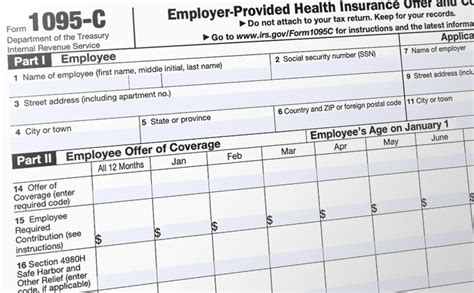

What Is A 1095 C Tax Form

The 1095-C tax form is a crucial document in the realm of health insurance and taxation, playing a significant role in understanding and complying with the provisions of the Affordable Care Act (ACA), commonly known as Obamacare. This form is specifically designed for employers to report information about the health coverage they offer to their employees, making it a vital component of the annual tax filing process for both businesses and their workforce.

Understanding the 1095-C Tax Form

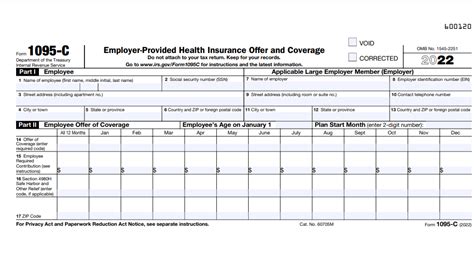

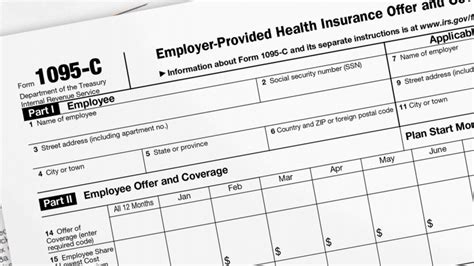

The 1095-C is one of several Information Returns that were introduced as part of the ACA. It is officially titled the “Employer-Provided Health Insurance Offer and Coverage” form. The primary purpose of this form is to provide the Internal Revenue Service (IRS) and individuals with detailed information about the health insurance plans offered by employers, and the extent to which employees and their families were covered during the previous calendar year.

This form is typically sent to employees by their employers, and it must be furnished to them by January 31st of the year following the coverage period. For example, if an employee is covered by their employer's health plan in 2023, they should receive the 1095-C form by January 31, 2024, detailing their coverage for the year 2023.

The 1095-C form is divided into six parts, each serving a specific purpose in reporting health coverage information.

Parts A and B: Employer and Employee Information

Part A of the 1095-C contains basic details about the employer, including their name, address, Employer Identification Number (EIN), and the tax year for which the coverage is being reported. Part B provides information about the employee, such as their name, Social Security Number (SSN), and the months during which they were covered under the employer’s health plan.

| Part | Details |

|---|---|

| Part A | Employer Information |

| Part B | Employee Details and Coverage Months |

Part C: Coverage Offered

Part C of the form details the type of health coverage offered by the employer. It includes information on whether the coverage is through a self-insured plan, a small business health plan, or a plan established or maintained by a governmental entity. It also indicates if the coverage is minimum essential coverage (MEC) and if it is affordable and provides minimum value.

Part D: Coverage for Employees and Their Families

Part D is where employers report the coverage offered to the employee and their family members. This includes details such as the employee’s share of the premium cost, whether coverage was offered to the employee’s spouse and dependents, and the months during which this coverage was available.

Parts E and F: Additional Information

Parts E and F are used to provide additional details that may be relevant to the employee’s health coverage. This could include information about any health savings accounts (HSAs) the employee has access to, or any other health-related coverage offered by the employer.

Importance of the 1095-C Form

The 1095-C form is a critical tool for both employers and employees. For employers, it serves as a means to demonstrate compliance with the ACA’s employer mandate, which requires certain employers to offer affordable health coverage to their full-time employees. Non-compliance with this mandate can result in significant penalties.

For employees, the 1095-C form is essential for verifying their health coverage and understanding their tax obligations. Under the ACA, individuals are required to have minimum essential coverage (MEC) or face a tax penalty. The 1095-C form helps employees understand whether they had MEC during the year and whether they need to report any additional coverage or pay a penalty on their tax return.

Additionally, the 1095-C form can be a valuable resource for employees when they are filing their taxes. It provides detailed information about their health coverage, which can be used to claim certain tax benefits or credits related to healthcare expenses.

Future Implications

As healthcare regulations continue to evolve, the role of the 1095-C form may also change. While the ACA remains in effect, the form is likely to continue serving as a key component of the healthcare reporting and compliance process. However, any future changes to the healthcare landscape, such as modifications to the ACA or the introduction of new healthcare policies, could impact the use and requirements of the 1095-C form.

For instance, if there were a shift towards universal healthcare coverage, the need for detailed reporting on employer-provided health insurance might diminish. Conversely, if the focus shifts towards more personalized healthcare plans or if there are changes to the definition of minimum essential coverage, the 1095-C form could become even more detailed or could be supplemented with additional forms to capture these changes.

In the meantime, for both employers and employees, understanding the 1095-C form and its implications is crucial for ensuring compliance with the law and for making informed decisions about healthcare coverage and tax obligations.

Who is required to file the 1095-C form?

+Employers with 50 or more full-time employees, including full-time equivalent employees, are required to file the 1095-C form. This is part of their obligation under the Affordable Care Act’s employer mandate.

What if an employee doesn’t receive their 1095-C form by the deadline?

+Employees should first check with their employer to ensure the form was mailed or is available through an online portal. If the form is not available, employees can contact the IRS for assistance. However, it’s important to note that the IRS does not enforce the employer’s obligation to furnish the form to employees, so penalties for non-compliance fall on the employer.

How does the 1095-C form affect my taxes?

+The 1095-C form provides details about your health coverage during the year, which is essential for determining your tax obligations. If you had employer-provided health insurance, this form will help you understand if you had minimum essential coverage and if you need to report any additional coverage or pay a penalty on your tax return. It can also be used to claim certain tax benefits or credits related to healthcare expenses.