Pre Tax Meaning

In the realm of personal finance and accounting, understanding the concept of pre-tax is essential for making informed financial decisions. This term, although seemingly straightforward, carries significant implications for individuals and businesses alike. Let's delve into the intricacies of pre-tax, exploring its meaning, its role in various financial contexts, and its impact on decision-making processes.

Unraveling the Pre-Tax Concept

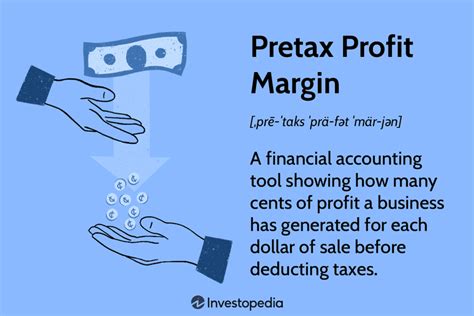

Pre-tax, in its simplest form, refers to the value or amount of money before any deductions for taxes are applied. It is the initial, unaltered figure that serves as a baseline for financial calculations and assessments. In essence, pre-tax signifies the gross or total amount, untouched by the complex web of tax regulations and obligations.

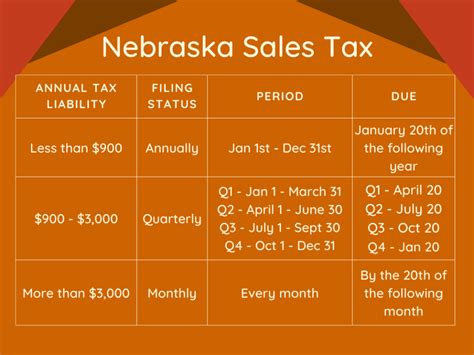

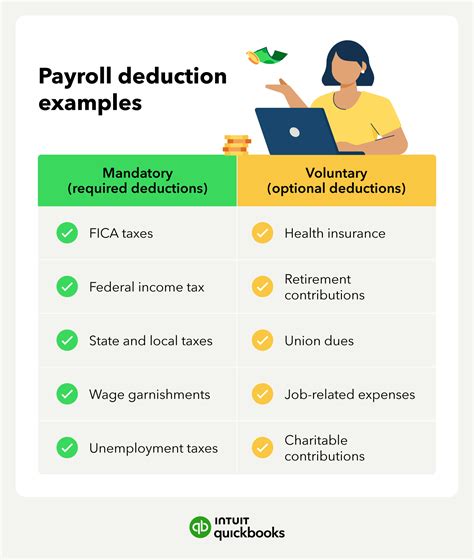

For individuals, the pre-tax amount often represents their gross income—the earnings they receive before any deductions for income tax, social security, Medicare, or other withholdings. Similarly, for businesses, pre-tax revenue or profits refer to the total earnings generated before accounting for various taxes, such as corporate income tax, payroll taxes, or sales taxes.

Understanding the pre-tax concept is crucial because it provides a clear picture of the initial financial position. It allows individuals and businesses to assess their true financial strength, make comparisons, and plan for the future without the distortion that tax deductions can introduce.

The Significance of Pre-Tax in Personal Finance

In personal finance, the pre-tax amount plays a pivotal role in various aspects of financial management.

Income Assessment

When individuals receive their paychecks, the pre-tax income is a critical figure. It represents the total earnings before any deductions, providing a clear understanding of the actual compensation received. This information is essential for budgeting, savings planning, and assessing one’s financial health.

Retirement Planning

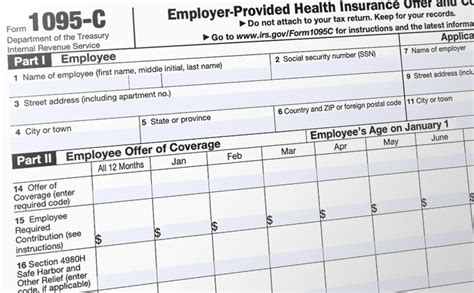

Pre-tax considerations are particularly relevant in retirement planning. Many retirement accounts, such as 401(k)s or traditional IRAs, allow individuals to contribute pre-tax dollars. This means that the contributions are made with funds that have not yet been taxed, offering immediate tax benefits. Understanding the pre-tax contributions and their potential growth over time is crucial for effective retirement planning.

Financial Goals and Savings

For individuals setting financial goals, such as saving for a house, education, or a dream vacation, the pre-tax amount serves as a starting point. By knowing their pre-tax income, individuals can allocate a specific portion towards their goals, ensuring they have a realistic plan for achieving their aspirations.

Pre-Tax in Business and Corporate Settings

In the business world, the pre-tax concept takes on a slightly different but equally significant role.

Corporate Revenue and Profitability

For businesses, the pre-tax revenue or profit is a critical metric. It represents the total earnings generated from sales or operations before accounting for various taxes. This figure is often used to assess the financial health and performance of a company. It provides a snapshot of the company’s ability to generate income, which is then compared to its expenses and tax obligations to determine its net profit.

Tax Planning and Strategies

Businesses engage in intricate tax planning to optimize their financial positions. Understanding pre-tax figures is essential for developing effective tax strategies. By analyzing pre-tax revenues and profits, businesses can identify opportunities to minimize tax liabilities, maximize deductions, and enhance their overall financial performance.

Investment Decisions

When businesses consider investment opportunities, the pre-tax perspective is crucial. It allows them to evaluate the potential return on investment (ROI) before considering the impact of taxes. This analysis helps businesses make informed decisions about where to allocate their resources for maximum financial gain.

Comparative Analysis and Decision-Making

The concept of pre-tax is not only about understanding initial amounts but also about making informed comparisons and decisions.

Comparing Pre-Tax and Post-Tax Figures

One of the key benefits of understanding pre-tax is the ability to compare it to post-tax figures. This comparison provides insight into the impact of taxes on financial outcomes. For example, an individual can compare their pre-tax income to their take-home pay (post-tax) to understand the tax burden they bear. Similarly, businesses can compare pre-tax profits to net profits to assess the effectiveness of their tax strategies.

Decision-Making Based on Pre-Tax Considerations

Pre-tax considerations influence a wide range of financial decisions. For individuals, it might involve choosing between pre-tax and post-tax investment accounts, deciding on the optimal contribution levels for retirement plans, or evaluating the impact of tax deductions on their overall financial strategy. Businesses, on the other hand, may use pre-tax figures to negotiate better tax rates, optimize their tax structure, or make strategic investments to minimize tax obligations.

Real-World Examples and Case Studies

To illustrate the significance of pre-tax in real-world scenarios, let’s explore a few examples.

Individual Tax Planning

Consider an individual earning a gross income of $70,000 annually. By understanding their pre-tax income, they can assess their tax obligations and plan accordingly. For instance, they might decide to contribute a portion of their pre-tax income to a 401(k) plan, reducing their taxable income and potentially lowering their tax liability. This strategic decision is made possible by a clear understanding of the pre-tax concept.

Business Tax Strategies

A small business with a pre-tax revenue of $500,000 can use this figure to develop tax-efficient strategies. By analyzing their pre-tax profits, they can identify areas where tax deductions or credits can be claimed. For example, they might invest in research and development, knowing that such expenses can lead to significant tax benefits. This strategic approach helps the business optimize its financial performance while adhering to tax regulations.

Investment Decisions for Retirement

An individual planning for retirement might consider the pre-tax contributions to their IRA. By understanding the pre-tax nature of these contributions, they can maximize their savings potential. For instance, if they contribute $6,000 annually to their pre-tax IRA, they can let these funds grow tax-free until withdrawal, potentially resulting in substantial savings over time.

Conclusion: The Importance of Pre-Tax Understanding

In the world of finance, the concept of pre-tax is a fundamental building block for making informed decisions. Whether it’s for personal financial planning or corporate strategic initiatives, grasping the pre-tax concept is essential. It provides a clear baseline for assessment, comparison, and strategy formulation.

By understanding pre-tax, individuals and businesses can navigate the complex landscape of taxes with confidence. They can make choices that align with their financial goals, optimize their tax positions, and ultimately achieve greater financial success. The pre-tax perspective is a powerful tool that empowers individuals and businesses to take control of their financial destiny.

What is the difference between pre-tax and post-tax income/revenue?

+Pre-tax income/revenue refers to the gross amount before any deductions for taxes, while post-tax income/revenue represents the amount remaining after taxes have been applied. It is the net figure that individuals or businesses take home or report as taxable income.

How does understanding pre-tax benefit individuals in retirement planning?

+Understanding pre-tax is crucial for retirement planning as it allows individuals to maximize their savings potential. Pre-tax contributions to retirement accounts, such as 401(k)s or IRAs, offer immediate tax benefits and can significantly impact long-term savings.

Can businesses manipulate their pre-tax figures for tax avoidance?

+While businesses engage in tax planning to optimize their financial positions, tax avoidance or evasion is illegal. Businesses must adhere to tax regulations and use legitimate strategies to minimize their tax obligations. Manipulating pre-tax figures for illicit purposes carries severe legal consequences.