De Franchise Tax

Franchise tax, also known as a privilege tax or an income privilege tax, is a unique type of levy imposed on corporations and certain legal entities by various state governments in the United States. It is a critical component of the tax landscape, particularly for businesses operating across multiple jurisdictions, as it can significantly impact their financial obligations and planning strategies.

Understanding Franchise Tax: A Complex Layer in Taxation

Franchise tax is a mandatory fee, often calculated based on a company’s net worth, capital stock, or income, that grants them the privilege of doing business in a specific state. Unlike income tax, which is typically levied on profits, franchise tax is an annual fee assessed irrespective of a company’s profitability. This means that even if a corporation incurs losses, it may still be liable for franchise tax payments.

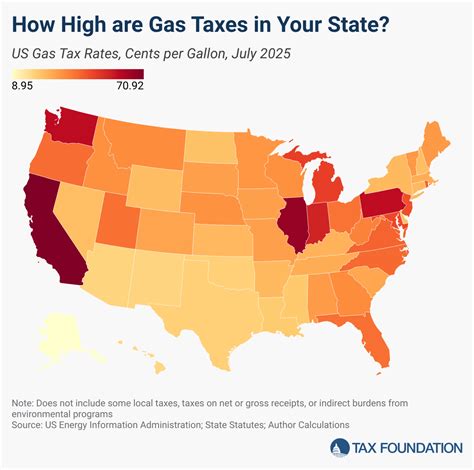

The complexity of franchise tax lies in its variation across different states. Each state has its own rules and regulations regarding the calculation, due dates, and exemption criteria for this tax. For instance, some states like Delaware and Nevada have no franchise tax, making them attractive incorporation destinations for businesses. On the other hand, states like Texas and Pennsylvania have complex franchise tax calculations that consider factors like total revenue, margin, and asset value.

Key Features and Considerations of Franchise Tax

Franchise tax is characterized by its distinct nature and implications for businesses. Here are some critical aspects to consider:

- State-Specific Variations: Every state has its own franchise tax rules, leading to a complex web of compliance requirements for businesses operating in multiple states. This can make tax planning and preparation a challenging task, often requiring the expertise of tax professionals.

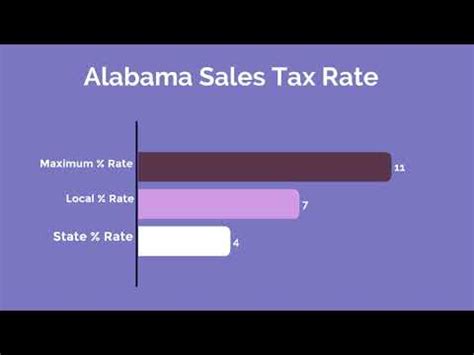

- Calculation Methods: The methods for calculating franchise tax differ widely. Some states use a simple flat rate, while others employ more intricate formulas that consider various financial metrics. For instance, California’s franchise tax is based on a corporation’s net income, while Texas calculates it based on the greater of a corporation’s margin or total revenue.

- Due Dates: Franchise tax due dates are typically annual, but the exact date can vary by state. For example, the deadline for Texas franchise tax is May 15th, whereas in California, it is April 15th.

- Exemptions and Credits: Certain entities, like S-corporations, limited liability companies (LLCs), and non-profit organizations, may be exempt from franchise tax in some states. Additionally, states may offer credits or deductions for various factors, such as business location or employment generation.

| State | Franchise Tax Calculation Method | Due Date |

|---|---|---|

| Texas | Greater of corporation's margin or total revenue | May 15th |

| California | Based on net income | April 15th |

| New York | Varies based on entity type | March 15th |

Impact of Franchise Tax on Business Operations

Franchise tax has a profound influence on business operations, particularly for entities operating across state lines. Here’s a deeper look at its implications:

Financial Considerations

Franchise tax adds a significant financial burden to businesses, especially those with operations in multiple states. This tax can impact a company’s cash flow and profitability, especially if it has a high revenue base or operates in states with complex franchise tax structures. For instance, a business with operations in both Texas and California would need to manage tax obligations in two distinct systems, each with its own calculation method and due date.

Compliance and Administrative Challenges

Navigating the intricacies of franchise tax laws across different states can be a daunting task. Businesses must ensure compliance with varying regulations, which often require detailed financial reporting and timely filing. Failure to comply can lead to penalties and interest charges, further impacting a company’s financial health. Moreover, the administrative burden of managing franchise tax obligations can divert valuable resources away from core business operations.

Strategic Planning and Business Decisions

Franchise tax considerations can influence key business decisions, such as where to locate operations, how to structure the business, and which states to expand into. For instance, a business may choose to incorporate in a state with no franchise tax, like Delaware, to minimize its tax obligations. Alternatively, it might opt to structure itself as an LLC, which is often exempt from franchise tax in many states.

Furthermore, businesses must consider the cumulative effect of franchise tax across multiple states. In some cases, the total franchise tax liability could exceed the corporation’s income tax liability, making tax planning a critical aspect of financial strategy.

Strategies for Effective Franchise Tax Management

Given the complexity and impact of franchise tax, businesses need to adopt effective strategies for management and planning. Here are some key approaches:

Seek Expert Advice

Engaging the services of tax professionals with expertise in franchise tax can be invaluable. These experts can provide insights into state-specific laws, help with compliance, and offer strategies to optimize tax liabilities. They can also assist in preparing the necessary documentation and ensuring timely filing, reducing the risk of penalties.

Implement Robust Tax Planning

Businesses should develop comprehensive tax planning strategies that account for franchise tax obligations. This involves understanding the tax laws of all states in which the business operates and identifying potential opportunities for savings. Tax planning can include structuring the business in a way that minimizes tax liabilities, such as leveraging exemptions or credits offered by certain states.

Utilize Technology and Automation

Implementing technology solutions can streamline franchise tax management. Tax software can automate many of the complex calculations and reporting requirements, reducing the risk of errors and ensuring compliance. Additionally, these tools can provide real-time insights into tax obligations, helping businesses stay on top of their financial responsibilities.

Stay Informed and Updated

Franchise tax laws are subject to change, and businesses must stay informed about any updates or amendments. Regularly reviewing state tax websites and following tax news can help businesses stay compliant and plan effectively. Subscribing to tax alerts or newsletters can provide timely updates on changes that may impact a business’s tax obligations.

Conclusion: Navigating the Franchise Tax Landscape

Franchise tax is a critical consideration for businesses, especially those with multi-state operations. Its complexity and impact on financial health make it a key factor in business planning and strategy. By understanding the intricacies of franchise tax, engaging expert advice, and implementing effective management strategies, businesses can navigate this landscape successfully, ensuring compliance and optimizing their tax obligations.

What is the primary purpose of franchise tax?

+Franchise tax is levied by state governments to grant corporations and certain legal entities the privilege of doing business within their borders. It is a critical revenue source for states and a way to regulate and control business activities within their jurisdiction.

How is franchise tax calculated?

+Franchise tax calculation methods vary by state. Some states use a simple flat rate, while others employ complex formulas that consider factors like net worth, capital stock, or income. For instance, Texas calculates franchise tax based on the greater of a corporation’s margin or total revenue.

Are there any exemptions or credits for franchise tax?

+Yes, certain entities like S-corporations, LLCs, and non-profit organizations may be exempt from franchise tax in some states. Additionally, states may offer credits or deductions for various factors, such as business location or employment generation.

How can businesses stay updated on franchise tax laws and changes?

+Businesses should regularly review state tax websites and follow tax news. Subscribing to tax alerts or newsletters can provide timely updates on changes that may impact their tax obligations. Engaging tax professionals can also ensure businesses are informed about the latest developments.