Nyc Commercial Rent Tax

The topic of commercial rent tax in New York City is an important consideration for businesses operating within the city limits. Known as the Commercial Rent Tax (CRT), this tax is unique to New York City and has been a significant factor in shaping the city's business landscape. In this comprehensive article, we will delve into the intricacies of the CRT, its impact on businesses, and the strategies employed by companies to navigate this complex tax system.

Understanding the Commercial Rent Tax (CRT)

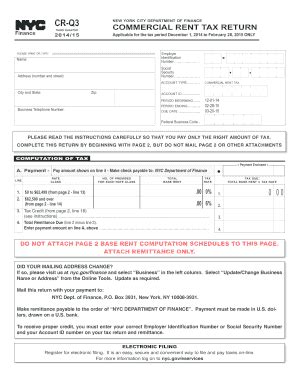

The Commercial Rent Tax is a tax levied by the New York City Department of Finance on commercial tenants occupying space within the five boroughs. It is a gross receipts tax, meaning it is calculated based on the total rent paid by the tenant, rather than the net income derived from the property. This tax is distinct from other forms of property tax, as it is specifically targeted at commercial tenants and not property owners.

The CRT was introduced in 1960 as a means to generate revenue for the city and has since undergone various modifications and adjustments to reflect the evolving business environment. The tax is imposed on a quarterly basis, with rates varying depending on the type of business and the location of the property.

One of the key aspects of the CRT is its progressive nature. The tax rate increases as the rent paid by the tenant increases, with higher rent levels resulting in a higher tax rate. This structure aims to ensure that larger businesses, which often occupy more expensive commercial spaces, contribute proportionally more to the city's revenue.

CRT Rates and Exemptions

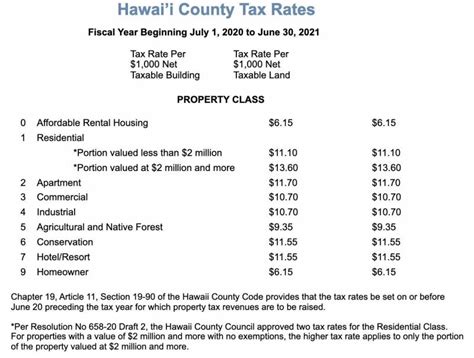

The CRT rates are set by the New York City Council and are subject to periodic review and adjustment. As of [current year], the tax rates are as follows:

| Rent Range | Tax Rate |

|---|---|

| $0 - $250,000 | 2.125% |

| $250,001 - $1 million | 2.625% |

| Above $1 million | 3.875% |

It's important to note that certain types of businesses are exempt from the CRT. These include non-profit organizations, government entities, and businesses operating in specific industries such as agriculture and fishing. Additionally, there are provisions for tax credits and deductions for businesses that meet certain criteria, such as those providing essential services or those that have been impacted by natural disasters.

Impact on Businesses

The Commercial Rent Tax has a significant impact on businesses operating in New York City. For small and medium-sized enterprises (SMEs), the tax can represent a substantial portion of their operational costs, potentially affecting their profitability and growth prospects. Larger corporations, while paying a higher tax rate, often have the financial resources and tax expertise to manage the tax more effectively.

One of the challenges faced by businesses is the complexity of the CRT calculation. The tax is not a simple percentage of the rent, but rather a calculation based on a formula that takes into account various factors, including the type of business, the location of the property, and the total rent paid. This complexity often requires businesses to seek professional tax advice to ensure accurate compliance.

Moreover, the CRT can influence a business's decision-making process when it comes to leasing commercial space. Companies may opt for smaller spaces or negotiate rent reductions to minimize their tax liability. This, in turn, can impact the availability and affordability of commercial real estate in the city.

Strategies for Navigating the CRT

Given the complexity and impact of the Commercial Rent Tax, businesses in New York City employ various strategies to manage their tax obligations effectively. These strategies range from tax planning and negotiation to exploring alternative business structures.

Tax Planning and Compliance

One of the key strategies for businesses is to engage in thorough tax planning. This involves understanding the CRT regulations, calculating the tax liability accurately, and exploring opportunities for deductions and credits. By working closely with tax professionals, businesses can ensure they are in compliance with the tax requirements and take advantage of any available tax benefits.

Additionally, businesses should maintain meticulous records of their rent payments and other relevant financial data. This documentation is essential for accurate tax reporting and can also be used to support any claims for tax credits or deductions.

Lease Negotiation and Optimization

Lease negotiation plays a crucial role in managing the CRT. Businesses can work with commercial real estate professionals and legal experts to negotiate favorable lease terms that take into account the CRT. This may involve negotiating rent reductions, rent-free periods, or incentives that help offset the tax liability.

Furthermore, businesses can explore alternative lease structures, such as percentage rent leases, where the rent is tied to a percentage of the tenant's revenue. This type of lease can provide flexibility and potentially reduce the tax burden, as the rent is tied to the business's performance rather than a fixed amount.

Alternative Business Structures

In some cases, businesses may consider alternative business structures to mitigate the impact of the CRT. This could involve setting up a separate legal entity for the purpose of leasing the commercial space, which may provide certain tax advantages. However, such strategies require careful consideration and professional advice, as they can have broader implications for the business’s operations and tax obligations.

Community Engagement and Advocacy

Some businesses and industry associations actively engage in advocacy efforts to influence the CRT regulations and rates. By participating in public consultations and expressing their concerns, businesses can contribute to the development of a tax system that is more aligned with their needs and the city’s economic goals. This collaborative approach can lead to more sustainable and fair tax policies.

The Future of Commercial Rent Tax in NYC

The Commercial Rent Tax is a dynamic and evolving component of New York City’s tax system. As the city’s business landscape continues to change, the CRT is likely to undergo further adjustments to remain relevant and effective. Here are some potential future developments and their implications.

Tax Reform and Modernization

The CRT, like many tax systems, is subject to periodic reviews and potential reforms. As the city’s economic priorities shift and new industries emerge, the tax system may need to adapt to ensure it remains fair and sustainable. This could involve revisions to the tax rates, the introduction of new exemptions, or the simplification of the tax calculation process to make it more accessible to businesses.

Impact of Economic Trends

Economic trends and market conditions can significantly influence the CRT. During periods of economic growth, the CRT may generate substantial revenue for the city, supporting various public services and infrastructure projects. However, in times of economic downturn, the tax can become a burden for businesses, potentially leading to calls for tax relief or reforms.

The city's response to economic fluctuations can have a direct impact on the CRT. For instance, during the COVID-19 pandemic, New York City implemented various tax relief measures to support businesses. These included temporary CRT exemptions and reduced tax rates, providing much-needed relief during a challenging economic period.

Technological Advancements and Digitalization

The digital transformation of the tax system is an ongoing trend, and the CRT is no exception. The New York City Department of Finance has been working towards digitizing tax processes, including the CRT, to enhance efficiency and accessibility. This digitalization can simplify tax filing, reduce administrative burdens, and provide businesses with real-time information and guidance.

Furthermore, technological advancements can also lead to the development of new tax technologies and tools that can assist businesses in managing their CRT obligations. These tools can range from tax calculation software to data analytics platforms that help businesses optimize their tax strategies.

Conclusion

The Commercial Rent Tax in New York City is a complex and influential component of the city’s tax system. It has a significant impact on businesses, shaping their decision-making processes and influencing the city’s commercial real estate market. By understanding the CRT and employing effective strategies, businesses can navigate this tax landscape and contribute to the city’s vibrant economy.

As the CRT continues to evolve, businesses and policymakers must work collaboratively to ensure a balanced and sustainable tax system that supports economic growth while also meeting the city's revenue needs. The future of the CRT is closely tied to the city's economic trajectory and the ongoing efforts to create a fair and efficient tax environment.

What is the purpose of the Commercial Rent Tax in New York City?

+

The Commercial Rent Tax is a revenue-generating measure aimed at funding city services and infrastructure projects. It ensures that businesses, particularly those occupying high-value commercial spaces, contribute proportionally to the city’s financial needs.

How often is the CRT rate reviewed and adjusted?

+

The CRT rate is reviewed periodically by the New York City Council, typically every few years, to ensure it aligns with the city’s economic goals and revenue requirements.

Are there any strategies to reduce the impact of the CRT on small businesses?

+

Yes, small businesses can explore various strategies such as negotiating rent reductions, seeking tax credits or deductions, and optimizing their lease terms to minimize the CRT’s impact. Engaging tax professionals can also help identify potential savings.

How does the CRT affect commercial real estate in NYC?

+

The CRT can influence the availability and affordability of commercial spaces. Businesses may opt for smaller spaces or negotiate rent incentives to manage their tax liability, potentially impacting the overall real estate market.