North Carolina Sales Tax Login

The North Carolina Sales and Use Tax Program is a crucial aspect of the state's revenue collection system, impacting businesses and consumers alike. Understanding how to navigate the system, especially when it comes to the North Carolina Sales Tax Login, is essential for compliance and effective tax management.

Understanding the North Carolina Sales Tax

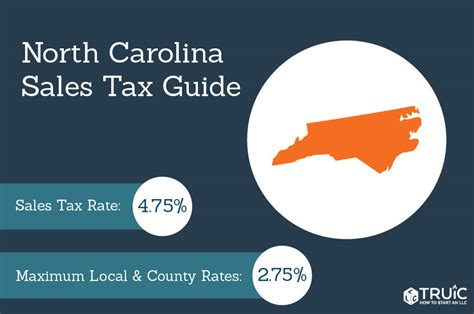

Sales tax in North Carolina is a state-level tax levied on the sale of tangible personal property and certain services. It is an essential revenue stream for the state, contributing to various public services and infrastructure projects. The tax rate varies across the state due to the inclusion of both state and local sales taxes.

Businesses registered for sales tax in North Carolina are responsible for collecting, reporting, and remitting the tax to the North Carolina Department of Revenue (NCDOR). This process involves regular filings, often on a monthly or quarterly basis, depending on the business's sales volume and type.

Sales Tax Registration and Responsibilities

To begin the sales tax collection process, businesses must first register with the NCDOR. This registration process involves providing detailed information about the business, including its legal name, physical address, and the types of products or services it offers. Once registered, the business receives a unique identification number, often referred to as a tax registration number or tax ID.

Registered businesses are then responsible for calculating the sales tax on each taxable transaction. This involves applying the appropriate tax rate, which can vary based on the location of the sale and the specific goods or services involved. The calculated sales tax is then added to the total cost of the transaction, which the customer pays.

At the end of each reporting period, registered businesses must file a sales tax return with the NCDOR. This return details the total sales, the sales tax collected, and any applicable deductions or credits. The business must then remit the collected sales tax to the state, typically through an online payment system.

The North Carolina Sales Tax Login Process

The North Carolina Department of Revenue provides an online platform for businesses to manage their sales tax obligations, including registration, filing, and payment. Accessing this platform requires a secure login, known as the North Carolina Sales Tax Login.

Obtaining a North Carolina Sales Tax Login

To obtain a North Carolina Sales Tax Login, businesses first need to register with the NCDOR. This process can be initiated online through the NCDOR’s website. During registration, businesses will be required to provide certain details, including:

- Business entity information: legal name, physical address, and type of business (e.g., sole proprietorship, partnership, corporation)

- Contact information: name, email address, and phone number of the person responsible for tax matters

- Taxpayer identification numbers: federal employer identification number (FEIN) or social security number (SSN)

- Bank account information: for setting up direct deposit or electronic funds transfer (EFT) for tax payments

Once the registration is complete, the NCDOR will assign a unique tax registration number to the business. This number will be used for all future tax filings and payments.

The NCDOR will also provide the business with login credentials, typically an username and password, to access the online platform. These credentials should be kept secure and not shared with unauthorized individuals.

Logging In to the North Carolina Sales Tax Portal

To log in to the North Carolina Sales Tax Portal, businesses can visit the NCDOR’s website and navigate to the Sales and Use Tax section. From there, they can click on the Login button or link, which will direct them to the login page.

On the login page, businesses will need to enter their username and password provided by the NCDOR. After entering the credentials, they should click on the Login button to access their account.

If a business has forgotten its login credentials, it can use the Forgot Username or Forgot Password links on the login page to reset or retrieve its information. This process typically involves providing the business's tax registration number and answering security questions.

Navigating the North Carolina Sales Tax Portal

Once logged in, businesses have access to a range of tools and features within the North Carolina Sales Tax Portal. These include:

- Sales Tax Filing: Businesses can file their sales tax returns online, entering the relevant sales data and calculating the tax due. The portal provides a user-friendly interface for this process, often with pre-populated data and error-checking features.

- Payment Options: The portal offers various payment methods, including credit card, electronic check, and direct debit. Businesses can choose the method that best suits their needs and preferences.

- Reporting: The portal provides access to previous sales tax returns and payments, allowing businesses to review their tax history and identify any potential errors or discrepancies.

- Tax Rate Lookup: Businesses can use the portal to look up sales tax rates for specific locations, which is especially useful for businesses with multiple store locations or online sales.

- Notifications and Alerts: The portal can send notifications and alerts to businesses about upcoming filing deadlines, changes in tax rates, or other important updates.

Managing Sales Tax Obligations

The North Carolina Sales Tax Portal is designed to simplify the process of managing sales tax obligations. It provides a centralized platform for businesses to register, file, and pay their sales taxes, ensuring compliance with state regulations.

The portal also offers various resources and guides to help businesses understand their sales tax responsibilities. These resources include:

- Sales tax rate tables for different locations within the state

- Instructions on how to calculate sales tax for different types of transactions

- Information on tax holidays and special events that may affect sales tax obligations

- Answers to frequently asked questions about sales tax registration, filing, and payment

Compliance and Reporting

Compliance with sales tax regulations is crucial for businesses operating in North Carolina. The NCDOR conducts regular audits to ensure businesses are accurately reporting and paying their sales taxes. Failure to comply can result in penalties, interest, and legal consequences.

Sales Tax Returns and Deadlines

Sales tax returns in North Carolina are due on the 20th day of the month following the end of the reporting period. For example, if a business’s reporting period ends on March 31st, the sales tax return is due on April 20th. However, if the 20th falls on a weekend or holiday, the due date is extended to the next business day.

It's important for businesses to note that the NCDOR does not grant automatic extensions for filing sales tax returns. If a business anticipates being unable to meet the deadline, it should contact the NCDOR in advance to request an extension. Late filings may result in penalties and interest charges.

Penalties and Interest

The NCDOR imposes penalties and interest on businesses that fail to comply with sales tax regulations. These penalties can vary depending on the severity of the violation and the business’s history of compliance.

Penalties for late filing or non-filing of sales tax returns can range from a minimum of $25 to a maximum of $500, or 5% of the tax due, whichever is greater. Interest is charged on the outstanding tax amount at a rate of 1.5% per month, or a portion of a month, until the tax is paid in full.

Sales Tax Audits

The NCDOR conducts sales tax audits to verify the accuracy of sales tax returns and payments. These audits can be random or based on specific risk factors, such as high sales volumes, changes in business operations, or previous compliance issues.

During an audit, the NCDOR will review a business's sales tax records, including sales receipts, invoices, and other financial documents. The business may be required to provide additional information or clarify certain transactions. It's important for businesses to maintain accurate records and be prepared for potential audits.

Future of Sales Tax in North Carolina

The landscape of sales tax in North Carolina is constantly evolving, influenced by changes in technology, consumer behavior, and state policies. As e-commerce continues to grow, the state is likely to face new challenges in collecting sales tax from online transactions.

Impact of E-Commerce

The rise of e-commerce has presented new challenges for sales tax collection. Online retailers, especially those without a physical presence in North Carolina, may not always collect and remit sales tax on their transactions. This can result in lost revenue for the state and an unfair advantage for out-of-state businesses.

To address this issue, North Carolina, like many other states, has been exploring ways to expand its sales tax jurisdiction to include online retailers. This often involves enacting laws that require online marketplaces and third-party sellers to collect and remit sales tax on behalf of the state.

Technological Advancements

Advancements in technology are also shaping the future of sales tax collection in North Carolina. The state is increasingly leveraging technology to streamline the registration, filing, and payment processes. This includes the development of user-friendly online portals, mobile apps, and integration with accounting software.

Additionally, the use of data analytics and artificial intelligence is expected to play a greater role in sales tax compliance. These technologies can help identify patterns of non-compliance, automate certain aspects of the auditing process, and improve the overall efficiency of tax collection.

Policy Changes and Reforms

Policy changes at the state level can significantly impact sales tax regulations and compliance. North Carolina may consider reforms to its sales tax system to simplify the process, reduce administrative burdens on businesses, and improve revenue collection.

Potential reforms could include:

- Streamlining the registration process for new businesses

- Simplifying the sales tax return forms and filing process

- Implementing more frequent but smaller tax payments to reduce the risk of late payments

- Adjusting tax rates or exemptions to reflect changes in the economy or consumer behavior

It's important for businesses to stay informed about any policy changes or reforms that may impact their sales tax obligations. The NCDOR often provides updates and guidance on its website and through other communication channels.

What are the sales tax rates in North Carolina?

+The state sales tax rate in North Carolina is 4.75%, while local sales tax rates vary depending on the county and municipality. These local rates can range from 0% to 2.5%, resulting in a combined state and local sales tax rate that varies across the state.

Are there any exemptions or special rules for certain products or services?

+Yes, North Carolina offers exemptions for certain products and services. These include groceries, prescription drugs, non-prepared food, and certain manufacturing equipment. There are also special rules for out-of-state sellers and online retailers, which may require them to collect and remit sales tax even without a physical presence in the state.

How often do businesses need to file sales tax returns in North Carolina?

+The frequency of sales tax filings depends on the business’s sales volume. Businesses with monthly sales of 10,000 or more must file sales tax returns monthly. Those with monthly sales between 1,000 and 9,999 can file quarterly, while those with sales of less than 1,000 can file annually. However, businesses should note that they must still remit sales tax on a monthly basis, even if they file quarterly or annually.