Sales Tax In Pennsylvania On Cars

When it comes to purchasing a vehicle in Pennsylvania, understanding the sales tax implications is crucial for both residents and prospective car buyers. Pennsylvania, like many other states, imposes a sales tax on the purchase of motor vehicles, and it's important to be well-informed about the rates and regulations to ensure a smooth and financially advantageous transaction.

Understanding Pennsylvania’s Sales Tax Structure

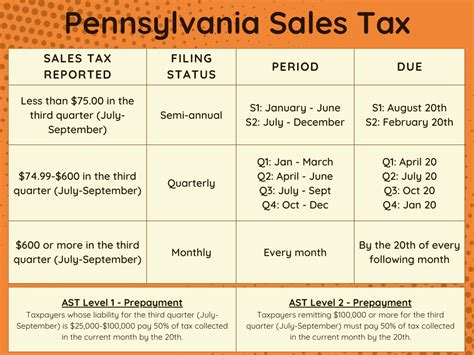

Pennsylvania’s sales tax system is a bit unique compared to other states. The state sales tax rate is 6%, which is applied to most retail transactions, including the purchase of cars. However, it’s important to note that the sales tax on vehicles in Pennsylvania is calculated based on a sliding scale, which takes into account the vehicle’s purchase price and its age.

Sliding Scale Sales Tax: A Closer Look

The sliding scale sales tax system in Pennsylvania is designed to encourage the purchase of newer vehicles and provide a fair taxation method. Here’s a breakdown of how it works:

- New Vehicles: For brand-new cars, the sales tax is calculated as 6% of the purchase price. This means if you buy a new car for $30,000, you'll pay a sales tax of $1,800.

- Used Vehicles: The sales tax rate for used cars depends on the vehicle's age and the purchase price. Here's a simplified overview:

- Vehicles under 2 years old: Sales tax is 10% of the purchase price.

- Vehicles 2 to 5 years old: Sales tax is 7% of the purchase price.

- Vehicles 5 to 10 years old: Sales tax is 6% of the purchase price (the same as new vehicles).

- Vehicles over 10 years old: Sales tax is 4% of the purchase price.

For example, if you buy a used car that's 3 years old for $25,000, you'll pay a sales tax of $1,750 (7% of the purchase price). This sliding scale ensures that buyers of older vehicles pay a lower tax rate, making used car purchases more affordable.

| Vehicle Age | Sales Tax Rate |

|---|---|

| New | 6% |

| Under 2 years | 10% |

| 2 to 5 years | 7% |

| 5 to 10 years | 6% |

| Over 10 years | 4% |

Additional Fees and Considerations

Apart from the sales tax, there are a few additional fees and considerations to keep in mind when purchasing a car in Pennsylvania:

- Title and Registration Fees: These fees vary depending on the county and the type of vehicle. On average, you can expect to pay around $100 to $200 for titling and registering a vehicle.

- Dealer Fees: Dealers often charge additional fees for services like documentation, preparation, and handling. These fees can range from a few hundred to over a thousand dollars, so it's important to inquire about them upfront.

- Trade-In Value: If you're trading in your old vehicle, the trade-in value can impact the overall purchase price and, consequently, the sales tax you pay. Ensure you understand the trade-in process and negotiate a fair value.

- Sales Tax Exemptions: Pennsylvania offers sales tax exemptions for certain types of vehicles, such as alternative fuel vehicles, mobility vehicles for people with disabilities, and vehicles purchased for resale. Check with the Pennsylvania Department of Revenue for specific eligibility criteria.

Performance Analysis: Comparing Sales Tax Rates

To put Pennsylvania’s sales tax rates into perspective, let’s compare them with a few other states:

| State | Sales Tax Rate for Vehicles |

|---|---|

| Pennsylvania | Sliding scale: 4% to 10% |

| California | 7.25% |

| Texas | 6.25% |

| New York | 4% |

| Florida | 6% |

As we can see, Pennsylvania's sliding scale sales tax system places it somewhere in the middle of the pack when compared to other states. While it offers a lower tax rate for older vehicles, the higher rates for newer cars can impact the overall purchase cost.

Future Implications and Industry Insights

The sales tax structure in Pennsylvania, particularly the sliding scale for vehicles, has several implications for the automotive industry and car buyers alike. Here are some key insights:

- Incentivizing Newer Vehicles: The higher sales tax rates for older vehicles encourage buyers to consider newer models. This can benefit both consumers, who may enjoy more reliable and fuel-efficient vehicles, and the environment, as newer cars tend to have better emissions standards.

- Used Car Market Dynamics: The lower tax rates for older vehicles make used car purchases more attractive. This can lead to a thriving used car market, providing more options for budget-conscious buyers and potentially driving down prices.

- Dealer Strategies: Dealers may adjust their strategies to cater to different buyer preferences. They might offer more incentives for newer vehicles to offset the higher tax rates or promote used car sales to take advantage of the lower tax rates.

- Consumer Education: Understanding the sliding scale sales tax is crucial for consumers. Educated buyers can negotiate better deals and make more informed choices, ensuring they get the best value for their money.

Conclusion

Pennsylvania’s sales tax structure for vehicles is a nuanced system that offers both advantages and considerations for car buyers. The sliding scale tax rate provides a unique approach to vehicle taxation, encouraging the purchase of newer models while making used cars more affordable. By understanding this system and the additional fees involved, buyers can navigate the car-buying process with confidence and make financially sound decisions.

What is the average sales tax rate in Pennsylvania for vehicle purchases?

+

The average sales tax rate for vehicle purchases in Pennsylvania is 6%. However, it’s important to note that this rate is part of a sliding scale system, which means the tax rate varies based on the vehicle’s age and purchase price.

Are there any sales tax exemptions for vehicle purchases in Pennsylvania?

+

Yes, Pennsylvania offers sales tax exemptions for certain types of vehicles. These include alternative fuel vehicles, mobility vehicles for people with disabilities, and vehicles purchased for resale. Check with the Pennsylvania Department of Revenue for detailed eligibility criteria.

How does Pennsylvania’s sales tax compare to other states for vehicle purchases?

+

Pennsylvania’s sliding scale sales tax system places it in a middle range when compared to other states. While it offers lower tax rates for older vehicles, the higher rates for newer cars can impact the overall purchase cost. It’s important to research and compare sales tax rates when considering a vehicle purchase across different states.