Real Estate Taxes Utah

Utah, a state renowned for its natural beauty and vibrant communities, boasts a real estate market that has experienced significant growth in recent years. As property values rise, one aspect that becomes increasingly important for homeowners and investors is understanding real estate taxes. In this comprehensive guide, we delve into the intricacies of real estate taxes in Utah, exploring the factors that influence tax assessments, the processes involved, and the strategies homeowners can employ to manage their tax obligations effectively.

The Utah Real Estate Tax Landscape

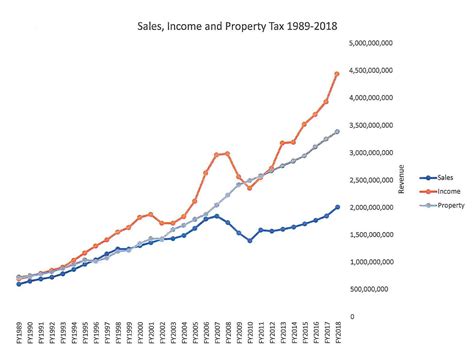

Real estate taxes in Utah are a vital component of the state’s revenue system, contributing to the funding of essential public services such as education, infrastructure development, and public safety. These taxes are levied on the assessed value of properties, with the primary goal of ensuring a fair and equitable distribution of the tax burden among property owners.

Utah's real estate tax system is governed by a set of regulations and guidelines established by the Utah State Tax Commission and local county assessors. The state operates on a biennial assessment cycle, with property values assessed every two years. This assessment cycle plays a pivotal role in determining the tax liability for each property owner.

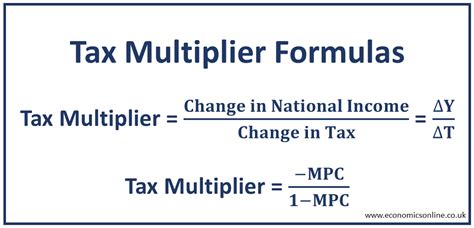

The tax rate applied to the assessed value of a property is determined by the local taxing jurisdictions, which may include cities, counties, special service districts, and school districts. These jurisdictions use the property tax revenue to fund their operations and provide vital services to the community. As a result, the tax rate can vary significantly from one area to another within the state.

Factors Influencing Real Estate Tax Assessments

The assessment of real estate taxes in Utah is a complex process that considers a multitude of factors. These factors include:

- Property Value: The assessed value of a property is a key determinant of its tax liability. Utah employs a mass appraisal system, where properties are valued based on their market value as of a specific assessment date. This value takes into account factors such as location, size, improvements, and the overall real estate market conditions.

- Tax Rates: As mentioned earlier, tax rates are set by local taxing authorities. These rates can vary based on the type of property, its location, and the services provided by the jurisdiction. For instance, properties located in areas with higher levels of public services or infrastructure may be subject to higher tax rates.

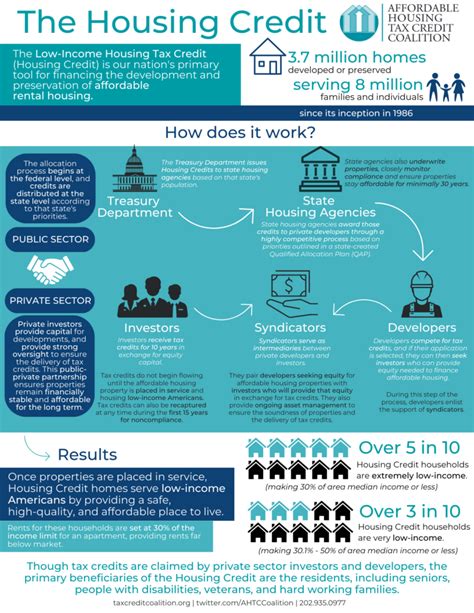

- Exemptions and Credits: Utah offers various exemptions and tax credits to certain property owners. These include homestead exemptions, veterans' exemptions, and tax credits for energy-efficient improvements. These provisions can significantly reduce the tax liability for eligible homeowners.

- Special Assessments: In some cases, properties may be subject to special assessments, which are additional charges levied to fund specific improvements or projects that benefit the property. These assessments can be imposed by local governments or special districts and are typically tied to the property rather than the owner.

The Real Estate Tax Assessment Process

The process of assessing real estate taxes in Utah is a systematic and detailed procedure. Here’s an overview of the key steps involved:

- Data Collection: County assessors gather information about properties within their jurisdiction. This data includes property characteristics, sales data, and other relevant market information. The assessors use this data to estimate the market value of each property.

- Mass Appraisal: Using the collected data, assessors employ mass appraisal techniques to determine the assessed value of properties. This process involves analyzing sales trends, comparing similar properties, and applying valuation models to estimate fair market values.

- Notices of Assessment: Once the assessed values are determined, property owners receive a Notice of Assessment. This notice outlines the property's assessed value, the applicable tax rates, and the estimated tax liability. Property owners have the right to review and appeal their assessments if they believe the value is inaccurate.

- Appeals Process: If a property owner disagrees with the assessed value, they can initiate an appeals process. This typically involves submitting documentation and evidence to support their claim. The appeals process aims to ensure that assessments are fair and accurate.

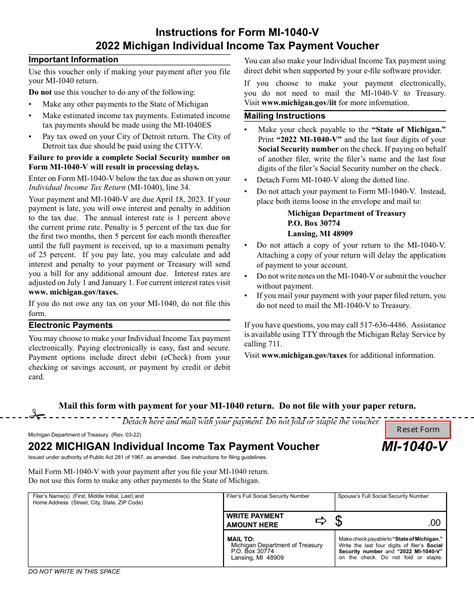

- Tax Calculation and Billing: After the assessment and potential appeals process, the tax liability for each property is calculated. The local taxing authorities then issue tax bills to property owners, outlining the amount due and the payment deadlines.

Managing Real Estate Tax Obligations

Understanding and managing real estate tax obligations is essential for Utah homeowners. Here are some strategies and considerations to keep in mind:

- Review Your Assessment: When you receive your Notice of Assessment, carefully review the details. Ensure that the assessed value aligns with the current market value of your property. If you believe the assessment is inaccurate, gather supporting evidence and consider appealing the assessment.

- Stay Informed: Stay updated on changes in tax rates, exemptions, and assessment practices in your area. Local governments and taxing authorities often provide information and resources to help property owners understand their tax obligations.

- Consider Tax Planning: Work with a tax professional or financial advisor to develop a tax planning strategy. This can involve taking advantage of available exemptions, credits, and deductions to minimize your tax liability. Additionally, consider the timing of purchases, improvements, or property sales to optimize your tax position.

- Explore Payment Options: Many taxing jurisdictions offer flexible payment options, such as installment plans or online payment systems. Explore these options to find the most suitable method for managing your tax payments.

- Understand Special Assessments: If your property is subject to special assessments, understand the purpose and duration of these charges. Ensure that you are aware of the payment schedule and any associated penalties for late payments.

The Impact of Real Estate Taxes on Utah’s Economy

Real estate taxes play a crucial role in Utah’s economic landscape. The revenue generated from these taxes supports vital public services and infrastructure development, contributing to the overall growth and prosperity of the state. Here are some key ways in which real estate taxes impact Utah’s economy:

- Funding Public Education: A significant portion of real estate tax revenue is allocated to funding public schools. This ensures that Utah's children receive quality education, fostering a skilled workforce and contributing to the state's long-term economic development.

- Infrastructure Development: Real estate taxes contribute to the construction and maintenance of essential infrastructure, including roads, bridges, and public transportation systems. Well-developed infrastructure attracts businesses and enhances the overall quality of life in Utah.

- Community Development: The tax revenue supports community development initiatives, such as parks, recreational facilities, and cultural centers. These amenities enhance the attractiveness of Utah's cities and towns, making them desirable places to live and work.

- Economic Stability: Real estate taxes provide a stable and reliable source of revenue for local governments. This stability allows for better planning and budgeting, ensuring that essential services are consistently provided to residents.

- Encouraging Homeownership: Utah's real estate tax system, with its exemptions and credits, encourages homeownership. This fosters a stable housing market and contributes to the overall economic health of the state.

Case Study: The Impact of Real Estate Taxes on Community Development

To illustrate the real-world impact of real estate taxes, let’s consider the city of Salt Lake City, Utah. Salt Lake City has experienced significant growth and development in recent years, and real estate taxes have played a pivotal role in shaping this transformation.

The city's real estate tax revenue has funded numerous community development projects, including the redevelopment of historic neighborhoods, the construction of affordable housing units, and the enhancement of public spaces. These initiatives have not only improved the quality of life for residents but have also attracted new businesses and investment to the area.

For instance, the Salt Lake City Downtown Alliance, a nonprofit organization dedicated to promoting downtown development, has partnered with the city to leverage real estate tax revenue for various projects. These projects include the revitalization of the historic Exchange Place district, the creation of pedestrian-friendly spaces, and the development of public art installations, all of which have enhanced the city's appeal and economic vitality.

Moreover, the real estate tax revenue has supported the city's efforts to address housing affordability. By allocating funds towards the construction of affordable housing units and providing incentives for developers, Salt Lake City has been able to accommodate the growing population while maintaining a diverse and inclusive community.

Future Implications and Trends in Real Estate Taxes

As Utah continues to thrive and its real estate market evolves, several factors will shape the future landscape of real estate taxes. Here are some key considerations:

- Population Growth: Utah's population is projected to continue growing, which will likely lead to increased demand for housing and rising property values. This trend may result in higher assessed values and, consequently, higher real estate tax revenue for local governments.

- Changing Tax Policies: Tax policies are subject to change, and Utah's legislature may introduce new exemptions, credits, or tax rate adjustments in response to economic conditions or community needs. Staying informed about these changes is crucial for property owners.

- Technology and Data Analytics: Advancements in technology and data analytics are transforming the real estate assessment process. These tools can enhance the accuracy and efficiency of assessments, potentially leading to more equitable tax distribution.

- Community Engagement: Local governments are increasingly recognizing the importance of community engagement in tax policy decisions. Engaging residents in discussions about tax rates and exemptions can lead to more transparent and acceptable tax systems.

Expert Insights and Tips for Property Owners

💡 Tip 1: Stay Engaged

Stay actively involved in your local community and attend town hall meetings or workshops related to tax policies. Your participation can influence decisions and ensure that your interests are considered.

💡 Tip 2: Utilize Online Resources

Take advantage of online tools and resources provided by the Utah State Tax Commission and local taxing authorities. These resources often include valuable information, calculators, and guides to help you understand and manage your real estate tax obligations.

💡 Tip 3: Seek Professional Advice

Consider consulting a tax professional or financial advisor who specializes in real estate taxes. They can provide personalized advice and strategies to optimize your tax position and ensure compliance with the latest regulations.

Conclusion

Understanding real estate taxes in Utah is essential for property owners and investors alike. By comprehending the assessment process, tax rates, and available exemptions, homeowners can effectively manage their tax obligations and contribute to the vibrant and thriving communities within the state. As Utah’s real estate market continues to flourish, staying informed and engaged will be key to navigating the ever-evolving landscape of real estate taxes.

How often are real estate taxes assessed in Utah?

+Real estate taxes in Utah are assessed every two years, following a biennial assessment cycle.

What factors influence the assessed value of a property in Utah?

+The assessed value of a property is influenced by factors such as location, size, improvements, and market conditions. Mass appraisal techniques are used to estimate fair market values.

Can property owners appeal their real estate tax assessments in Utah?

+Yes, property owners have the right to appeal their assessments if they believe the assessed value is inaccurate. The appeals process allows for a review and potential adjustment of the assessed value.

How can property owners minimize their real estate tax liability in Utah?

+Property owners can minimize their tax liability by staying informed about available exemptions and credits, engaging in tax planning with professionals, and considering the timing of purchases or improvements.