Short Term Rental Tax Loophole

The short-term rental market has witnessed explosive growth in recent years, fueled by the rise of online platforms like Airbnb, Vrbo, and Booking.com. While these platforms have revolutionized the travel and hospitality industry, they have also introduced new complexities and challenges, particularly when it comes to tax compliance. One of the most controversial aspects of this emerging market is the so-called "short-term rental tax loophole", which refers to the various strategies used by property owners and platform companies to evade or minimize their tax obligations.

This loophole has significant implications for governments, local communities, and even fellow taxpayers. As the short-term rental industry continues to expand, the need to address these tax issues becomes increasingly urgent. In this comprehensive article, we will delve into the intricacies of the short-term rental tax loophole, exploring the strategies employed, their impact on various stakeholders, and potential solutions to ensure a fair and transparent tax system.

Understanding the Short-Term Rental Tax Landscape

The short-term rental market operates within a unique tax environment, characterized by a complex interplay of local, state, and federal regulations. Property owners are typically required to pay a variety of taxes, including income tax on rental income, sales tax on guest bookings, occupancy tax, and even local tourism taxes. The specific tax obligations vary widely depending on the jurisdiction, with some cities and states imposing stringent regulations and others taking a more lenient approach.

The challenge arises from the dynamic and decentralized nature of the short-term rental market. Unlike traditional hospitality businesses like hotels, which have long been subject to strict tax regulations, short-term rentals are often managed by individual property owners who may not have a comprehensive understanding of their tax obligations. Additionally, the online platforms that facilitate these rentals often operate as intermediaries, making it difficult for tax authorities to track and collect taxes effectively.

Tax Evasion Strategies in the Short-Term Rental Market

The short-term rental tax loophole encompasses a range of strategies employed by property owners and platform companies to reduce their tax liabilities. These strategies can be broadly categorized into three main types: non-compliance, underreporting, and tax avoidance.

Non-compliance is perhaps the most straightforward strategy, involving property owners simply failing to report their rental income or pay the required taxes. This can be intentional or the result of a lack of awareness about tax obligations. Underreporting, on the other hand, involves property owners accurately reporting their rental income but deliberately underestimating the value of their rentals or the number of nights rented to reduce their tax burden.

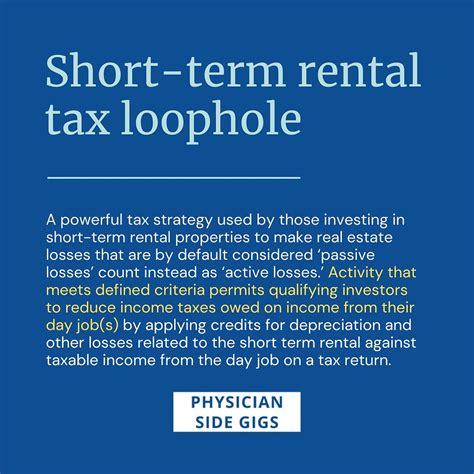

Tax avoidance strategies are more complex and often involve exploiting legal loopholes or leveraging the decentralized nature of the short-term rental market. For example, some property owners may register their rentals as businesses, allowing them to deduct a range of expenses, including mortgage interest, property taxes, and maintenance costs, from their taxable income. Others may exploit the fact that many short-term rental platforms operate in a gray area when it comes to tax collection, with some jurisdictions requiring platforms to collect and remit taxes while others do not.

The Impact on Stakeholders

The short-term rental tax loophole has far-reaching implications for various stakeholders, including governments, local communities, traditional hospitality businesses, and even individual taxpayers.

For governments, the tax revenue lost due to the loophole can be significant. In some cases, this lost revenue can amount to millions of dollars annually, representing a substantial portion of a city or state's budget. This revenue is crucial for funding public services, infrastructure projects, and social programs. When short-term rental taxes go unpaid, it places a greater burden on other taxpayers, who may have to shoulder higher tax rates or reduced public services.

Local communities are also impacted by the loophole. Short-term rentals can have a significant effect on housing affordability and community character. When property owners opt for short-term rentals over long-term leases, it can reduce the available housing stock for local residents, driving up rents and exacerbating housing crises. Additionally, the transient nature of short-term rentals can disrupt the sense of community and lead to increased noise, traffic, and other neighborhood nuisances.

Traditional hospitality businesses, such as hotels and bed-and-breakfasts, are also affected by the short-term rental tax loophole. These businesses often face stricter tax regulations and higher tax burdens compared to short-term rentals. When short-term rentals evade or minimize their tax obligations, it creates an uneven playing field, allowing them to undercut the prices of traditional hospitality businesses and gain a competitive advantage. This can lead to lost revenue and market share for these established businesses, potentially threatening their viability.

Lastly, individual taxpayers may also feel the impact of the short-term rental tax loophole. When short-term rental owners evade or avoid taxes, it contributes to a sense of unfairness and injustice within the tax system. Honest taxpayers may feel resentful or discouraged, leading to decreased tax morale and potentially lower tax compliance rates overall.

Addressing the Short-Term Rental Tax Loophole

Given the significant implications of the short-term rental tax loophole, it is essential to explore potential solutions to ensure a fair and transparent tax system. While there is no one-size-fits-all approach, a combination of regulatory measures, technological innovations, and industry collaboration can help address this issue.

Regulatory Measures

Strengthening regulatory frameworks is a crucial step in closing the short-term rental tax loophole. Governments at all levels can take a more proactive approach to taxing short-term rentals by implementing clear and consistent tax regulations. This includes defining short-term rentals explicitly, specifying the types of taxes that apply, and establishing straightforward reporting and payment processes.

Enforcement is also key. Tax authorities should have the resources and tools necessary to identify non-compliant property owners and platform companies. This may involve leveraging data analytics and machine learning to detect patterns of tax evasion, as well as conducting targeted audits and inspections. By making it more difficult and risky for property owners to evade taxes, compliance rates can be improved.

Technological Innovations

Technology can play a significant role in addressing the short-term rental tax loophole. Online platforms, in particular, have a responsibility to ensure that their users comply with tax regulations. Platform companies can implement automatic tax collection and remittance systems, similar to those used by ride-sharing and food delivery apps. By integrating tax calculations into the booking process and automatically remitting taxes to the appropriate authorities, platforms can simplify the tax compliance process for property owners and ensure that taxes are paid accurately and on time.

Additionally, blockchain technology and smart contracts can be leveraged to create a transparent and tamper-proof record of rental transactions. By storing rental data on a distributed ledger, it becomes more difficult for property owners to manipulate or underreport their rental income. Smart contracts can also automate tax calculations and payments, further streamlining the tax compliance process.

Industry Collaboration

Collaboration between governments, platform companies, and the short-term rental industry is essential for finding sustainable solutions to the tax loophole. Industry associations and property owner groups can work together to develop best practices and guidelines for tax compliance. These guidelines can help educate property owners about their tax obligations and provide resources to ensure they are meeting those obligations.

Platform companies, for their part, can play a more proactive role in promoting tax compliance. They can provide clear and accessible information about tax regulations to their users, as well as offer tools and resources to help property owners calculate and remit their taxes accurately. By fostering a culture of tax compliance within the industry, platform companies can contribute to a more sustainable and responsible short-term rental market.

Conclusion

The short-term rental tax loophole is a complex issue with significant implications for governments, local communities, and taxpayers. By understanding the strategies employed to evade or minimize taxes, we can begin to develop effective solutions to ensure a fair and transparent tax system. A combination of regulatory measures, technological innovations, and industry collaboration can help address this loophole, fostering a more equitable and sustainable short-term rental market.

How do short-term rental platforms contribute to the tax loophole?

+Short-term rental platforms often operate in a regulatory gray area, with some jurisdictions requiring them to collect and remit taxes while others do not. This lack of consistency creates opportunities for property owners to evade taxes. Additionally, platforms may not always have robust systems in place to ensure tax compliance among their users.

What are the potential consequences of the short-term rental tax loophole for local communities?

+The loophole can lead to decreased housing affordability, as property owners opt for short-term rentals over long-term leases. It can also disrupt community character, increase neighborhood nuisances, and impact local businesses that rely on tourism.

How can blockchain technology help address the tax loophole?

+Blockchain technology can create a transparent and tamper-proof record of rental transactions, making it more difficult for property owners to manipulate or underreport their rental income. Smart contracts can also automate tax calculations and payments, streamlining the tax compliance process.