I deduct property taxes if I rent my home?

+

No, renters cannot deduct their landlord’s property taxes. However, if the landlord passes on the property tax burden to the tenants, a portion of the rent may be deductible.

What is the SALT deduction cap, and how does it affect property tax deductions?

+

The SALT deduction cap limits the deduction for state and local taxes, including property taxes, to 10,000 (5,000 for married filing separately) per tax year. This cap can restrict the deductibility of property taxes for taxpayers in high-tax states.

Are there any alternatives to itemizing deductions to write off property taxes?

+

Yes, taxpayers can opt for the standard deduction, which is a fixed amount set by the IRS. However, the standard deduction may not provide the same level of tax benefits as itemizing, especially for homeowners with high property taxes.