Capital Gains Tax Texas

Welcome to an in-depth exploration of Capital Gains Tax in the vibrant state of Texas. In this comprehensive guide, we will delve into the intricacies of this tax system, shedding light on its unique aspects and implications for individuals and businesses alike. As one of the most dynamic states in the US, Texas boasts a robust economy and a business-friendly environment, making it an ideal setting to understand the nuances of capital gains taxation.

Texas, known for its entrepreneurial spirit and diverse industries, offers a unique landscape when it comes to capital gains tax. Unlike many other states, Texas has its own set of rules and regulations, often deviating from the federal guidelines. This can be both an advantage and a challenge for taxpayers, especially those unfamiliar with the state's specific tax policies.

Understanding Capital Gains Tax in Texas

Capital gains tax is a key component of the tax system in Texas, and it refers to the tax levied on the profit or gain realized from the sale of a capital asset. A capital asset could be anything from real estate and stocks to bonds and collectibles. When these assets are sold for a profit, the resulting gain is subject to taxation.

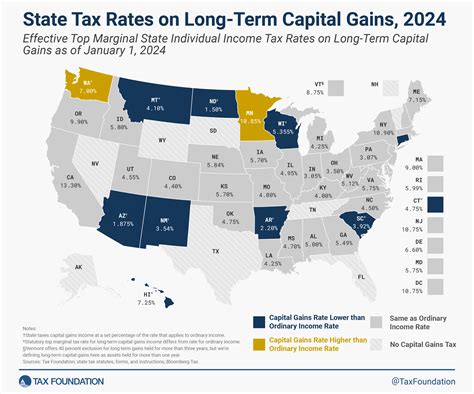

In Texas, the capital gains tax system is relatively straightforward, yet it has its complexities. The state operates on a no-income-tax policy, which means that unlike many other states, Texas does not levy a state income tax on its residents' earnings. However, this does not exempt Texans from paying capital gains tax, as this tax is calculated and paid at the federal level.

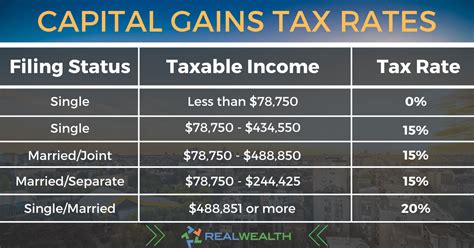

The federal government imposes a capital gains tax on the profit from the sale of assets held for more than a year, which is known as a long-term capital gain. The tax rate for these gains is typically lower than the ordinary income tax rate. However, short-term capital gains, which are profits from assets held for a year or less, are taxed at the ordinary income tax rate, which can be significantly higher.

Texas residents, despite not paying state income tax, are still subject to the federal capital gains tax. This means that when they sell an asset for a profit, they must calculate and pay this tax to the Internal Revenue Service (IRS). The specific tax rate depends on the individual's income bracket and the length of time the asset was held.

Calculating Capital Gains Tax in Texas

To understand the capital gains tax in Texas, one must first grasp the concept of basis. The basis of an asset is its cost, adjusted for improvements or depreciation. When an asset is sold, the difference between the selling price and the basis is the capital gain or loss. This gain or loss is what is subject to tax.

| Asset Type | Tax Rate |

|---|---|

| Long-Term Capital Gain | 0%, 15%, or 20% depending on income |

| Short-Term Capital Gain | Ordinary Income Tax Rate |

For instance, if an individual in Texas purchased a stock for $1,000 and sold it for $1,500 after holding it for more than a year, they would have a long-term capital gain of $500. This gain would be taxed at the applicable federal rate, which could be 0%, 15%, or 20%, depending on the individual's income.

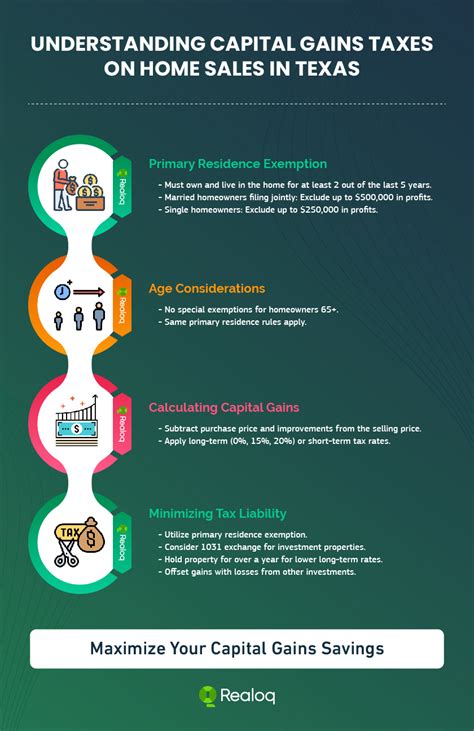

Exemptions and Special Considerations

Texas, like many states, has certain exemptions and special considerations when it comes to capital gains tax. One notable exemption is for the sale of a primary residence. The federal government allows individuals to exclude a certain amount of capital gains from the sale of their primary residence, and Texas follows this federal guideline.

Additionally, Texas has specific rules for capital gains on real estate investments. For instance, the state has a property tax exemption for certain types of real estate, which can impact the capital gains tax calculation. It's crucial for real estate investors in Texas to understand these rules to ensure they are compliant with the tax laws.

Strategies for Minimizing Capital Gains Tax

Minimizing capital gains tax is a common goal for many investors, and there are several strategies that can be employed to achieve this, especially in a state like Texas with its unique tax landscape.

Hold Assets for the Long Term

As mentioned earlier, long-term capital gains are taxed at a lower rate than short-term gains. By holding onto an asset for more than a year, individuals can take advantage of these lower tax rates. This strategy is particularly beneficial in Texas, where the lack of state income tax means the federal tax rates are even more significant.

Utilize Tax-Efficient Investment Vehicles

Certain investment vehicles, such as tax-free municipal bonds, can be a great way to avoid capital gains tax altogether. These bonds are issued by state and local governments, and the interest earned from them is typically exempt from federal, state, and local taxes. This makes them an attractive option for Texas residents looking to minimize their tax burden.

Take Advantage of Tax Loss Harvesting

Tax loss harvesting is a strategy where investors sell losing investments to offset capital gains from other investments. This can help reduce the overall tax liability. While this strategy is applicable nationwide, it can be especially beneficial in Texas due to the state's unique tax structure.

Consider Business Structures

The choice of business structure can have a significant impact on capital gains tax. For instance, a sole proprietorship may have different tax implications compared to a limited liability company (LLC) or a corporation. Understanding these differences and choosing the right structure can help minimize tax liability.

The Future of Capital Gains Tax in Texas

As Texas continues to grow and evolve, so does its tax landscape. The state's no-income-tax policy has been a key factor in its economic success, attracting businesses and individuals alike. However, the lack of an income tax also means that the state relies heavily on other sources of revenue, including sales tax and property tax.

While the current capital gains tax system in Texas seems to favor investors and businesses, there are ongoing discussions and proposals to introduce new tax measures. Some argue that the state's reliance on certain taxes, like the sales tax, disproportionately affects lower-income individuals. As such, there is a push to explore alternative revenue streams, which could potentially include a state-level capital gains tax.

Additionally, with the ever-changing federal tax landscape, Texas may need to adapt its policies to remain competitive and attractive to businesses and investors. The state's unique position of not having an income tax provides an interesting challenge when it comes to tax policy, and it will be fascinating to see how these discussions and proposals unfold in the coming years.

Conclusion

In conclusion, understanding the capital gains tax system in Texas is crucial for individuals and businesses operating within the state. With its unique no-income-tax policy, Texas offers a different perspective on capital gains taxation. By being aware of the federal tax rates, exemptions, and strategies to minimize tax liability, taxpayers can navigate this complex system with confidence.

As the state continues to thrive and its tax policies evolve, staying informed about these changes will be essential. Whether you're an investor, a business owner, or an individual looking to understand your tax obligations, this guide provides a comprehensive overview of capital gains tax in Texas. Stay tuned for further developments, as the tax landscape in Texas is always an intriguing topic of discussion.

What is the average capital gains tax rate in Texas for long-term gains?

+The average capital gains tax rate in Texas for long-term gains varies based on income. It can be 0%, 15%, or 20%, depending on the individual’s income bracket.

Are there any state-specific exemptions for capital gains tax in Texas?

+Yes, Texas has specific exemptions for capital gains tax, including an exemption for the sale of a primary residence and certain types of real estate investments.

How does Texas’s no-income-tax policy affect capital gains tax calculations?

+Texas’s no-income-tax policy means that residents are not subject to state income tax, but they still pay federal capital gains tax. This can result in a higher tax burden for certain individuals, as they are not benefiting from state-level tax deductions.

Can you provide an example of tax loss harvesting in action?

+Sure! Let’s say an investor in Texas has a stock portfolio. They realize that one of their stocks has lost value and is now worth less than their initial investment. By selling this stock at a loss, they can offset their capital gains from other stocks in the same tax year, reducing their overall tax liability.