Tn Sales Tax

The sales tax system in Tennessee is an intricate component of the state's revenue generation and economic policy. With a unique structure and a set of regulations, understanding the ins and outs of the Tennessee sales tax is crucial for businesses and consumers alike.

A Comprehensive Guide to Tennessee’s Sales Tax

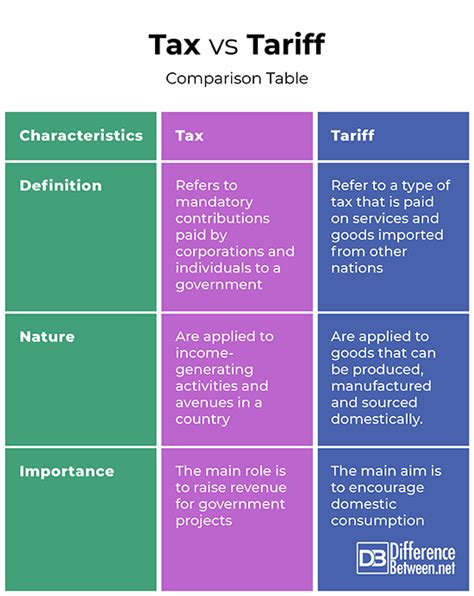

Tennessee’s sales tax is a key component of the state’s revenue collection, accounting for a significant portion of its annual budget. This tax is applied to the sale of goods and certain services within the state, with rates varying across different jurisdictions. In this comprehensive guide, we will delve into the specifics of Tennessee’s sales tax, its structure, rates, exemptions, and the implications it has for businesses and consumers.

The Structure of Tennessee Sales Tax

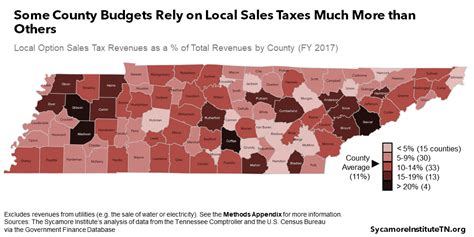

Tennessee operates a combined sales tax system, where the state and local governments collaborate to impose taxes on retail sales. The state sets a base sales tax rate, which is then combined with additional local taxes, resulting in a combined rate unique to each jurisdiction.

The base state sales tax rate in Tennessee is 7%, one of the higher rates in the country. This rate applies uniformly across the state, ensuring a level playing field for businesses and consistent tax collection.

On top of the state sales tax, local governments, including counties and municipalities, have the authority to levy additional sales taxes. These local taxes can vary significantly, ranging from 1.5% to 2.75%, depending on the jurisdiction. This variation in local taxes creates a complex landscape, with combined rates differing from one area to another.

| Jurisdiction | Combined Sales Tax Rate |

|---|---|

| Memphis | 9.25% |

| Nashville | 9% |

| Knoxville | 8.75% |

| Chattanooga | 8.75% |

| State Average | 9.45% |

These varying rates create a dynamic where businesses and consumers must be vigilant about the sales tax rates in their specific areas. It also presents opportunities for businesses to strategically locate in areas with more favorable tax rates, impacting their bottom line and competitive positioning.

Sales Tax Exemptions in Tennessee

While Tennessee applies sales tax to a wide range of goods and services, there are notable exemptions and special provisions that businesses and consumers should be aware of.

- Food and Groceries: Tennessee exempts unprepared food and groceries from sales tax, providing a significant relief to consumers’ budgets. This exemption, however, does not extend to prepared foods or meals served in restaurants.

- Prescription Drugs: Sales of prescription drugs are also exempt from Tennessee sales tax, a measure that aims to reduce the financial burden on patients in need of medical treatment.

- Manufacturing Equipment: To promote economic growth, Tennessee offers a sales tax exemption for the purchase of manufacturing equipment and machinery. This exemption is a key incentive for businesses to invest in the state’s manufacturing sector.

- Agricultural Sales: Sales of agricultural products, including livestock, seeds, and farm equipment, are exempt from sales tax in Tennessee. This provision supports the state’s agricultural industry and its economic contribution.

Understanding these exemptions is crucial for businesses to avoid overcharging on sales tax and for consumers to be aware of their rights and potential savings.

Tennessee’s Sales Tax on Services

Tennessee’s sales tax extends beyond the sale of tangible goods and applies to certain services as well. These services include, but are not limited to, the following:

- Telecommunications Services: Sales tax is imposed on services provided by phone companies, internet service providers, and other telecommunications businesses.

- Lodging Services: Accommodations, such as hotels and motels, are subject to a lodging tax, which varies across jurisdictions but typically ranges from 5% to 9%.

- Entertainment Services: Sales tax is applied to tickets for movies, concerts, and sporting events, as well as to admissions for amusement parks and other recreational facilities.

- Vehicle Storage Services: Storage facilities for vehicles, such as self-storage units or parking lots, are subject to sales tax.

The application of sales tax to services adds complexity to the tax landscape and requires businesses to stay updated on the latest regulations to ensure compliance.

Tennessee’s Online Sales Tax

With the rise of e-commerce, Tennessee has implemented regulations to ensure that online retailers collect and remit sales tax on purchases made by Tennessee residents. This measure, known as the Marketplace Fairness Act, aims to level the playing field between brick-and-mortar stores and online retailers.

Online retailers with substantial nexus in Tennessee, such as those with a physical presence or significant economic activity, are required to collect and remit sales tax on online sales. This includes out-of-state retailers that ship goods into Tennessee.

For consumers, this means that they are now paying sales tax on online purchases, which was not always the case in the past. This change has significant implications for both businesses and consumers, impacting their online shopping habits and tax obligations.

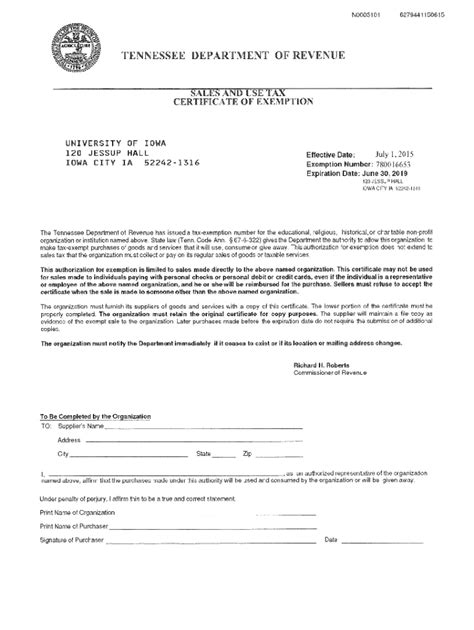

Sales Tax Registration and Remittance

Businesses operating in Tennessee, whether they sell goods or services, are required to register with the Tennessee Department of Revenue and obtain a sales tax permit. This permit authorizes businesses to collect sales tax from customers and remit it to the state.

Sales tax remittance is typically done on a monthly or quarterly basis, depending on the business’s sales volume. The tax collected is then reported and paid to the state, ensuring that the government can allocate these funds towards public services and infrastructure development.

The Impact of Tennessee’s Sales Tax

Tennessee’s sales tax system has a profound impact on the state’s economy and its residents. Here are some key implications to consider:

- Revenue Generation: Sales tax is a significant source of revenue for Tennessee, funding essential public services, infrastructure projects, and government operations. It allows the state to invest in education, healthcare, and other critical areas.

- Economic Incentives: The sales tax exemptions and incentives offered by Tennessee, such as those for manufacturing equipment and agricultural sales, encourage economic growth and investment in specific sectors. These measures help attract businesses and create jobs.

- Consumer Behavior: The sales tax rates and exemptions influence consumer spending habits. For instance, the exemption on unprepared food encourages grocery shopping, while the sales tax on entertainment services may impact attendance at certain events.

- Online Shopping Habits: The implementation of the Marketplace Fairness Act has shifted online shopping habits. Consumers now factor in sales tax when making online purchases, potentially impacting their buying decisions and the success of e-commerce businesses.

Understanding these implications provides a comprehensive view of how Tennessee's sales tax system shapes the state's economy and influences the lives of its residents.

Future Considerations and Potential Changes

As the economic landscape evolves, Tennessee’s sales tax system may undergo changes to adapt to new challenges and opportunities. Here are some potential considerations for the future:

- Simplification of Rates: With the complex web of state and local sales tax rates, there have been discussions about simplifying the system. This could involve a uniform state sales tax rate, with local governments receiving funding through other means, to reduce administrative burdens and confusion.

- Expansion of Exemptions: There may be calls to expand sales tax exemptions to additional goods and services, such as certain medical devices or renewable energy equipment, to promote public health and environmental sustainability.

- Digital Services Tax: As the digital economy grows, Tennessee may consider implementing a tax on digital services, such as streaming services or online advertising, to capture revenue from this emerging sector.

- Online Sales Tax Reform: The current online sales tax system may be refined to better capture revenue from out-of-state retailers, ensuring a fair playing field for local businesses and generating additional revenue for the state.

Frequently Asked Questions

What is the current state sales tax rate in Tennessee?

+The current state sales tax rate in Tennessee is 7%, effective since 2016. This rate applies uniformly across the state and is subject to change through legislative action.

How often are sales tax rates reviewed and adjusted in Tennessee?

+Sales tax rates in Tennessee are typically reviewed and adjusted on an as-needed basis, driven by economic factors and budgetary requirements. The state government has the authority to propose changes to the sales tax rate, which are then subject to legislative approval.

Are there any plans to simplify the sales tax system in Tennessee?

+There have been discussions about simplifying Tennessee’s sales tax system, particularly by reducing the complexity of varying local tax rates. Some proposals suggest a uniform state sales tax rate, with local governments receiving funding through other means, to streamline the tax landscape.

How does Tennessee’s sales tax system compare to other states?

+Tennessee’s sales tax system is relatively high compared to many other states. While the base state sales tax rate of 7% is on the higher end, the combination of state and local taxes can result in some of the highest combined sales tax rates in the country. This dynamic distinguishes Tennessee’s tax landscape from other states.

Are there any ongoing initiatives to reform Tennessee’s sales tax system?

+Yes, there are ongoing discussions and initiatives aimed at reforming Tennessee’s sales tax system. These initiatives focus on simplifying the tax structure, expanding exemptions to support specific industries or social causes, and ensuring fair taxation in the digital economy. The state government and legislative bodies are actively engaged in these discussions to shape future tax policies.