What Is Consumption Tax

The concept of consumption tax is an integral part of modern economic systems, influencing both personal finances and broader economic policies. It is a type of indirect tax levied on the consumption or purchase of goods and services, playing a significant role in a country's revenue generation and fiscal planning.

Understanding Consumption Tax

Consumption tax is a broad term encompassing various taxes imposed on the consumption of products and services. These taxes are often designed to generate revenue for the government and can have significant implications for consumers and businesses alike. Unlike income taxes, which are directly paid by individuals or businesses based on their earnings, consumption taxes are usually embedded in the prices of goods and services, making them an indirect tax.

The primary types of consumption taxes include:

- Value Added Tax (VAT): A VAT is applied at each stage of the supply chain, from production to retail. It is usually included in the selling price of a product or service, and businesses can reclaim the VAT they've paid on purchases.

- Sales Tax: This tax is applied to the final sale of a good or service to the consumer. It is typically a percentage of the purchase price and is often calculated at the point of sale.

- Excise Tax: Excise taxes are imposed on specific goods, such as tobacco, alcohol, or fuel. They are often included in the retail price and are designed to discourage the consumption of these products.

Impact and Benefits of Consumption Taxes

Consumption taxes have a wide-ranging impact on the economy. Firstly, they provide a significant source of revenue for governments, which can be used to fund public services, infrastructure projects, and social programs. This revenue stability is particularly beneficial in times of economic downturn when other tax revenues might decrease.

Secondly, consumption taxes can encourage savings and investment. Unlike income taxes, which are levied on earnings regardless of how the money is spent, consumption taxes only apply to spending. This means that individuals who save or invest their money rather than spending it can reduce their tax burden. This incentive can lead to increased savings rates and more capital available for investment, which can stimulate economic growth.

| Country | Consumption Tax Type | Rate |

|---|---|---|

| United States | Sales Tax | Varies by State |

| European Union | Value Added Tax (VAT) | Standard Rate: 15-25% |

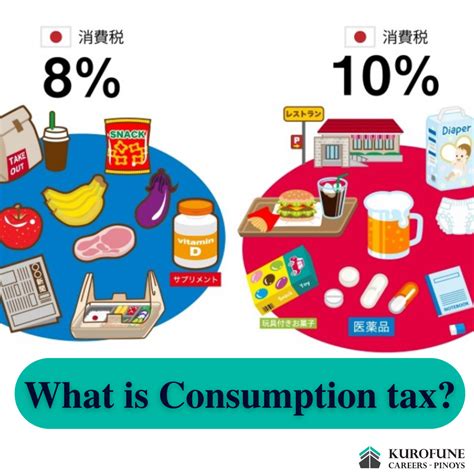

| Japan | Consumption Tax (VAT) | 10% |

Moreover, consumption taxes can be more equitable than income taxes. Since consumption taxes are often levied as a percentage of the purchase price, they affect higher-income individuals more than lower-income individuals for the same goods and services. This can help to redistribute wealth and promote social equity.

Challenges and Considerations

However, consumption taxes also come with certain challenges. They can be regressive, meaning they disproportionately affect lower-income individuals who spend a higher proportion of their income on taxable goods and services. This can lead to calls for additional measures to ensure tax fairness.

Additionally, the administration and compliance of consumption taxes can be complex, especially for businesses operating in multiple jurisdictions with different tax rates and regulations. This complexity can lead to increased costs for businesses and potential tax evasion or avoidance.

From a consumer perspective, the inclusion of consumption taxes in the prices of goods and services can make it difficult for individuals to understand the true cost of their purchases. This lack of transparency can lead to confusion and potentially impact consumer behavior.

Global Perspectives on Consumption Tax

The implementation and structure of consumption taxes vary significantly across countries. For instance, the United States primarily uses sales tax, which is administered and set by individual states, leading to a complex system with varying rates and rules.

In contrast, many European countries employ a Value Added Tax (VAT) system, which is applied uniformly across the EU, with some countries allowed to have reduced rates for specific goods or services. This uniformity simplifies compliance for businesses operating across multiple EU countries.

Japan has its own version of a consumption tax, which is a Value Added Tax with a single rate applied nationwide. This simplicity aids in tax administration and understanding for both businesses and consumers.

Future Implications and Trends

Looking ahead, consumption taxes are likely to remain a critical component of government revenue strategies. With the increasing digitalization of the economy, the challenge will be to ensure that consumption taxes are applied fairly and efficiently across both traditional and digital sectors.

Furthermore, as sustainability and environmental concerns become more prominent, consumption taxes may play a role in influencing consumer behavior towards more sustainable choices. For example, excise taxes on single-use plastics or carbon-intensive goods could encourage consumers to adopt more eco-friendly alternatives.

Conclusion

Consumption taxes are a fundamental aspect of economic policy, impacting individuals, businesses, and governments alike. While they provide a stable source of revenue and can encourage savings and investment, they also present challenges related to fairness and administration. Understanding the different types of consumption taxes and their implications is essential for making informed financial and business decisions.

What is the difference between consumption tax and income tax?

+Consumption tax is levied on the purchase of goods and services, while income tax is levied on earnings from work or investments. Consumption taxes are usually embedded in the prices of goods and services, making them an indirect tax, whereas income taxes are directly paid by individuals or businesses based on their earnings.

How do consumption taxes impact the economy?

+Consumption taxes provide a significant source of revenue for governments, which can be used to fund public services and infrastructure. They can also encourage savings and investment, as individuals who save or invest their money rather than spending it can reduce their tax burden. However, they can be regressive and impact lower-income individuals more significantly.

What are the different types of consumption taxes, and how do they work?

+The primary types of consumption taxes include Value Added Tax (VAT), Sales Tax, and Excise Tax. VAT is applied at each stage of the supply chain and can be reclaimed by businesses. Sales Tax is applied to the final sale of a good or service to the consumer. Excise Tax is imposed on specific goods like tobacco or alcohol.