Ny Sales Tax Rate

In the state of New York, sales tax rates can vary depending on the location and the type of goods or services being purchased. Understanding the sales tax landscape is crucial for businesses and consumers alike, as it directly impacts pricing and financial planning. This comprehensive guide aims to shed light on the intricacies of the New York sales tax rates, providing a detailed breakdown of rates, regulations, and relevant examples to ensure a clear understanding of this complex yet essential aspect of doing business in the Empire State.

The Basics of New York Sales Tax Rates

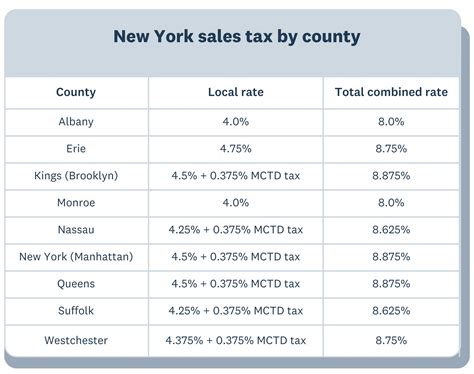

New York State imposes a 4% sales tax on most retail sales, including those made online. However, this base rate is often subject to additional local and municipal taxes, which can vary significantly across the state. For instance, New York City applies an extra 4.5% on top of the state rate, resulting in a total sales tax of 8.875% for most purchases within the city limits.

These rates can be further influenced by the type of goods being sold. Certain categories, such as clothing and footwear, have reduced sales tax rates during specific promotional periods, offering a temporary respite for consumers and a strategic marketing opportunity for retailers. Conversely, luxury items and certain services often carry higher sales tax rates, reflecting the state's policy on these types of purchases.

It's also important to note that New York State offers sales tax exemptions for certain items and situations. For example, most groceries are exempt from sales tax, providing a much-needed financial relief for families and individuals on a budget. Additionally, charitable organizations and government entities are often eligible for sales tax exemptions, helping to support these vital sectors of society.

Sales Tax Rates by Region

New York State is divided into several tax jurisdictions, each with its own unique sales tax rate. While the state’s base rate of 4% remains consistent, local additions can vary significantly. For instance, the Catskill region adds an extra 3% to the state rate, resulting in a total sales tax of 7%. In contrast, the Long Island region has a combined rate of 8.625%, with a local addition of 4.5%.

These regional variations are crucial for businesses operating in multiple locations within the state. A company with stores in both Albany and Buffalo, for example, would need to adjust its pricing and accounting practices to account for the different sales tax rates in these regions.

| Region | Local Addition | Total Sales Tax |

|---|---|---|

| New York City | 4.5% | 8.875% |

| Catskill Region | 3% | 7% |

| Long Island | 4.5% | 8.625% |

| Albany | 4% | 8% |

| Buffalo | 4% | 8% |

Special Cases and Exemptions

New York’s sales tax regulations also include a range of special cases and exemptions that can further complicate the sales tax landscape. For instance, certain non-profit organizations and government entities are exempt from sales tax on qualifying purchases. This exemption extends to both the state and local sales tax rates, providing a significant cost savings for these organizations.

Additionally, certain business-to-business transactions are also exempt from sales tax. For example, a company purchasing equipment for use in manufacturing may be eligible for a sales tax exemption, provided the equipment is not for resale. This exemption can provide a substantial cost savings for businesses, particularly those making large purchases.

Compliance and Reporting

Ensuring compliance with New York’s sales tax regulations is a complex task, requiring careful record-keeping and accurate reporting. Businesses are responsible for collecting and remitting sales tax to the state on a regular basis, with the frequency of reporting depending on the volume of sales.

The New York State Department of Taxation and Finance provides detailed guidelines and resources to help businesses understand their sales tax obligations. These resources include online tools for calculating sales tax, as well as guidance on record-keeping and reporting requirements. Failure to comply with these regulations can result in significant penalties and interest charges.

For businesses with a significant online presence, it's important to note that New York State requires the collection of sales tax on online sales, even if the business does not have a physical presence in the state. This economic nexus rule applies to businesses that meet certain sales thresholds, and failure to comply can result in audits and penalties.

Online Sales and Marketplace Facilitator Laws

With the rise of e-commerce, New York State has implemented marketplace facilitator laws to ensure that sales tax is collected on online transactions. Under these laws, online marketplaces and third-party sellers are responsible for collecting and remitting sales tax on behalf of the state. This includes platforms like Amazon and eBay, as well as smaller online retailers.

These laws have had a significant impact on the way online businesses operate, particularly for smaller sellers who may not have the resources to navigate complex sales tax regulations. By shifting the burden of sales tax collection to the marketplaces, the state aims to ensure fair competition and increase tax compliance among online retailers.

Impact on Businesses and Consumers

The varying sales tax rates across New York State can have a significant impact on both businesses and consumers. For businesses, understanding and managing these rates is crucial for accurate pricing and compliance with state regulations. Failure to account for these rates can lead to unexpected costs and potential legal issues.

For consumers, sales tax rates can influence purchasing decisions, particularly for larger ticket items. The difference in rates between regions can also impact where consumers choose to shop, with some seeking out lower-tax areas for significant purchases. Additionally, the varying rates can make it more difficult for consumers to compare prices across different retailers, as the final cost may not be immediately apparent.

Strategic Pricing and Marketing

Businesses operating in New York State must consider sales tax rates when setting their pricing strategies. In regions with higher sales tax rates, businesses may need to adjust their pricing to remain competitive, particularly if their competitors are located in lower-tax areas. Alternatively, businesses may choose to absorb the sales tax cost, offering a net price to customers to maintain their pricing advantage.

Sales tax rates can also be a key consideration in marketing and promotional strategies. For example, a business may choose to highlight the post-tax price of an item in its advertising, particularly if the sales tax rate is high in its target market. This can help to make the final cost more transparent for consumers and potentially increase sales.

Future Implications and Potential Changes

As the economic landscape continues to evolve, so too will the sales tax rates and regulations in New York State. While the state’s current rates provide a stable framework for businesses and consumers, there are several factors that could lead to potential changes in the future.

One key factor is the ongoing debate around sales tax fairness. With the rise of e-commerce, there is increasing pressure to ensure that online retailers are collecting and remitting sales tax in a fair and consistent manner. This could lead to further changes in marketplace facilitator laws, as well as potential adjustments to sales tax rates to account for the changing nature of retail.

Additionally, the state's budget and economic priorities can influence sales tax rates. In times of fiscal constraint, the state may consider raising sales tax rates to increase revenue. Conversely, in periods of economic growth, the state may opt to reduce rates to stimulate spending and investment.

Potential Changes and Their Impact

A potential increase in the state’s sales tax rate could have a significant impact on businesses and consumers. For businesses, this would likely result in increased costs, particularly for those operating in multiple regions with varying tax rates. Consumers, on the other hand, would see an immediate increase in the cost of goods and services, potentially leading to a decrease in spending.

Conversely, a decrease in the sales tax rate could provide a much-needed boost to the economy. Lower rates would make goods and services more affordable for consumers, potentially increasing spending and stimulating economic growth. For businesses, this could lead to increased sales and potentially lower prices, as the reduced tax burden allows for more competitive pricing.

Regardless of the direction of any potential changes, it's clear that sales tax rates in New York State will continue to play a vital role in the state's economic landscape. By staying informed and adaptable, businesses and consumers can navigate these changes and continue to thrive in the dynamic environment of the Empire State.

How often do sales tax rates change in New York State?

+Sales tax rates in New York State can change annually, typically as part of the state’s budget process. However, in some cases, rates may change mid-year if there is a significant budget shortfall or surplus.

Are there any items exempt from sales tax in New York State?

+Yes, New York State offers sales tax exemptions for certain items and situations. These include most groceries, certain prescription drugs, and purchases made by non-profit organizations and government entities.

How do I calculate the sales tax on a purchase in New York State?

+To calculate the sales tax on a purchase in New York State, you’ll need to know the applicable sales tax rate for your location. Multiply the purchase price by the sales tax rate (including any local additions) to determine the sales tax amount. For example, if the sales tax rate is 8.875% and the purchase price is 100, the sales tax would be 8.88.

What happens if I fail to collect and remit sales tax in New York State?

+Failure to collect and remit sales tax in New York State can result in significant penalties and interest charges. The state takes sales tax compliance seriously, and businesses found to be in violation may face audits, fines, and legal action.

Are there any resources available to help businesses understand their sales tax obligations in New York State?

+Yes, the New York State Department of Taxation and Finance provides a wealth of resources to help businesses understand their sales tax obligations. These include online tools for calculating sales tax, guidance on record-keeping and reporting requirements, and detailed information on sales tax rates and exemptions.