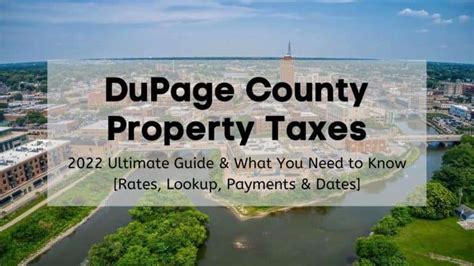

Dupage County Real Estate Taxes

Welcome to a comprehensive exploration of DuPage County's real estate taxes, a crucial aspect of the local economy and a key consideration for property owners and prospective buyers alike. This article aims to provide an in-depth analysis of the tax system, offering insights into how it works, what it entails, and its impact on the community. By delving into specific figures, historical context, and real-world examples, we aim to deliver a comprehensive understanding of DuPage County's real estate tax landscape.

Understanding DuPage County’s Real Estate Tax Structure

DuPage County, nestled in the heart of Illinois, boasts a diverse real estate market, ranging from quaint suburbs to bustling urban centers. As such, the real estate tax system plays a pivotal role in funding essential services and infrastructure while ensuring the county’s continued prosperity.

The real estate tax system in DuPage County operates on a property-based valuation model, where the value of a property determines the amount of tax owed. This valuation is a complex process, involving the assessment of various factors such as location, property size, improvements, and market trends.

Assessment Process

The assessment process is overseen by the DuPage County Assessor’s Office, an independent body responsible for determining the fair market value of each property in the county. This valuation is conducted periodically, typically every few years, to ensure accuracy and fairness. During the assessment, the assessor considers recent sales data, construction costs, and other relevant market factors to arrive at an estimated value for each property.

| Assessment Cycle | Property Valuation |

|---|---|

| Triennial (Every 3 Years) | Based on Market Trends and Recent Sales |

Property owners have the right to appeal their assessed value if they believe it to be inaccurate or unfair. The appeal process provides an opportunity for property owners to present evidence and argue their case before an independent review board.

Tax Rates and Calculations

Once the assessed value of a property is determined, the real estate tax rate is applied to calculate the tax liability. The tax rate is a crucial factor, as it directly impacts the amount of tax owed. In DuPage County, the tax rate is determined by various taxing bodies, including the county government, local municipalities, school districts, and special taxing districts.

The tax rate is expressed as a percentage of the assessed value and is typically composed of multiple components. For instance, the county tax rate may be 1.5%, while the school district tax rate could be 3.25%. These rates are combined to form the total tax rate applicable to a specific property.

| Taxing Body | Tax Rate (%) |

|---|---|

| DuPage County | 1.5 |

| Local Municipality (e.g., City of Wheaton) | 1.2 |

| School District (e.g., DuPage High School District 88) | 3.25 |

| Special Taxing District (e.g., DuPage Forest Preserve) | 0.5 |

| Total Tax Rate | 6.45% |

Using the example above, a property with an assessed value of $500,000 would have a real estate tax liability of $32,250 (6.45% of $500,000). This tax liability is then divided into installments, typically paid twice a year, to ensure a steady revenue stream for the taxing bodies.

Impact of Real Estate Taxes on DuPage County

Real estate taxes play a vital role in shaping the economic landscape of DuPage County. These taxes fund a wide range of essential services and infrastructure projects that directly impact the quality of life for residents.

Funding Essential Services

The revenue generated from real estate taxes is a primary source of funding for critical services provided by the county and its municipalities. These services include public safety (police and fire departments), education (school districts), healthcare (hospitals and clinics), and infrastructure maintenance (roads, bridges, and public transportation). By investing in these areas, DuPage County aims to create a safe, healthy, and prosperous community.

Economic Development and Community Growth

Real estate taxes also contribute to the county’s economic development initiatives. A portion of the tax revenue is allocated towards attracting new businesses, supporting local entrepreneurs, and fostering job growth. This, in turn, leads to increased tax revenue, creating a positive cycle of economic prosperity.

Additionally, real estate taxes fund community development projects, such as parks, recreational facilities, and cultural centers. These amenities enhance the quality of life for residents and contribute to the overall attractiveness of DuPage County as a place to live, work, and invest.

Impact on Property Owners

While real estate taxes are a necessary contribution to the community, they can also represent a significant financial burden for property owners. The tax liability can vary widely depending on the property’s assessed value and the applicable tax rates. As such, property owners must carefully consider the tax implications when purchasing or investing in real estate in DuPage County.

To assist property owners, the county provides resources and tools to estimate tax liabilities, offering transparency and predictability. Property owners can also explore tax incentives and exemptions, such as the Homestead Exemption, which provides a tax reduction for primary residences.

Comparative Analysis: DuPage County vs. Neighboring Counties

To gain a broader perspective on DuPage County’s real estate tax landscape, it is beneficial to compare it with neighboring counties in Illinois. This analysis provides insights into how DuPage County’s tax rates and practices compare to those of its peers.

Tax Rates Across Illinois Counties

Illinois is known for its diverse tax landscape, with varying tax rates across counties. While DuPage County’s tax rates are relatively competitive, some neighboring counties offer lower tax rates, which can impact the attractiveness of certain areas for property owners and investors.

| County | Total Tax Rate (%) |

|---|---|

| DuPage County | 6.45 |

| Cook County | 6.86 |

| Kane County | 6.20 |

| Will County | 5.80 |

| McHenry County | 5.70 |

As seen in the table above, DuPage County's total tax rate is slightly higher than that of Kane and Will Counties but lower than Cook County. This comparison highlights the importance of considering tax rates when making real estate decisions.

Impact on Property Values

The real estate tax landscape can significantly influence property values and market trends. Counties with lower tax rates may experience higher demand and faster appreciation, while areas with higher tax rates may face challenges in attracting buyers.

For example, a comparative analysis of property values in DuPage County and neighboring counties reveals that DuPage County properties tend to appreciate at a slightly slower pace due to its higher tax rates. However, the county's strong economic foundation, excellent schools, and high quality of life continue to attract homebuyers, offsetting the tax-related challenges.

Future Outlook and Potential Changes

The real estate tax landscape in DuPage County is subject to change, influenced by various economic, political, and social factors. Understanding the potential future directions of the tax system can provide valuable insights for property owners, investors, and community members.

Economic Factors

Economic trends, such as changes in the housing market, inflation rates, and employment levels, can significantly impact real estate tax revenue. During periods of economic growth, tax revenue tends to increase, providing additional funding for community initiatives. Conversely, economic downturns can lead to reduced tax revenue, necessitating budget adjustments.

Political Influences

Political decisions at the county and state levels can also affect the real estate tax system. Changes in tax policies, assessment practices, or the distribution of tax revenue can have a direct impact on property owners. For instance, a shift towards a more progressive tax system could result in higher taxes for high-value properties, while a shift towards a more regressive system could burden lower-value properties.

Community Needs and Priorities

The evolving needs and priorities of the community can drive changes in the real estate tax system. As community needs change, taxing bodies may adjust their budgets and tax rates to allocate resources accordingly. For example, if there is a growing demand for improved infrastructure or expanded social services, the tax rate may need to be adjusted to fund these initiatives.

Technological Innovations

Advancements in technology can also play a role in shaping the future of real estate taxes. For instance, the implementation of digital assessment tools and online tax payment systems can enhance efficiency and transparency. Additionally, the use of data analytics can improve the accuracy of property assessments, ensuring a fair and equitable tax system.

Conclusion

DuPage County’s real estate tax system is a complex yet essential component of the local economy. It plays a vital role in funding essential services, driving economic development, and shaping the community’s future. By understanding the assessment process, tax calculations, and potential future changes, property owners and investors can navigate the tax landscape with confidence.

As DuPage County continues to thrive, its real estate tax system will remain a critical tool for sustaining the community's prosperity. Through transparency, fairness, and responsible governance, the county aims to ensure that its real estate taxes support a vibrant, resilient, and thriving community.

How often are properties assessed for real estate taxes in DuPage County?

+Properties in DuPage County are typically assessed every three years as part of a triennial assessment cycle. This process ensures that property values remain up-to-date and fair.

Can property owners appeal their assessed value in DuPage County?

+Absolutely! Property owners have the right to appeal their assessed value if they believe it to be inaccurate or unfair. The appeal process is overseen by an independent review board and provides an opportunity for property owners to present their case.

What are some common tax incentives or exemptions available to property owners in DuPage County?

+DuPage County offers several tax incentives and exemptions, including the Homestead Exemption, which provides a tax reduction for primary residences. Other exemptions may be available for senior citizens, veterans, and certain agricultural properties.

How can property owners stay informed about changes in the real estate tax landscape in DuPage County?

+Property owners can stay informed by regularly checking the DuPage County Assessor’s Office website for updates and announcements. Additionally, subscribing to local news sources and attending community meetings can provide valuable insights into potential tax-related changes.