Maine Tax Refund Status

Are you a resident of the Pine Tree State wondering about the status of your Maine tax refund? The Maine Revenue Services (MRS) processes income tax returns and issues refunds to eligible taxpayers. In this comprehensive guide, we'll delve into the intricacies of tracking your Maine tax refund status, understanding the refund process, and exploring ways to optimize your refund journey. From understanding the factors that influence refund timing to discovering online tools and resources, we'll ensure you have all the information you need.

Understanding the Maine Tax Refund Process

The journey of your tax refund begins with the submission of your Maine income tax return. The MRS meticulously processes these returns, ensuring compliance with state tax laws and regulations. Here’s a simplified breakdown of the key stages:

1. Return Processing

Upon receiving your tax return, the MRS initiates a comprehensive review process. This involves verifying your personal information, income sources, deductions, and credits. It’s during this stage that any discrepancies or errors in your return might be identified, triggering additional scrutiny or potential delays.

2. Refund Calculation

Once your return passes the initial scrutiny, the MRS calculates your refund amount. This calculation takes into account your total tax liability, any credits or deductions you’re eligible for, and the state’s current tax rates. The accuracy of this calculation is paramount, as it directly impacts the amount you’ll receive.

3. Payment Processing

With the refund amount determined, the MRS proceeds to the payment processing stage. Here, they ensure that the correct refund amount is allocated to your designated refund method. Whether it’s a direct deposit to your bank account or a mailed check, this stage ensures the timely and accurate disbursement of your refund.

4. Refund Disbursement

Finally, the MRS disburses your refund according to the selected method. If you opted for direct deposit, you can expect the funds to hit your account within a few business days. For mailed checks, the timeline might be slightly longer, typically taking 7-14 business days to arrive.

Factors Influencing Maine Tax Refund Timing

The timing of your Maine tax refund can vary based on several factors. Understanding these factors can help you manage your expectations and plan accordingly.

1. Filing Method

The method you choose to file your tax return can impact the speed of processing. Electronic filing, often referred to as e-filing, is typically faster than traditional paper filing. With e-filing, your return is transmitted directly to the MRS, reducing the time it takes for processing to begin.

2. Payment Method

The payment method you select for your refund also plays a crucial role. Direct deposit is generally the fastest option, as it eliminates the need for manual check processing. Mailed checks, while reliable, may take slightly longer due to postal service delays.

3. Return Complexity

The complexity of your tax return can influence processing time. Returns with multiple income sources, deductions, or credits may require additional review, leading to potential delays. Simplifying your return and ensuring accuracy can help expedite the process.

4. Peak Filing Season

Tax season is a busy time for the MRS. During this period, the volume of returns increases significantly, which can lead to processing delays. Filing your return early in the season can help you avoid the rush and potentially receive your refund sooner.

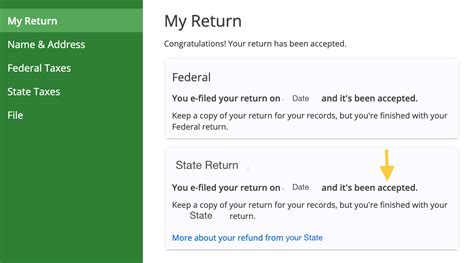

Tracking Your Maine Tax Refund Status

The MRS offers several convenient ways to track the status of your Maine tax refund. These methods provide real-time updates, ensuring you’re always informed about the progress of your refund.

1. Online Refund Tracker

The MRS provides an online refund tracker, accessible through their official website. This user-friendly tool allows you to enter your personal information and track the status of your refund. It provides up-to-date information, including the date your return was received, the refund amount, and the expected disbursement date.

2. Mobile Apps

For added convenience, the MRS offers dedicated mobile apps for both iOS and Android devices. These apps provide the same refund tracking capabilities as the online tracker, allowing you to stay informed on the go. Simply download the app, enter your details, and access real-time refund status updates.

3. Phone Inquiry

If you prefer a more traditional approach, you can contact the MRS by phone to inquire about your refund status. Their customer service representatives are available to provide assistance and answer any questions you may have. Be prepared to provide your personal information and tax return details.

Optimizing Your Maine Tax Refund Journey

To ensure a smooth and efficient refund process, consider implementing these best practices:

1. Accurate and Timely Filing

Accuracy is key when filing your tax return. Take the time to review your return thoroughly, ensuring all information is correct and up-to-date. Additionally, filing your return promptly can help you avoid potential delays caused by the peak filing season.

2. Direct Deposit

Opting for direct deposit as your refund method is a smart choice. It’s the fastest and most secure way to receive your refund, as it eliminates the risk of lost or stolen checks. Ensure you provide accurate banking information to avoid any potential issues.

3. E-File and Pay Online

E-filing your tax return offers numerous benefits, including faster processing and reduced errors. Additionally, paying your taxes online through the MRS’s secure payment portal ensures timely payment and reduces the risk of processing delays.

4. Stay Informed

Stay updated on the latest tax news and announcements from the MRS. This includes any changes to tax laws, refund processing times, or potential delays. By staying informed, you can make informed decisions and plan your refund journey effectively.

Maine Tax Refund FAQs

How long does it take to receive my Maine tax refund after filing?

+The time it takes to receive your Maine tax refund can vary. On average, it takes about 4-6 weeks for the MRS to process refunds. However, factors like filing method, payment method, and return complexity can influence the timing. Direct deposit refunds are generally faster, while mailed checks may take a bit longer.

Can I check the status of my Maine tax refund online?

+Absolutely! The MRS provides an online refund tracker, accessible through their official website. This tracker allows you to enter your personal information and view the status of your refund, including the date of receipt, refund amount, and expected disbursement date.

What if my Maine tax refund is delayed or I haven’t received it yet?

+If your Maine tax refund is delayed or you haven’t received it within the expected timeframe, there are a few steps you can take. First, check the status of your refund using the online tracker or by contacting the MRS. If the refund is still pending, ensure your return was filed correctly and all necessary information was included. If further assistance is needed, you can contact the MRS for help.

How can I ensure my Maine tax refund is processed accurately and quickly?

+To ensure accurate and timely processing of your Maine tax refund, follow these best practices: file your return accurately and on time, choose direct deposit as your refund method, e-file your return and pay your taxes online, and stay informed about any tax-related updates from the MRS.

Are there any penalties or fees associated with Maine tax refunds?

+Generally, there are no penalties or fees associated with Maine tax refunds. However, if your refund is delayed due to errors or discrepancies in your return, you may incur additional processing time. It’s important to file your return accurately and promptly to avoid any potential issues.

Remember, staying informed and proactive can greatly enhance your Maine tax refund journey. By understanding the process, tracking your refund status, and implementing best practices, you can ensure a smooth and timely refund experience.