Wisconsin State Income Tax

The Wisconsin state income tax is an essential component of the state's revenue system, playing a crucial role in funding public services and infrastructure. This article delves into the intricacies of Wisconsin's income tax, exploring its history, current structure, and impact on residents and businesses.

A Historical Perspective on Wisconsin Income Tax

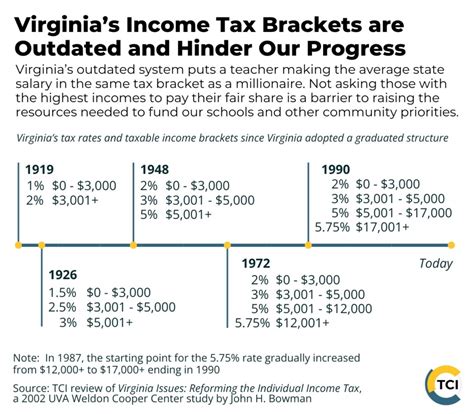

The roots of Wisconsin’s income tax can be traced back to the early 20th century. The state first introduced an income tax in 1911, with the goal of providing a more stable and equitable source of revenue. This initial tax structure underwent several revisions over the years to align with the evolving economic landscape and changing policy priorities.

One significant milestone in the history of Wisconsin's income tax was the introduction of the "single rate" system in 1988. This simplified the tax structure by eliminating the graduated rate system and implementing a flat tax rate for all income levels. While this move aimed to reduce administrative complexities, it also sparked debates about tax fairness and the impact on low- and middle-income earners.

In recent years, Wisconsin's income tax system has continued to evolve. The state has made efforts to balance the need for revenue with the desire to promote economic growth and competitiveness. As a result, the tax code has undergone periodic updates, including adjustments to tax rates, deductions, and credits, to reflect changing economic conditions and policy objectives.

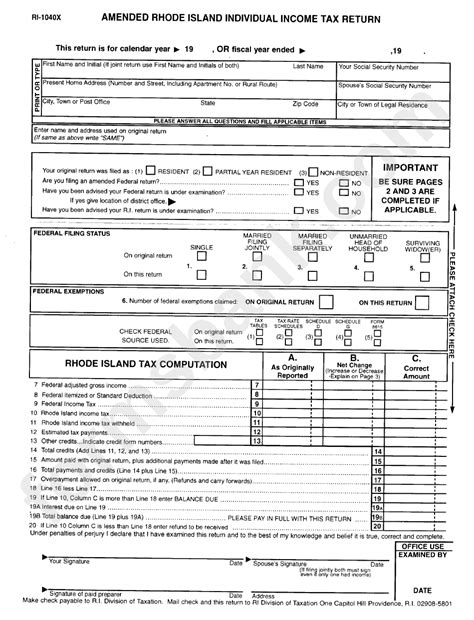

Understanding Wisconsin’s Current Income Tax Structure

Wisconsin’s income tax operates on a progressive system, meaning that higher income levels are subject to higher tax rates. As of the most recent tax year, Wisconsin has four tax brackets, each with its own tax rate. These brackets are designed to ensure that those with higher incomes contribute a greater proportion of their earnings to state revenue.

| Tax Bracket | Income Range | Tax Rate |

|---|---|---|

| 1 | $0 - $11,375 | 3.88% |

| 2 | $11,376 - $25,700 | 4.60% |

| 3 | $25,701 - $110,600 | 5.90% |

| 4 | $110,601 and above | 6.92% |

It's worth noting that these tax rates apply to Wisconsin taxable income, which may differ from federal adjusted gross income due to unique state-level adjustments and deductions. Additionally, Wisconsin offers a standard deduction of $5,150 for single filers and $10,300 for joint filers, which can further reduce taxable income.

Beyond the basic tax structure, Wisconsin provides various tax credits and deductions to ease the tax burden on specific groups and promote certain behaviors. For instance, residents may qualify for credits related to education, childcare, or property taxes. Furthermore, certain expenses, such as student loan interest or medical costs, can be deducted to lower taxable income.

Special Considerations for Businesses

Wisconsin’s income tax system also applies to businesses operating within the state. Corporations are subject to a 7.9% tax rate on their net income, while S corporations and partnerships face a 6.9% rate. These entities can benefit from various tax credits and incentives, particularly those that align with the state’s economic development priorities.

Moreover, Wisconsin offers pass-through entity (PTE) tax relief, which provides a credit to individuals receiving income from S corporations, partnerships, or limited liability companies. This credit aims to mitigate the double taxation that can occur when business income is taxed at both the entity and individual levels.

The Impact of Wisconsin’s Income Tax on Residents and Businesses

Wisconsin’s income tax system has a profound impact on the state’s residents and businesses. For individuals, the progressive nature of the tax means that higher-income earners contribute a larger share of their income to state revenue. This can result in a sense of tax fairness, as those with greater financial means bear a proportionally greater tax burden.

On the other hand, the tax structure can also present challenges for lower- and middle-income earners. While Wisconsin's tax brackets are designed to be progressive, the state's tax rates are generally higher compared to some neighboring states. This can make Wisconsin less attractive for those seeking to relocate or start a business, especially in a competitive regional market.

For businesses, Wisconsin's income tax environment presents both opportunities and considerations. The state's tax incentives and credits can make it an attractive location for certain industries, particularly those aligned with the state's economic development goals. However, businesses must also navigate the administrative complexities of Wisconsin's tax system, including compliance with unique state-level rules and regulations.

Comparative Analysis: Wisconsin’s Income Tax in a Regional Context

When examining Wisconsin’s income tax in comparison to its neighboring states, several interesting dynamics emerge. Wisconsin’s tax rates are generally higher than those of states like Illinois and Iowa, which can influence business decisions and individual relocation choices.

| State | Individual Income Tax Rates |

|---|---|

| Wisconsin | 3.88% - 6.92% |

| Illinois | 4.95% - 4.99% |

| Iowa | 2.9% - 8.98% |

| Minnesota | 5.35% - 9.85% |

However, Wisconsin's tax system also offers deductions and credits that can offset the impact of higher tax rates. Additionally, Wisconsin's tax structure may be more favorable for certain types of businesses or individuals, depending on their specific circumstances and eligibility for tax benefits.

Future Implications and Policy Considerations

Looking ahead, several key considerations will shape the future of Wisconsin’s income tax system. One of the primary focuses is on tax fairness and equity. As the state’s economy and population evolve, policymakers will need to ensure that the tax system remains progressive and adaptable, effectively distributing the tax burden across different income levels.

Another critical aspect is economic competitiveness. In a rapidly changing business landscape, Wisconsin must balance the need for revenue with the desire to attract and retain businesses and talent. This may involve ongoing evaluations of tax rates, deductions, and incentives to ensure the state remains an attractive location for investment and economic growth.

Additionally, the ongoing digitalization of the economy presents new challenges and opportunities for Wisconsin's tax system. As more economic activities move online, the state will need to navigate issues related to remote work, e-commerce, and the taxation of digital services, ensuring that its tax policies remain relevant and effective in a digital age.

What is the deadline for filing Wisconsin income taxes?

+The deadline for filing Wisconsin income taxes typically aligns with the federal deadline, which is generally April 15th of the year following the tax year. However, this deadline can be extended under certain circumstances.

Are there any unique tax deductions or credits available in Wisconsin?

+Yes, Wisconsin offers a range of tax deductions and credits, including the Homestead Credit, the Property Tax Credit, and the Earned Income Tax Credit. These credits aim to reduce the tax burden for eligible residents, particularly those with lower incomes.

How does Wisconsin’s income tax compare to other states in the region?

+Wisconsin’s income tax rates are generally higher compared to neighboring states like Illinois and Iowa. However, the state’s tax system also offers deductions and credits that can make it more attractive for certain individuals and businesses.