State Of Vermont Taxes

Welcome to a comprehensive exploration of the State of Vermont's tax system, designed to provide an in-depth understanding of the various taxes imposed by the Green Mountain State. Vermont's tax landscape is unique, offering a mix of traditional and innovative approaches to revenue generation. From income taxes to innovative strategies like the Use Value Appraisal Program, Vermont's tax system plays a crucial role in funding essential public services and infrastructure. This guide aims to shed light on these aspects, offering insights into how the state's tax policies impact residents, businesses, and the overall economy.

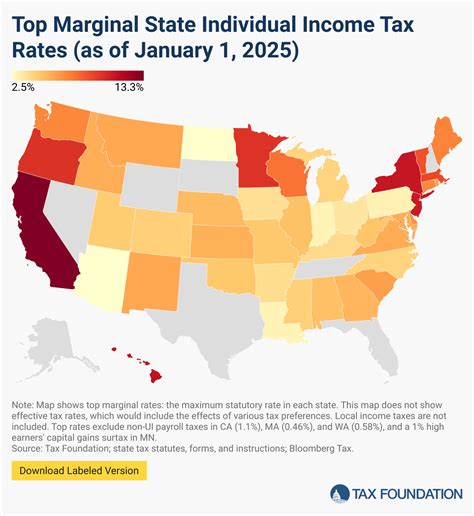

The Vermont Income Tax: A Progressive Approach

The Vermont income tax operates on a progressive structure, meaning that higher incomes are taxed at progressively higher rates. This system ensures that those with greater financial means contribute a larger share to the state’s revenue. The current income tax brackets for Vermont residents are as follows:

| Income Bracket | Tax Rate |

|---|---|

| $0 - $10,275 | 3.55% |

| $10,276 - $35,000 | 6.5% |

| $35,001 - $200,000 | 7.8% |

| Over $200,000 | 8.95% |

For example, a resident earning $50,000 annually would fall into the second bracket, paying taxes at a rate of 6.5% on their entire income. This progressive tax system ensures that the burden of taxation is distributed equitably across different income levels.

Tax Benefits and Credits

Vermont offers a range of tax benefits and credits to its residents, which can significantly reduce the tax burden. These include:

- Vermont Earned Income Tax Credit (EITC): A refundable tax credit for low- to moderate-income working individuals and families, designed to offset the burden of social security taxes and provide an incentive to work.

- Property Tax Rebate: Vermonters aged 65 or older or with a qualifying disability can apply for a rebate on their property taxes, offering relief for those on fixed incomes.

- Energy Efficiency Credits: The state encourages energy conservation by offering tax credits for energy-efficient home improvements, renewable energy systems, and electric vehicles.

Sales and Use Taxes: Funding Essential Services

The Vermont sales and use tax is a vital source of revenue for the state, contributing to the funding of public services such as education, healthcare, and infrastructure development. The current sales tax rate in Vermont is 6%, which applies to most retail sales of tangible personal property and certain services. However, there are several exemptions and special provisions to consider.

Exemptions and Special Provisions

Vermont’s sales tax has a number of notable exemptions and special provisions. Some of the key ones include:

- Groceries and Non-Prepared Food: A unique feature of Vermont’s sales tax is the exemption for groceries and non-prepared food, making essential items more affordable for residents.

- Clothing and Footwear: Clothing and footwear purchases under $125 are exempt from sales tax, providing a tax break for basic necessities.

- Prescription Drugs: Sales of prescription drugs are exempt from sales tax, a significant benefit for individuals with ongoing medical needs.

- Farm Equipment: To support the state’s agricultural sector, sales of farm equipment are exempt from sales tax.

These exemptions demonstrate Vermont's commitment to supporting its residents and key industries through thoughtful tax policies.

Use Value Appraisal Program: A Vermont Innovation

One of the most distinctive features of Vermont’s tax system is the Use Value Appraisal Program, which allows agricultural and forestland owners to have their property taxes assessed based on the value of their land for agricultural or forest use rather than its fair market value. This innovative program encourages the preservation of open spaces and supports Vermont’s agricultural and forestry industries. By providing a tax incentive for maintaining land in these uses, the program helps ensure the continued availability of agricultural products and forest resources for the state’s residents.

Property Taxes: Supporting Local Communities

Property taxes in Vermont are primarily assessed and collected at the town level, with each town setting its own tax rates. These taxes are a significant source of revenue for local governments, funding essential services such as education, emergency services, and local infrastructure. The property tax system in Vermont is designed to be fair and equitable, with a focus on ensuring that all property owners contribute their fair share.

The Grand List and Appraisal Process

Vermont’s property taxes are based on the Grand List, which is a comprehensive list of all taxable property in the state. This list is updated annually, and properties are appraised to determine their fair market value. The appraisal process ensures that properties are assessed accurately and fairly, taking into account factors such as location, size, and condition.

For instance, a residential property in Burlington valued at $300,000 would be subject to a property tax rate set by the local municipality. If the tax rate is 1.5%, the owner would pay $4,500 in property taxes annually. This rate can vary significantly across towns, reflecting the unique needs and priorities of each community.

Property Tax Relief Programs

Vermont offers several property tax relief programs to assist homeowners, particularly those on fixed incomes or with low to moderate incomes. These programs aim to make property ownership more affordable and ensure that residents can continue to live in their communities. Some of the key programs include:

- Homestead Property Tax Credit: A credit available to homeowners aged 65 or older or with a qualifying disability, providing relief on their property taxes.

- Income Sensitivity Program: This program reduces property taxes for low- and moderate-income homeowners based on their income and property value.

- Low-Income Property Tax Rebate: A refundable tax credit for low-income homeowners, offering a rebate on their property taxes.

Business Taxes: Encouraging Economic Growth

Vermont’s tax system is designed to support business growth while also contributing to the state’s revenue. The state offers a range of business tax incentives and a favorable business climate to attract and retain businesses. This approach ensures that businesses can thrive, creating jobs and driving economic development.

Business Entity Taxes

Vermont imposes taxes on various business entities, including corporations, limited liability companies (LLCs), partnerships, and sole proprietorships. The specific tax obligations and rates vary depending on the business type and its operations. For instance, corporations are subject to a corporate income tax, while LLCs and partnerships are generally treated as pass-through entities for tax purposes.

For example, a Vermont corporation with taxable income of $100,000 would be subject to a corporate income tax rate of 8.5%, resulting in a tax liability of $8,500.

Business Tax Incentives and Programs

Vermont offers a range of tax incentives and programs to support businesses, encourage investment, and foster economic growth. These include:

- Vermont Enterprise Fund: A program offering low-interest loans and grants to small businesses, helping them start up, expand, or innovate.

- Research and Development Tax Credit: A credit available to businesses engaged in research and development activities, encouraging innovation and technological advancement.

- Business Equipment Tax Exemption: An exemption from sales and use tax for the purchase of certain business equipment, making it more affordable for businesses to invest in their operations.

Estate and Inheritance Taxes: Transferring Wealth Responsibly

Vermont imposes estate and inheritance taxes on the transfer of wealth upon death. These taxes ensure that a portion of the wealth transferred is contributed to the state’s revenue, supporting essential public services. The state’s estate and inheritance tax system is designed to be fair and equitable, with a focus on ensuring that all individuals pay their fair share.

Estate Tax

The Vermont estate tax applies to the transfer of an individual’s estate upon their death. The tax is imposed on the value of the estate above a certain threshold, known as the exclusion amount. For 2023, the exclusion amount is 4,187,500</strong>, meaning that estates valued at 4,187,500 or less are not subject to the estate tax. The tax rate for estates above this threshold is 16%.

For instance, an estate valued at $5 million would be subject to the estate tax, with a tax liability of $120,000 (16% of the amount over the exclusion threshold of $4,187,500). This tax is a significant source of revenue for the state, contributing to the funding of public services.

Inheritance Tax

The Vermont inheritance tax applies to the transfer of property from an individual to their beneficiaries upon their death. The tax rate varies depending on the relationship between the deceased and the beneficiary. Spouses and charitable organizations are exempt from the inheritance tax, while other beneficiaries are subject to a tax rate of 11% on the value of the property received.

For example, if an individual inherits property valued at $200,000 from a friend, they would be subject to an inheritance tax of $22,000 (11% of the property value). This tax contributes to the state's revenue and ensures that the transfer of wealth is taxed appropriately.

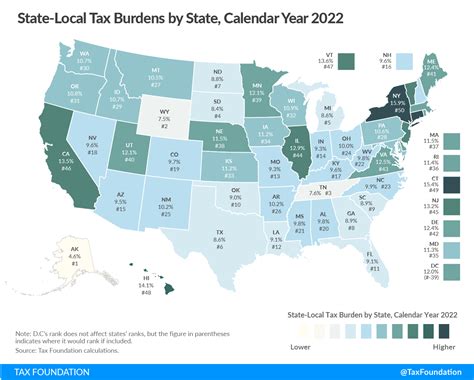

The Impact of Vermont’s Tax System

Vermont’s tax system plays a crucial role in funding essential public services and supporting the state’s economy. The income, sales, and property taxes provide the majority of the state’s revenue, while business and estate taxes contribute additional funds. This revenue is used to support a wide range of services, including education, healthcare, infrastructure development, and social services.

For instance, the revenue generated from the income tax is used to fund Vermont's renowned public education system, ensuring that all residents have access to quality education. The sales tax contributes to the funding of essential services like emergency response and public safety, while property taxes support local governments and their services, such as road maintenance and community programs.

Fairness and Equity

A key aspect of Vermont’s tax system is its commitment to fairness and equity. The progressive income tax ensures that higher-income earners pay a larger share of taxes, while the sales tax exemptions and special provisions provide relief for essential items and support key industries. The property tax relief programs assist homeowners, particularly those on fixed or low incomes, ensuring that property ownership remains affordable.

Economic Development and Business Support

Vermont’s tax system is designed to encourage economic growth and support businesses. The state’s business tax incentives and favorable business climate attract and retain businesses, creating jobs and driving economic development. The research and development tax credit, business equipment tax exemption, and low-interest loan programs are just a few examples of how the state supports businesses and fosters innovation.

Future Implications and Considerations

As Vermont’s tax system continues to evolve, there are several key considerations for the future. These include the ongoing need to balance the state’s budget, the impact of economic trends and shifts, and the potential for tax reforms to address emerging challenges.

Budgetary Considerations

Vermont’s tax system is a significant contributor to the state’s revenue, but it is also subject to economic trends and shifts. The state must carefully manage its revenue and expenses to ensure a balanced budget, which can be challenging in times of economic uncertainty. This balance is crucial to maintain the state’s financial health and continue funding essential public services.

Economic Trends and Shifts

Economic trends and shifts can significantly impact Vermont’s tax revenue. For instance, changes in income levels, business operations, or consumer behavior can affect the state’s income, sales, and business tax revenue. The state must stay agile and responsive to these shifts to ensure that its tax system remains effective and efficient.

Potential Tax Reforms

As Vermont’s economy and demographics evolve, the state may consider tax reforms to address emerging challenges and opportunities. These reforms could include adjustments to tax rates, the introduction of new taxes or tax incentives, or the revision of existing tax laws. For example, the state could explore the expansion of the Use Value Appraisal Program to include additional land uses or consider adjustments to the estate and inheritance tax rates to reflect changing economic conditions.

Conclusion

Vermont’s tax system is a comprehensive and thoughtful approach to revenue generation, designed to fund essential public services while supporting the state’s economy and residents. From the progressive income tax to the innovative Use Value Appraisal Program, Vermont’s tax policies demonstrate a commitment to fairness, equity, and the preservation of the state’s natural resources. As the state navigates future challenges and opportunities, its tax system will continue to play a crucial role in shaping Vermont’s economic and social landscape.

How often are property taxes assessed in Vermont?

+Property taxes in Vermont are assessed annually, based on the Grand List, which is updated each year. This ensures that property values are accurately reflected and that the tax burden is distributed fairly among property owners.

Are there any plans to change Vermont’s estate and inheritance tax rates?

+While there are no current plans to change the estate and inheritance tax rates, the state regularly reviews its tax policies to ensure they remain effective and responsive to changing economic conditions. Any proposed changes would be subject to public discussion and legislative approval.