How Long Do You Keep Tax Returns

In the realm of personal finance and legal obligations, understanding the appropriate duration for retaining tax-related documents is essential. This article aims to provide a comprehensive guide on the topic of tax return retention, offering expert insights and practical advice to ensure you stay compliant and organized.

Navigating Tax Return Retention: A Comprehensive Guide

Tax season is a crucial period that brings about a flurry of activity and a multitude of questions, one of the most common being, "How long should I keep my tax returns and related documents?" While the Internal Revenue Service (IRS) provides guidelines, the specific answer to this question can vary based on individual circumstances and the type of taxes filed.

This guide will delve into the intricacies of tax return retention, offering a detailed breakdown of recommended timelines, storage methods, and exceptional cases. By the end, you'll have a clear understanding of how to manage your tax-related documentation efficiently and securely.

Understanding the IRS Guidelines

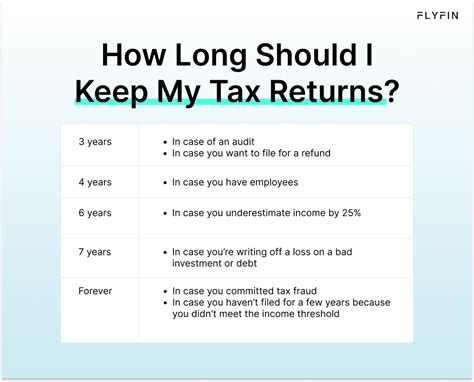

The Internal Revenue Service (IRS) offers general guidelines on tax return retention, suggesting that individuals keep their tax returns and supporting documents for a minimum of three years after the date of filing. This three-year period is a standard recommendation and applies to most taxpayers.

During this timeframe, the IRS may request to audit or review your tax return. Having your records readily available can simplify the process and ensure a smooth interaction with the tax authorities. It's worth noting that the IRS has up to three years from the date you filed your return to initiate an audit, so maintaining your records beyond this period can provide an extra layer of protection.

However, it's important to recognize that certain circumstances may warrant longer retention periods. For instance, if you fail to report income or make a mistake on your return, the IRS has up to six years to audit your return. In more severe cases of fraud or failure to file, the IRS has no time limit to initiate an audit.

Tax Records: A Deeper Dive

Tax records encompass a wide range of documents, including:

- W-2 forms (Wage and Tax Statement)

- 1099 forms (Miscellaneous Income)

- Proof of deductions, such as receipts for charitable donations, business expenses, or medical costs

- Records of capital gains and losses from investments

- Documentation of any tax credits claimed, such as the Child Tax Credit or Education Credits

- Records of any refunds or payments made to the IRS

Ensuring that you retain these documents in an organized manner can greatly simplify the process of filing taxes and responding to any inquiries from the IRS.

Best Practices for Tax Return Retention

While the IRS guidelines provide a baseline, adopting best practices for tax return retention can further enhance your financial security and peace of mind.

Digital Storage

In today's digital age, storing tax returns and related documents electronically offers several advantages. Digital storage provides easy access, eliminates the risk of physical damage or loss, and allows for quick retrieval in case of an audit or review.

Here are some tips for effective digital storage:

- Scan and Save: Use a scanner or smartphone app to digitize your tax returns and supporting documents. Ensure that the scans are high-quality and easily readable.

- Secure Cloud Storage: Consider using secure cloud storage services specifically designed for financial documents. These services often offer enhanced security features and encryption to protect your sensitive information.

- Backup and Redundancy: Always maintain multiple backups of your digital tax records. Store them in different locations, such as an external hard drive and the cloud, to ensure data redundancy and disaster recovery.

- Organize with Folders: Create a systematic folder structure on your computer or cloud storage platform. Label folders with the tax year and relevant categories (e.g., income, deductions, credits) to streamline access.

Physical Storage

For those who prefer physical storage or need to retain certain original documents, here are some recommendations:

- Secure Location: Store your tax returns and supporting documents in a secure location, such as a fireproof safe or a locked cabinet. This protects your records from unauthorized access, theft, or damage.

- Organized Filing System: Use file folders or binders to keep your tax returns and related documents organized by year. Label each folder clearly to facilitate quick access when needed.

- Consider Scanning: While it's important to keep original documents for certain records, such as W-2 forms, consider scanning and digitally storing other supporting documents. This reduces the physical bulk and makes it easier to retrieve information.

Exception Cases: When to Keep Tax Returns Longer

While the standard IRS guideline is to retain tax returns and records for three years, there are certain circumstances where longer retention periods are recommended or required.

Homeownership and Real Estate

If you've recently bought or sold a home, it's advisable to retain your tax records related to the transaction for at least five years. This includes documents such as:

- Purchase and sale agreements

- Mortgage documents

- Property tax records

- Home improvement receipts

These records are essential for tracking capital gains, deductions, and other tax implications associated with real estate transactions.

Business Ownership

For business owners, the retention period for tax records is typically six years. This extended timeframe is due to the complexity of business finances and the potential for more frequent audits.

Retaining business tax records for at least six years is crucial, as it allows for accurate record-keeping and ensures compliance with tax laws. This period also aligns with the IRS's statute of limitations for assessing additional taxes on business returns.

Inheritance and Estate Planning

In cases of inheritance or estate planning, tax records may need to be retained for an extended period, often up to seven years or more. This is especially true if the estate includes complex assets or investments.

Retaining tax records related to inheritance can help with estate tax calculations, ensuring that beneficiaries receive their rightful share and that all tax obligations are met.

Conclusion: A Secure and Compliant Approach

Navigating the complexities of tax return retention can be simplified with the right knowledge and strategies. By understanding the IRS guidelines and adopting best practices for storage and organization, you can ensure that your tax records are secure, accessible, and compliant with legal requirements.

Remember, the length of time you should keep tax returns and related documents depends on your individual circumstances. Whether you're an individual taxpayer, a business owner, or managing complex estate planning, this guide provides a solid foundation for making informed decisions about tax record retention.

FAQs

How long should I keep my tax returns if I’m a business owner?

+

Business owners are advised to retain their tax records for at least six years. This extended period aligns with the IRS’s statute of limitations for assessing additional taxes on business returns and allows for accurate record-keeping.

What if I need to amend my tax return? How long should I keep the amended return?

+

If you need to amend your tax return, it’s crucial to keep the amended return and all supporting documents indefinitely. Amended returns may trigger additional audits or reviews, so having these records readily available is essential.

Can I shred my tax records after the recommended retention period?

+

While you’re not legally required to keep your tax records forever, it’s generally recommended to retain them for at least a few years beyond the recommended retention period. This provides an extra layer of protection in case of any unforeseen audits or inquiries.