Virginia Beach Real Estate Tax

Welcome to this comprehensive guide on the Virginia Beach Real Estate Tax, an essential aspect of owning property in this vibrant coastal city. Understanding the tax landscape is crucial for homeowners, investors, and prospective buyers alike. This article will delve into the intricacies of Virginia Beach's tax system, offering insights, real-world examples, and expert advice to help you navigate this complex but vital topic.

The Basics of Virginia Beach Real Estate Tax

In the bustling city of Virginia Beach, property taxes play a significant role in the local economy and the lives of its residents. These taxes are a primary source of revenue for the city, funding essential services and infrastructure projects. The Virginia Beach Real Estate Tax system is designed to be fair and equitable, taking into account various factors to determine the tax liability of property owners.

Let's break down the key components and understand how this tax system works.

Property Assessment

The journey of a Virginia Beach property owner towards understanding their tax liability begins with the assessment process. Each property within the city is subject to an evaluation, typically conducted every year, to determine its fair market value. This value is crucial as it forms the basis for calculating the property tax.

The assessment considers several factors, including:

- Property Type: Residential, commercial, or industrial properties are assessed differently, taking into account their unique characteristics and market trends.

- Location: Properties in prime locations or with desirable views may command higher assessments.

- Size and Condition: The size of the land and the overall condition of the property, including any improvements or renovations, are taken into account.

- Market Conditions: The overall real estate market in Virginia Beach influences property values, and assessors consider recent sales and market trends.

Once the assessment is complete, property owners receive a Notice of Assessment, detailing the estimated value of their property. This notice serves as a critical piece of information for understanding the upcoming tax bill.

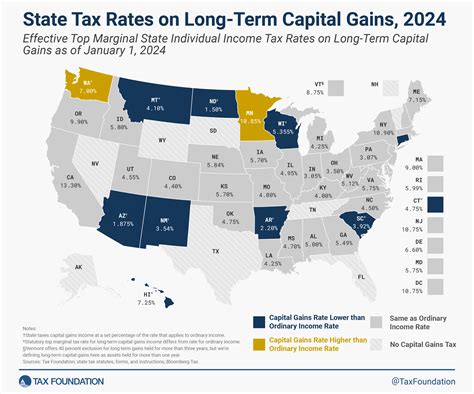

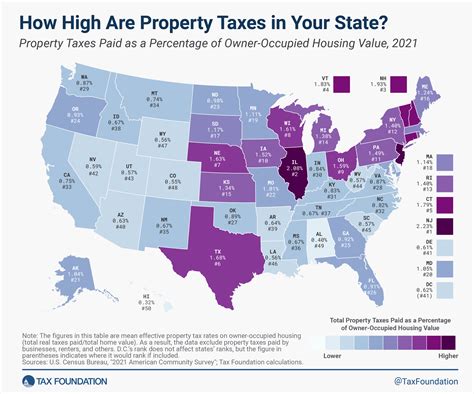

Tax Rates and Calculations

The assessed value of a property is just one part of the equation. The other crucial factor is the tax rate, which is set by the city’s governing bodies, including the Virginia Beach City Council and the Board of Supervisors. These rates are typically expressed as a percentage and can vary from year to year, based on the city’s budget needs and financial plans.

To calculate the actual tax amount, the assessed value is multiplied by the applicable tax rate. For instance, if a property is assessed at $300,000 and the tax rate is 0.85%, the annual tax liability would be $2,550 ($300,000 x 0.0085). This calculation provides a clear picture of the tax obligation for property owners.

| Property Value | Tax Rate | Annual Tax Amount |

|---|---|---|

| $250,000 | 0.9% | $2,250 |

| $350,000 | 0.8% | $2,800 |

| $450,000 | 0.75% | $3,375 |

Tax Relief and Exemptions

Virginia Beach offers various tax relief programs and exemptions to eligible property owners, helping to reduce their tax burden. These programs are designed to support specific groups, such as:

- Homestead Exemption: This program provides a tax relief benefit for primary residence homeowners, reducing the assessed value of their property by a certain amount. For instance, the Homestead Exemption could reduce the taxable value of a property by $25,000, lowering the tax bill.

- Senior Citizen Tax Relief: Older homeowners who meet certain age and income criteria may be eligible for reduced tax rates or additional tax credits.

- Military Exemptions: Active-duty military personnel and their families may be entitled to tax exemptions or reduced rates on their primary residences.

- Agricultural and Forestry Land Tax Relief: Properties used for agricultural or forestry purposes may qualify for reduced tax rates, encouraging land preservation.

These programs aim to provide financial relief to specific groups and encourage certain behaviors, such as land conservation or homeownership.

Navigating the Virginia Beach Real Estate Tax Process

Understanding the basics is just the first step. Here’s a deeper dive into the process, from assessment to payment, to help property owners navigate the Virginia Beach Real Estate Tax landscape with confidence.

Assessment Appeal Process

If a property owner disagrees with the assessed value of their property, they have the right to appeal. The assessment appeal process in Virginia Beach is designed to ensure fairness and accuracy in property valuations.

To initiate an appeal, property owners must first review their Notice of Assessment and identify any discrepancies or concerns. Common reasons for appealing include:

- Inaccurate Property Description: If the assessment includes incorrect details about the property, such as the size, number of rooms, or condition, it can lead to an unfair valuation.

- Comparable Sales Data: Property owners can argue that the assessment does not reflect recent sales data or market trends in the area.

- Overvaluation: If the assessed value is significantly higher than similar properties in the neighborhood, it may warrant an appeal.

To initiate an appeal, property owners must submit a formal request within a specified timeframe, typically 30-60 days after receiving the Notice of Assessment. The request should include detailed reasons for the appeal and any supporting documentation, such as recent property sales data or appraisals.

The appeal is reviewed by an independent panel or board, who will consider the evidence and make a determination. If the appeal is successful, the assessed value may be adjusted, resulting in a lower tax liability.

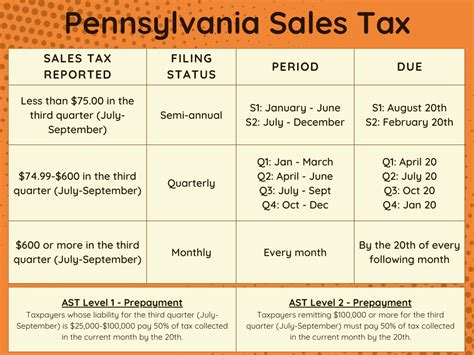

Payment Options and Deadlines

Once the tax amount is determined, property owners in Virginia Beach have several payment options to choose from, depending on their preference and financial situation.

- Online Payments: Property owners can make secure online payments through the Virginia Beach ePayments portal, which offers a convenient and efficient way to settle their tax obligations. This method is particularly popular for those who prefer digital transactions.

- Mail-in Payments: For those who prefer a more traditional approach, payments can be mailed to the Virginia Beach Treasurer's Office. This option provides flexibility for those who may not have immediate access to online payment methods.

- In-Person Payments: Property owners can also visit the Treasurer's Office in person to make their payments. This option allows for immediate resolution and provides an opportunity to discuss any concerns directly with the staff.

It's crucial to note that payment deadlines are strictly enforced, and late payments may incur additional fees and penalties. Typically, tax bills are due in two installments, with specific due dates set by the city. Missing these deadlines can result in financial consequences, so it's essential to stay informed and plan accordingly.

Understanding Tax Bills and Statements

The tax bill or statement is a critical document for property owners, providing a clear breakdown of their tax obligations. Understanding the components of this document is essential for financial planning and ensuring compliance.

A typical tax bill in Virginia Beach includes the following information:

- Property Information: Details about the property, including the address, parcel number, and assessed value.

- Taxable Amount: The amount subject to taxation, which is calculated based on the assessed value and applicable tax rates.

- Tax Due: The total amount of tax owed, including any additional charges or credits.

- Payment Instructions: Clear instructions on how and where to make the payment, including online portals, mailing addresses, and office locations.

- Due Dates: Specific dates by which the payment must be received to avoid late fees and penalties.

- Contact Information: Details on how to reach the Treasurer's Office for inquiries or assistance.

Property owners should carefully review their tax bills to ensure accuracy and promptly address any discrepancies or concerns. This proactive approach helps maintain a positive relationship with the city and avoids potential issues down the line.

The Impact of Real Estate Taxes on Property Owners

Real estate taxes are a significant consideration for property owners in Virginia Beach, influencing their financial planning and investment strategies. Understanding the implications of these taxes is crucial for making informed decisions and managing one’s financial obligations effectively.

Financial Planning and Budgeting

Property taxes are a recurring expense, and as such, they play a critical role in a property owner’s financial planning. When purchasing a property, it’s essential to factor in the tax liability to ensure the overall affordability of the investment.

For instance, a homeowner with a fixed income may need to allocate a significant portion of their budget towards property taxes. On the other hand, an investor with multiple properties may need to strategize their cash flow to cover tax obligations across different holdings.

Effective financial planning involves setting aside funds specifically for tax payments, ensuring that these obligations are met without compromising other financial goals. This may involve adjusting savings strategies, investment plans, or even seeking tax relief options to reduce the overall tax burden.

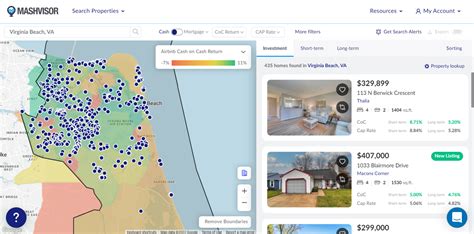

Investment Strategies and Property Management

Real estate taxes also impact investment strategies and property management decisions. Investors and property managers must consider the tax implications when deciding on property acquisitions, renovations, or rental rates.

For example, a property with a high tax liability may require a higher rental rate to cover the costs, potentially impacting the property's competitiveness in the market. On the other hand, a property with tax relief benefits may be more attractive to investors, offering a reduced tax burden and potentially higher returns.

Additionally, property managers must stay informed about tax obligations and deadlines to ensure timely payments and avoid penalties. This may involve setting up automated payment systems or employing dedicated property management software to streamline the process.

Long-Term Property Ownership and Planning

Over the long term, real estate taxes can significantly impact the financial health of a property and its owner. Consistent and timely tax payments are essential to maintaining good standing with the city and avoiding potential legal issues.

Property owners should also consider the potential for tax increases over time. While tax rates are generally stable, they can change due to various factors, including city budget needs, inflation, or changes in property values. Planning for these potential increases is crucial to ensure financial stability and avoid unexpected tax burdens.

Furthermore, long-term property ownership may entail additional tax considerations, such as estate planning or property transfers. Understanding the tax implications of these events is essential to minimize potential liabilities and ensure a smooth transition of property ownership.

Future Outlook and Considerations

As Virginia Beach continues to grow and evolve, the real estate tax landscape is likely to experience changes and adjustments. Staying informed about these potential shifts is crucial for property owners and investors to adapt their strategies and ensure continued financial stability.

Economic Factors and Market Trends

The real estate market in Virginia Beach is influenced by various economic factors, including employment rates, population growth, and overall economic health. These factors can impact property values and, consequently, tax assessments.

For instance, a thriving job market and population growth may drive up property values, leading to higher tax assessments. On the other hand, economic downturns or shifts in industry trends could result in lower property values and potentially reduced tax liabilities.

Property owners and investors should stay abreast of these economic indicators to anticipate potential changes in their tax obligations. This proactive approach allows for better financial planning and strategic decision-making.

Potential Tax Reform and Policy Changes

The city of Virginia Beach, like any other municipality, may consider tax reform or policy changes to address budget needs, social programs, or infrastructure projects. These changes could impact the tax rates, assessment processes, or available tax relief programs.

For instance, the city may implement a new tax incentive program to encourage certain types of development or preserve green spaces. Alternatively, budget constraints could lead to increased tax rates or changes in assessment methodologies.

Staying informed about these potential changes is crucial for property owners and investors to understand how their tax obligations may evolve. This knowledge allows for proactive financial planning and strategic adjustments to ensure continued compliance and financial stability.

Community Engagement and Advocacy

Property owners and investors in Virginia Beach have a stake in the city’s future and can play an active role in shaping the tax landscape through community engagement and advocacy.

Engaging with local government officials, attending community meetings, and participating in public forums allows property owners to voice their concerns, share insights, and influence tax policies that impact their financial obligations.

Additionally, advocating for tax policies that support the community's interests, such as funding for education, infrastructure, or social services, ensures that tax dollars are invested in ways that benefit the city as a whole. This proactive approach fosters a sense of community and contributes to the overall well-being of Virginia Beach.

Conclusion

Understanding the Virginia Beach Real Estate Tax is a complex but essential task for property owners and investors. From the assessment process to payment options, and from financial planning to community engagement, every aspect of the tax landscape impacts the lives and investments of those who call Virginia Beach home.

By staying informed, proactive, and engaged, property owners can navigate the tax system with confidence, ensuring their financial obligations are met while also contributing to the vibrant community of Virginia Beach.

How often are property assessments conducted in Virginia Beach?

+Property assessments in Virginia Beach are typically conducted annually to ensure accurate valuation of properties. This yearly assessment allows for adjustments to be made based on market trends and property changes.

What happens if I miss the deadline to pay my real estate taxes?

+Missing the deadline to pay your real estate taxes can result in late fees and penalties. It’s important to stay informed about payment deadlines and consider setting up automated reminders or payment plans to avoid these additional charges.

Are there any online resources to help me estimate my real estate tax liability in Virginia Beach?

+Yes, the Virginia Beach government website provides an online tool to estimate your real estate tax liability. This tool considers your property’s assessed value and the current tax rates to provide an estimate of your annual tax obligation.