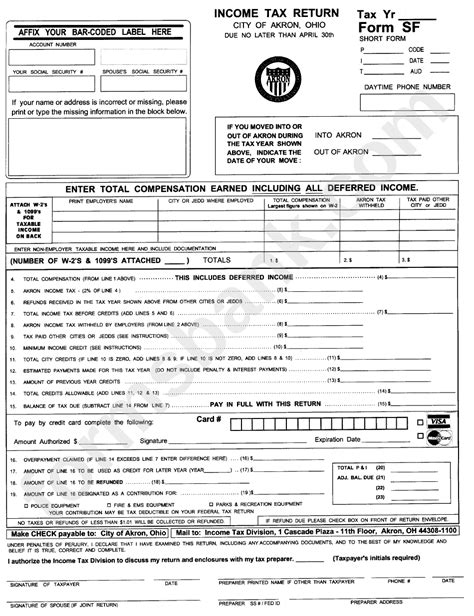

City Of Akron Income Tax

Welcome to a comprehensive exploration of the City of Akron's income tax system. This journal-style article aims to provide an in-depth analysis, shedding light on the intricacies of this municipal tax structure and its impact on the local economy. With a focus on the City of Akron Income Tax, we will delve into the tax rates, regulations, and the revenue it generates for the city's development and growth.

The City of Akron: A Brief Overview

Nestled in the heart of Summit County, Ohio, the City of Akron is a vibrant urban center with a rich history and a thriving community. With a population of approximately 190,000 residents, Akron plays a crucial role in the state’s economic landscape. Known for its innovation and resilience, Akron has a diverse economy, ranging from manufacturing and healthcare to education and technology.

The city's tax structure is an essential component of its economic framework, contributing to the funding of vital services, infrastructure development, and community initiatives. Understanding the intricacies of the City of Akron Income Tax is key to comprehending the city's financial landscape and its impact on both residents and businesses.

Understanding the City of Akron Income Tax

The City of Akron levies an income tax on its residents and businesses, contributing to the city’s overall revenue stream. This municipal tax is a critical component of Akron’s financial strategy, providing a stable source of income for essential services and development projects.

Tax Rates and Structure

The City of Akron Income Tax operates on a graduated rate system, meaning that tax rates increase as income levels rise. This progressive structure ensures that higher-income earners contribute a larger share of their income to the city’s revenue. As of the latest available information, the tax rates for the City of Akron are as follows:

| Income Bracket | Tax Rate |

|---|---|

| $0 - $10,000 | 1.5% |

| $10,001 - $25,000 | 1.75% |

| $25,001 - $50,000 | 2% |

| $50,001 and above | 2.25% |

These rates are applicable to both residents and businesses operating within the city limits of Akron. It's important to note that the tax rates are subject to change based on legislative decisions and economic considerations.

Taxable Income and Exemptions

The City of Akron Income Tax is assessed on various sources of income, including wages, salaries, commissions, bonuses, and self-employment earnings. Additionally, certain types of income, such as pensions, Social Security benefits, and unemployment compensation, are exempt from city income tax. This ensures that individuals with fixed incomes or those relying on government assistance are not unduly burdened.

Businesses, on the other hand, are required to withhold income tax from their employees' wages and remit it to the city. They are also responsible for paying income tax on their net profits. However, there are provisions for tax credits and deductions, which can reduce the overall tax liability for both individuals and businesses.

Revenue Generation and Allocation

The revenue generated through the City of Akron Income Tax is a significant source of funding for the city’s operations and development projects. It contributes to the maintenance and improvement of infrastructure, including roads, bridges, and public facilities. Additionally, the tax revenue supports vital services such as education, public safety, healthcare, and social welfare programs.

The city's budget allocation process ensures that the revenue is distributed across various departments and initiatives, prioritizing areas of need and strategic development. This revenue stream plays a crucial role in sustaining the city's economic growth and enhancing the quality of life for its residents.

Impact and Analysis

The City of Akron Income Tax has a profound impact on the local economy, influencing the financial well-being of residents and businesses alike. By examining the tax’s implications, we can gain valuable insights into its effectiveness and potential areas for improvement.

Economic Growth and Development

The revenue generated through the income tax plays a pivotal role in fostering economic growth and development within Akron. It provides the necessary funding for infrastructure upgrades, business incentives, and community development projects. These investments create a more attractive business environment, encouraging entrepreneurship and attracting new industries to the city.

Additionally, the tax revenue supports initiatives aimed at enhancing the city's competitiveness, such as technology upgrades, workforce development programs, and business support services. By investing in these areas, Akron can position itself as a thriving economic hub, attracting investment and creating job opportunities for its residents.

Community Impact and Services

The City of Akron Income Tax directly impacts the quality of life for residents by funding essential community services. Revenue allocation for education, healthcare, and social services ensures that the city’s residents have access to high-quality public schools, affordable healthcare options, and support systems for vulnerable populations.

Furthermore, the tax revenue contributes to the maintenance and improvement of public spaces, recreational facilities, and cultural institutions. These amenities enhance the overall well-being and satisfaction of residents, creating a vibrant and engaging community. The tax, therefore, plays a crucial role in building a strong and cohesive society.

Comparative Analysis

Comparing the City of Akron Income Tax to similar municipal tax structures provides valuable insights into its competitiveness and effectiveness. While Akron’s tax rates are relatively moderate, they are strategically structured to encourage economic growth while ensuring a fair contribution from higher-income earners.

A comprehensive analysis of other cities' tax structures and their impact on economic development can provide valuable lessons for Akron. By studying best practices and successful strategies, the city can further refine its tax policies to maximize economic growth and community well-being.

Future Implications and Strategies

Looking ahead, the City of Akron Income Tax will continue to play a vital role in shaping the city’s economic landscape and community development. As the city evolves and adapts to changing economic conditions, a forward-thinking approach to tax policy is essential.

Potential Adjustments and Reforms

The city may consider adjustments to its tax structure to maintain a competitive edge and adapt to the evolving economic landscape. This could involve reevaluating tax rates, exploring incentives for specific industries, or introducing new tax credits to support targeted development initiatives.

Additionally, the city may explore options for tax reform, such as simplifying the tax filing process, enhancing taxpayer education, or implementing digital technologies to streamline tax administration. These reforms can improve efficiency, reduce compliance burdens, and enhance taxpayer satisfaction.

Sustainable Development and Community Engagement

As Akron continues to grow and develop, a focus on sustainable practices and community engagement is crucial. The income tax revenue can be strategically allocated to support environmentally conscious initiatives, such as green infrastructure projects, renewable energy programs, and sustainable transportation options.

Furthermore, engaging the community in decision-making processes related to tax revenue allocation can foster a sense of ownership and accountability. By involving residents in identifying priority areas for investment, the city can ensure that tax revenue is directed towards initiatives that align with the community's vision and needs.

Economic Resilience and Long-Term Planning

Building economic resilience is essential for Akron’s long-term prosperity. The city can leverage its income tax revenue to invest in strategic initiatives that enhance its economic resilience, such as diversifying its economic base, supporting small businesses, and fostering innovation.

Long-term planning, backed by sustainable funding from the income tax, can ensure that Akron remains competitive and adaptable in the face of economic challenges. By investing in infrastructure, workforce development, and business support, the city can position itself for continued growth and prosperity.

Conclusion

The City of Akron Income Tax is a vital component of the city’s economic framework, contributing to its growth, development, and community well-being. Through a progressive tax structure, the city ensures a fair contribution from its residents and businesses, while also providing essential funding for vital services and infrastructure.

As Akron continues to evolve, a strategic approach to tax policy and revenue allocation will be key to its success. By adapting to changing economic conditions, engaging the community, and investing in sustainable development, the city can thrive and create a bright future for its residents. The City of Akron Income Tax remains a powerful tool in shaping a prosperous and vibrant urban center.

How does the City of Akron Income Tax impact local businesses?

+

The City of Akron Income Tax affects local businesses by requiring them to withhold income tax from their employees’ wages and remit it to the city. Additionally, businesses pay income tax on their net profits. However, tax credits and deductions can reduce their overall tax liability. The tax revenue supports infrastructure, services, and initiatives that create a favorable business environment, encouraging economic growth and development.

What are the tax rates for residents and businesses in Akron?

+

As of the latest available information, the City of Akron Income Tax rates are graduated, with rates increasing as income levels rise. The rates are 1.5% for income up to 10,000, 1.75% for income between 10,001 and 25,000, 2% for income between 25,001 and 50,000, and 2.25% for income above 50,001. These rates apply to both residents and businesses operating within the city limits.

How is the revenue from the City of Akron Income Tax allocated?

+

The revenue generated from the City of Akron Income Tax is allocated across various departments and initiatives based on the city’s budget allocation process. It primarily funds essential services such as education, public safety, healthcare, and social welfare programs. Additionally, it supports infrastructure development, community initiatives, and economic development projects, contributing to the overall growth and well-being of the city.

What are the potential benefits of the City of Akron’s income tax structure for economic growth?

+

The City of Akron’s income tax structure, with its progressive rates, can encourage economic growth by providing funding for infrastructure upgrades, business incentives, and community development projects. This creates a more attractive business environment, attracts new industries, and fosters entrepreneurship. Additionally, the tax revenue can support initiatives aimed at enhancing the city’s competitiveness, such as technology upgrades and workforce development programs.