Mastering Virginia Income Tax Tips for Smart Filers

Virginia’s state income tax system, often overlooked in the broader national tax landscape, embodies a complex interplay of legislative updates, fiscal policies, and seasonal filing strategies that demand both precision and adaptability from taxpayers. Unlike federal counterparts that influence national economic patterns, Virginia's tax policies directly shape the livelihoods of hundreds of thousands of residents, from city dwellers in Richmond to rural entrepreneurs across the Shenandoah Valley. For the astute filer, mastering Virginia income tax tips isn't merely about compliance; it’s a strategic exercise in financial stewardship, legal savvy, and informed decision-making.

Understanding Virginia’s Income Tax Framework: Foundations and Nuances

The structure of Virginia’s income tax system hinges on progressive taxation, with tiers that evolve annually based on legislative amendments and economic forecasts. It encompasses a broad spectrum of income sources, including wages, business profits, capital gains, and even certain types of retirement income. For filers, grasping these foundational elements is essential to optimize deductions, identify credits, and avoid pitfalls that could trigger audits or penalties.

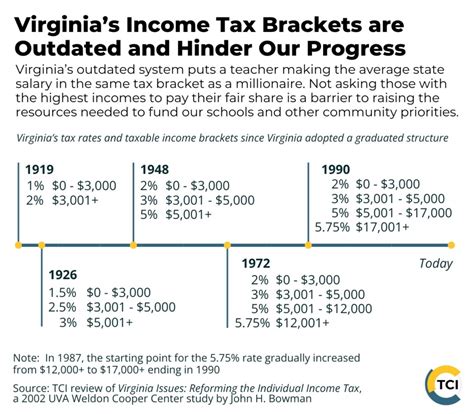

Virginia employs a set of tax brackets that are recalibrated annually, often influenced by the state’s revenue needs and economic growth targets. The latest data reveal that the top marginal rate for individual filers sits at approximately 5.75%, a figure competitive among neighboring states but significant when considering local tax diversities. This layered structure underscores the importance for filers to stay updated on legislative changes and to leverage available tax planning opportunities accordingly.

Furthermore, Virginia’s income tax collection varies locally, with counties and cities imposing additional local income taxes. This multiplicity necessitates a nuanced understanding of jurisdictional responsibilities, especially for residents with multijurisdictional income sources, as oversight can lead to underpayment or penalties.

Key Strategies for Smart Virginia Income Tax Filers

Maximizing Deductions and Credits Available in Virginia

Virginia offers an array of deductions and credits tailored to both individual and business taxpayers, from standard deductions to specific incentives for renewable energy investments or educational expenses. A critical approach involves meticulous documentation of expenses that qualify under state-specific provisions, such as mortgage interest, charitable contributions, and medical expenses, which can be itemized to reduce taxable income effectively.

Among the most impactful credits are the Virginia Earned Income Tax Credit (EITC), which amplifies federal EITC benefits, and the College Savings plan credits, designed to encourage education investment. Leveraging these credits requires strategic timing and an awareness of eligibility thresholds—an advantage in an era where tax law intricately intertwines with personal financial planning.

| Relevant Category | Substantive Data |

|---|---|

| Virginia EITC | Up to 20% of federal EITC; phased out at higher income thresholds (phase-out begins at $53,000 for single filers) |

Strategies to Minimize Tax Liability for Virginians

Beyond deductions and credits, income deferral and strategic investments can significantly mitigate tax burdens. For instance, contributing to Virginia-approved 529 college savings plans not only accelerates wealth accumulation but also secures state-level tax advantages. Additionally, timing asset sales or business income recognition to fall within favorable brackets can lead to substantial savings.

For retirees, understanding the specifics of Virginia’s taxation of retirement income—such as pensions, Social Security benefits, and IRA withdrawals—is vital. Notably, Virginia exempts Social Security benefits from state income tax, yet other retirement income is taxed progressively, demanding tailored planning to optimize cash flow post-retirement.

Legal Compliance and Filing Efficiency Tips

Virginia’s filing procedures, though aligned with federal standards, contain unique elements such as local tax submissions and specific schedules. Accurate filing requires mastery of Virginia’s Department of Taxation portals, understanding file deadlines—generally April 15—and avoiding common filing errors that could delay refunds or trigger audits.

Tax software tailored to Virginia’s requirements can streamline the process, but expert review remains recommended—particularly for complex scenarios involving multi-jurisdictional income or non-traditional income sources. Electronic filing, coupled with direct deposit, enhances efficiency and security in refund processing.

| Relevant Category | Substantive Data |

|---|---|

| Filing Deadline | Typically April 15; extensions available until October 15 |

| Electronic Filing Adoption | Over 85% of returns filed electronically in recent years, increasing accuracy and speed |

Emerging Trends and Policy Changes in Virginia Tax Policies

Virginia’s legislative landscape is dynamic, with recent proposals targeting increased transparency, expanded tax credits for green energy, and adjustments to local tax regulations. The ongoing debates over expanding the base of taxable retirement income and increasing top income brackets reflect a balancing act between fiscal needs and taxpayer fairness.

Moreover, the influence of federal tax reforms—such as the Tax Cuts and Jobs Act (TCJA)—has prompted Virginia policymakers to reconsider certain deductions and credits, often enhancing or restricting them based on revenue projections and political agendas. Critical evaluation of these trends assists savvy filers in tailoring their strategies accordingly.

Impact of Policy Shifts on Human Behavior and Society

Revisions in Virginia tax laws serve not just fiscal purposes but actively shape behaviors, including investment choices, retirement planning, and even employment decisions. For example, expanding tax credits for renewable energy can incentivize both individual installation of solar panels and broader corporate adoption of green policies, influencing societal norms toward sustainability. Conversely, increases in marginal rates can motivate income shifting or strategic deferrals.

Such policy shifts catalyze a culture of financial literacy, pushing residents to become more engaged with their fiscal responsibilities and societal contributions. This dynamic underscores the importance of continuous education and adaptive planning in maintaining economic resilience and social equity.

Key Points

- Comprehensive understanding of Virginia’s tax brackets and local tax variations is essential for precise filing.

- Leveraging credits like the Virginia EITC and educational incentives can significantly reduce liability.

- Proactive planning with contributions to tax-advantaged accounts and strategic income timing optimizes financial outcomes.

- Staying informed of policy changes influences both individual strategies and societal trends in tax compliance and behavioral shifts.

- Expert consultation with Virginia-specific tax professionals mitigates risk and harnesses evolving opportunities.

What are the most common mistakes Virginia filers make?

+Common errors include misreporting local income taxes, overlooking available credits, miscalculating deductions, and missing filing deadlines. Proper documentation and consulting up-to-date guidelines can prevent these issues.

How can I optimize my Virginia tax refund?

+Maximize deductions and credits, contribute early to tax-advantaged accounts, and ensure accurate reporting of all income sources. Consulting a tax advisor familiar with Virginia law enhances refund prospects.

Are there any recent legislative changes affecting Virginia tax filing?

+Recent legislation has modified local tax caps, expanded energy-related credits, and adjusted income brackets. Keeping informed through official Virginia Department of Taxation updates ensures compliance and strategic advantage.