Calculate Vehicle Tax

Vehicle taxation, often referred to as vehicle excise duty (VED) in the UK, is a crucial aspect of road transportation regulations. It is a legal requirement for all eligible vehicles to be taxed, and the process of calculating and paying this tax is an essential step for vehicle owners and operators. In this comprehensive guide, we will delve into the intricacies of vehicle tax calculation, providing a detailed understanding of the factors, methods, and implications involved.

Understanding Vehicle Tax

Vehicle tax is a government-imposed levy on vehicles registered for use on public roads. It is designed to contribute to the maintenance and development of transportation infrastructure, ensuring a safe and efficient road network. The tax amount is determined by various factors, including the type of vehicle, its environmental impact, and sometimes, the purpose for which it is used.

In the UK, the vehicle tax system has undergone significant reforms in recent years, with the introduction of new tax bands and rates. These changes aim to incentivize the use of environmentally friendly vehicles and discourage the operation of highly polluting vehicles. As such, understanding the current vehicle tax calculation methods is essential for both personal and commercial vehicle owners.

Factors Influencing Vehicle Tax

The calculation of vehicle tax involves several key factors, each playing a unique role in determining the final tax amount. These factors can be broadly categorized as follows:

Vehicle Type and Purpose

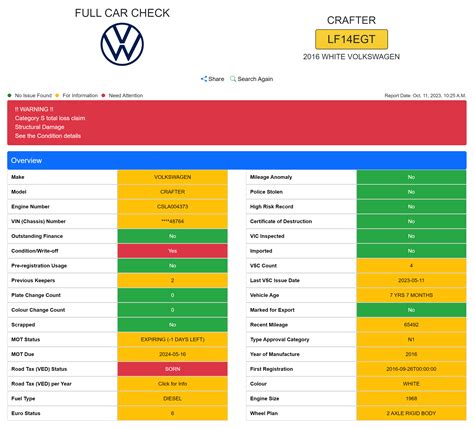

The type of vehicle is a primary determinant of the tax rate. Different categories of vehicles, such as cars, motorcycles, vans, and heavy goods vehicles, are subject to distinct tax bands and rates. Additionally, the purpose for which a vehicle is used can also impact the tax amount. For instance, vehicles used for business purposes may have different tax rates compared to those used for personal use.

Environmental Considerations

One of the most significant changes in the UK’s vehicle tax system is the emphasis on environmental factors. The carbon dioxide (CO2) emissions of a vehicle are a key determinant of its tax band. Vehicles with lower CO2 emissions often benefit from reduced tax rates, while those with higher emissions face higher taxes. This approach aims to encourage the adoption of cleaner, more sustainable transportation options.

Fuel Type

The type of fuel a vehicle uses can also influence its tax category. Vehicles running on alternative fuels, such as electric or hybrid technologies, often benefit from reduced tax rates, reflecting the government’s commitment to promoting eco-friendly transportation.

Age of the Vehicle

The age of a vehicle is another factor in tax calculations. Older vehicles, particularly those registered before certain cut-off dates, may be subject to different tax bands and rates. This aspect of the tax system encourages the replacement of older, potentially more polluting vehicles with newer, more efficient models.

Vehicle Tax Calculation Methods

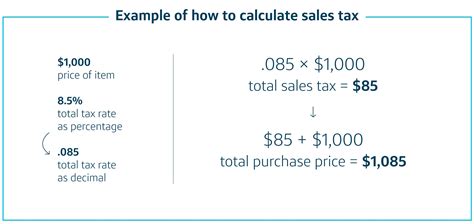

The calculation of vehicle tax involves a multi-step process, with each step contributing to the final tax amount. Here’s a breakdown of the typical calculation methodology:

Step 1: Determining the Vehicle’s Tax Band

The first step is to identify the vehicle’s tax band. This is typically based on the vehicle’s CO2 emissions and fuel type. Each tax band corresponds to a specific range of CO2 emissions, with vehicles emitting higher levels of CO2 assigned to higher tax bands.

For example, in the UK, the tax bands for cars are categorized as follows:

| Tax Band | CO2 Emissions (g/km) |

|---|---|

| A | <100 |

| B | 101-110 |

| ... | ... |

| M | >255 |

Step 2: Applying the Standard Tax Rate

Once the tax band is determined, the standard tax rate for that band is applied. The standard tax rate is a fixed amount that remains constant within each tax band. For instance, vehicles in tax band A might have a standard tax rate of £10 per year, while those in tax band M could have a rate of £190 per year.

Step 3: Adjustments for First-Year Rates

In some cases, vehicles are subject to a higher first-year rate. This is particularly true for newer vehicles with higher CO2 emissions. The first-year rate is designed to discourage the purchase of highly polluting vehicles, as it can significantly increase the initial tax cost.

Step 4: Additional Considerations

Beyond the standard rates and first-year adjustments, there may be other factors that impact the final tax amount. These can include:

- Discounts for low-emission vehicles.

- Reduced rates for certain vehicle categories, such as disabled drivers' vehicles.

- Surcharges for certain types of vehicles, like heavy goods vehicles.

Real-World Examples and Calculations

Let’s explore a couple of real-world scenarios to illustrate the vehicle tax calculation process. These examples will help provide a clearer understanding of how the various factors and methods come together to determine the tax amount.

Example 1: Electric Vehicle

Consider a scenario where an individual is purchasing a new electric car. Since electric vehicles have zero CO2 emissions, they typically fall into the lowest tax band (e.g., Band A in the UK’s system). The standard tax rate for this band might be £0 per year, reflecting the government’s encouragement of eco-friendly transportation.

However, there might be an additional consideration. Some countries offer incentives for the purchase of electric vehicles, such as a reduced tax rate for the first year of ownership. This could result in a significantly lower tax cost for the first year, encouraging more individuals to adopt electric transportation.

Example 2: Diesel Van

Now, let’s consider a small business owner who operates a diesel-powered van. Diesel vehicles, particularly those with higher CO2 emissions, often fall into higher tax bands. For instance, a diesel van with CO2 emissions of 200 g/km might be placed in tax band M.

The standard tax rate for this band could be £190 per year. However, since this vehicle is used for business purposes, the owner might be eligible for a reduced rate. Business-use vehicles often have lower tax rates to support commercial operations. As a result, the final tax amount for this van might be significantly lower than the standard rate.

Future Implications and Environmental Impact

The vehicle tax system is an evolving entity, with governments continuously refining their strategies to encourage sustainable transportation. The emphasis on environmental considerations in vehicle tax calculation is a clear indicator of this trend.

As technology advances and the world moves towards a more sustainable future, vehicle tax systems are likely to play a pivotal role in shaping transportation choices. The potential for reduced tax rates for electric and hybrid vehicles, along with incentives for low-emission technologies, could significantly impact the adoption of these greener options.

Furthermore, the future of vehicle taxation may also involve a shift towards a pay-as-you-go model, where taxes are based on actual vehicle usage rather than a fixed annual amount. This approach could further incentivize efficient driving practices and reduce the environmental impact of transportation.

How often do I need to pay vehicle tax?

+Vehicle tax is typically paid annually. However, some countries offer the option of paying for a shorter period, such as six months, which can be beneficial for vehicles that are only used seasonally.

Are there any exemptions from vehicle tax?

+Yes, certain vehicles may be exempt from vehicle tax. This includes classic cars over a certain age, electric vehicles in some regions, and vehicles used exclusively for disabled individuals.

Can I transfer my vehicle tax to a new owner when selling my car?

+No, vehicle tax is not transferable. When you sell your vehicle, the new owner must apply for their own tax.