Company Tax Rate Canada

In Canada, the tax system for businesses is designed to support economic growth and competitiveness while also ensuring a fair distribution of tax burdens. The tax rate structure is complex, as it varies based on several factors, including the type of business entity, revenue, and the province or territory where the business operates. Understanding the tax landscape is crucial for businesses to plan their finances effectively and ensure compliance with Canadian tax laws.

Understanding the Canadian Business Tax Structure

The Canadian tax system applies different tax rates to various business entities. These entities can be broadly categorized into corporations and self-employed individuals or partnerships. Each category has its own set of tax rules and rates, which can further vary based on the jurisdiction within Canada.

Corporate Tax Rates

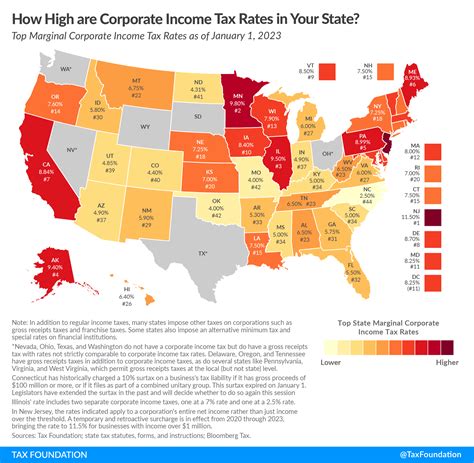

Canadian corporations are subject to both federal and provincial corporate income taxes. The federal corporate tax rate is a flat rate applied to taxable income, currently set at 15%. However, this rate can be reduced under certain circumstances, such as when a corporation’s taxable income is below a specified threshold or when it qualifies for tax incentives or credits.

In addition to the federal rate, corporations must also pay provincial corporate income tax. The provincial tax rates vary significantly across the country. For instance, in Ontario, the provincial corporate tax rate is 11.5%, while in Alberta, it is 12%. These rates can also change periodically, so it's essential for businesses to stay updated with the latest tax legislation.

To illustrate, consider a hypothetical corporation based in Ontario. This corporation would pay a federal corporate tax of 15% on its taxable income, and an additional 11.5% provincial tax. The combined federal and provincial tax rate for this corporation would be 26.5%, a rate that could significantly impact its financial planning and strategy.

| Province | Corporate Tax Rate |

|---|---|

| Ontario | 11.5% |

| Alberta | 12% |

| British Columbia | 11.5% |

Self-Employed Individuals and Partnerships

Self-employed individuals and partnerships in Canada are taxed differently from corporations. They are considered personal taxpayers and are subject to the personal income tax rates, which are also determined by both federal and provincial governments.

The federal personal income tax rates are progressive, meaning the tax rate increases as taxable income rises. The highest federal personal income tax rate is currently 33%, applicable to taxable income over $220,000. On the other hand, the lowest rate starts at 15% for taxable income up to $49,020.

Similar to corporate taxes, provincial personal income tax rates also vary. For example, the highest provincial tax rate in Ontario is 13.16%, while in Alberta, it is 10%. These rates can be subject to change, and businesses should consult the latest tax tables to determine the exact rate applicable to their situation.

Let's take an example of a self-employed individual in Ontario with a taxable income of $75,000. This individual would pay a federal personal income tax of 20.5% on their income, plus an additional 13.16% in provincial tax. The combined federal and provincial tax rate for this individual would be 33.66%, which could have a substantial impact on their financial planning.

| Province | Personal Income Tax Rate |

|---|---|

| Ontario | 13.16% |

| Alberta | 10% |

| British Columbia | 16.8% |

Tax Incentives and Credits

The Canadian tax system offers a range of incentives and credits to support businesses and individuals. These incentives are designed to encourage investment, innovation, and economic growth. Some common tax incentives include:

- Small Business Deduction: Corporations and self-employed individuals can benefit from a reduced federal tax rate if their taxable capital is below a specified threshold. The current small business deduction rate is 9%, providing significant tax savings for eligible businesses.

- Research and Development (R&D) Tax Credits: Businesses engaged in eligible R&D activities can claim tax credits, which can be used to offset their tax liability. These credits are designed to encourage innovation and technological advancement.

- Capital Cost Allowance (CCA): This incentive allows businesses to deduct a portion of their capital expenditures over time. The CCA rates vary depending on the type of asset and its class, providing businesses with flexibility in managing their tax liabilities.

Conclusion: Navigating the Canadian Tax Landscape

Understanding the Canadian tax system is a complex but necessary task for any business operating in the country. The tax rates and incentives can have a significant impact on a company’s financial health and strategy. Staying informed about the latest tax laws, rates, and incentives is crucial for effective financial planning and compliance.

For businesses seeking to optimize their tax strategies, it's advisable to consult with tax professionals who can provide tailored advice based on the specific circumstances of the business. With the right guidance, companies can navigate the Canadian tax landscape successfully and focus on their core business objectives.

What are the main differences between corporate and personal tax rates in Canada?

+Corporate tax rates are applied to businesses and are generally lower than personal tax rates. Personal tax rates are progressive and apply to individuals’ income, with higher rates for higher income brackets. Corporate tax rates are flat rates and are often subject to additional provincial taxes, while personal tax rates vary by province as well.

Are there any tax incentives available for Canadian businesses?

+Yes, Canada offers various tax incentives and credits to support businesses. These include the Small Business Deduction, Research and Development Tax Credits, and Capital Cost Allowance. These incentives can significantly reduce a business’s tax liability and encourage investment and innovation.

How often do tax rates change in Canada?

+Tax rates in Canada can change periodically, often as a result of budget announcements or legislative changes. Both the federal and provincial governments have the authority to adjust tax rates, so it’s essential for businesses to stay updated with the latest tax legislation to ensure compliance and accurate financial planning.