How to Navigate and Reduce Guilford County Tax Burdens Effectively

Guilford County, nestled within North Carolina's Piedmont region, presents a complex tapestry of fiscal policies, economic realities, and demographic trends—all intertwined with its local tax burden. For residents, business owners, and policymakers alike, understanding how to navigate and strategically reduce tax burdens in Guilford County isn't merely an exercise in financial literacy; it’s a pathway to community resilience and economic prosperity. While local taxes fund essential services—from education and infrastructure to public safety—an overburdened tax system can stifle growth, erode disposable income, and hinder overall quality of life. Therefore, a nuanced approach that balances revenue needs with taxpayer equity is critical. This article offers a comprehensive blueprint for effectively navigating this landscape, backed by data-driven insights, legal frameworks, and best-practice examples.

Understanding Guilford County’s Tax System: Foundations and Challenges

Before delving into strategies for reduction, it’s vital to grasp the structural intricacies of Guilford County’s taxation landscape. The county’s revenue predominantly comes from property taxes, sales taxes, and various user fees. Property tax rates, assessed valuations, and exemptions each play pivotal roles in determining individual and corporate burdens. Additionally, state-level allocations and federal aid influence local fiscal policies, often complicating efforts for tax relief.

Historically, Guilford County’s tax base has been resilient, buoyed by a diverse economy encompassing manufacturing, healthcare, higher education, and retail sectors. However, rapid population growth—projected at an average of 1.8% annually—has stressed infrastructure and public services, prompting an increase in tax demands. Simultaneously, economic disparities persist, with low-income communities disproportionately affected by property tax increases, which underscores the importance of equitable tax reduction strategies.

Tax Burden Metrics and Community Impact

To contextualize efforts towards reduction, examining key metrics reveals the extent of burden. According to the latest Guilford County Taxpayer Survey (2022), the effective property tax rate stands at approximately 1.05%, which is slightly above the North Carolina statewide average of 1.00%. For homeowners, this translates into an average annual tax bill of around $2,400, which can represent a significant percentage of household income, particularly for fixed-income residents.

| Relevant Category | Substantive Data |

|---|---|

| Effective Property Tax Rate | 1.05% in Guilford County vs. 1.00% statewide |

| Average Property Valuation | $210,000 as of 2023 |

| Median Household Income | $52,000 in Guilford County |

| Tax Revenue Allocation | 55% Education, 25% Public safety, 20% Infrastructure |

Strategic Pathways to Reduce and Navigate Guilford County’s Tax Burdens

Navigating and reducing tax burdens in Guilford County requires a multi-pronged, evidence-based approach—combining legal avenues, community engagement, economic incentives, and policy reforms. Each pathway is mediated by the specific context—whether you are an individual homeowner, a local business, or a policymaker—yet all share a common goal: maximizing fiscal efficiency without sacrificing service quality.

1. Leveraging Tax Exemptions and Relief Programs

One of the most immediate and accessible methods for residents to mitigate property tax burdens involves understanding and utilizing available exemptions. Guilford County, aligned with North Carolina law, offers several programs including the Elderly or Disabled Persons Exclusion, which can exempt up to a certain valuation cap from property taxes. Additionally, veteran exemptions and low-income relief programs provide targeted assistance.

For property owners, regularly reviewing eligibility criteria and applying for these exemptions, often through the county assessor’s office, can substantially reduce annual liabilities. It’s imperative to stay informed about annual updates, as legislative changes may expand or modify available reliefs.

2. Advocating for Policy Reforms and Budget Transparency

Long-term reduction efforts require active engagement with policymaking processes. Advocacy groups and community coalitions can push for reforms such as shifting towards a more equitable tax structure—perhaps through tiered assessments that alleviate burden on lower-income households or corporate tax incentives to foster economic growth.

Transparency in budgeting—requesting detailed financial reports, attending public hearings, and participating in local government consultations—empowers residents to influence fiscal priorities effectively. Transparent budgets can reveal inefficiencies and redirect funds from wasteful expenditures to smarter revenue strategies, ultimately easing the tax burden.

3. Economic Development and Diversification as Leverage

Economic diversification—attracting new industries, fostering entrepreneurship, and investing in workforce development—serves as a catalyst for increased revenue without solely relying on tax hikes. A thriving, diversified economy broadens the tax base, alleviating pressure on individual taxpayers.

For instance, incentivizing technology firms and green industry investments can generate substantial sales and corporate income taxes. These revenues can be reinvested into infrastructure projects that increase overall economic efficiency, creating a virtuous cycle that ultimately reduces reliance on high property taxes.

4. Utilizing District and Special Taxing Authorities

Guilford County residents and businesses can explore the strategic use of special districts, such as municipal service districts or transportation improvement districts, which can levy additional taxes for targeted projects. When implemented judiciously, these districts can improve specific community needs without increasing the general tax rate, thus compartmentalizing tax burdens.

5. Strategic Real Estate and Investment Planning

Individual homeowners and investors can adopt strategic property management practices—such as appealing property assessments, exploring conservation easements, or investing in properties within targeted districts—to reduce taxes. Proper valuation appeals, supported by market data and independent appraisals, can lower assessed values, directly impacting tax bills.

Key Points

- Understanding and utilizing tax exemptions can provide near-term relief and should be a routine part of tax planning.

- Engaging in local policy advocacy fosters reforms that align tax burdens more equitably with ability to pay.

- Economic diversification bolsters public revenue streams, reducing reliance on property taxes.

- Targeted districting strategies allow for localized funding without broad tax hikes.

- Proactive real estate strategies can help individual taxpayers appeal assessments and manage their liabilities effectively.

Integrating Data-Driven Decision-Making into Tax Strategies

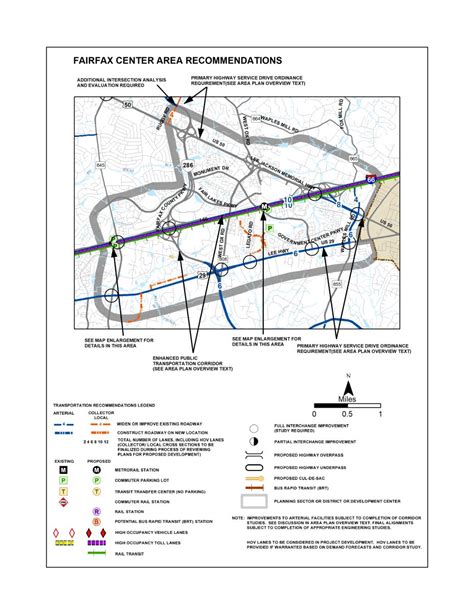

Advanced analytical tools and data repositories now empower residents and officials to craft precise, impactful strategies. Geographic Information Systems (GIS), property valuation software, and economic modeling enable stakeholders to identify high-burden areas, forecast fiscal impacts, and simulate policy outcomes.

For example, GIS mapping of property assessments versus income levels can prioritize targeted relief efforts. Similarly, economic impact analysis can gauge how tax incentives influence revenue streams and regional development, ensuring that reforms foster growth rather than unintended fiscal deficits.

Case Studies and Best Practices

Across North Carolina, several counties have adopted innovative tax reduction frameworks. Durham County, for instance, implemented a tiered property tax system that exempts a larger portion of the valuation for low-income homeowners while maintaining revenue for critical infrastructure. Mecklenburg County has leveraged enterprise zones to stimulate business growth in underdeveloped neighborhoods, reducing overall tax burdens through economic activity.

Guilford County can learn from these models, customizing approaches that suit its demographics and economic profile. A collaborative approach—encompassing public-private partnerships, community input, and expert analysis—maximizes the potential for sustainable tax relief.

Facing Limitations and Obstacles: A Realistic Outlook

Efforts to reduce tax burdens are inherently constrained by legal, financial, and political realities. State legislation may limit the scope of exemptions or competitive incentives. Fiscal shortfalls can lead to service cuts, creating resistance among constituents. Additionally, economic shocks—like downturns or transitions—can abruptly shift fiscal priorities.

Thus, implementing incremental reforms backed by robust data, coupled with transparent communication, is vital. Building consensus around shared goals—such as equitable relief and sustainable growth—further ensures reforms withstand political shifts.

Anticipating Future Trends

Technology will continue to transform tax management, with initiatives like blockchain-based assessment systems and real-time revenue tracking promising more efficiency and transparency. Furthermore, evolving environmental policies and climate resilience investments may introduce new sources of revenue through green taxes or conservation charges, offering additional avenues for balancing fiscal needs with sustainability.

What are the most effective ways for residents to appeal property assessments in Guilford County?

+Residents should gather comparable property data, conduct independent appraisals if necessary, and file appeals within the designated timeframe through the Guilford County Assessor’s Office. Providing solid evidence supporting a lower valuation increases the chance of success.

How do economic incentives influence tax burdens in Guilford County?

+Economic incentives, such as tax credits or abatements offered to attract or retain businesses, can reduce corporate tax liabilities, thereby impacting public revenues. When strategically applied, these incentives stimulate growth and expand the overall tax base, easing the burden on individual taxpayers.

What role does community engagement play in sustainable tax reform?

+Community engagement fosters transparency, builds consensus, and ensures that reforms align with residents’ needs. Active participation in public hearings, surveys, and advisory boards enhances policy legitimacy and efficacy.