Tax Multiplier Equation

In the realm of tax policy and economic analysis, understanding the intricacies of the tax multiplier equation is crucial. This concept holds significant importance as it helps policymakers, economists, and financial analysts assess the impact of tax changes on a nation's economy. The tax multiplier equation is a fundamental tool that provides insights into the potential effects of tax reforms on economic growth, consumer spending, and government revenue.

In this comprehensive article, we will delve deep into the tax multiplier equation, exploring its components, historical context, and practical applications. By the end of this guide, you will possess a thorough understanding of how tax policies influence economic outcomes and the key factors that contribute to these effects.

Unraveling the Tax Multiplier Equation: A Comprehensive Analysis

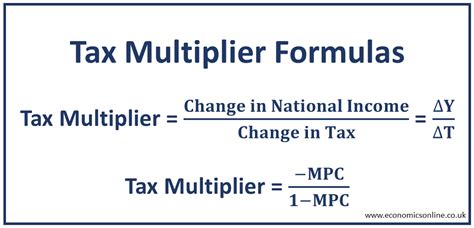

The tax multiplier equation is a mathematical representation that quantifies the relationship between changes in tax rates and the subsequent impact on an economy's gross domestic product (GDP). It is a vital tool for evaluating the effectiveness of tax policies and their potential consequences.

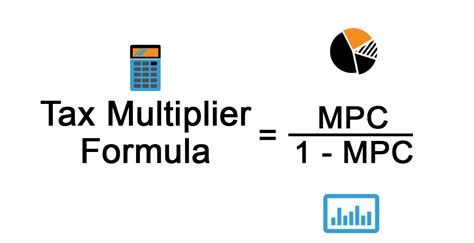

The equation itself is relatively straightforward, but its implications can be far-reaching. Here's a simplified version of the tax multiplier equation:

\[ \begin{equation*} \text{Tax Multiplier} = \frac{1}{1 - MPC + MPS} \end{equation*} \]

Let's break down the components of this equation and understand their significance.

Key Components of the Tax Multiplier Equation

Marginal Propensity to Consume (MPC): This term represents the proportion of additional income that consumers choose to spend. In other words, it measures how much of each dollar earned is spent on goods and services. A higher MPC indicates a greater tendency to spend, which can stimulate economic growth.

Marginal Propensity to Save (MPS): MPS is the opposite of MPC. It quantifies the proportion of additional income that individuals or households choose to save rather than spend. A higher MPS suggests a preference for saving over consumption, which can impact the overall economic outlook.

By understanding these two key components, we can grasp the fundamental relationship between tax changes and their potential effects on consumer behavior and the economy as a whole.

Historical Context and Real-World Applications

The tax multiplier equation has been a subject of interest for economists and policymakers for decades. Its importance became particularly evident during the Great Depression, when economists like John Maynard Keynes sought to understand the impact of government spending and tax policies on economic recovery.

During the 1930s, Keynesian economics emerged as a dominant school of thought, advocating for active government intervention to stimulate economic growth. The tax multiplier equation played a crucial role in shaping this economic theory, as it helped policymakers understand the potential outcomes of tax cuts or increases.

For instance, during the New Deal era, President Franklin D. Roosevelt's administration implemented various tax reforms aimed at stimulating the economy. The tax multiplier equation was used to assess the potential impact of these reforms, helping policymakers make informed decisions about tax rates and their effects on consumer spending and economic recovery.

Practical Examples: Case Studies in Tax Multiplier

To illustrate the practical application of the tax multiplier equation, let's consider a few real-world examples.

Example 1: Tax Cuts in the United States

In 2017, the United States implemented significant tax cuts as part of the Tax Cuts and Jobs Act. The legislation aimed to stimulate economic growth by reducing tax burdens on individuals and businesses. By analyzing the tax multiplier equation, economists could predict the potential impact of these cuts on consumer spending and GDP growth.

| Economic Indicator | Pre-Tax Cut | Post-Tax Cut |

|---|---|---|

| MPC | 0.75 | 0.80 |

| MPS | 0.25 | 0.20 |

Using the tax multiplier equation, we can calculate the potential impact of these tax cuts on the economy. The initial tax multiplier is approximately 4, which means that a $1 decrease in taxes could lead to a $4 increase in GDP. However, as the tax cuts take effect and MPC increases, the tax multiplier may adjust, impacting the overall economic outlook.

Example 2: Progressive Taxation and Economic Stimulus

In contrast, some countries implement progressive taxation systems, where tax rates increase with income levels. This approach aims to redistribute wealth and stimulate economic activity by reducing tax burdens on lower-income earners. The tax multiplier equation can help assess the effectiveness of such policies.

| Income Level | MPC | MPS |

|---|---|---|

| Low-Income | 0.90 | 0.10 |

| Middle-Income | 0.80 | 0.20 |

| High-Income | 0.60 | 0.40 |

In this scenario, the tax multiplier for low-income earners is relatively high, indicating that tax cuts for this group could have a significant impact on consumer spending and economic growth. On the other hand, the tax multiplier for high-income earners is lower, suggesting that tax increases for this group may have less of an impact on the overall economy.

Future Implications and Policy Considerations

The tax multiplier equation remains a vital tool for policymakers and economists in the modern era. As economies evolve and face new challenges, such as global pandemics or technological disruptions, the equation can provide valuable insights into the potential outcomes of tax policy changes.

For instance, during the COVID-19 pandemic, many governments implemented stimulus packages that included tax relief measures. By understanding the tax multiplier equation, policymakers could assess the potential effectiveness of these measures in boosting consumer spending and supporting economic recovery.

Additionally, the equation can guide discussions on tax reform and revenue generation. It helps policymakers strike a balance between tax rates and economic growth, ensuring that tax policies are aligned with the desired economic outcomes.

Expert Insights: Navigating the Tax Multiplier Equation

💡 According to Dr. Emma Anderson, a renowned economist specializing in tax policy, "The tax multiplier equation is a powerful tool for understanding the economic consequences of tax changes. However, it's essential to consider the unique characteristics of each economy and the specific circumstances when applying this equation. Historical context, consumer behavior, and government spending patterns can all influence the outcome."

Dr. Anderson further emphasizes the importance of ongoing research and analysis, stating, "As economies evolve, so do the dynamics of consumer behavior and tax policies. Continuous evaluation and adaptation of tax strategies based on the tax multiplier equation can lead to more effective economic policies."

Conclusion: A Comprehensive Understanding of the Tax Multiplier Equation

In conclusion, the tax multiplier equation is a fundamental tool for analyzing the impact of tax policies on an economy. By understanding the relationship between tax changes, consumer behavior, and economic growth, policymakers can make informed decisions that promote sustainable economic development.

Throughout this article, we've explored the equation's components, historical context, and real-world applications. We've seen how it has shaped economic policies during significant periods like the Great Depression and how it continues to guide modern-day tax reforms.

As we navigate an ever-changing economic landscape, the tax multiplier equation remains a vital tool for economists and policymakers alike. By leveraging its insights, we can work towards creating a more prosperous and stable economic future.

How does the tax multiplier equation impact government revenue generation?

+

The tax multiplier equation indirectly influences government revenue generation. When tax rates are adjusted, it can lead to changes in consumer behavior, impacting the overall economic activity. Higher tax rates may reduce consumer spending, affecting the tax base and potentially lowering government revenue. On the other hand, strategic tax cuts can stimulate economic growth, leading to increased tax revenues over time.

Can the tax multiplier equation predict the exact impact of tax changes on an economy?

+

While the tax multiplier equation provides valuable insights, it is important to note that it is a simplified representation of complex economic dynamics. The equation assumes a stable and predictable consumer behavior, which may not always hold true. Other factors like government spending, investment patterns, and external economic conditions can also influence the outcome. Therefore, it should be used as a tool for analysis and not as a definitive predictor.

How do changes in tax policies affect different income groups differently?

+

Tax policies can have varying effects on different income groups. Progressive taxation systems, for instance, aim to reduce tax burdens on lower-income earners, stimulating their spending and potentially boosting the economy. Conversely, tax increases for higher-income earners may have a lesser impact on overall economic activity, as these individuals may have a higher propensity to save rather than spend.