Nebraska Sales Tax

Nebraska's sales tax system is an essential component of the state's revenue structure, playing a significant role in funding public services and infrastructure. This article aims to provide an in-depth exploration of Nebraska's sales tax, its rates, applicability, and the impact it has on the state's economy and businesses.

Understanding Nebraska’s Sales Tax Structure

The sales tax in Nebraska is a state-wide tax imposed on the sale of tangible personal property and certain services. It is a consumption tax, meaning the burden of the tax falls on the final consumer of the goods or services. The state’s sales tax is administered by the Nebraska Department of Revenue, which oversees compliance and collection.

As of [current year], Nebraska's state-wide sales tax rate stands at 5.5%, which is applied uniformly across the state. However, this is not the only tax that consumers may encounter. Nebraska also allows its local municipalities, including cities and counties, to impose their own local option sales taxes. These additional taxes can significantly increase the total sales tax rate depending on the location of the purchase.

Local Sales Tax Variations

The local option sales tax in Nebraska is a unique feature of the state’s tax system. Each municipality has the authority to determine whether it wants to levy this additional tax and at what rate. This means that the total sales tax rate can vary significantly depending on the location of the purchase, with some areas having a total rate as high as 8.5% when combined with the state’s base rate.

For instance, Lincoln, Nebraska's capital city, has a local option sales tax rate of 2.5%, bringing the total sales tax to 8%. On the other hand, Omaha, the state's largest city, has a slightly lower local option sales tax of 2%, resulting in a total sales tax of 7.5%.

| City | Local Option Sales Tax Rate | Total Sales Tax Rate |

|---|---|---|

| Lincoln | 2.5% | 8% |

| Omaha | 2% | 7.5% |

| Scottsbluff | 3% | 8.5% |

| Grand Island | 1.5% | 7% |

These variations in local sales tax rates can have a significant impact on consumer behavior and business strategies. Consumers may choose to shop in areas with lower tax rates, especially for big-ticket items, while businesses might consider their location and the potential tax implications when making strategic decisions.

Sales Tax Exemptions and Special Considerations

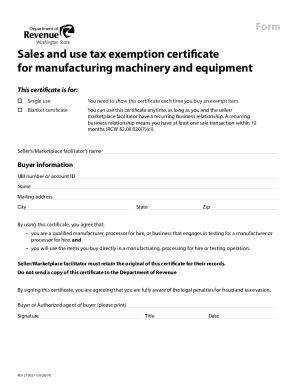

While Nebraska’s sales tax applies to a broad range of goods and services, there are certain exemptions and special considerations in place. These exemptions are designed to promote specific economic activities or to provide relief to certain sectors or consumer groups.

Food and Grocery Sales Tax Exemption

One notable exemption in Nebraska’s sales tax system is for unprepared food items, often referred to as grocery items. This exemption covers a wide range of food products that are typically purchased for home consumption and not intended for immediate consumption. This includes most items found in a grocery store, such as bread, milk, eggs, fruits, vegetables, and meat.

However, it's important to note that this exemption does not extend to all food products. Prepared foods, which are ready to eat or require minimal preparation, are subject to sales tax. This includes items like hot deli foods, pre-made sandwiches, and bakery items. Additionally, beverages like soda and juice, whether prepared or not, are also subject to sales tax in Nebraska.

Sales Tax Holidays

Nebraska, like many other states, offers sales tax holidays to encourage consumer spending and provide temporary relief from sales tax. During these designated periods, certain items are exempt from sales tax, often including back-to-school supplies, clothing, and emergency preparedness items. These holidays are usually set for specific dates, often coinciding with major shopping seasons.

For example, Nebraska typically has a back-to-school sales tax holiday in late July or early August, where school supplies, clothing, and computers are exempt from sales tax up to a certain value. This can be a significant savings for families preparing for the new school year.

Compliance and Collection: The Role of Businesses

Businesses operating in Nebraska play a crucial role in the state’s sales tax system. They are responsible for collecting the appropriate sales tax from customers, remitting it to the Nebraska Department of Revenue, and maintaining accurate records of sales and tax collections.

Sales Tax Registration and Remittance

All businesses in Nebraska that sell taxable goods or services are required to register for a sales tax permit with the Department of Revenue. This permit allows them to collect and remit sales tax to the state. The registration process involves providing business information, selecting a tax filing frequency, and understanding the tax rates and regulations applicable to their business.

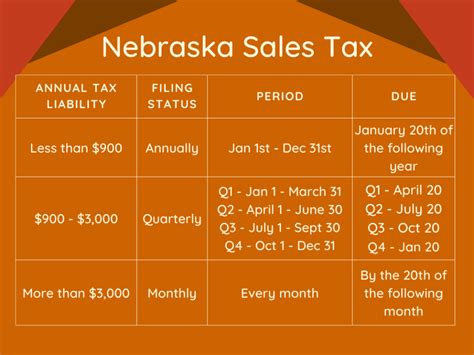

Once registered, businesses must collect the appropriate sales tax from customers based on the total purchase amount and the applicable tax rate. This tax is then remitted to the state on a regular basis, typically monthly or quarterly, depending on the business's sales volume and filing frequency.

Sales Tax Compliance Challenges

Ensuring compliance with Nebraska’s sales tax regulations can be a complex task for businesses, especially those operating in multiple locations or selling online. The varying tax rates across the state, combined with the different tax treatments for various products and services, can make it challenging to calculate and collect the correct tax amounts.

Businesses must stay informed about any changes in tax rates, new regulations, and exemptions to ensure they are compliant. This often requires robust accounting systems and trained staff to manage sales tax compliance effectively.

Impact on Nebraska’s Economy and Consumers

Nebraska’s sales tax system has a significant impact on the state’s economy and consumers. The revenue generated from sales tax is a major source of funding for public services, infrastructure projects, and government operations.

Funding Public Services and Infrastructure

Sales tax revenue in Nebraska contributes to a range of public services, including education, healthcare, public safety, and transportation. For instance, a portion of the sales tax revenue is allocated to the Nebraska Department of Roads, which uses it to maintain and improve the state’s highway system. This ensures safe and efficient transportation for residents and businesses.

Sales tax revenue also supports the state's education system, helping to fund public schools, colleges, and universities. This investment in education is crucial for the state's future economic growth and development.

Consumer Impact and Spending Behavior

For consumers, the sales tax can influence purchasing decisions and spending behavior. The varying tax rates across the state can lead to tax-driven shopping patterns, where consumers choose to shop in areas with lower tax rates to save money, particularly for large purchases.

Additionally, the sales tax can impact the affordability of goods and services, especially for low-income households. While sales tax holidays and exemptions can provide some relief, the overall impact of sales tax on consumer spending and the economy is a complex interplay of various factors.

What happens if a business fails to collect or remit sales tax in Nebraska?

+Businesses that fail to collect or remit sales tax as required can face penalties and interest charges from the Nebraska Department of Revenue. The penalties can be significant, and repeated violations can lead to the revocation of the business’s sales tax permit.

Are there any special considerations for online businesses operating in Nebraska?

+Yes, online businesses operating in Nebraska must comply with the state’s sales tax laws. This includes collecting sales tax from Nebraska customers based on the shipping or delivery destination. The business must register for a sales tax permit and remit the collected tax to the state.

How often do sales tax rates change in Nebraska?

+The state-wide sales tax rate in Nebraska is relatively stable and has not changed in recent years. However, local option sales tax rates can change more frequently, typically after a vote or approval by the local governing body. Businesses should stay informed about any changes to ensure compliance.