Lee County Florida Property Taxes

Property taxes are a significant aspect of homeownership, and understanding the process and rates can be crucial for homeowners and prospective buyers. This comprehensive guide will delve into the world of Lee County, Florida's property taxes, providing an in-depth analysis of the tax assessment process, rates, exemptions, and more. With a focus on expert insights and real-world examples, we aim to equip you with the knowledge needed to navigate the property tax landscape in this vibrant Florida county.

Understanding Lee County’s Property Tax Landscape

Lee County, situated along the breathtaking Gulf Coast of Florida, boasts a diverse range of properties, from coastal mansions to quaint suburban homes. The property tax system in this region plays a pivotal role in funding essential services and infrastructure development. Let’s explore how this system operates and what it means for property owners.

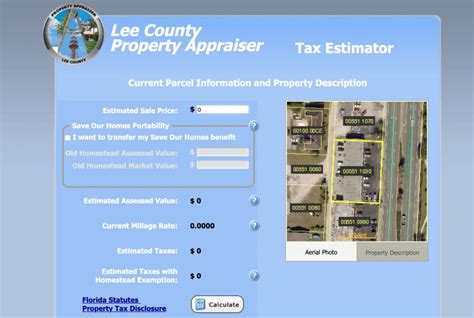

The Assessment Process: A Step-by-Step Breakdown

Each year, the Lee County Property Appraiser’s Office undertakes a meticulous process to determine the taxable value of properties. This involves several key steps:

- Data Collection: Appraisers gather information about each property, including recent sales data, improvements, and market trends. This data is crucial for accurate valuation.

- Property Inspection: Physical inspections are conducted to assess the property's condition, square footage, and any recent changes.

- Valuation Calculation: Using complex algorithms and market comparisons, the appraiser's office determines the property's assessed value. This value forms the basis for tax calculations.

- Notice of Proposed Taxes: Property owners receive a notice detailing the proposed taxable value and the estimated taxes. This notice provides an opportunity for appeals.

- Final Assessment: After considering any appeals or adjustments, the final assessed value is determined, and tax rates are applied to calculate the property tax due.

This process ensures fairness and accuracy in the property tax system, as properties are assessed based on their current market value.

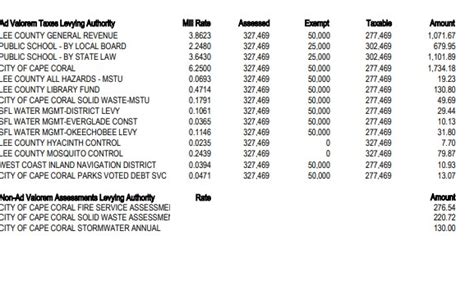

Tax Rates and How They’re Determined

Lee County’s property taxes are calculated using a millage rate, which represents the tax per thousand dollars of assessed property value. The millage rate is set annually by the Lee County Board of Commissioners and other taxing authorities, such as school districts and special districts.

| Taxing Authority | Millage Rate |

|---|---|

| Lee County | 7.9687 |

| Lee County School Board | 7.8317 |

| Special Districts (e.g., Fire, Water) | Varies by district |

The total millage rate for a property is the sum of these individual rates. For instance, a property with a total assessed value of $250,000 and a combined millage rate of 10.00 would have a property tax bill of $2,500.

Exemptions: Reducing Your Property Tax Burden

Lee County offers various property tax exemptions to eligible homeowners, which can significantly reduce their tax liability. Here are some of the key exemptions:

- Homestead Exemption: Permanent Florida residents who own and occupy their property as their primary residence can apply for a homestead exemption. This exemption reduces the assessed value of the property, resulting in lower taxes. The standard homestead exemption is $25,000, but additional exemptions are available for veterans, seniors, and those with disabilities.

- Senior Exemption: Property owners aged 65 or older may qualify for an additional exemption of up to $50,000 on their primary residence.

- Veterans' Exemption: Qualified veterans can receive an exemption of up to $50,000 on their primary residence, with additional exemptions available for those with service-connected disabilities.

- Widow/Widower Exemption: Surviving spouses of deceased veterans or first responders may be eligible for an exemption, depending on their circumstances.

- Low-Income Senior Exemption: Seniors with limited income may qualify for a full or partial exemption.

These exemptions can provide substantial savings for eligible property owners, making homeownership more affordable.

Analyzing Lee County’s Property Tax Performance

To gain a deeper understanding of Lee County’s property tax landscape, let’s delve into some key performance indicators and real-world examples.

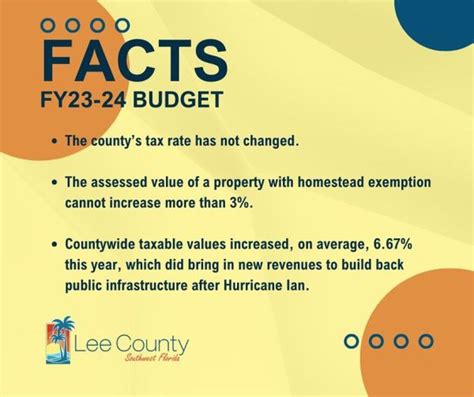

Taxable Property Values: A Growing Trend

Over the past decade, Lee County has experienced a steady increase in taxable property values. This growth can be attributed to several factors, including a thriving real estate market, population growth, and property improvements.

| Year | Total Taxable Value | Growth Rate (%) |

|---|---|---|

| 2015 | $33.1 Billion | N/A |

| 2016 | $34.2 Billion | 3.32% |

| 2017 | $35.7 Billion | 4.39% |

| 2018 | $37.1 Billion | 3.92% |

| 2019 | $38.6 Billion | 4.04% |

| 2020 | $40.3 Billion | 4.41% |

The consistent growth in taxable property values has contributed to a stable revenue stream for the county, ensuring the continued provision of essential services.

Real-World Tax Calculation Example

Let’s consider a practical example to illustrate how property taxes are calculated in Lee County. Imagine a homeowner, John, who owns a single-family residence with the following characteristics:

- Assessed Value: $300,000

- Millage Rate: 9.00 (combined rate for Lee County and local districts)

- Homestead Exemption: $25,000

Here's how John's property tax calculation would break down:

- Assessed Value ($300,000) - Homestead Exemption ($25,000) = Taxable Value ($275,000)

- Taxable Value ($275,000) x Millage Rate (9.00) = Property Taxes ($2,475)

John would owe $2,475 in property taxes for the year, which is a substantial amount but significantly reduced due to the homestead exemption.

Impact of Exemptions: A Case Study

To further illustrate the impact of exemptions, let’s consider the case of Jane, a senior homeowner in Lee County.

- Assessed Value: $200,000

- Millage Rate: 8.50

- Homestead Exemption: $25,000

- Senior Exemption: $50,000

Without any exemptions, Jane's property taxes would be calculated as follows:

- Assessed Value ($200,000) x Millage Rate (8.50) = Property Taxes ($17,000)

However, with the homestead and senior exemptions, her taxable value is reduced, resulting in a much lower tax bill:

- Assessed Value ($200,000) - Homestead Exemption ($25,000) - Senior Exemption ($50,000) = Taxable Value ($125,000)

- Taxable Value ($125,000) x Millage Rate (8.50) = Property Taxes ($10,625)

Thanks to these exemptions, Jane enjoys a substantial reduction in her property taxes, making her home more affordable to maintain.

Future Implications and Expert Insights

As we look ahead, it’s essential to consider the potential future implications of Lee County’s property tax landscape. Here are some expert insights and predictions:

Population Growth and Property Values

Lee County’s population is expected to continue growing, driven by its attractive climate, vibrant culture, and economic opportunities. This population growth will likely lead to increased demand for housing, which, in turn, could drive up property values. As property values rise, so too will the taxable base, potentially resulting in higher property tax revenues for the county.

Infrastructure Development and Tax Allocation

The county’s commitment to infrastructure development, including road improvements, water management, and environmental initiatives, will require significant funding. Property taxes are a key source of revenue for these projects. As such, future tax rates may be influenced by the need to finance these essential improvements.

Exemption Policies and Equity

The current exemption policies in Lee County provide substantial benefits to eligible homeowners. However, as the population diversifies and ages, there may be calls for policy revisions to ensure fairness and equity. Balancing the need for revenue with the desire to support residents is an ongoing challenge for the county’s leadership.

Expert Recommendations

Industry experts offer the following recommendations for homeowners and prospective buyers in Lee County:

- Stay Informed: Keep abreast of changes in property tax laws, exemptions, and assessment practices. Understanding these nuances can help you optimize your tax liability.

- Appeal if Necessary: If you believe your property has been over-assessed, consider appealing the assessment. The process is designed to be fair, and successful appeals can result in significant savings.

- Explore Financing Options: For prospective buyers, consider the impact of property taxes on your overall budget. Explore financing options that may offer tax benefits, such as mortgage interest deductions.

- Plan for the Future: As property values and tax rates can fluctuate, it's wise to plan ahead. Consider setting aside funds for potential tax increases or take advantage of exemptions to reduce your tax burden.

Conclusion

Lee County’s property tax system is a dynamic and crucial component of the local economy. By understanding the assessment process, tax rates, and available exemptions, homeowners can make informed decisions about their financial responsibilities. As the county continues to thrive and grow, staying informed and proactive will be key to navigating the property tax landscape successfully.

What is the timeline for property tax assessments in Lee County?

+The Lee County Property Appraiser’s Office typically completes assessments by January 1st each year. Property owners receive their Notice of Proposed Taxes shortly after, allowing them time to review and appeal if necessary.

How can I appeal my property assessment if I believe it’s inaccurate?

+If you disagree with your property’s assessed value, you have the right to appeal. The process involves submitting an appeal application, providing supporting evidence, and potentially attending a hearing. It’s advisable to consult a professional appraiser or tax advisor for guidance.

Are there any property tax relief programs for low-income homeowners in Lee County?

+Yes, Lee County offers the Florida Property Tax Relief Program for eligible low-income homeowners. This program provides a credit on their property tax bill, helping to make homeownership more affordable. To qualify, homeowners must meet certain income and asset limits.

Can I pay my property taxes online in Lee County?

+Absolutely! Lee County provides an online payment portal, making it convenient for homeowners to pay their property taxes. The portal accepts various payment methods, including credit cards and e-checks.

What happens if I fail to pay my property taxes on time in Lee County?

+Late payment of property taxes can result in penalties and interest. If the taxes remain unpaid, the property may be subject to a tax certificate sale, where the county sells the right to collect the taxes to a third party. It’s crucial to stay current on your property tax payments to avoid these consequences.