California San Jose Sales Tax

The city of San Jose, nestled in the heart of Silicon Valley, California, is not just a tech hub but also a bustling commercial center with its own unique tax landscape. Understanding the sales tax structure in this vibrant city is crucial for both businesses and consumers alike.

Unraveling the San Jose Sales Tax: A Comprehensive Guide

San Jose, with its diverse economy and thriving local businesses, has a sales tax system that reflects its dynamic nature. Let’s delve into the specifics and uncover the intricacies of this tax.

The Basics of San Jose Sales Tax

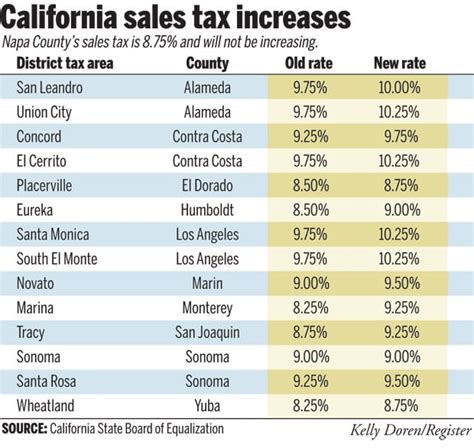

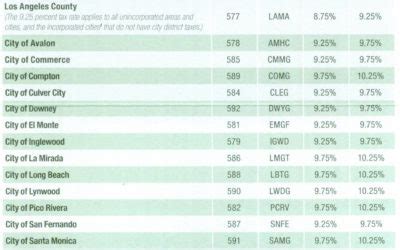

The sales tax in San Jose operates on a multi-level structure, comprising both state and local taxes. As of the last update, the state sales tax rate in California stands at 7.25%, while San Jose adds an additional 0.875% to this, bringing the total sales tax rate in the city to 8.125%. This rate is applicable to most goods and services sold within the city limits.

However, it's important to note that sales tax in California, and by extension in San Jose, is not a uniform entity. It varies based on the type of goods or services being sold and can be influenced by various factors, including the location of the transaction and the nature of the business.

| Tax Type | Rate |

|---|---|

| State Sales Tax | 7.25% |

| San Jose City Tax | 0.875% |

| Total Sales Tax in San Jose | 8.125% |

Diving Deeper: How San Jose’s Sales Tax Works

San Jose’s sales tax is levied on the sale of tangible personal property, certain digitally transmitted products, and selected services. This includes items like clothing, electronics, furniture, and even admission tickets to certain events. The tax is collected by the seller at the point of sale and is then remitted to the California Department of Tax and Fee Administration (CDTFA), which is responsible for sales tax administration in the state.

It's worth noting that San Jose, like many other cities in California, has a Use Tax in addition to the sales tax. Use Tax is applicable when goods are purchased from out-of-state vendors and brought into the city for use. This tax is often overlooked, but it ensures that residents pay tax on goods purchased online or from catalogs, maintaining a level playing field for local businesses.

Tax Exemptions and Special Cases in San Jose

While the general sales tax rate in San Jose is 8.125%, there are certain items and situations where the tax is either reduced or waived altogether. For instance, groceries and prescription drugs are subject to a lower tax rate of 1%, a significant relief for residents’ daily essentials.

Additionally, certain types of businesses, like nonprofit organizations, may be eligible for tax exemptions or reduced tax rates. This is especially relevant for charities, educational institutions, and religious organizations that often have unique tax considerations.

| Item/Service | Tax Rate |

|---|---|

| Groceries | 1% |

| Prescription Drugs | 1% |

| Nonprofit Sales | Varies; may be exempt |

Compliance and Penalties: A Word of Caution

Sales tax compliance is a serious matter in San Jose, and non-compliance can lead to significant penalties. Businesses are required to obtain a seller’s permit from the CDTFA and are responsible for accurately calculating and remitting sales tax on a regular basis. Failure to do so can result in fines, interest charges, and even criminal penalties in extreme cases.

It's crucial for businesses to stay informed about their tax obligations and to utilize proper accounting practices to ensure compliance. The CDTFA provides resources and guidance to help businesses navigate the complex world of sales tax, including registration, reporting, and payment processes.

The Future of Sales Tax in San Jose: Trends and Predictions

Looking ahead, the sales tax landscape in San Jose is expected to remain dynamic. With the ever-evolving digital economy and the rise of e-commerce, the way sales tax is collected and remitted is likely to see further changes. The city and state may need to adapt their tax systems to keep up with the digital age, potentially introducing new tax categories or modifying existing ones.

Furthermore, with the ongoing discussion around tax equity and the need to support local businesses, San Jose might explore innovative ways to utilize sales tax revenue for community development and economic stimulation. This could include initiatives to promote small businesses, invest in infrastructure, or provide tax incentives for specific industries.

Conclusion: A Complex Yet Vital Component of San Jose’s Economy

In conclusion, understanding the sales tax system in San Jose is crucial for both businesses and consumers. It impacts the city’s economic landscape, influencing consumer behavior, business decisions, and even the overall tax revenue that funds essential services and infrastructure. As San Jose continues to thrive and adapt, its sales tax system will remain a key component of its economic vitality.

What is the difference between sales tax and use tax in San Jose?

+Sales tax is charged on goods and services sold within San Jose, while use tax is applicable when goods are purchased from out-of-state vendors and brought into the city. Use tax ensures that residents pay tax on online or catalog purchases, maintaining fairness for local businesses.

Are there any special tax rates for businesses in San Jose?

+Yes, certain types of businesses, like nonprofits, may be eligible for tax exemptions or reduced tax rates. It’s important for businesses to consult with tax professionals to understand their specific tax obligations.

How often do businesses need to remit sales tax in San Jose?

+The frequency of sales tax remittance depends on the business’s sales volume. Typically, businesses with higher sales volumes are required to remit sales tax more frequently. It’s crucial for businesses to adhere to the CDTFA’s guidelines to avoid penalties.