Connecticut Taxes Refund

In the state of Connecticut, taxes are an important aspect of financial management, and understanding the tax landscape is crucial for residents and businesses alike. One of the key considerations for taxpayers is the potential for receiving tax refunds. A tax refund is a return of overpaid taxes, and it can provide a significant financial boost to individuals and families. This article aims to delve into the intricacies of Connecticut taxes and explore the topic of tax refunds, offering valuable insights and guidance.

Understanding Connecticut’s Tax System

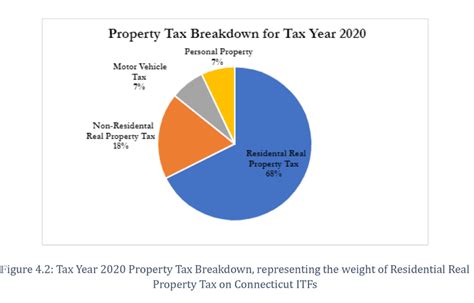

Connecticut operates under a comprehensive tax system that includes various types of taxes such as income tax, sales tax, property tax, and more. The state’s tax policies and regulations are designed to fund public services, infrastructure, and government operations.

The income tax is a significant revenue generator for the state. Connecticut utilizes a progressive tax system, which means that higher incomes are taxed at higher rates. The state offers multiple tax brackets, and the tax rate increases as taxable income rises. This approach ensures that those with higher earnings contribute a larger proportion of their income towards state finances.

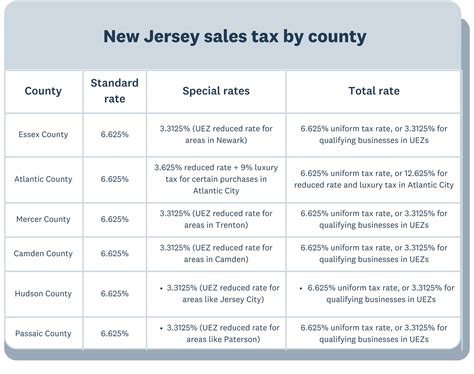

Sales tax is another vital component of Connecticut's tax structure. The state applies a sales and use tax to most retail sales, leases, and rentals of tangible personal property. The standard sales tax rate in Connecticut is 6.35%, which is applied to the purchase price of taxable goods and services. However, certain items like food, clothing, and prescription drugs are exempt from sales tax, providing some relief to consumers.

The Process of Claiming a Tax Refund

Taxpayers in Connecticut who believe they are eligible for a tax refund must follow a specific process. The first step is to ensure that all tax obligations for the year are fulfilled. This includes filing the appropriate tax forms and providing accurate information to the Connecticut Department of Revenue Services (CT DRS). The CT DRS is the state agency responsible for administering and enforcing tax laws.

The tax refund process typically begins with the taxpayer filing their annual income tax return. This return serves as a comprehensive record of their taxable income, deductions, credits, and other relevant information. It is crucial to accurately report all sources of income and applicable deductions to avoid any discrepancies that could delay or reduce the refund amount.

After submitting the tax return, the CT DRS reviews the information provided and calculates the taxpayer's tax liability. If the taxpayer has overpaid their taxes throughout the year, the CT DRS will issue a refund for the difference. The refund amount is determined based on the taxpayer's income, deductions, and any applicable credits or adjustments.

Connecticut offers several methods for taxpayers to receive their tax refunds. The most common and convenient option is direct deposit, which allows the refund to be deposited directly into the taxpayer's bank account. This method is not only faster but also more secure, as it eliminates the risk of lost or stolen refund checks.

Taxpayers who prefer a more traditional approach can opt to receive their refund via a paper check mailed to their address on record. While this method may take longer, it provides a physical record of the refund for those who prefer to keep physical documentation.

Maximizing Your Tax Refund: Tips and Strategies

While receiving a tax refund can be a welcome financial windfall, it is important to approach it strategically. Here are some tips and strategies to help taxpayers make the most of their Connecticut tax refund:

1. Take Advantage of Tax Credits and Deductions

Connecticut offers various tax credits and deductions that can reduce the amount of tax owed or increase the size of the refund. Taxpayers should familiarize themselves with these incentives and ensure they meet the eligibility criteria. Some common tax credits and deductions include the Earned Income Tax Credit (EITC), child and dependent care expenses, educational expenses, and property taxes paid.

For example, the EITC is a refundable credit designed to provide financial assistance to low- and moderate-income working individuals and families. By claiming this credit, eligible taxpayers can reduce their tax liability or even receive a refund if the credit amount exceeds their tax liability.

2. Contribute to Retirement Accounts

Contributing to retirement accounts like a 401(k) or IRA can provide significant tax benefits. These contributions are often tax-deductible, which means they reduce the taxable income and can increase the size of the refund. Additionally, funds within these accounts grow tax-deferred, allowing for compounded growth over time.

For instance, a taxpayer who contributes $5,000 to their 401(k) plan may be eligible for a deduction on their Connecticut income tax return, depending on their income level and other factors. This deduction could reduce their taxable income, resulting in a larger refund or a lower tax liability.

3. Utilize Tax Preparation Software

Tax preparation software can be a valuable tool for taxpayers, especially those who find the tax process complex or time-consuming. These software programs guide users through the tax filing process, ensuring that all relevant forms are completed accurately and that all applicable credits and deductions are considered.

By utilizing tax preparation software, taxpayers can increase their chances of claiming all eligible deductions and credits, maximizing their refund potential. These programs often provide a step-by-step process, making it easier to navigate the sometimes daunting world of tax filings.

4. Stay Informed about Tax Law Changes

Tax laws and regulations can change from year to year, and it is crucial for taxpayers to stay informed about these changes. Connecticut, like many other states, may introduce new tax credits, modify existing ones, or adjust tax rates. By staying up-to-date with these changes, taxpayers can ensure they are taking advantage of all available incentives and avoid any unexpected surprises when filing their tax returns.

For instance, in recent years, Connecticut has introduced tax incentives for renewable energy initiatives and electric vehicle purchases. Taxpayers who invest in these areas may be eligible for tax credits, providing an opportunity to reduce their tax liability and increase their refund.

Common Misconceptions and Pitfalls to Avoid

While tax refunds can be a positive financial outcome, it is essential to approach them with caution and awareness. Here are some common misconceptions and pitfalls to avoid when dealing with Connecticut tax refunds:

1. Overestimating Refund Amounts

One common misconception is that taxpayers tend to overestimate the amount of their tax refund. While it is natural to hope for a larger refund, it is important to base these expectations on realistic calculations. Overestimating refund amounts can lead to disappointment and financial strain if the actual refund is significantly lower.

To avoid this pitfall, taxpayers should calculate their expected refund based on their income, deductions, and applicable credits. Utilizing tax calculators or seeking assistance from tax professionals can provide a more accurate estimate of the refund amount.

2. Failing to Report All Income

Another critical aspect of tax refund management is ensuring that all income is accurately reported. Taxpayers who fail to report all sources of income may face penalties and interest charges, which can reduce the refund amount or even result in additional taxes owed.

It is crucial to carefully review all income statements and ensure that all income, including wages, self-employment earnings, investment gains, and any other taxable income, is reported on the tax return. Failing to report income can lead to serious legal consequences and financial penalties.

3. Missing Deadlines and Filing Errors

Taxpayers should be mindful of important deadlines when it comes to filing their tax returns and claiming refunds. Missing these deadlines can result in penalties and interest charges, reducing the refund amount or leading to additional tax liabilities.

Additionally, taxpayers should take the time to carefully review their tax returns for accuracy. Filing errors, such as incorrect Social Security numbers, misspelled names, or miscalculations, can delay the refund process or trigger an audit. It is essential to double-check all information and seek professional assistance if needed to ensure a smooth filing process.

The Future of Tax Refunds in Connecticut

As the tax landscape continues to evolve, it is essential to consider the potential future implications for tax refunds in Connecticut. While the state’s tax system is generally stable, there are ongoing discussions and initiatives that could impact tax refunds in the coming years.

1. Proposed Tax Reform Initiatives

Connecticut, like many states, periodically reviews its tax system to ensure fairness and efficiency. There have been discussions and proposals for tax reform initiatives aimed at simplifying the tax code, reducing tax burdens, and providing relief to certain taxpayer groups.

For instance, there have been proposals to introduce a flat tax rate for certain income brackets, which could simplify the tax filing process and potentially increase the refund amounts for taxpayers in those brackets. Additionally, there have been discussions about expanding tax credits and deductions to provide greater financial support to low- and middle-income households.

2. Technological Advancements in Tax Filing

The world of taxation is increasingly influenced by technological advancements. Connecticut, along with other states, is exploring ways to leverage technology to streamline the tax filing process and enhance taxpayer experiences.

One notable development is the implementation of electronic filing systems, which allow taxpayers to file their tax returns online. These systems not only simplify the filing process but also reduce the risk of errors and speed up the refund process. Additionally, the use of artificial intelligence and machine learning algorithms can further improve the accuracy and efficiency of tax calculations.

3. Impact of Economic Trends and Policy Changes

Economic trends and policy changes can significantly impact tax refunds in Connecticut. For instance, during periods of economic growth, taxpayers may experience higher incomes, leading to increased tax liabilities and potentially smaller refunds. Conversely, during economic downturns, taxpayers may face financial challenges, and tax refunds could provide much-needed relief.

Additionally, policy changes at the federal and state levels can influence tax refunds. Changes in tax rates, brackets, or the introduction of new tax credits and deductions can directly impact the size and availability of tax refunds. Taxpayers should stay informed about these policy changes to understand their potential impact on their financial situations.

Conclusion

Connecticut taxes and the potential for tax refunds are complex topics that require careful consideration and understanding. By exploring the state’s tax system, the process of claiming refunds, and offering strategic tips and insights, this article aims to empower taxpayers to navigate the tax landscape effectively.

As the tax environment continues to evolve, staying informed and adapting to changes is crucial. Whether it's taking advantage of tax credits and deductions, utilizing technological advancements, or staying aware of economic trends, taxpayers can optimize their tax refund opportunities and make informed financial decisions.

Remember, a tax refund is a valuable financial tool, but it should be approached with caution and a strategic mindset. By following the guidance and insights provided in this article, taxpayers can maximize their refund potential and make the most of their hard-earned money.

How long does it typically take to receive a tax refund in Connecticut?

+The time it takes to receive a tax refund in Connecticut can vary. On average, it takes approximately 4-6 weeks for the Connecticut Department of Revenue Services to process tax returns and issue refunds. However, certain factors, such as the complexity of the return or any errors or discrepancies, can impact the processing time. Direct deposit refunds are generally faster than receiving a paper check.

Can I check the status of my tax refund online?

+Yes, Connecticut taxpayers can check the status of their tax refund online through the Connecticut Department of Revenue Services website. The online refund status tool provides real-time updates on the processing of tax returns and the status of refunds. Taxpayers will need their Social Security number and the exact amount of their refund to access this information.

What happens if my tax refund is delayed or I don’t receive it as expected?

+If a tax refund is delayed or not received as expected, taxpayers should take immediate action. They can contact the Connecticut Department of Revenue Services to inquire about the status of their refund. It is important to provide accurate and detailed information, including the tax year, Social Security number, and any other relevant details. The CT DRS will investigate the issue and provide an update on the refund status.

Are there any tax refund scams that taxpayers should be aware of?

+Yes, taxpayers should be vigilant about tax refund scams, as they can be a common target for fraudulent activities. Scammers may impersonate tax authorities or government agencies and attempt to steal personal and financial information. It is crucial to verify the identity of any individuals or organizations claiming to represent the tax department. Taxpayers should never provide sensitive information over the phone or through unsolicited emails. It is always best to contact the CT DRS directly using official contact information to verify any communications regarding tax refunds.