Texas Sales Tax Only

Welcome to a comprehensive exploration of the unique world of sales tax in the Lone Star State! Texas, with its rich history and diverse economy, has a sales tax system that is both fascinating and complex. In this expert guide, we will delve into the intricacies of Texas sales tax, uncovering its rules, rates, and real-world implications. Whether you're a business owner, an accountant, or simply curious about the financial landscape of this great state, you're in for a treat! Get ready to dive into the heart of Texas' sales tax regime, and discover the ins and outs of this essential revenue stream.

Understanding the Texas Sales Tax Landscape

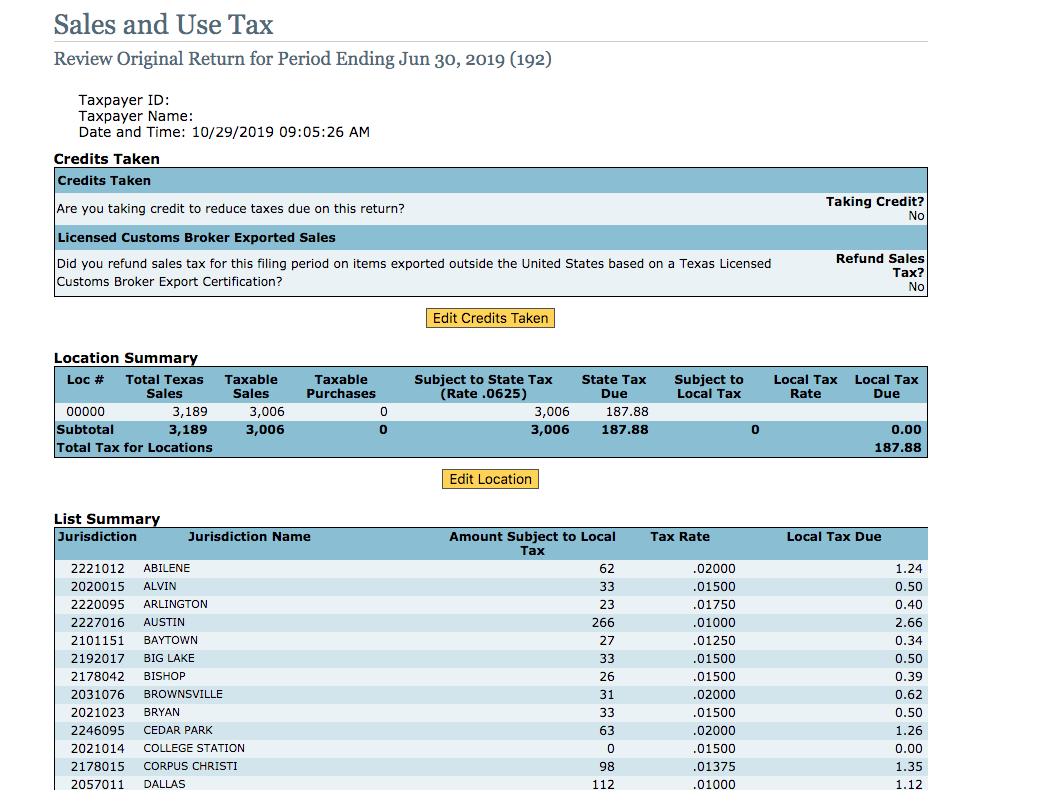

Texas is renowned for its vibrant economy and diverse business landscape, and at the heart of this prosperity lies its sales tax system. With a statewide sales tax rate of 6.25%, Texas has one of the highest base sales tax rates in the nation. However, this is just the beginning of the story. The Texas sales tax system is a dynamic beast, with various local and special taxes adding complexity and nuance.

The state of Texas allows local jurisdictions, such as cities, counties, and special purpose districts, to impose additional sales taxes. These local option taxes can significantly impact the total sales tax rate, with some areas boasting rates as high as 8.25%. For instance, in the bustling city of Austin, the total sales tax rate stands at 8.25%, with the city and county adding an extra 2% on top of the state rate.

But that's not all. Texas also has a range of special taxes that apply to specific goods and services. These include taxes on prepared food (ranging from 1% to 2%), rental cars (6.25%), and telecommunications services (ranging from 4.5% to 17%). Additionally, there are surcharges on certain items like alcohol and tobacco products, further complicating the sales tax landscape.

| Category | Tax Rate |

|---|---|

| State Sales Tax | 6.25% |

| Local Option Taxes | Varies (up to 2% additional) |

| Prepared Food Tax | 1% - 2% |

| Rental Car Tax | 6.25% |

| Telecommunications Tax | 4.5% - 17% |

To illustrate the complexity, let's consider a real-world example. Imagine you're purchasing a new smartphone in Houston, Texas. With a state sales tax rate of 6.25% and a local option tax of 1%, the total sales tax on your purchase would be 7.25%. However, if you were to buy that same smartphone in San Antonio, where the local option tax is 2%, your total sales tax would be 8.25%! These variations in tax rates across different regions of the state can have a significant impact on businesses and consumers alike.

The Impact of Texas Sales Tax on Businesses

The diverse sales tax landscape in Texas has a profound impact on businesses, big and small. For retailers, the challenge lies in navigating the complex web of tax rates and ensuring compliance. This involves understanding not only the state sales tax rate but also the local option taxes and special taxes that apply to their specific location and industry.

Consider a small business owner, Jane, who operates a bakery in a small town in Texas. Jane must not only calculate the sales tax for her baked goods but also understand the prepared food tax that applies to her business. On top of that, she might need to consider additional taxes for specific items, such as a telecommunications tax on her business phone line or a rental car tax if she leases a vehicle for deliveries.

Large corporations face an even greater challenge. With multiple locations across the state, they must ensure consistent compliance across all their stores. This requires a sophisticated understanding of the varying tax rates and the ability to implement robust tax collection and reporting systems. For example, a major retailer like Walmart, with numerous stores in Texas, would need to navigate the complex sales tax landscape to ensure accurate tax collection and avoid potential audits and penalties.

Sales Tax Compliance and Challenges

Ensuring sales tax compliance in Texas is no small feat. Businesses must accurately calculate and collect the appropriate sales tax based on their location and the nature of the goods or services they provide. This involves staying up-to-date with the ever-changing tax rates and regulations, as well as implementing efficient tax collection systems.

One of the key challenges businesses face is tax rate changes. Texas sales tax rates can fluctuate due to various factors, such as legislative decisions or local referendums. For example, in 2019, the city of Dallas increased its local option tax rate from 1% to 2%, resulting in a total sales tax rate of 8.25%. Businesses operating in Dallas had to quickly adapt to this change, ensuring their tax collection systems were updated accordingly.

Another challenge lies in special tax considerations. As mentioned earlier, Texas has a range of special taxes that apply to specific goods and services. Businesses must be aware of these taxes and ensure they are correctly applied to the right items. For instance, a restaurant owner must understand the prepared food tax and how it applies to their menu items, while a car rental agency must calculate and collect the rental car tax accurately.

Texas Sales Tax and Consumer Behavior

The sales tax system in Texas also has a significant impact on consumer behavior and purchasing decisions. The varying tax rates across different regions can influence where consumers choose to shop, with some seeking out lower tax rates to save money.

Consider a scenario where a consumer, John, is planning to purchase a new television. He discovers that the sales tax rate in his local area is 8.25%, while a neighboring city has a lower rate of 7.25%. John might decide to drive to the neighboring city to make his purchase, saving himself a considerable amount of money in sales tax. This behavior, known as border shopping, is a common phenomenon in states with varying sales tax rates, as consumers seek out the most favorable tax environments.

However, it's not just about the tax rates. The perceived fairness of the sales tax system also plays a role in consumer behavior. Some consumers may feel that certain special taxes, such as the prepared food tax or telecommunications tax, are unfair or excessive. This can lead to resistance or even avoidance of certain purchases, impacting businesses that rely on these sales.

The Impact of Sales Tax Holidays

To encourage consumer spending and provide relief, Texas, like many other states, offers sales tax holidays during specific periods. During these holidays, certain items are exempt from sales tax, making them more affordable for consumers. These holidays often target essential items, such as back-to-school supplies or emergency preparedness items.

For example, in Texas, there is an annual Sales Tax Holiday that typically takes place over a weekend in August. During this time, qualifying items such as clothing, footwear, and school supplies are exempt from sales tax. This holiday provides a significant boost to retailers, as consumers take advantage of the tax-free period to stock up on these items. It also helps stimulate the economy by encouraging spending and reducing the financial burden on families.

The Future of Texas Sales Tax

As we look ahead, the future of Texas sales tax is an intriguing prospect. With the ever-evolving landscape of e-commerce and online sales, the state will need to adapt its sales tax system to keep up with changing consumer behavior and technological advancements.

One potential area of focus is the digital sales tax. As more and more transactions move online, Texas may need to consider implementing a digital sales tax to capture revenue from out-of-state sellers who currently do not collect sales tax on their online sales. This could help level the playing field for local businesses and ensure a more equitable tax system.

Additionally, with the increasing use of sales tax automation tools, Texas businesses may be able to streamline their sales tax compliance processes. These tools can help businesses accurately calculate and collect sales tax, ensuring compliance and reducing the risk of audits and penalties. By embracing technology, businesses can focus more on their core operations and less on the complexities of sales tax.

Potential Reforms and Future Outlook

There is ongoing debate about potential reforms to the Texas sales tax system. Some argue for a simplification of the tax structure, proposing a uniform tax rate across the state to reduce complexity and administrative burdens. Others suggest an expansion of the tax base to include certain services, which could provide a more stable and reliable revenue stream for the state.

Regardless of the specific reforms proposed, the future of Texas sales tax is likely to be shaped by a combination of economic factors, technological advancements, and legislative decisions. As the state continues to grow and evolve, its sales tax system will need to adapt to meet the changing needs of businesses and consumers alike.

How often do sales tax rates change in Texas?

+

Sales tax rates in Texas can change periodically, typically as a result of legislative decisions or local referendums. It is important for businesses and consumers to stay informed about any changes to ensure compliance and make informed purchasing decisions.

Are there any tax-free items in Texas?

+

Yes, Texas offers sales tax holidays for specific items, such as clothing, footwear, and school supplies. During these holidays, these items are exempt from sales tax, providing a financial benefit to consumers.

What happens if a business fails to collect the correct sales tax in Texas?

+

Businesses that fail to collect the correct sales tax in Texas may face penalties and audits from the Texas Comptroller of Public Accounts. It is crucial for businesses to ensure accurate tax collection and compliance to avoid these consequences.