Clark County Sales Tax

In the bustling state of Nevada, nestled in the vibrant city of Las Vegas, lies Clark County, a thriving hub of commerce and tourism. With its iconic casinos, dazzling nightlife, and world-class entertainment, this county boasts a robust economy and a unique tax system. At the heart of this fiscal landscape is the Clark County Sales Tax, a crucial revenue generator that plays a pivotal role in funding essential services and driving economic growth.

Understanding the Clark County Sales Tax

The Clark County Sales Tax is a vital component of the county’s fiscal framework, serving as a significant source of revenue for the local government. It is a consumption tax, levied on the sale or lease of tangible personal property and certain services within the county’s boundaries. This tax is collected by businesses and remitted to the state and county authorities, contributing to the overall economic stability and development of the region.

The sales tax in Clark County is structured as a percentage of the sale price of goods and services. This percentage rate is applied uniformly across the county, ensuring a fair and consistent tax system. The revenue generated from this tax is then allocated to various public services, including law enforcement, fire protection, road maintenance, and other vital infrastructure projects.

Tax Rates and Categories

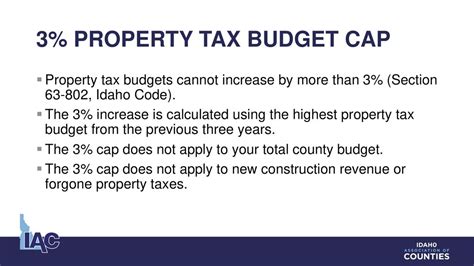

The Clark County Sales Tax is composed of both state and local tax rates, with the state portion being 4.60% and the county portion varying depending on the location within the county. The county tax rate can range from 1.275% to 2.875%, resulting in a total sales tax rate of 5.875% to 7.475%. This variability in the county tax rate allows for a more tailored approach to funding specific community needs.

| Tax Jurisdiction | State Tax Rate | County Tax Rate | Total Tax Rate |

|---|---|---|---|

| Clark County | 4.60% | 1.275% - 2.875% | 5.875% - 7.475% |

The sales tax is applied to a wide range of goods and services, covering most retail transactions. However, there are certain exemptions and special categories that impact the tax liability. For instance, groceries and prescription drugs are exempt from sales tax, providing relief to residents and visitors on essential items. Additionally, certain services, such as legal and medical services, are not subject to sales tax, ensuring that these vital sectors remain accessible.

The Impact on Local Businesses

The Clark County Sales Tax has a profound impact on local businesses, both large and small. For retailers, the tax represents an additional cost that must be factored into their pricing strategies. While it can be a challenge to navigate, many businesses view it as an opportunity to showcase their fiscal responsibility and commitment to the community. By collecting and remitting sales tax, businesses contribute directly to the growth and sustainability of the local economy.

For new businesses considering establishing themselves in Clark County, understanding the sales tax system is crucial. It provides insights into the financial landscape and helps entrepreneurs make informed decisions about pricing, inventory management, and overall business planning. The county's tax structure, with its varying rates, allows for a certain level of flexibility, enabling businesses to strategize and adapt to the local market conditions.

Revenue Allocation and Community Development

The revenue generated from the Clark County Sales Tax is a crucial source of funding for various public services and community development initiatives. A significant portion of the tax revenue is allocated to essential services such as public safety, healthcare, and education. This funding ensures that residents and visitors alike have access to quality services and infrastructure.

Law enforcement agencies, for instance, rely on sales tax revenue to maintain a robust police force, ensuring the safety and security of the community. Similarly, the fire department utilizes these funds to purchase equipment, train personnel, and respond to emergencies effectively. The sales tax also plays a vital role in funding local schools, ensuring that students have access to quality education and resources.

Investing in Infrastructure

One of the key areas where the Clark County Sales Tax revenue is invested is infrastructure development. The county’s roads, bridges, and public transportation systems are crucial for the efficient movement of people and goods, and their maintenance and improvement are funded in part by the sales tax. This investment not only enhances the quality of life for residents but also attracts businesses and visitors, contributing to the county’s economic growth.

Additionally, the sales tax revenue is utilized for public works projects, such as the construction and maintenance of parks, recreational facilities, and cultural centers. These amenities enhance the overall well-being of the community, providing spaces for leisure, sports, and cultural activities. The revenue generated from the sales tax thus plays a pivotal role in creating a vibrant and thriving community.

Compliance and Administration

Ensuring compliance with the Clark County Sales Tax regulations is a collaborative effort between businesses, taxpayers, and the Nevada Department of Taxation. Businesses are responsible for accurately calculating, collecting, and remitting the sales tax to the department. This process involves a meticulous understanding of the tax rates, exemptions, and applicable laws, making it crucial for businesses to stay informed and up-to-date with any changes or updates.

Registration and Remittance

To comply with the sales tax requirements, businesses must first register with the Nevada Department of Taxation. This registration process involves providing essential business information and obtaining a unique identification number. Once registered, businesses are responsible for calculating the sales tax on each transaction and remitting it to the department on a regular basis, typically quarterly or monthly, depending on the volume of sales.

The Nevada Department of Taxation provides businesses with guidance and resources to navigate the sales tax compliance process. This includes access to informative materials, online tools for tax calculation and reporting, and dedicated support services. By offering these resources, the department aims to streamline the compliance process, making it more efficient and accessible for businesses of all sizes.

Future Implications and Economic Outlook

As Clark County continues to evolve and adapt to changing economic landscapes, the role of the sales tax becomes increasingly significant. The revenue generated from this tax will continue to play a vital role in funding public services and community development initiatives, ensuring the county’s long-term sustainability and prosperity.

Looking ahead, the county's economic growth and development strategies will heavily rely on the effective utilization of sales tax revenue. With a focus on infrastructure improvements, business attraction, and resident well-being, the county aims to create a vibrant and resilient economy. The sales tax will remain a key instrument in achieving these goals, providing a stable source of funding for essential services and community projects.

Sustainable Development and Community Engagement

Clark County recognizes the importance of sustainable development and community engagement in its economic strategies. The revenue generated from the sales tax will be directed towards initiatives that foster environmental sustainability, social equity, and community resilience. This includes investments in green infrastructure, renewable energy projects, and initiatives aimed at reducing the county’s carbon footprint.

Furthermore, the county aims to enhance community engagement and participation in decision-making processes. By involving residents and stakeholders in the planning and development of public spaces, services, and events, the county aims to create a sense of ownership and pride among its citizens. This collaborative approach will contribute to a stronger, more cohesive community, fostering a positive environment for economic growth and development.

What are the penalties for non-compliance with the Clark County Sales Tax regulations?

+

Non-compliance with Clark County Sales Tax regulations can result in penalties and interest charges. Businesses that fail to register, collect, or remit sales tax accurately may face fines, late payment penalties, and even legal consequences. It is essential for businesses to stay informed and seek professional advice to ensure compliance.

How often do sales tax rates change in Clark County?

+

Sales tax rates in Clark County are subject to change periodically, typically based on legislative decisions and community needs. While major changes are relatively infrequent, it is crucial for businesses and taxpayers to stay updated on any modifications to ensure accurate tax calculations and compliance.

Are there any online resources available for businesses to learn more about Clark County Sales Tax regulations?

+

Yes, the Nevada Department of Taxation provides a wealth of online resources for businesses and taxpayers. These resources include detailed guides, instructional videos, and interactive tools to assist with sales tax compliance. By leveraging these resources, businesses can stay informed and navigate the sales tax landscape effectively.

How does the Clark County Sales Tax revenue impact local businesses’ competitiveness?

+

The Clark County Sales Tax revenue directly contributes to the funding of essential public services and infrastructure, creating a favorable business environment. By investing in roads, public transportation, and other amenities, the county enhances its competitiveness, attracting businesses and fostering economic growth. Additionally, the sales tax revenue supports initiatives that benefit local businesses, such as business attraction programs and community development projects.

What steps can businesses take to stay informed about changes in Clark County Sales Tax regulations?

+

Businesses can stay informed about changes in Clark County Sales Tax regulations by subscribing to newsletters and updates from the Nevada Department of Taxation. They can also attend workshops, seminars, and webinars hosted by the department, which provide valuable insights and guidance on tax compliance. Additionally, businesses should regularly review official websites and resources for any updates or announcements regarding tax changes.