Palm Beach Property Tax

Property taxes in Palm Beach, Florida, are an important consideration for both homeowners and investors. These taxes contribute to the revenue of local governments, which use the funds to provide essential services and maintain infrastructure. In this comprehensive guide, we will delve into the intricacies of Palm Beach property taxes, offering a detailed analysis and insights for property owners and prospective buyers.

Understanding Palm Beach Property Tax Assessments

Property taxes in Palm Beach County are determined through a systematic assessment process. The Property Appraiser’s Office plays a pivotal role in this procedure, evaluating each property’s market value and classifying it based on various factors. These factors include the property’s location, size, improvements, and any applicable exemptions.

Market Value Assessment

The market value of a property is a critical determinant in calculating property taxes. The Property Appraiser’s Office employs a range of methods to estimate this value, including sales comparison, cost approach, and income approach. Sales comparison involves analyzing recent sales of similar properties in the area. The cost approach considers the replacement cost of the property, while the income approach is relevant for income-producing properties, estimating their value based on potential rental income.

It's important to note that the assessed value of a property does not necessarily equate to its actual market value. The assessed value serves as a basis for tax calculations, and it can be challenged by property owners through the appeals process if they believe it is inaccurate.

| Assessment Method | Description |

|---|---|

| Sales Comparison | Analyzes recent sales of comparable properties. |

| Cost Approach | Estimates replacement cost and depreciation. |

| Income Approach | Applicable for rental properties, considers potential income. |

Classification and Exemptions

Properties in Palm Beach County are classified into different categories, each with its own tax rate. The primary classifications include homestead, non-homestead, and agricultural properties. Homestead properties, which are primary residences owned and occupied by Florida residents, benefit from a constitutional tax exemption. This exemption ensures that homestead properties are assessed at a lower rate than non-homestead properties.

Additionally, certain properties may qualify for other exemptions, such as the elderly exemption, disability exemption, or military service exemption. These exemptions can further reduce the taxable value of a property, resulting in lower tax bills.

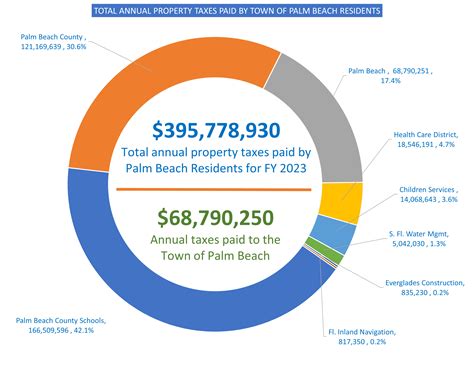

Palm Beach Property Tax Rates and Calculations

The property tax rate in Palm Beach County is established by the local government and various taxing authorities. This rate is expressed as mills, where one mill represents 1 of tax for every 1,000 of assessed value. The tax rate is a combination of the countywide millage rate and the millage rates set by individual taxing authorities, such as municipalities, school districts, and special districts.

Tax Rate Components

The tax rate in Palm Beach County consists of several components, each contributing to the overall rate. These components include:

- Countywide Millage Rate: This rate is set by the Board of County Commissioners and applies uniformly across the county.

- Municipal Millage Rates: Each municipality within the county sets its own millage rate to fund local services and infrastructure.

- School District Millage Rates: The school board determines the millage rate to support public education within its jurisdiction.

- Special District Millage Rates: Special districts, such as water management districts or fire control districts, may also levy taxes to finance specific services or projects.

The combined millage rates from these sources determine the overall tax rate for a property.

Tax Calculation Example

Let’s illustrate the tax calculation process with an example. Assume a property with an assessed value of $500,000 and a combined millage rate of 10 mills.

| Assessed Value | $500,000 |

|---|---|

| Combined Millage Rate | 10 mills |

| Tax Calculation | $500,000 x 0.01 (10 mills) = $5,000 |

In this example, the property owner would owe $5,000 in property taxes for the year.

Tax Bill and Payment Process

Property owners in Palm Beach County receive their tax bills from the Tax Collector’s Office. These bills are typically mailed out in November, and the first installment is due by March 31st of the following year. The second installment is due by September 30th. Property owners have the option to pay their taxes in full or in two installments.

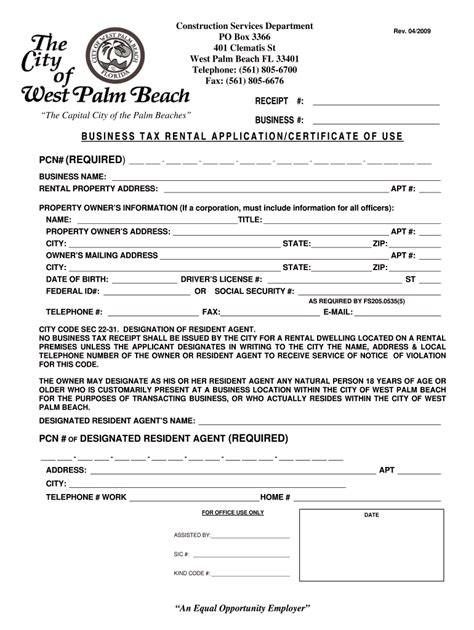

Payment Options

The Tax Collector’s Office offers various payment methods for property taxes, including:

- Online payments through their secure website.

- Mail-in payments using the provided return envelope.

- In-person payments at the Tax Collector's Office or authorized payment locations.

- Automatic payment plans, which allow for automatic deductions from a bank account.

It's important to note that failure to pay property taxes can result in penalties and interest, and in extreme cases, a tax lien or foreclosure.

Appealing Property Tax Assessments

If a property owner believes that their assessed value or tax bill is inaccurate, they have the right to appeal the assessment. The appeals process in Palm Beach County is overseen by the Value Adjustment Board (VAB), which is responsible for hearing and deciding on property tax disputes.

Steps in the Appeals Process

- Filing a Petition: Property owners must file a petition with the VAB within a specified timeframe, usually 25 days after the Notice of Proposed Property Taxes is mailed.

- Providing Evidence: Owners should gather evidence to support their case, such as recent sales data, appraisals, or expert opinions.

- Hearing: The VAB will schedule a hearing where the property owner can present their case and provide evidence.

- Decision: After considering the evidence, the VAB will issue a decision, either upholding or adjusting the assessed value.

It's advisable to consult with a tax professional or legal advisor before initiating the appeals process to ensure a strong case and proper representation.

The Impact of Property Taxes on Real Estate Decisions

Property taxes are a significant factor in real estate investment and homeownership decisions. For investors, understanding the tax implications can influence the choice of properties and strategies. For homeowners, property taxes are a regular expense that must be considered when budgeting and planning.

Investment Considerations

When evaluating investment properties in Palm Beach County, investors should factor in the potential property taxes. Higher tax rates can impact cash flow and overall profitability. Additionally, understanding the tax benefits, such as depreciation and cost segregation, can help optimize tax strategies.

Homeownership Planning

For prospective homebuyers, property taxes are an essential consideration in their decision-making process. Besides the purchase price, ongoing expenses like property taxes should be factored into the budget. Understanding the tax implications can help homeowners plan for these expenses and ensure they are prepared for the financial commitment.

Future Outlook and Potential Changes

The property tax landscape in Palm Beach County is subject to change over time. While the county’s tax rate has remained relatively stable in recent years, there are ongoing discussions and initiatives that could impact future tax rates and assessments.

Potential Future Developments

- Revaluation of Property Values: Periodic revaluations of property values are conducted to ensure assessments remain accurate. These revaluations can result in changes to taxable values and, consequently, tax bills.

- Legislative Changes: Amendments to state or local laws could affect property tax rates, exemptions, or assessment methods. It’s crucial to stay informed about any proposed or enacted changes that may impact tax obligations.

- Economic Factors: Economic conditions, such as inflation or changes in the housing market, can influence property values and, by extension, tax assessments. Monitoring these economic factors can provide insights into potential tax implications.

Conclusion

Understanding Palm Beach property taxes is essential for both homeowners and investors. From assessment processes to tax calculations and payment options, this guide provides a comprehensive overview. By staying informed and proactive, property owners can effectively manage their tax obligations and make informed real estate decisions.

How often are property values reassessed in Palm Beach County?

+Property values in Palm Beach County are reassessed every other year. This means that assessments are updated to reflect current market conditions and property improvements. The reassessment cycle helps ensure that property taxes remain fair and accurate.

Can I qualify for property tax exemptions if I am not a Florida resident?

+While the homestead exemption is primarily for Florida residents, there are other exemptions that may be applicable to non-residents. These include the Save Our Homes Cap, which limits the increase in assessed value for non-homestead properties, and certain disability or veteran exemptions. It’s recommended to consult with a tax professional to determine eligibility.

What happens if I miss the deadline to pay my property taxes?

+If you miss the deadline to pay your property taxes, you may be subject to penalties and interest. The Tax Collector’s Office may also place a tax lien on your property, which could eventually lead to a tax deed sale if the taxes remain unpaid. It’s important to stay on top of payment deadlines to avoid these consequences.